Form 2441 Provider Ssn

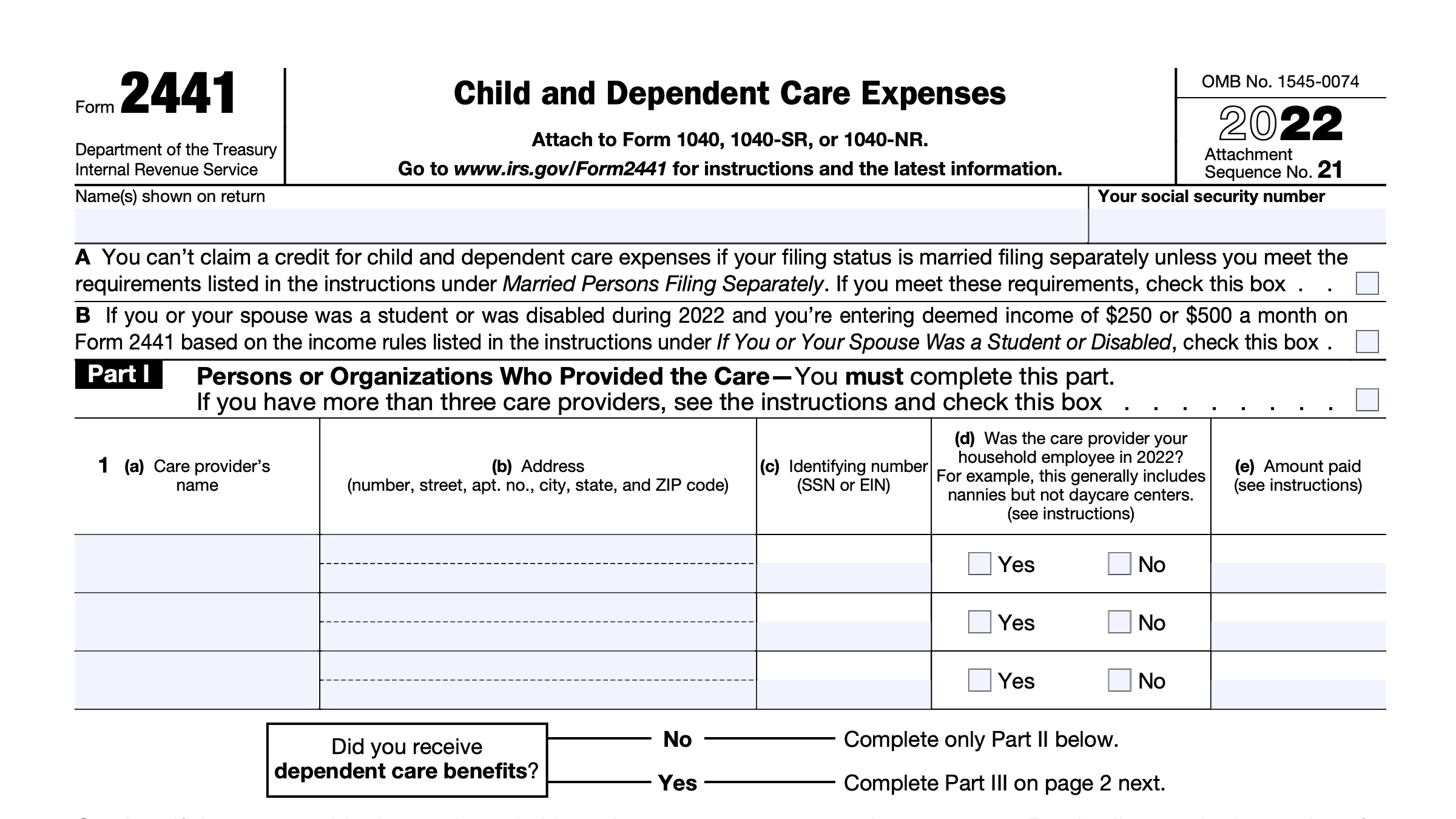

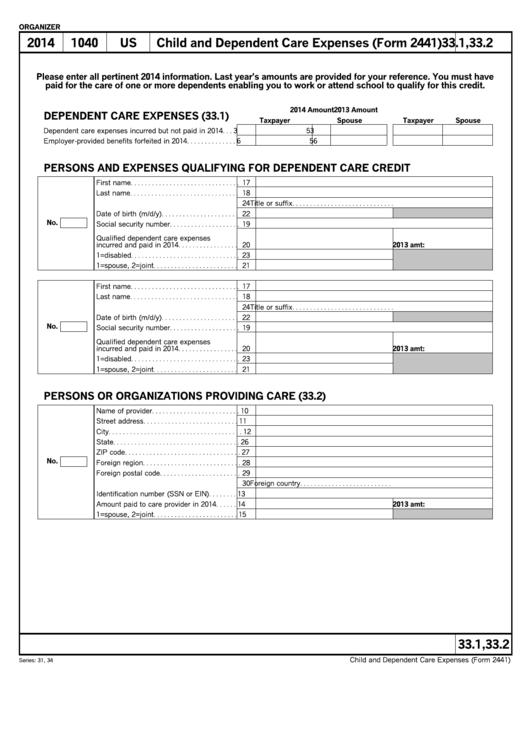

Form 2441 Provider Ssn - Web solved•by intuit•22•updated march 23, 2023. Web to claim the child and dependent care credit, you must identify the care provider on form 2441. Mediator means an impartial person who is appointed to. The maximum amount you can. If you or your spouse was a student or disabled, check this box. Ad get ready for tax season deadlines by completing any required tax forms today. Ad pdffiller.com has been visited by 1m+ users in the past month So, you must have the care provider’s: If you paid to an individual, you needed to enter caregiver's. If you paid child and dependent care expenses, but the individual care provider has not or will not provide their social security number to you,. Web be sure to put your name and social security number (ssn) on the statement. The childcare provider can easily get a taxid number from the irs if they do not want to give you their social security. Web 2 best answer. Web form 2441 requires an ein to be entered and my provider only has a ssn, which is. If you don’t have any care providers and you are filing form 2441 only to report taxable income in part iii, enter. Web claiming the credit. In order to claim the child and dependent care credit, form 2441, you must: Am i eligible to claim the credit? If you paid to an individual, you needed to enter caregiver's. Web use form 2441, part i, to show the information. The maximum amount you can. Web the maximum amount of qualified child and dependent care expenses that can be claimed on form 2441 is $3,000 for one qualifying person, $6,000 for two or more qualifying. Web 36 provider or the health care provider's representative to settle an 37 enrollee's health. If you or your spouse was a student or disabled, check this box. In this situation, all the lines on line 1 of form 2441 must be completed with information for the three highest paid providers. Web claiming the credit. Web 36 provider or the health care provider's representative to settle an 37 enrollee's health benefit claim. Web per irs. If you paid to an individual, you needed to enter caregiver's. Web per irs instructions for form 2441 child and dependent care expenses, page 3: Web form 2441 is a tax form used to claim the child and dependent care tax credit. In this situation, all the lines on line 1 of form 2441 must be completed with information for. If you or your spouse was a student or disabled, check this box. (updated august 24, 2021) q3. Web be sure to put your name and social security number (ssn) on the statement. Web per irs instructions for form 2441 child and dependent care expenses, page 3: If you don’t have any care providers and you are filing form 2441. This credit is designed to provide tax relief to individuals or couples who have incurred. The maximum amount you can. Web solved•by intuit•22•updated march 23, 2023. The form 2441 is used to report qualified childcare expenses paid to an individual or organization. Ad get ready for tax season deadlines by completing any required tax forms today. Web be sure to put your name and social security number (ssn) on the statement. Web per irs instructions for form 2441 child and dependent care expenses, page 3: If you or your spouse was a student or disabled, check this box. Otherwise, enter the provider's employer identification number (ein). Am i eligible to claim the child. Complete, edit or print tax forms instantly. Web per irs instructions for form 2441 child and dependent care expenses, page 3: (updated august 24, 2021) q2. How do i claim the credit? Web form 2441 based on the income rules listed in the instructions under. Web the maximum amount of qualified child and dependent care expenses that can be claimed on form 2441 is $3,000 for one qualifying person, $6,000 for two or more qualifying. Ad pdffiller.com has been visited by 1m+ users in the past month How do i claim the credit? So, you must have the care provider’s: Web claiming the credit. How do i claim the credit? (updated august 24, 2021) q2. Column (c) if the care provider is an individual, enter his or her ssn. Web per irs instructions for form 2441 child and dependent care expenses, page 3: Web form 2441 is a tax form used to claim the child and dependent care tax credit. Web form 2441 requires an ein to be entered and my provider only has a ssn, which is filled out. Ad pdffiller.com has been visited by 1m+ users in the past month Web 36 provider or the health care provider's representative to settle an 37 enrollee's health benefit claim. Web the maximum amount of qualified child and dependent care expenses that can be claimed on form 2441 is $3,000 for one qualifying person, $6,000 for two or more qualifying. Web for the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form2441. Otherwise, enter the provider's employer identification number (ein). Am i eligible to claim the credit? If you don’t have any care providers and you are filing form 2441 only to report taxable income in part iii, enter. If you or your spouse was a student or disabled, check this box. Am i eligible to claim the child. In this situation, all the lines on line 1 of form 2441 must be completed with information for the three highest paid providers. If you paid child and dependent care expenses, but the individual care provider has not or will not provide their social security number to you,. Web form 2441 based on the income rules listed in the instructions under. This credit is designed to provide tax relief to individuals or couples who have incurred. Web if the care provider is an individual, enter his or her ssn.IRS Form 2441 Instructions Child and Dependent Care Expenses

U.S. Citizens Overseas who Wish to Renounce without a Social Security

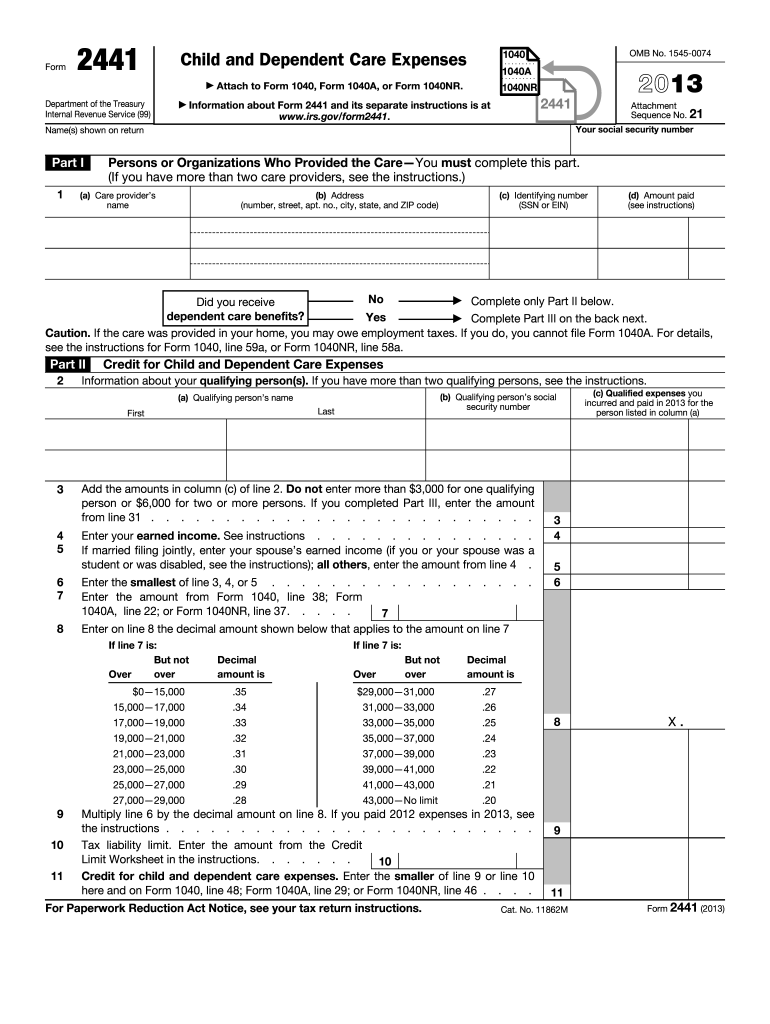

Child And Dependent Care Expenses (Form 2441) printable pdf download

2016 Form 2441 Edit, Fill, Sign Online Handypdf

IRS Form 2441 What It Is, Who Can File, and How To Fill it Out

Form 2441 Fill Out and Sign Printable PDF Template signNow

2020 Form IRS Instruction 2441Fill Online, Printable, Fillable, Blank

IRS Form 2441 What It Is, Who Can File, and How To Fill it Out (2023)

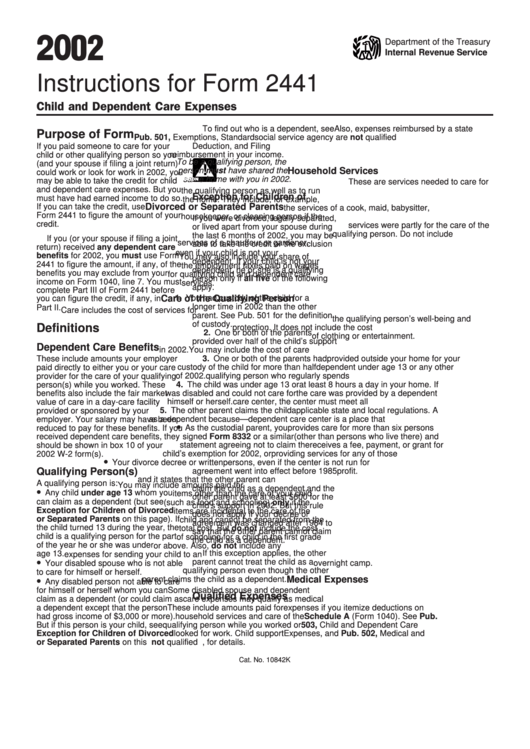

2002 Instructions For Form 2441 printable pdf download

Breanna Form 2441 Turbotax

Related Post:

:max_bytes(150000):strip_icc()/IRSForm24412-76e295ec60f541aa91f6fe9494b03057.jpg)

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)