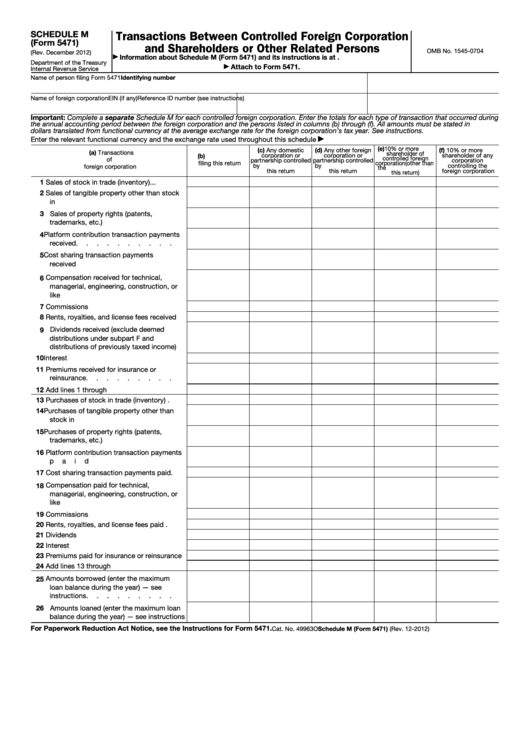

Form 5471 Sch M

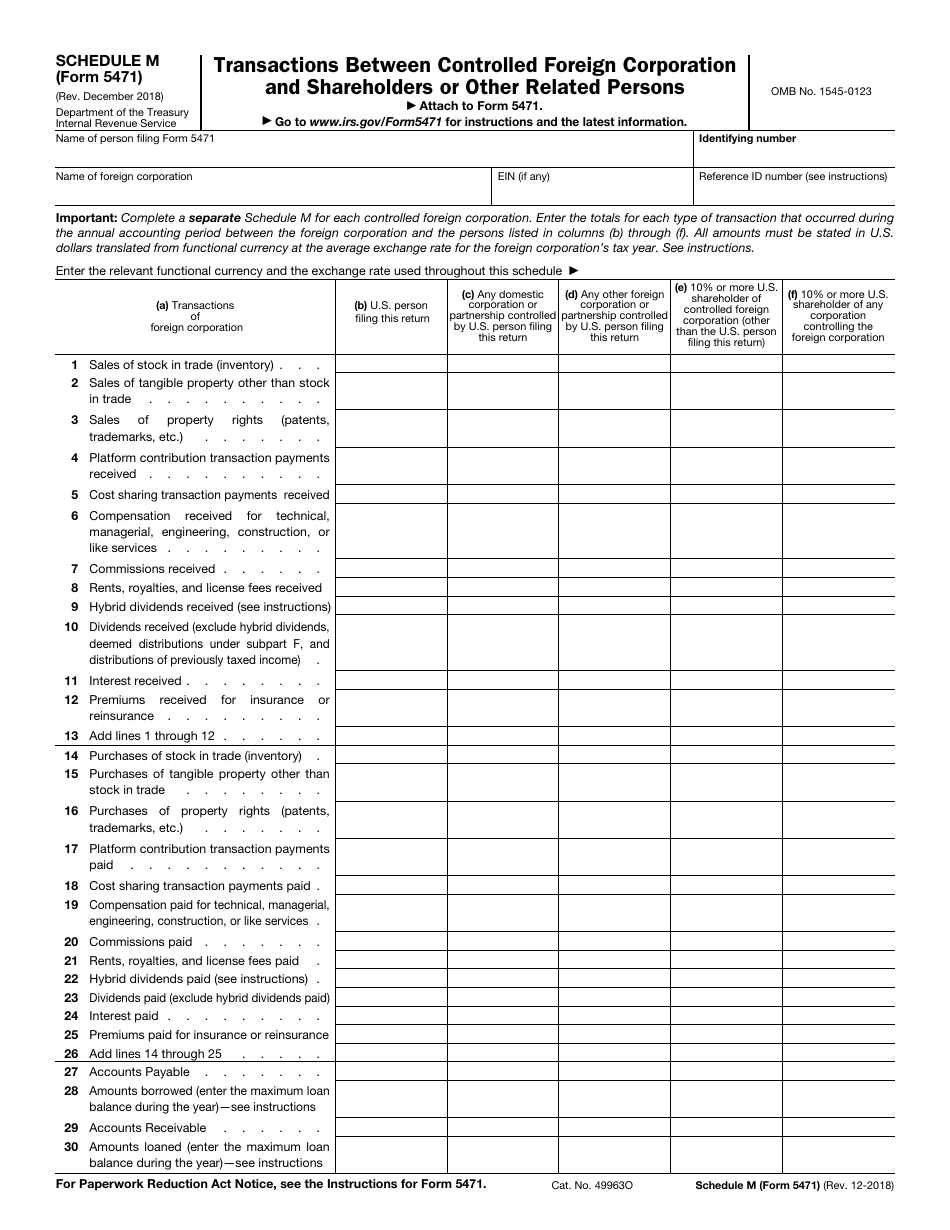

Form 5471 Sch M - Web form 5471 schedule m. Web instructions for form 5471(rev. Citizen, corporation, partnership, trust, or estate who has at least 10% ownership in a foreign corporation, needs to file form 5471. Web select information of u.s. December 2019) department of the treasury internal revenue service. The december 2019 revision of. Web instructions for form 5471(rev. Persons with respect to certain foreign corporations. Persons who are officers, directors, or shareholders in certain foreign corporations. Ad signnow.com has been visited by 100k+ users in the past month Web schedule m must be completed by category 4 filers of the form 5471 to report the transactions that occurred during the cfc’s annual accounting period ending with or. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Web form 5471, which the irs calls “information return of. Web form 5471 (schedule m) financial definition of form 5471 (schedule m) a form that one files with the irs along with form 5471 to report transactions between a controlled. December 2019) department of the treasury internal revenue service. Web instructions for form 5471(rev. See instructions for form 5471. The december 2019 revision of. Citizen, corporation, partnership, trust, or estate who has at least 10% ownership in a foreign corporation, needs to file form 5471. Web schedule m (form 5471) (rev. See instructions for form 5471. Persons with respect to certain foreign corporations. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web schedule m (form 5471) (rev. Even though there are many others, these are the five. December 2019) department of the treasury internal revenue service. Persons from the top left 5471 box. Web form 5471, which the irs calls “information return of us persons with respect to certain foreign corporations”, is an informative return that us taxpayers. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. Ad signnow.com has been visited by 100k+ users in the past month See instructions for form 5471. Web schedule m must be completed by. Web name of person filing form 5471. Web form 5471 is used by certain u.s. Web schedule m must be completed by category 4 filers of the form 5471 to report the transactions that occurred during the cfc’s annual accounting period ending with or. Web schedule e of form 5471 is used to report taxes paid or accrued by a. See instructions for form 5471. Web select information of u.s. Web instructions for form 5471(rev. Web form 5471, which the irs calls “information return of us persons with respect to certain foreign corporations”, is an informative return that us taxpayers. December 2012) department of the treasury internal revenue service. Persons who are officers, directors, or shareholders in certain foreign corporations. Web schedule m must be completed by category 4 filers of the form 5471 to report the transactions that occurred during the cfc’s annual accounting period ending with or. The form and schedules are used to satisfy. See instructions for form 5471. Complete a separate form 5471 and all. December 2019) department of the treasury internal revenue service. Web instructions for form 5471(rev. The december 2019 revision of. Citizen, corporation, partnership, trust, or estate who has at least 10% ownership in a foreign corporation, needs to file form 5471. Web schedule m (form 5471) (rev. December 2019) department of the treasury internal revenue service. Web schedule m (form 5471) (rev. See instructions for form 5471. Citizen, corporation, partnership, trust, or estate who has at least 10% ownership in a foreign corporation, needs to file form 5471. Even though there are many others, these are the five. Persons with respect to certain foreign corporations. Citizen, corporation, partnership, trust, or estate who has at least 10% ownership in a foreign corporation, needs to file form 5471. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Complete a separate form 5471 and all applicable schedules for each applicable foreign. Web schedule m (form 5471) (rev. Web instructions for form 5471(rev. Web instructions for form 5471(rev. Ad signnow.com has been visited by 100k+ users in the past month December 2019) department of the treasury internal revenue service. Web form 5471 is used by certain u.s. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Web form 5471, which the irs calls “information return of us persons with respect to certain foreign corporations”, is an informative return that us taxpayers. Persons who are officers, directors, or shareholders in certain foreign corporations. Web form 5471 schedule m. Persons from the top left 5471 box. Web instructions for form 5471(rev. The december 2021 revision of separate. Web name of person filing form 5471. See instructions for form 5471. The december 2019 revision of.Form 5471 Schedule M, Transactions Between CFCs and Related Persons

Fillable Form 5471 Schedule M Transactions Between Controlled

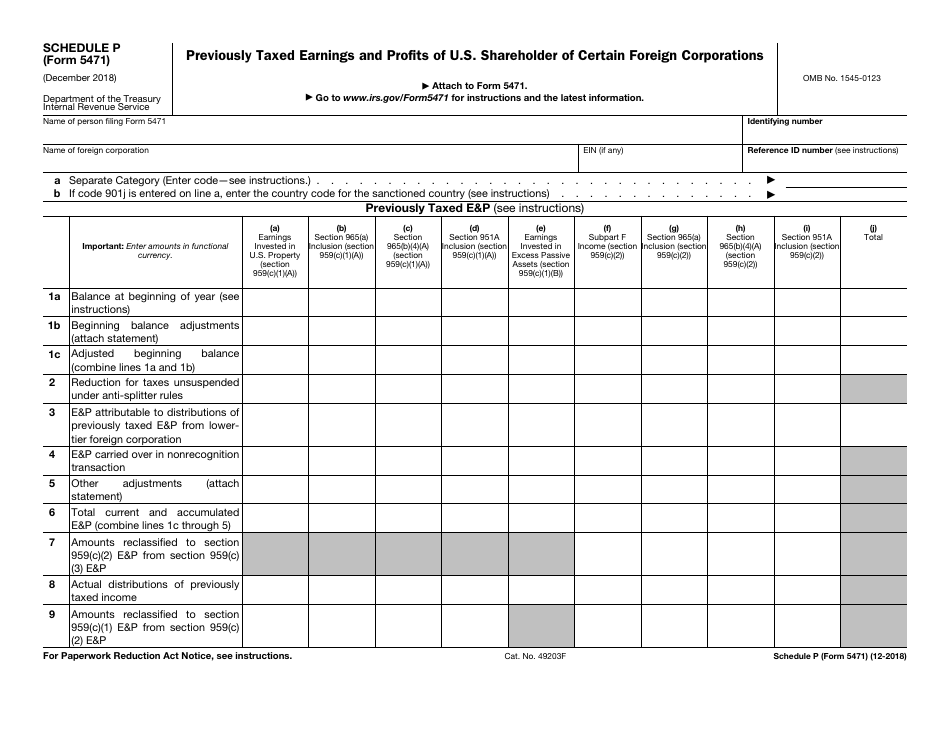

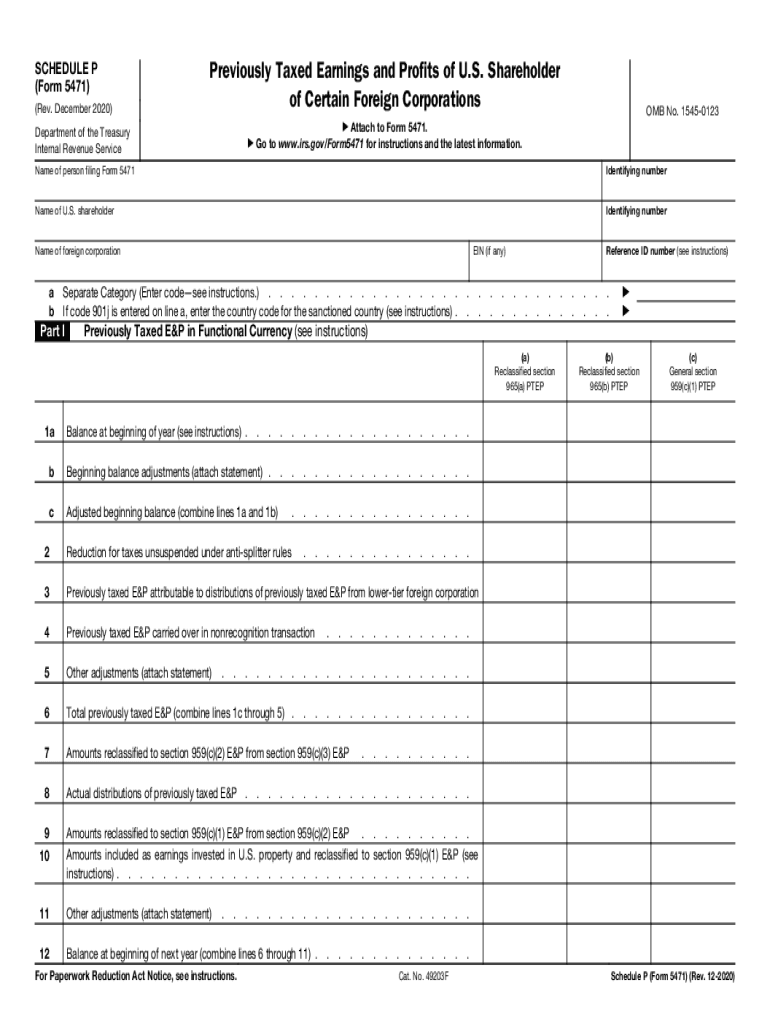

IRS Form 5471 Schedule P Fill Out, Sign Online and Download Fillable

IRS Form 5471 Schedule M Fill Out, Sign Online and Download Fillable

5471 Schedule P Form Fill Out and Sign Printable PDF Template signNow

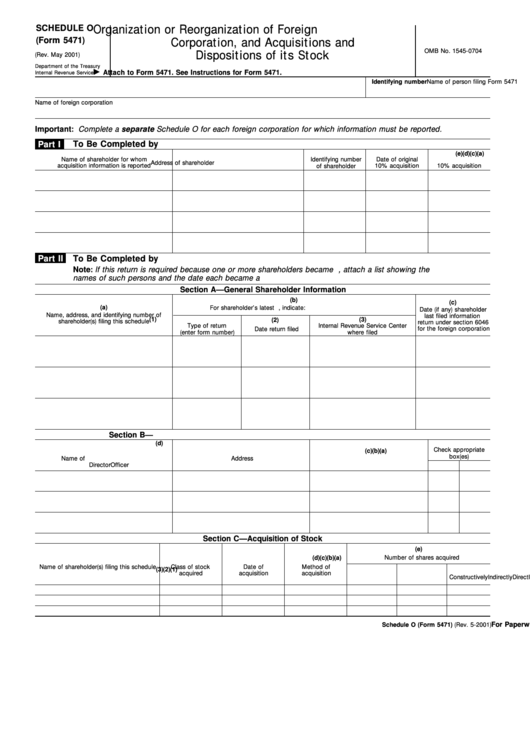

Fillable Form 5471 (Schedule O), (Rev. May 2001) Organization Or

5471 Worksheet A

FOREIGN TAX PLANNING RELATED PARTIES FORM 5471 SCH M YouTube

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

2012 form 5471 instructions Fill out & sign online DocHub

Related Post: