Form 5471 Sch H

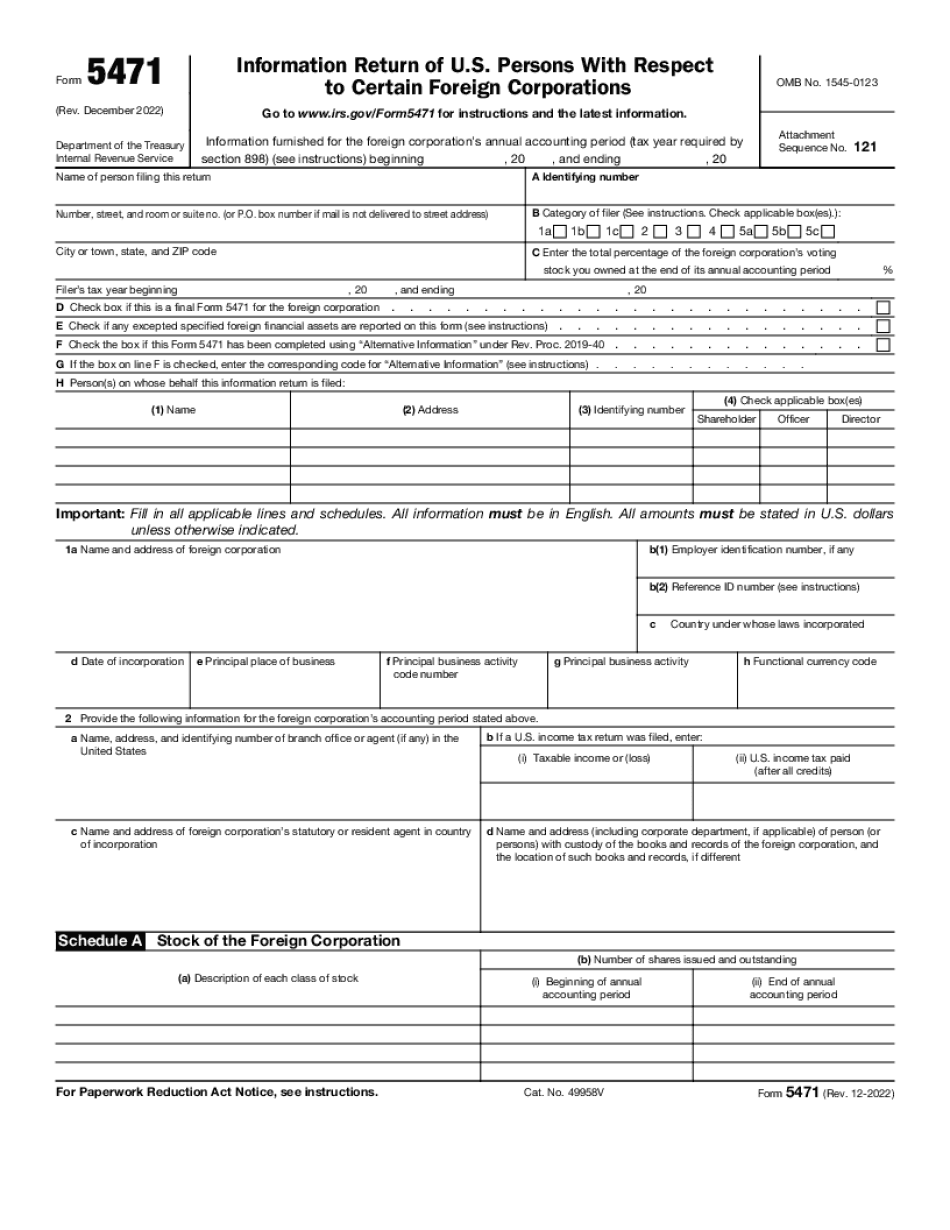

Form 5471 Sch H - Schedule h is now completed once,. For this portion of the discussion, we're going to be discussing the purpose of form. (4) check applicable box(es) (1) name (2) address (3) identifying number shareholder officer director d person(s) on. Web information about form 5471, information return of u.s. The instructions for schedule h, line 2i, have been revised to clarify that taxpayers must report an adjustment if u.s. If you apply for an extension for your tax return, your form 5471 goes on extension as well. Web schedule h is completed with a form 5471 to disclose the current earnings & profits (e&p) of the cfc. Get ready for tax season deadlines by completing any required tax forms today. Transactions between controlled foreign corporation and shareholders or other. Persons with respect to certain foreign corporations.” in translation, it is a form that some taxpayers use to. Attach form 5471 to your income tax. Web an overview of schedule h of form 5471 schedule h is used to report a cfc’s current e&p. Schedule h is no longer completed separately for each applicable category of income. A foreign corporation's e&p is completed in a similar fashion to an e&p. Gaap income reported on schedule c. It is a required form for taxpayers who are officers,. Dastm will also print on schedule c and schedule f to indicate this method of filing. Persons with respect to certain foreign corporations. Web who must complete schedule h form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following categories. For this portion of the discussion, we're going to be discussing the purpose of form. Persons with respect to certain foreign corporations. Get ready for tax season deadlines by completing any required tax forms today. Schedule h (form 5471) (rev. Complete, edit or print tax forms instantly. Complete a separate form 5471 and all applicable schedules for each applicable foreign. Schedule h is no longer completed separately for each applicable category of income. Web execute dhs 3471 within a couple of moments following the guidelines listed below: Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to. If you apply. Ad access irs tax forms. Web and today, we're going to give you an overview of the form 5471. Select the template you want from our library of legal form samples. Web instructions for form 5471(rev. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to. Web schedule h is completed with a form 5471 to disclose the current earnings & profits (e&p) of the cfc. Web a form 5471 is also known as the information return of u.s. Schedule h is used to report a controlled foreign corporation’s (“cfcs”) current. It is a required form for taxpayers who are officers,. So let's jump right into. Click the get form button. Web information about form 5471, information return of u.s. If you apply for an extension for your tax return, your form 5471 goes on extension as well. So let's jump right into it. Schedule h is used to report a controlled foreign corporation’s (“cfcs”) current. Web schedule h is completed with a form 5471 to disclose the current earnings & profits (e&p) of the cfc. Persons with respect to certain foreign corporations. (4) check applicable box(es) (1) name (2) address (3) identifying number shareholder officer director d person(s) on. Web an overview of schedule h of form 5471 schedule h is used to report a. Complete a separate form 5471 and all applicable schedules for each applicable foreign. Web instructions for form 5471(rev. Persons with respect to certain foreign corporations. Click the get form button. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to. Persons with respect to certain foreign corporations. The instructions for schedule h, line 2i, have been revised to clarify that taxpayers must report an adjustment if u.s. Attach form 5471 to your income tax. Category 4 and category 5 filers complete schedule h. Web changes to separate schedule h (form 5471). The december 2021 revision of separate. Schedule h is now completed once,. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web who must complete schedule h form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following categories of persons:. Web and today, we're going to give you an overview of the form 5471. Web lacerte will carry from schedule c, line 21 to schedule h, line 1. Dastm will also print on schedule c and schedule f to indicate this method of filing. Schedule h is no longer completed separately for each applicable category of income. Web recently, the internal revenue service (“irs”) issued a draft of a new schedule h for form 5471. Schedule h is used to report a controlled foreign corporation’s (“cfcs”) current. (4) check applicable box(es) (1) name (2) address (3) identifying number shareholder officer director d person(s) on. Web irs form 5471 is filed alongside your tax return. Gaap income reported on schedule c. Get ready for tax season deadlines by completing any required tax forms today. Web information about form 5471, information return of u.s. If you apply for an extension for your tax return, your form 5471 goes on extension as well. Web instructions for form 5471(rev. Category 4 and category 5 filers complete schedule h. Ad access irs tax forms. Persons with respect to certain foreign corporations.Form 5471 Filing Requirements with Your Expat Taxes

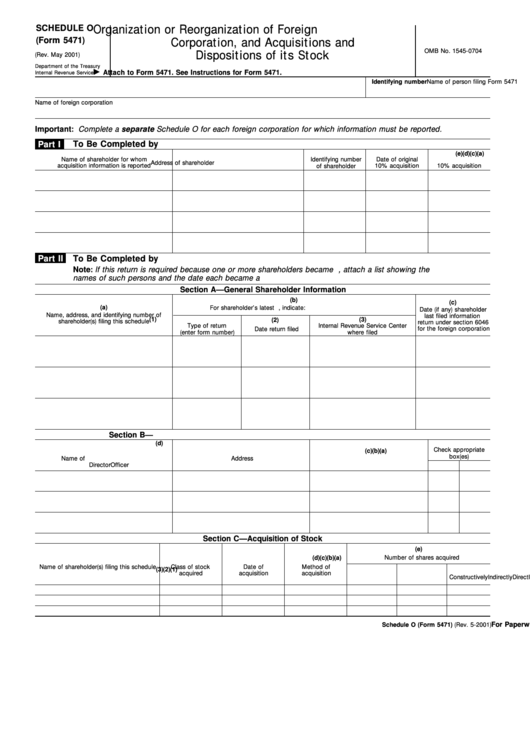

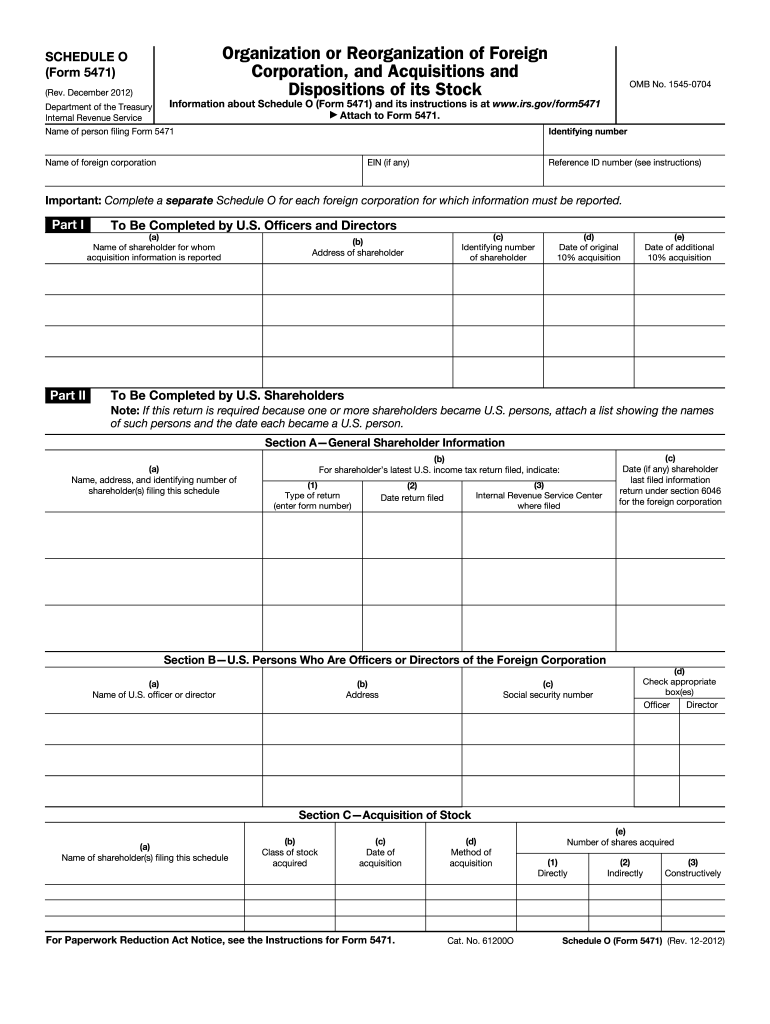

Fillable Form 5471 (Schedule O), (Rev. May 2001) Organization Or

IRS Form 5471 Schedule E and Schedule H SF Tax Counsel

5471 Worksheet A

New Form 5471, Sch Q You Really Need to Understand This Extensive

Form 5471 Instructions 20222023 Fill online, Printable, Fillable Blank

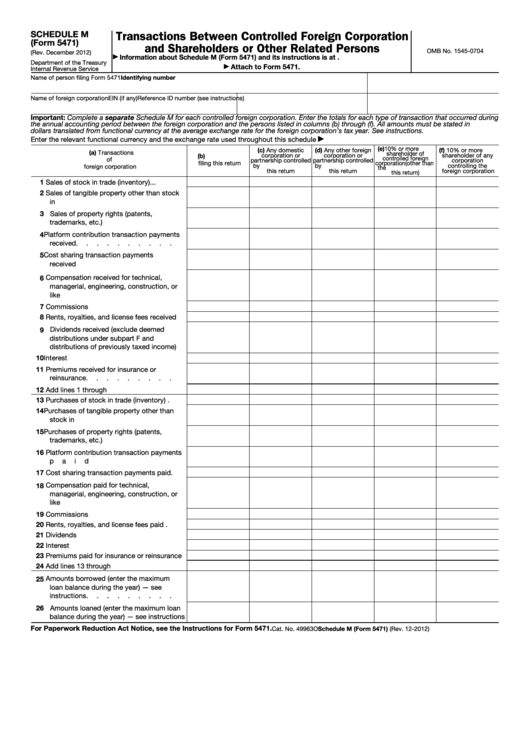

Fillable Form 5471 Schedule M Transactions Between Controlled

Editable IRS Form 5471 2018 2019 Create A Digital Sample in PDF

Form 5471 Schedule Form Fill Out and Sign Printable PDF Template

IRS Issues Updated New Form 5471 What's New?

Related Post: