Form 1120 Schedule G Instructions

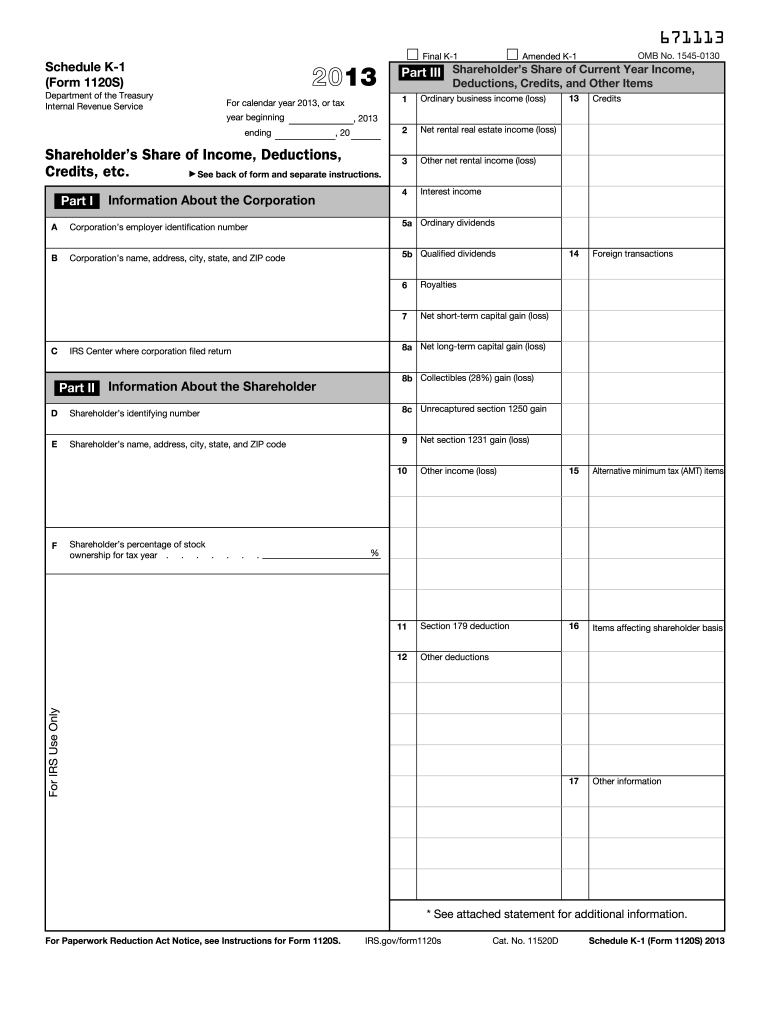

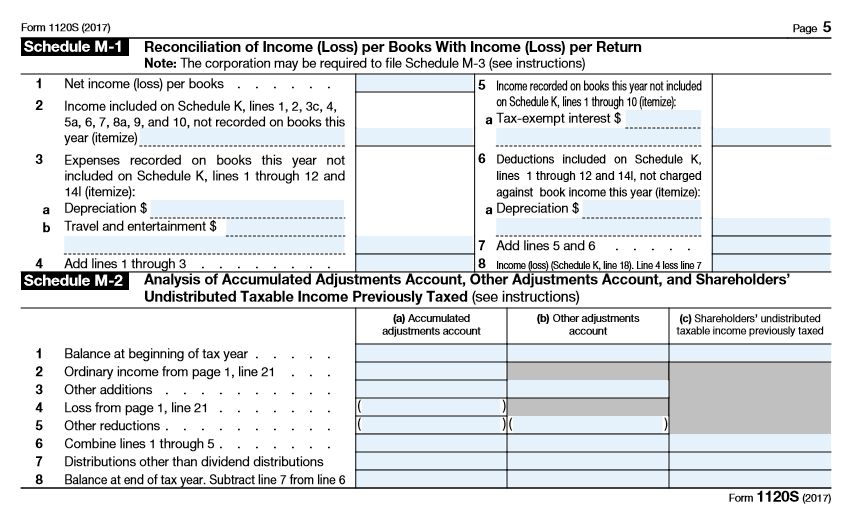

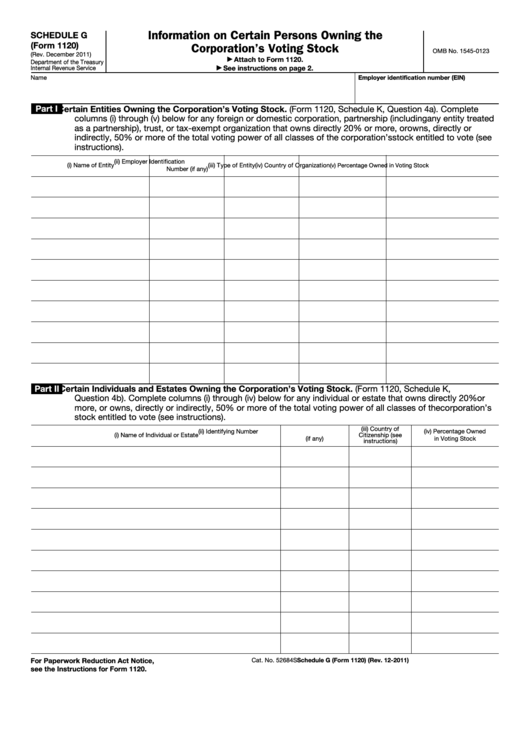

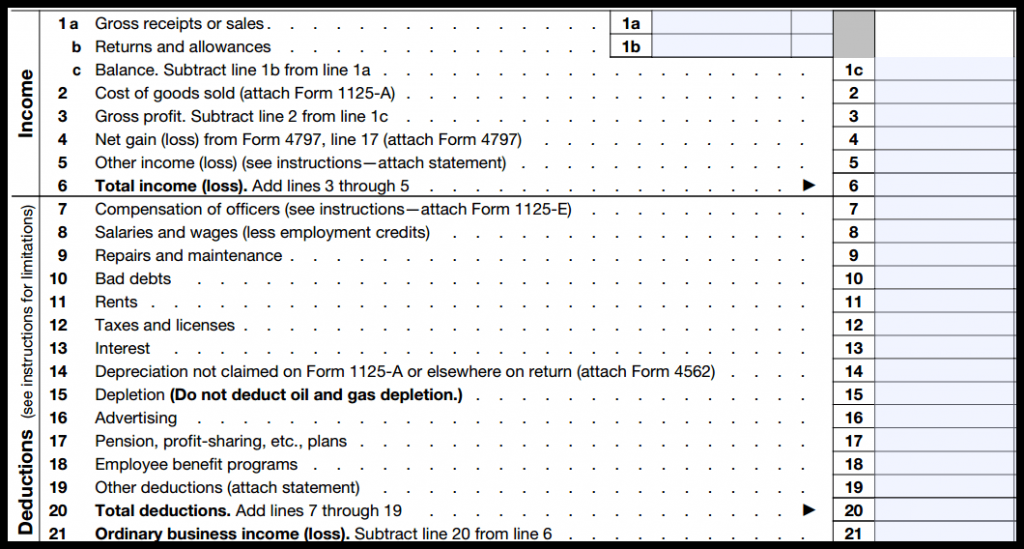

Form 1120 Schedule G Instructions - Web schedule g (form 1120) (rev. Web irs form 1120 schedule g is used to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. Get form 1120 schedule g. Dividends, inclusions, and special deductions. Schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or. Web what is the form used for? Web foreign taxes are included on line 12 only if they are deductible and not creditable taxes under sections 901 and 903. Increase in penalty for failure to file. Instructions for form 1120 ( print version pdf) recent developments. Easily sign the form with your finger. Get ready for tax season deadlines by completing any required tax forms today. Schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or. Web under the 20% direct or 50% direct/indirect owners section, use the percentage constructively owned, if different field to override the ownership for schedule g. Get. Send filled & signed form or. B did any individual or estate own directly 20% or more, or own, directly or indirectly, 50% or more. Get ready for this year\'s tax season quickly and safely with pdffiller!create a blank &. Irs instructions for form 1120. Web we last updated the information on certain persons owning the corporation's voting stock in. Get ready for this year\'s tax season quickly and safely with pdffiller!create a blank &. It is important to hi. Ad taxact.com has been visited by 10k+ users in the past month Schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or. Web we last updated the information on. Web form 1120, u.s. Instructions for form 1120 ( print version pdf) recent developments. Web what is the form used for? Corporate income tax return, is the form incorporated businesses use to file income taxes for the year. It is important to hi. Web schedule g (form 1120) (rev. Web irs form 1120 schedule g is used to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. Use schedule g (form 1120) to. Instructions for form 1120 ( print version pdf) recent developments. Web we last updated the information on certain persons. Web irs form 1120 schedule g is used to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. Send filled & signed form or. Web schedule g is included with your form 1120 filing if you have shareholders that own more than 20% of the voting stock in a. Get ready for tax season deadlines by completing any required tax forms today. Corporate income tax return, is the form incorporated businesses use to file income taxes for the year. Get form 1120 schedule g. Web schedule g is included with your form 1120 filing if you have shareholders that own more than 20% of the voting stock in a. Use schedule g (form 1120) to. Web schedule g (form 1120) and instructions. Ad taxact.com has been visited by 10k+ users in the past month Increase in penalty for failure to file. Get form 1120 schedule g. Dividends, inclusions, and special deductions. Ad taxact.com has been visited by 10k+ users in the past month Web schedule g (form 1120) and instructions. Easily sign the form with your finger. Web schedule g is included with your form 1120 filing if you have shareholders that own more than 20% of the voting stock in a corporation. Get ready for this year\'s tax season quickly and safely with pdffiller!create a blank &. Department of the treasury internal revenue service. Send filled & signed form or. Get form 1120 schedule g. Easily sign the form with your finger. Irs instructions for form 1120. Get form 1120 schedule g. December 2011) department of the treasury internal revenue service information on certain persons owning the corporation’s voting stock. For calendar year 2022 or tax year beginning, 2022, ending. Increase in penalty for failure to file. Web what is the form used for? Easily sign the form with your finger. Web we last updated the information on certain persons owning the corporation's voting stock in february 2023, so this is the latest version of 1120 (schedule g), fully updated for. Web schedule g is included with your form 1120 filing if you have shareholders that own more than 20% of the voting stock in a corporation. Use schedule g (form 1120) to. Open form follow the instructions. Dividends, inclusions, and special deductions. Ad taxact.com has been visited by 10k+ users in the past month Web foreign taxes are included on line 12 only if they are deductible and not creditable taxes under sections 901 and 903. Complete, edit or print tax forms instantly. B did any individual or estate own directly 20% or more, or own, directly or indirectly, 50% or more. Get ready for tax season deadlines by completing any required tax forms today. Web schedule g (form 1120) (rev. Web under the 20% direct or 50% direct/indirect owners section, use the percentage constructively owned, if different field to override the ownership for schedule g. Corporate income tax return, is the form incorporated businesses use to file income taxes for the year.2013 form 1120 s Fill out & sign online DocHub

What is Form 1120S and How Do I File It? Ask Gusto

Form 1120 Schedule G Fillable Printable Forms Free Online

Fill out the 1120S Form including the M1 & M2 with

General InstructionsPurpose of FormUse Schedule G (Form...

Form 1120 schedule g 2017 Fill out & sign online DocHub

Fillable Schedule G (Form 1120) Information On Certain Persons Owning

IRS Form 1120S Definition, Download, & 1120S Instructions

form 1120 schedule g

irs form 1120 schedule g

Related Post: