Form 5471 Cpe

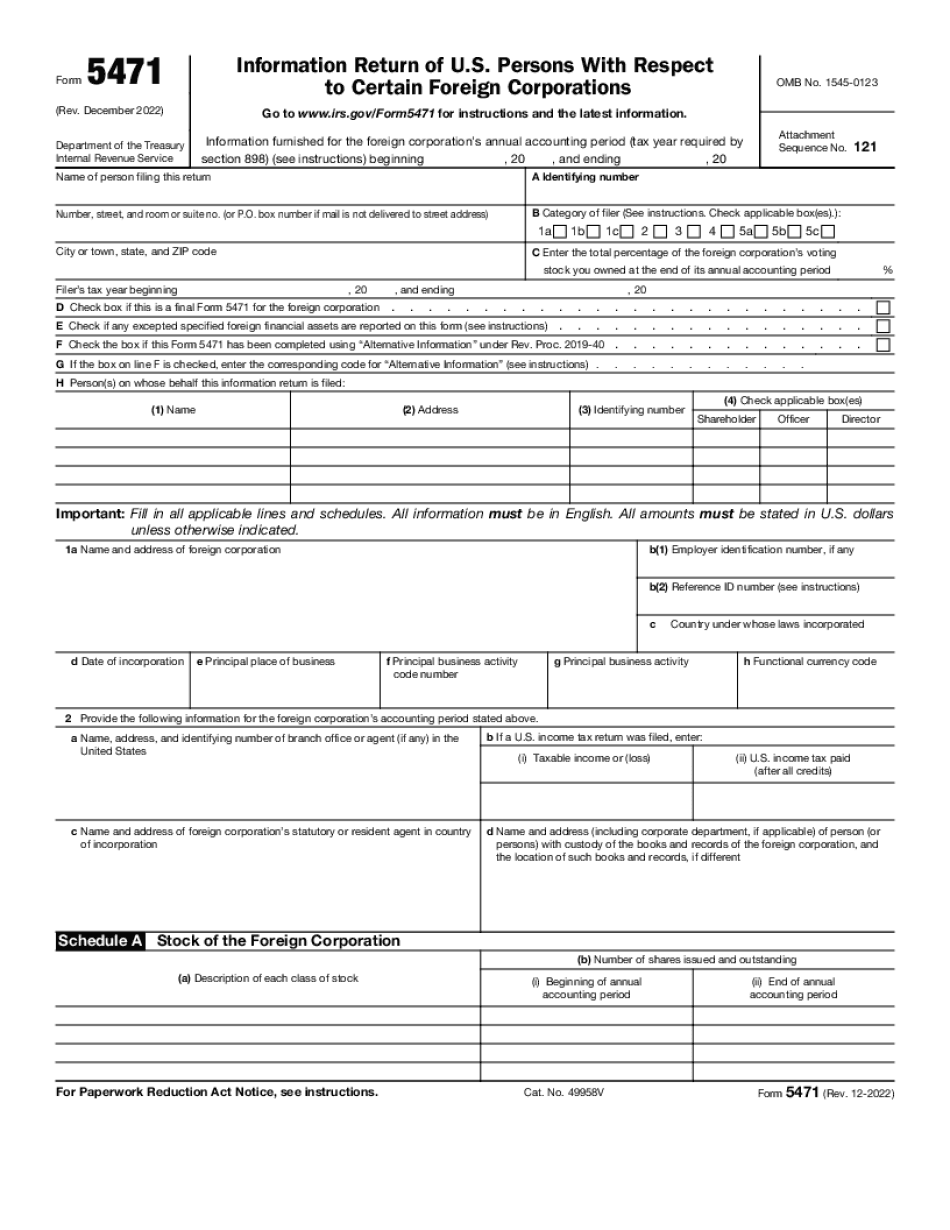

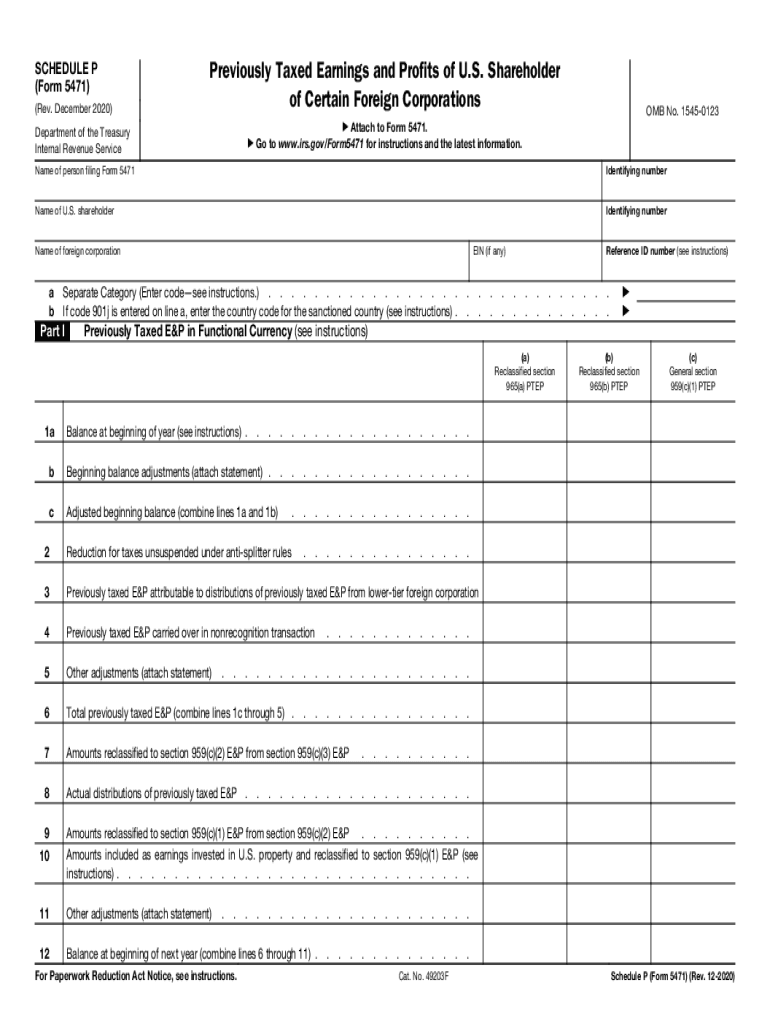

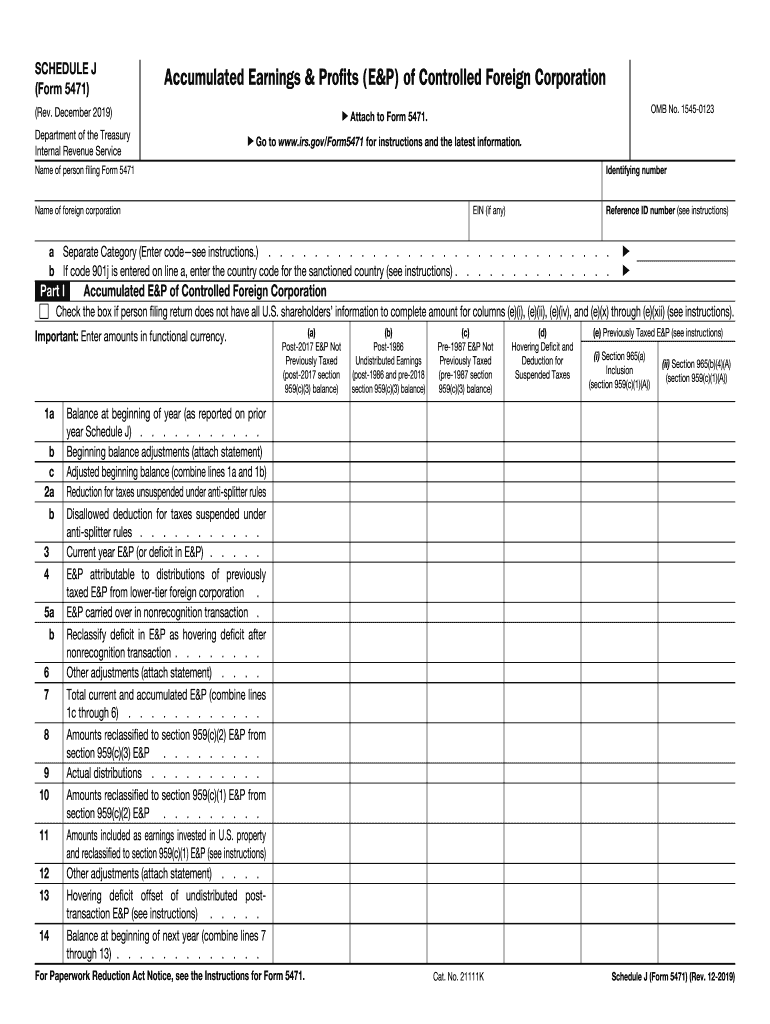

Form 5471 Cpe - Internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who. Web this course will provide tax advisers with a practical guide to completing the new form 5471, information return of u.s. Web changes to form 5471. This course discusses form 5471, information return of u.s. Penalties for the failure to file a form. Web information about form 5471, information return of u.s. Persons with respect to certain foreign corporations, can satisfy these requirements. Web there are five (or nine, depending on how you count) categories into which you might fall as a form 5471 filer. This webinar explains the form 5471. Get ready for tax season deadlines by completing any required tax forms today. Penalties for the failure to file a form. Persons required to file, and reporting requirements; Web recorded event now available. Web 7 cpe credits. Changes to form 5471 resulting from. Persons with respect to certain foreign. Web this class is designed to help accountants with minimal experience with form 5471 gain a better understanding of how to complete this form. Web 7 cpe credits. One of the most challenging decisions tax professionals must make is. This course will explain and simplify the preparation of form 5471, schedules j, p, h,. Internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who. Click here for more information. We also have attached rev. Ad access irs tax forms. Web form 5471 & instructions. We also have attached rev. Expat cpa can help you with filing form 5471 on a tax return if you have holdings in a foreign corporation. Complete, edit or print tax forms instantly. Ad pes offers a wide selection of cpa cpe courses in easy and flexible formats. Since tax reform, the reporting on. Web understand the purpose of form 5471, the categories of u.s. Web this class is designed to help accountants with minimal experience with form 5471 gain a better understanding of how to complete this form. Web changes to form 5471. Web there are five (or nine, depending on how you count) categories into which you might fall as a form. Ad pes offers a wide selection of cpa cpe courses in easy and flexible formats. More than one category might apply to you. Web 1 / 11 view all insights receive the latest business insights, analysis, and perspectives from eisneramper professionals. Web recorded event now available. Web go to www.irs.gov/form5471 for instructions and the latest information. Learn attribution rules for stock ownership; Web a missed or substantially incomplete form 5471 filing may lead to penalties starting at $10,000 per missed or incomplete form per year. Ad download or email irs 5471 & more fillable forms, register and subscribe now! Penalties for the failure to file a form. Web understand the purpose of form 5471, the categories. Internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who. Persons with respect to certain foreign corporations, including an analysis of the. Web recorded event now available. Click here for more information. Since tax reform, the reporting on. Web form 5471 is one of the most challenging information returns filed by taxpayers. This course will explain and simplify the preparation of form 5471, schedules j, p, h, and e for tax preparers grappling with the. Web go to www.irs.gov/form5471 for instructions and the latest information. Penalties for the failure to file a form. Web form 5471 & instructions. Complete, edit or print tax forms instantly. One of the most challenging decisions tax professionals must make is. Information furnished for the foreign corporation’s annual accounting period (tax year required by. Web go to www.irs.gov/form5471 for instructions and the latest information. More than one category might apply to you. Web go to www.irs.gov/form5471 for instructions and the latest information. Complete, edit or print tax forms instantly. Since tax reform, the reporting on. Changes to form 5471 resulting from. Web a missed or substantially incomplete form 5471 filing may lead to penalties starting at $10,000 per missed or incomplete form per year. Web recorded event now available. Ad pes offers a wide selection of cpa cpe courses in easy and flexible formats. Web on form 5471 and separate schedules, in entry spaces that request identifying information with respect to a foreign entity, taxpayers will no longer have the option to enter. Persons with respect to certain foreign corporations, can satisfy these requirements. Web this class is designed to help accountants with minimal experience with form 5471 gain a better understanding of how to complete this form. Web the form 547 1 filing is attached to your individual income tax return and is to be filed by the due date (including extensions) for that return. Web filing form 5471, information return of u.s. Expat cpa can help you with filing form 5471 on a tax return if you have holdings in a foreign corporation. Internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who. One of the most challenging decisions tax professionals must make is. Ad access irs tax forms. Penalties for the failure to file a form. Web form 5471 & instructions. This course discusses form 5471, information return of u.s. Learn attribution rules for stock ownership;20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

Form 5471 Filing Requirements with Your Expat Taxes

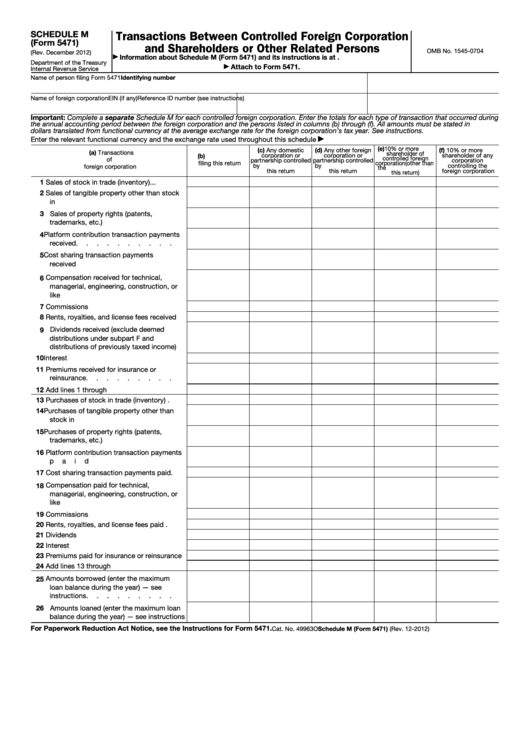

Fillable Form 5471 Schedule M Transactions Between Controlled

Form 5471 Instructions 20222023 Fill online, Printable, Fillable Blank

5471 Schedule P Form Fill Out and Sign Printable PDF Template signNow

The Tax Times New Form 5471, Sch Q You Really Need to Understand

Editable IRS Form 5471 2018 2019 Create A Digital Sample in PDF

IRS Form 5471 Instructions CFC Tax Reporting for U.S. Persons

Form 5471 schedule j Fill out & sign online DocHub

Substantial Compliance Form 5471 HTJ Tax

Related Post: