Form 540 No Use Tax Checkbox

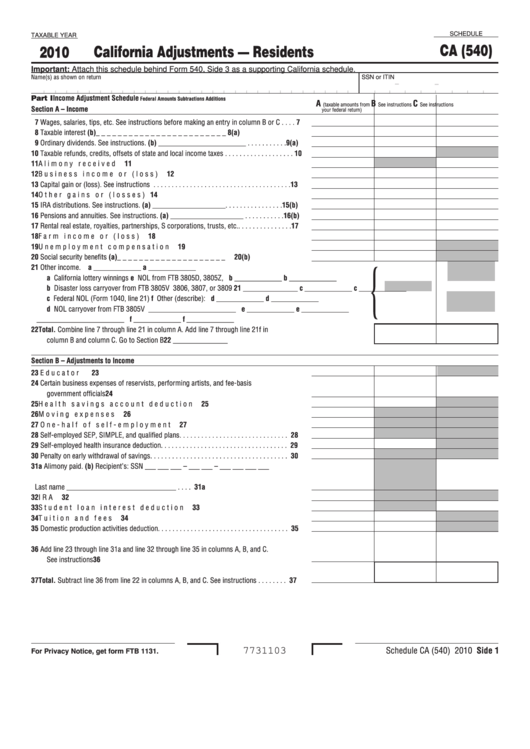

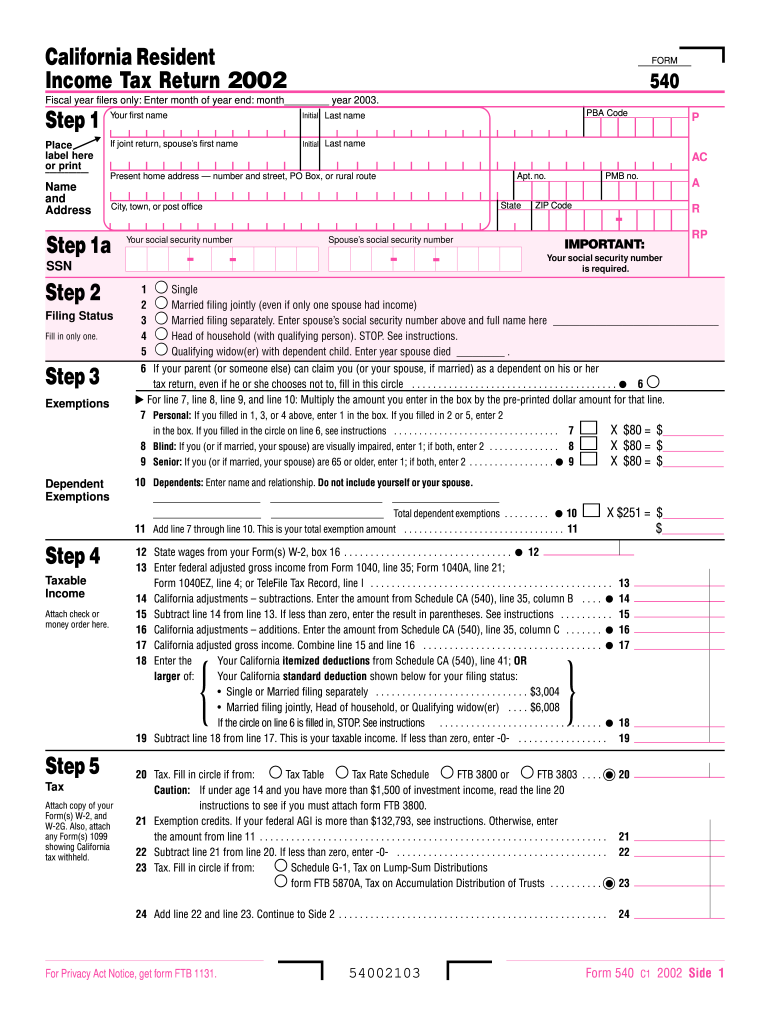

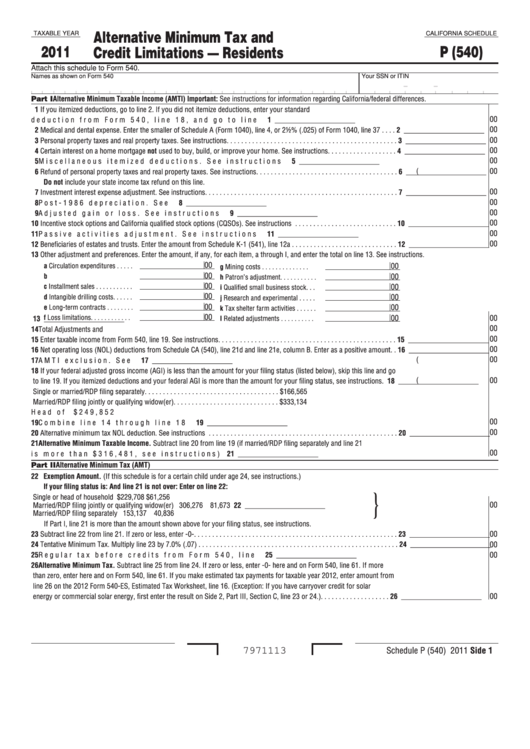

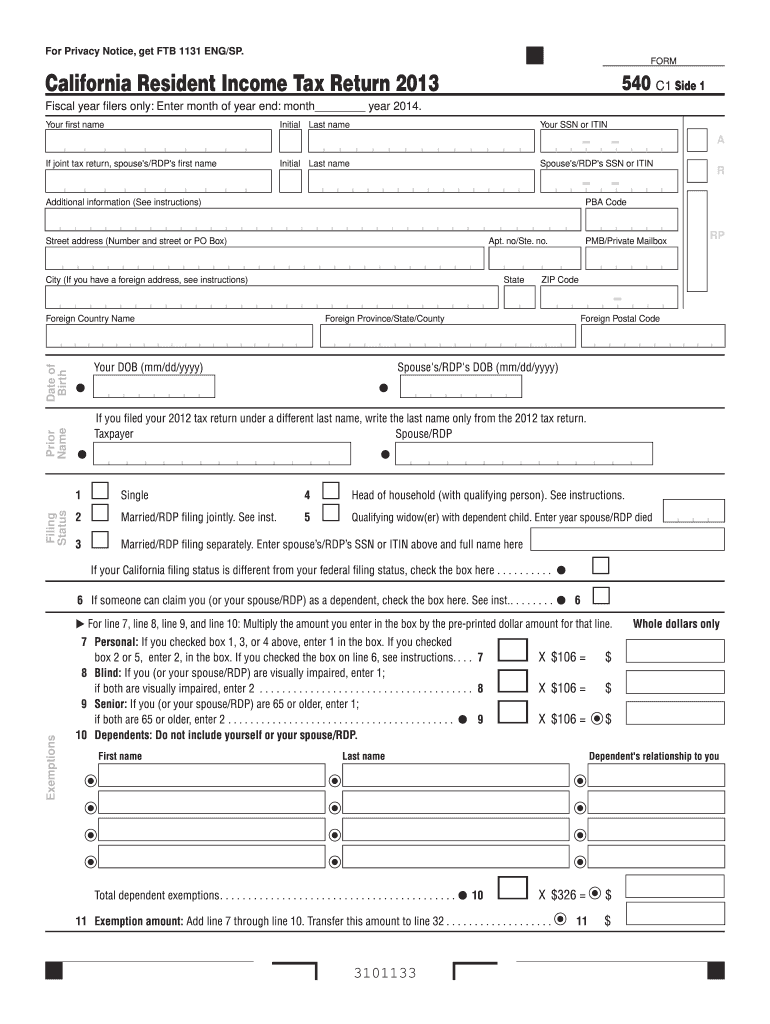

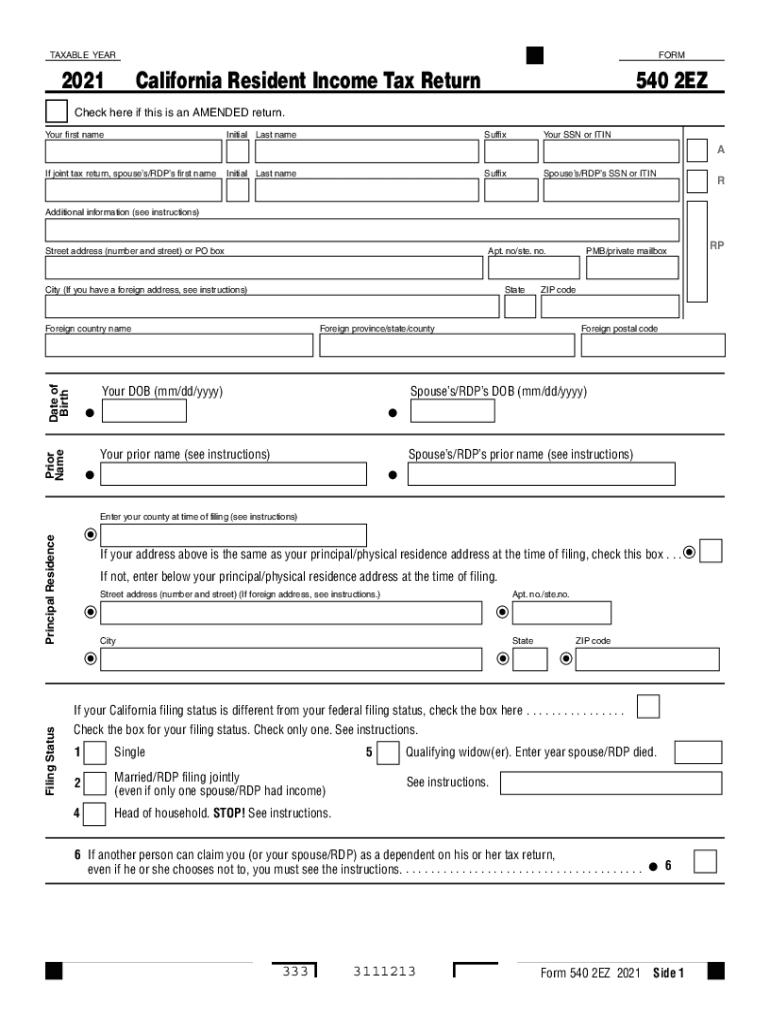

Form 540 No Use Tax Checkbox - Before you decide check out your online filing options. 00 00 00 00 00 00 00 00 00 00 00 00 00. Enter the required additional information if you checked the box on line 3 or line 5. 06/2023 important dates $$$ for you federal earned income credit. Forms 540, 540nr and 540ez include a check box to indicate. Enter month of year end: Transfer this amount to line 32. Add line 7 through line 10. Enter month of year end: Web check only one box for line 1 through line 5. Web 540 forms we updated our 540 forms to report qualifying health coverage and premium assistance subsidies. • form 940 • form 940 schedule r. Web overview to determine what form you should file, you first need to determine your residency. Web in taxslayer pro after 2019, when starting either california form 540 or 540nr, unless the taxpayer is indicated. Web tax year 2023 940 mef ats scenario 3 crocus company. Web if the taxpayer enters zero on line 91, the taxpayer must check one of two boxes indicating that either the taxpayer owes no use tax or the taxpayer has remitted. • form 940 • form 940 schedule r. Web 540 forms we updated our 540 forms to report. Web 2022 california resident income tax return 540 check here if this is an amended return. Web if you can check that box on form 540, california resident income tax return; (this may be accomplished via withholding, estimates, form 3519 payment, etc.) taxpayer. 00 00 00 00 00 00 00 00 00 00 00 00 00. Forms 540, 540nr and. You are required to enter a number on this line. Web ultratax cs displays a diagnostic message and prevents creation of the form 540 electronic record if no amount is due and an appropriate box on form 540 is not. Forms 540, 540nr and 540ez include a check box to indicate. For filing status requirements, see page 3. Transfer this. Enter the required additional information if you checked the box on line 3 or line 5. Enter month of year end: Web taxpayer pays at least 90 percent of the tax by the original due date, april 18, 2023. 06/2023 important dates $$$ for you federal earned income credit. Transfer this amount to line 32. Add line 7 through line 10. Web use tax on form 540, line 91 is zero, and the 'no use tax is owed' box has been checked. Web check only one box for line 1 through line 5. Form 540 is the state of california income tax form. Web in taxslayer pro after 2019, when starting either california form 540. Web taxpayer pays at least 90 percent of the tax by the original due date, april 18, 2023. Web check only one box for line 1 through line 5. Enter the required additional information if you checked the box on line 3 or line 5. Web ultratax cs displays a diagnostic message and prevents creation of the form 540 electronic. Add line 7 through line 10. Enter the required additional information if you checked the box on line 3 or line 5. Web 2020 california resident income tax return 540 check here if this is an amended return. Web california resident if you are a resident and earn a taxable income, then you are required to file in california with. Less than 3% of all. Web 2020 california resident income tax return 540 check here if this is an amended return. Forms 540, 540nr and 540ez include a check box to indicate. If the amount due is zero, you must check the. Web in taxslayer pro after 2019, when starting either california form 540 or 540nr, unless the taxpayer is. Enter the required additional information if you checked the box on line 3 or line 5. Enter month of year end: Web ultratax cs displays a diagnostic message and prevents creation of the form 540 electronic record if no amount is due and an appropriate box on form 540 is not. Web tax year 2023 940 mef ats scenario 3. Enter month of year end: Enter month of year end: (this may be accomplished via withholding, estimates, form 3519 payment, etc.) taxpayer. Web ultratax cs displays a diagnostic message and prevents creation of the form 540 electronic record if no amount is due and an appropriate box on form 540 is not. Web taxpayer pays at least 90 percent of the tax by the original due date, april 18, 2023. Add line 7 through line 10. Web 2022 california resident income tax return 540 check here if this is an amended return. Web 540 forms we updated our 540 forms to report qualifying health coverage and premium assistance subsidies. Web check only one box for line 1 through line 5. Web use tax on form 540, line 91 is zero, and the 'no use tax is owed' box has been checked. Web overview to determine what form you should file, you first need to determine your residency. Web if there is none, enter 0 (zero) or check one of the line 91 checkboxes to indicate no use tax is owed or the use tax obligation was paid directly to the cdtfa. Web in taxslayer pro after 2019, when starting either california form 540 or 540nr, unless the taxpayer is indicated as a dependent on someone else's return you will be asked did. • form 940 • form 940 schedule r. Web if the taxpayer enters zero on line 91, the taxpayer must check one of two boxes indicating that either the taxpayer owes no use tax or the taxpayer has remitted. Forms 540, 540nr and 540ez include a check box to indicate. You are required to enter a number on this line. Transfer this amount to line 32. 06/2023 important dates $$$ for you federal earned income credit. Web tax year 2023 940 mef ats scenario 3 crocus company.Fillable Schedule Ca (540) California Adjustments Residents 2010

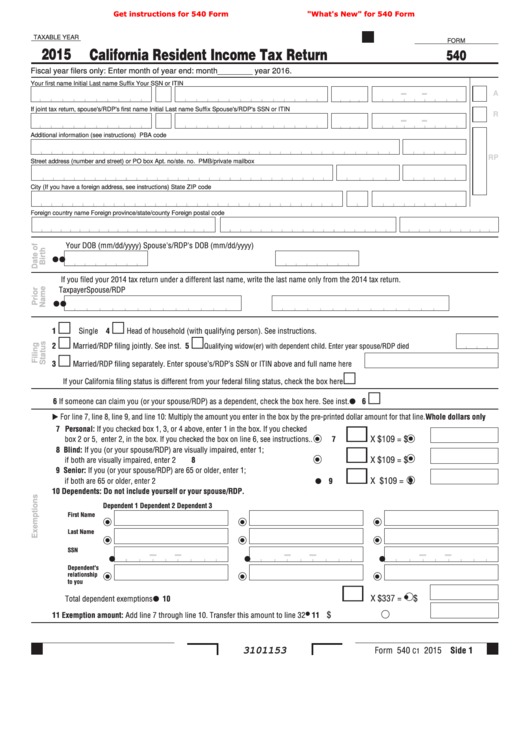

Fillable Form 540 Printable Forms Free Online

Fillable Form 540 Printable Forms Free Online

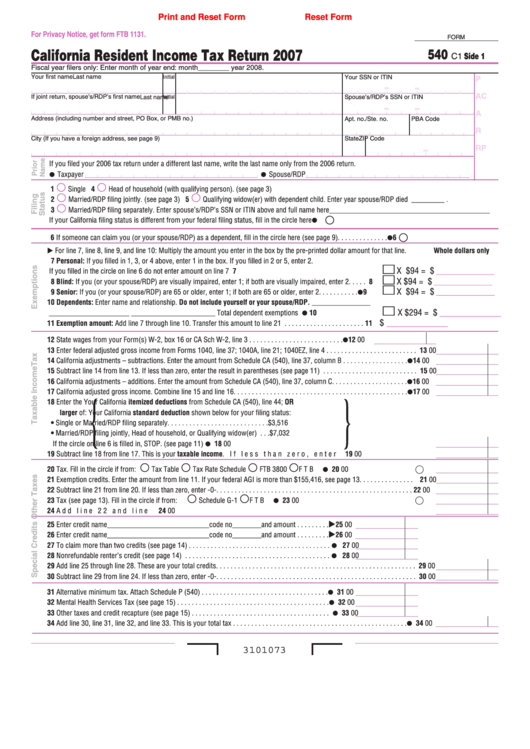

Fillable form 540 Fill out & sign online DocHub

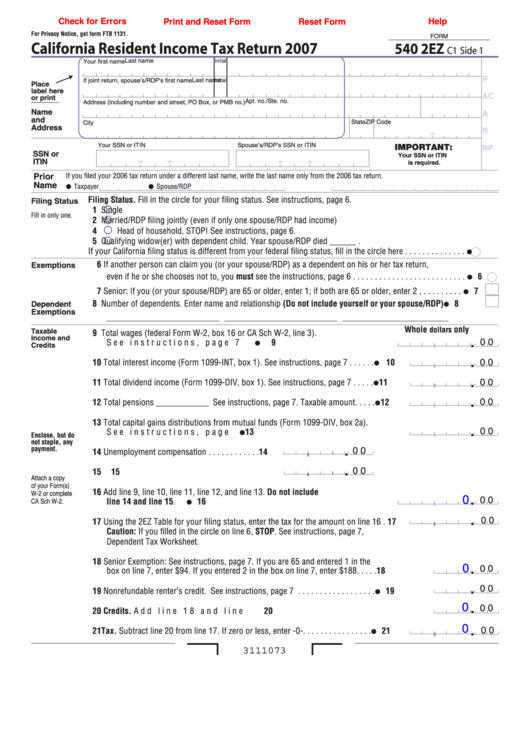

Fillable Form 540 Printable Forms Free Online

2002 form 540 Fill out & sign online DocHub

Fillable California Schedule P (540) Attach To Form 540 Alternative

Form 540 2EZ Download Fillable PDF or Fill Online California Resident

Form 540 Fill Out and Sign Printable PDF Template signNow

20212023 Form CA FTB 540 2EZ Fill Online, Printable, Fillable, Blank

Related Post: