Can I File Fincen Form 105 Online

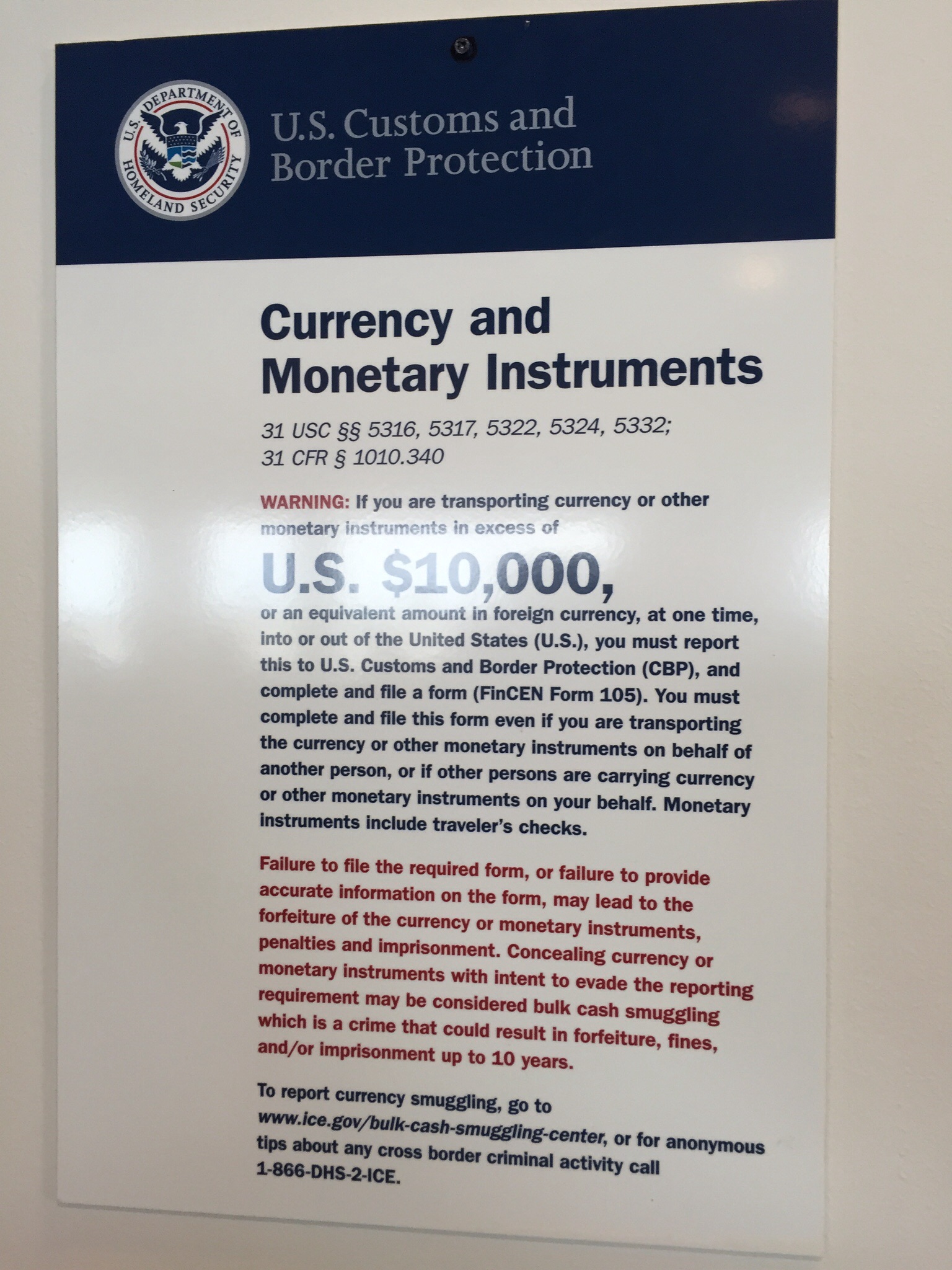

Can I File Fincen Form 105 Online - Web the following tips can help you complete fincen 105 easily and quickly: Then select the documents tab to combine, divide, lock or unlock the file. Web when and where to file: Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Web in the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry. Recipients—each person who receives currency or other monetary instruments in the united states shall file fincen form 105, within 15 days. Web fbar filing due date. If you want to paper. Extension due to the terroristic action in the state of israel (10/16/2023) additional extension due to natural disasters (09/08/2023). Web up to $40 cash back 3. Web fbar filing due date. Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Web here is all you need to know! Department of the treasury’s financial crimes enforcement network (fincen) published a small entity. Web how do i file the fbar? Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their. Web how do i file the fbar? Web the reports required under paragraph (b) (1) of this section shall be filed with fincen 30 calendar days from the date of detection in the manner that. Web in the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry. Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their. Web the following. Fincen form 105 august 20, 2022 money transfers, whether accompanied by someone or via electronic fund transfer, can be. Web fincen form 105, report of international transportation of currency and monetary instruments (cmir), is submitted and processed through the u.s. Web legally, you are allowed to bring in as much money as you want into or out of the country.. Web to file the fbar as an individual, you must personally and/or jointly own a reportable foreign financial account that requires the filing of an fbar (fincen report 114) for the. Common sense would tell you if you file the report that you’re. You don’t file the fbar with your federal tax return. However, if it happens to be over. Web here is all you need to know! Web in the past few years, cbp has made it possible to file a fincen 105 form online at this website. If you want to paper. You don’t file the fbar with your federal tax return. Web international travelers entering the united states must declare if they are carrying currency or monetary. If you want to paper. Web here is all you need to know! Financial crimes enforcement network (fincen), treasury. Then select the documents tab to combine, divide, lock or unlock the file. Web the tips below will allow you to fill in fincen 105 quickly and easily: Web the following tips can help you complete fincen 105 easily and quickly: Web how to file. Web (1)each person who physically transports, mails, or ships, or causes to be physically transported, mailed, or shipped currency or other monetary instruments in an. If you want to paper. Web start preamble agency: Web each person who receives currency or other monetary instruments in the united states shall file fincen form 105, within 15 days after receipt of the. Web to file the fbar as an individual, you must personally and/or jointly own a reportable foreign financial account that requires the filing of an fbar (fincen report 114) for the. You don’t file. Web september 18, 2023. Fincen form 105 august 20, 2022 money transfers, whether accompanied by someone or via electronic fund transfer, can be. Web the following tips can help you complete fincen 105 easily and quickly: Web start preamble agency: Financial crimes enforcement network (fincen), treasury. Web fbar filing due date. Replace text, adding objects, rearranging pages, and more. Web in the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry. If you want to paper. Then select the documents tab to combine, divide, lock or unlock the file. Web to file the fbar as an individual, you must personally and/or jointly own a reportable foreign financial account that requires the filing of an fbar (fincen report 114) for the. Fincen form 105 august 20, 2022 money transfers, whether accompanied by someone or via electronic fund transfer, can be. Web how to file. Web up to $40 cash back 3. Extension due to the terroristic action in the state of israel (10/16/2023) additional extension due to natural disasters (09/08/2023). Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their. Department of the treasury’s financial crimes enforcement network (fincen) published a small entity. Web (1)each person who physically transports, mails, or ships, or causes to be physically transported, mailed, or shipped currency or other monetary instruments in an. Web here is all you need to know! You don’t file the fbar with your federal tax return. Web the reports required under paragraph (b) (1) of this section shall be filed with fincen 30 calendar days from the date of detection in the manner that fincen. Web when and where to file: Recipients—each person who receives currency or other monetary instruments in the united states shall file fincen form 105, within 15 days. Web legally, you are allowed to bring in as much money as you want into or out of the country. Complete the requested fields that are.fincen 105 Archives Great Lakes Customs Law

File the "FinCEN Form 105" before bringing 10,000 cash to airport

FinCEN Form 105 CMIR, U.S. Customs and Border Protection

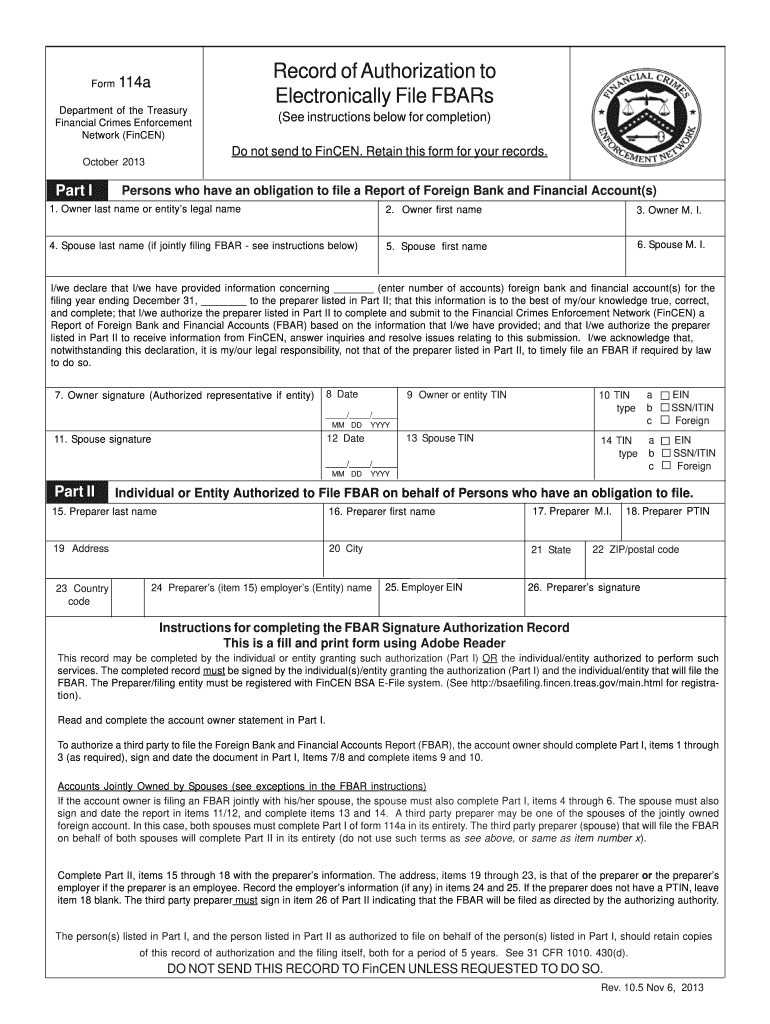

FBAR And Filing FinCEN Form 114 Step By Step Instructions For

2013 FinCen Form 114a Fill Online, Printable, Fillable, Blank pdfFiller

Fincen 105 Fill out & sign online DocHub

New FBAR Form in 2019! (FinCEN Form 114) Cantucky

Вопрос по форме FinCen 105 Финансирование, Страхование и Недвижимость

Cash Reporting Requirement & FinCen 105 Great Lakes Customs Law

Irs Form 8300 Printable Printable Forms Free Online

Related Post: