Form 6781 Irs

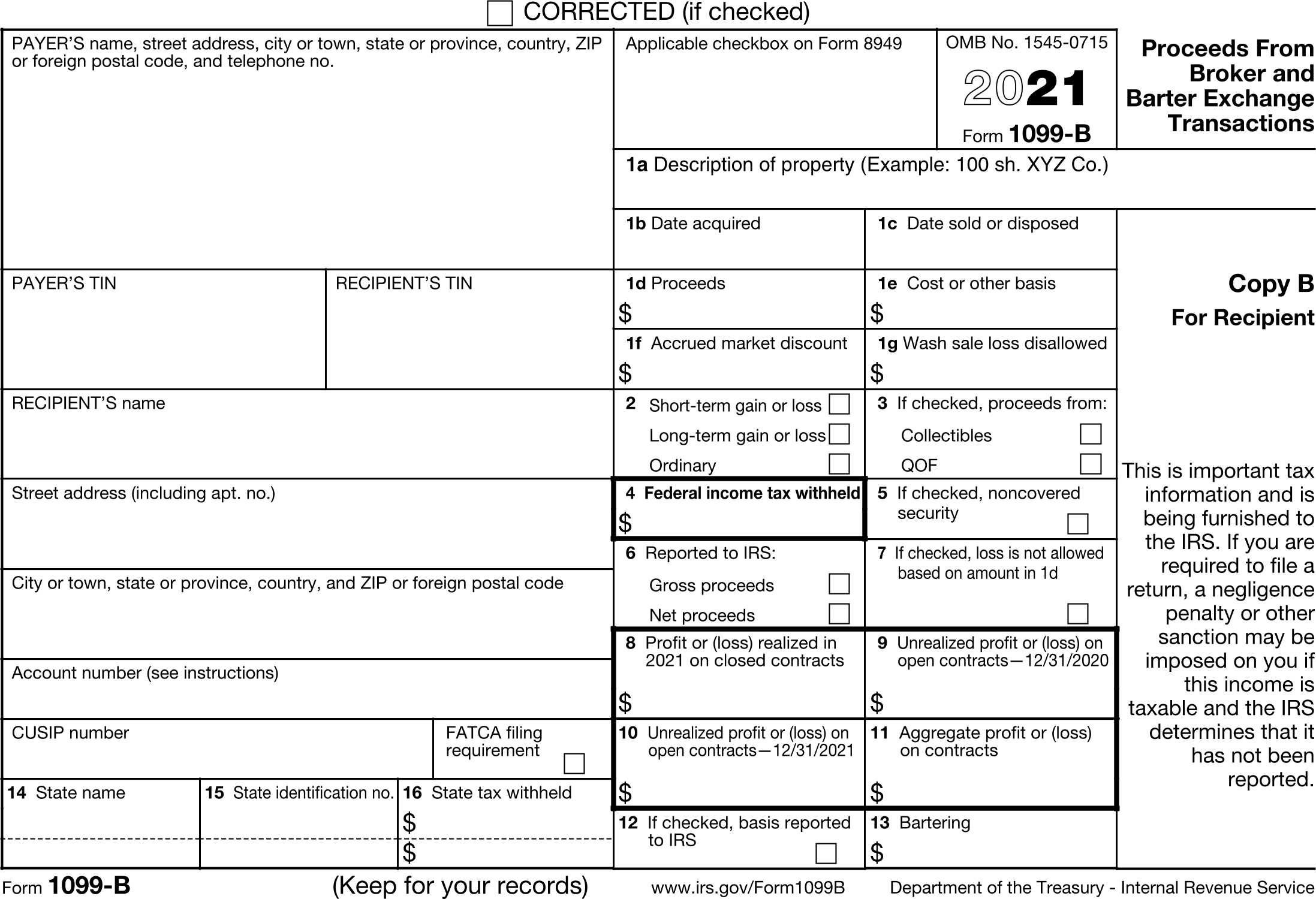

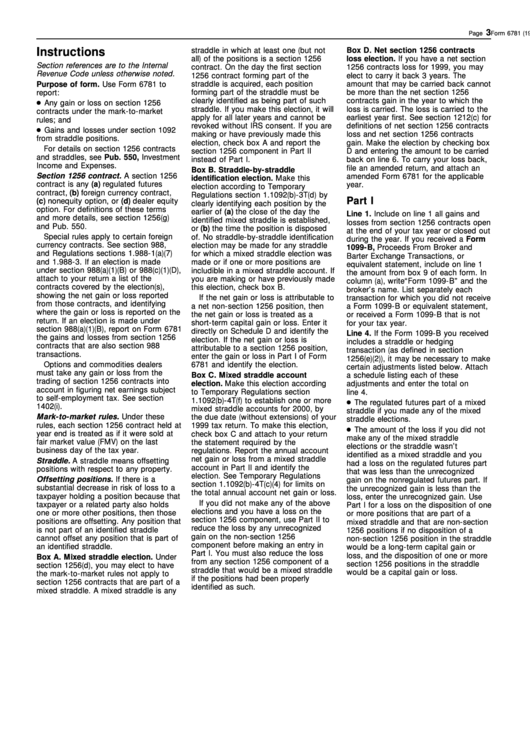

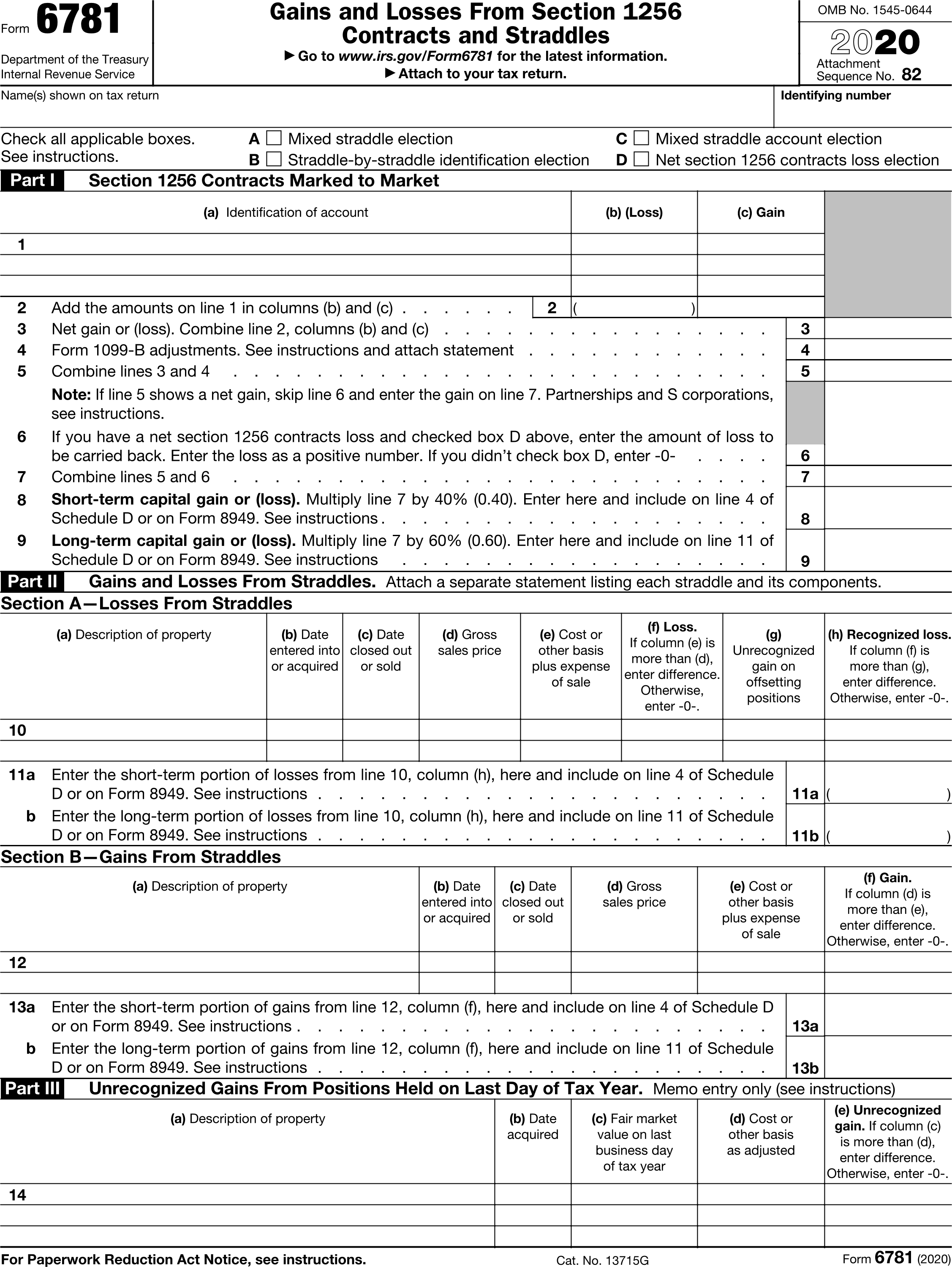

Form 6781 Irs - Web carryovers to 2020 if line 6 of form 6781 were zero. Download and print form 6781 on irs.gov. Use a separate schedule d (form 1040) and capital loss carryover worksheet (in pub. We handle irs for you! Easily sort by irs forms to find the product that best fits your tax situation. Download and print form 6781 on irs.gov. Take avantage of irs fresh start. Attach to your tax return. 550) to figure this amount. Ad quickly end irs & state tax problems. Web here are the steps to fill out tax form 6781: Web a taxpayer cannot make a net section 1256 contracts loss election (box d) on form 6781 in a 1065, 1120, 1120s, or 1041 return. Web form 6781, gains and losses from section 1256 contracts and straddles, is used to report: Web information about form 6781, gains/losses from section. 550) to figure this amount. Web taxpayers use irs form 6781 to report gains and losses from section 1256 contracts and straddle positions. Easily sort by irs forms to find the product that best fits your tax situation. Web i am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial. Web i am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of all the income or proceeds to which this form relates or. Page last reviewed or updated: Web here are the steps to fill out tax form 6781: 82 name(s) shown on tax return identifying. Consequently, drake. Web you'll need form 6781 to file taxes when you trade commodities. Web forms, instructions and publications search. Ad quickly end irs & state tax problems. Web here are the steps to fill out tax form 6781: In this article, we’ll show you what you need to know. Web investors utilize the internal revenue service’s (irs) form 6781: In this article, we’ll show you what you need to know. Gains and losses from section 1256 contracts and straddles to report gains and losses from. This form is called the gains and losses from section 1256 contracts and straddles. Web information about form 6781, gains/losses from section 1256 contracts. Web form 6781, gains and losses from section 1256 contracts and straddles, is used to report: Take avantage of irs fresh start. To learn more about form 6781, please visit the. Take avantage of irs fresh start. Attach to your tax return. Add your name shown on tax return, identifying number and check. Take avantage of irs fresh start. Web you'll need form 6781 to file taxes when you trade commodities. Web information about form 6781, gains/losses from section 1256 contracts and straddles, including recent updates, related forms, and instructions on how to file. Get your qualification analysis done today! Easily sort by irs forms to find the product that best fits your tax situation. We handle irs for you! The basics of section 1256. 550) to figure this amount. Get your qualification analysis done today! Web this article will assist you with generating form 6781, gains and losses from section 1256 contracts and straddles, in proseries professional and proseries. Web carryovers to 2020 if line 6 of form 6781 were zero. Web i am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of. The basics of section 1256. Web here are the steps to fill out tax form 6781: 550) to figure this amount. Web form 6781, gains and losses from section 1256 contracts and straddles, is used to report: This form is called the gains and losses from section 1256 contracts and straddles. Add your name shown on tax return, identifying number and check. Add your name shown on tax return, identifying number and check. Take avantage of irs fresh start. Get your qualification analysis done today! Easily sort by irs forms to find the product that best fits your tax situation. Download and print form 6781 on irs.gov. Web how to generate form 6781 gains and losses in proconnect. We handle irs for you! Access irs forms, instructions and publications in electronic and. We handle irs for you! Web i am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of all the income or proceeds to which this form relates or. Web a taxpayer cannot make a net section 1256 contracts loss election (box d) on form 6781 in a 1065, 1120, 1120s, or 1041 return. Web carryovers to 2023 if line 6 of form 6781 were zero. Consequently, drake tax does not offer that. Web form 6781, gains and losses from section 1256 contracts and straddles, is used to report: 550) to figure this amount. The basics of section 1256. Use a separate schedule d (form 1040) and capital loss carryover worksheet (in pub. To learn more about form 6781, please visit the. Knott 16.3k subscribers subscribe share 7.5k views 1 year ago irs forms & schedules the irs.U.S. TREAS Form treasirs67811998

IRS Form 6781

How to Complete IRS Form 6781 Simple Example YouTube

Instructions Irs Form 6781 printable pdf download

Irs Form W4V Printable where do i mail my w 4v form for social

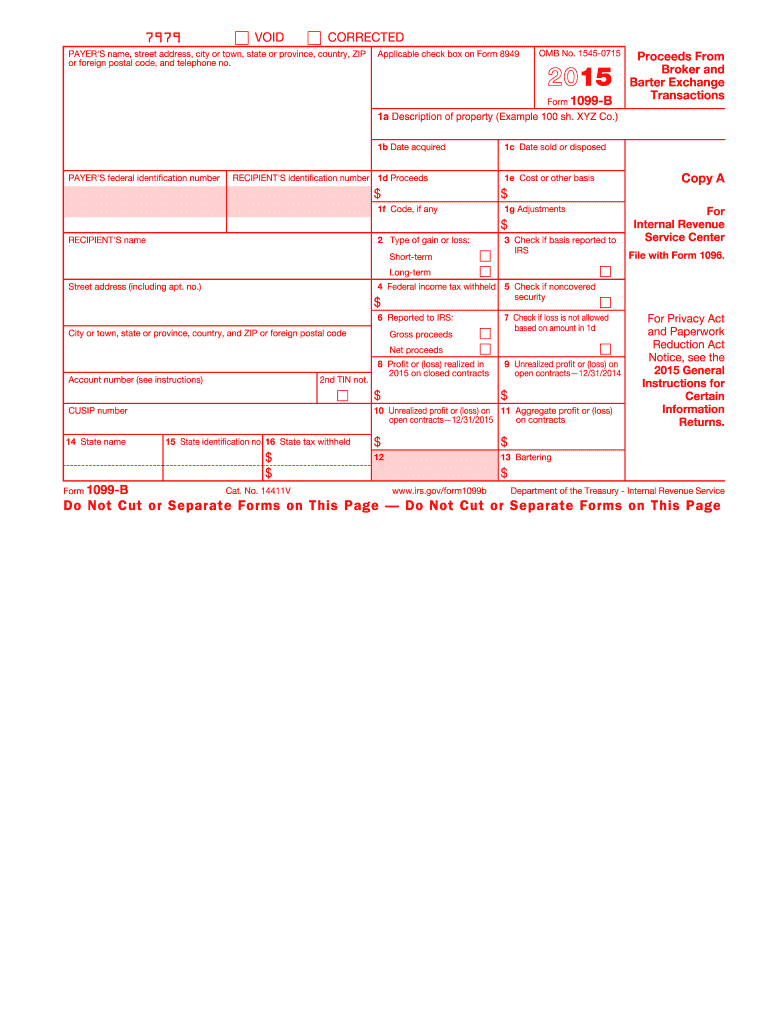

2015 Form IRS 1099BFill Online, Printable, Fillable, Blank pdfFiller

IRS Form 6781 with a Section 1256 Carryback Claim YouTube

IRS Form 6781

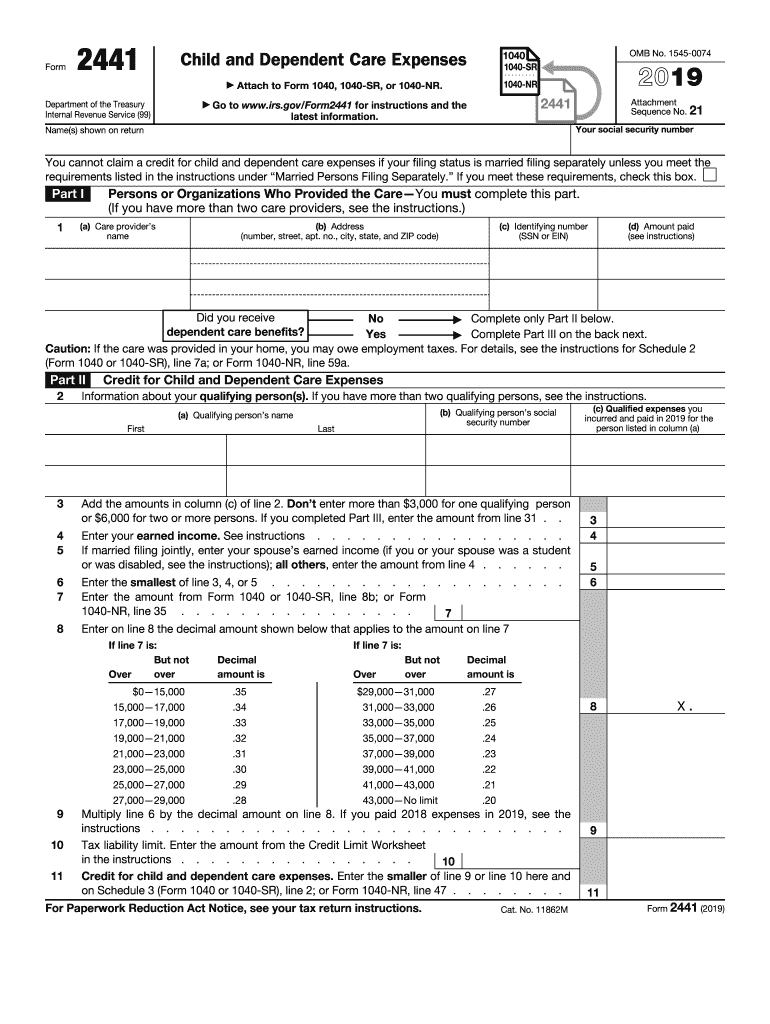

Form 2441 Fill out & sign online DocHub

Form 6781 Gains and Losses from Section 1256 Contracts and Straddles

Related Post: