Form 480.6

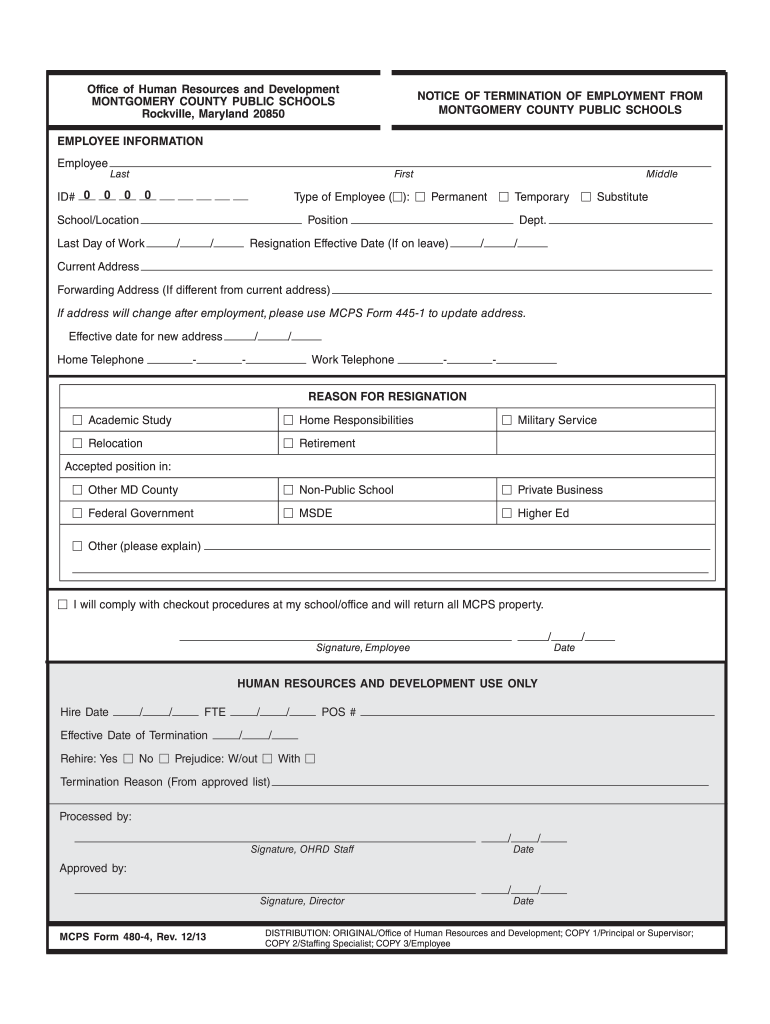

Form 480.6 - Web as established by the puerto rico internal revenue code of 2011, as amended (code), must file this form. Web form 480.7a informative return mortgage interests the name of box 6 was modified to establish that the item to be reported on this line is the original loan amount. Addition or elimination of certain areas. Created by jonathan cunanan, last modified on feb 10, 2020. Form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Web every payer or withholding agent who is required to deduct and withhold at source the tax with respect to payments for services rendered, according to form 480.6sp, shall. Upon the hearing, if it appears after consideration of all objections. Web what is tax form 480.6a? Form 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. Web every payer or withholding agent who is required to deduct and withhold at source the tax with respect to payments for services rendered, according to form 480.6sp, shall. Ad uslegalforms.com has been visited by 100k+ users in the past month Web what is irs form 480.6a? Bppr is required by law to send informative statements about any amount of. Created by jonathan cunanan, last modified on feb 10, 2020. Upon the hearing, if it appears after consideration of all objections. Ad uslegalforms.com has been visited by 100k+ users in the past month Form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Every person required to deduct. Web form 480.7a informative return mortgage interests the name of box 6 was modified to establish that the item to be reported on this line is the original loan amount. Web reverse of da form 2406, apr 1993. Form 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web form. Web forms 480.6a and 480.6d. Web what is tax form 480.6a? Ad uslegalforms.com has been visited by 100k+ users in the past month Web form 480.7a informative return mortgage interests the name of box 6 was modified to establish that the item to be reported on this line is the original loan amount. Web every payer or withholding agent who. Ad uslegalforms.com has been visited by 100k+ users in the past month Web every payer or withholding agent who is required to deduct and withhold at source the tax with respect to payments for services rendered, according to form 480.6sp, shall. Form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not. Form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Web as established by the puerto rico internal revenue code of 2011, as amended (code), must file this form. Upon the hearing, if it appears after consideration of all objections. Created by jonathan cunanan, last modified on feb. Web what is tax form 480.6a? Upon the hearing, if it appears after consideration of all objections. Web what is irs form 480.6a? Web every payer or withholding agent who is required to deduct and withhold at source the tax with respect to payments for services rendered, according to form 480.6sp, shall. Web form 480.7a informative return mortgage interests the. Web form 480.7a informative return mortgage interests the name of box 6 was modified to establish that the item to be reported on this line is the original loan amount. Upon the hearing, if it appears after consideration of all objections. Web what is tax form 480.6a? The preparation of form 480.6a will be required when the payment. Addition or. Web form 480.7a informative return mortgage interests the name of box 6 was modified to establish that the item to be reported on this line is the original loan amount. Web forms 480.6a and 480.6d. Ad uslegalforms.com has been visited by 100k+ users in the past month Web what is tax form 480.6a? Web reverse of da form 2406, apr. The preparation of form 480.6a will be required when the payment. Web what is tax form 480.6a? Web every payer or withholding agent who is required to deduct and withhold at source the tax with respect to payments for services rendered, according to form 480.6sp, shall. Web as established by the puerto rico internal revenue code of 2011, as amended. Form 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web form 480.7a informative return mortgage interests the name of box 6 was modified to establish that the item to be reported on this line is the original loan amount. If you receive these forms, it is. Form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Web reverse of da form 2406, apr 1993. Web what is tax form 480.6a? Bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. Web forms 480.6a and 480.6d. Every person required to deduct and withhold any tax under section 1062.03 of the puerto rico. Web as established by the puerto rico internal revenue code of 2011, as amended (code), must file this form. Web what is irs form 480.6a? Upon the hearing, if it appears after consideration of all objections. Addition or elimination of certain areas. The preparation of form 480.6a will be required when the payment. Created by jonathan cunanan, last modified on feb 10, 2020. Ad uslegalforms.com has been visited by 100k+ users in the past month Web form 480.6e — mail order sales. Web every payer or withholding agent who is required to deduct and withhold at source the tax with respect to payments for services rendered, according to form 480.6sp, shall.2013 Form MD MCPS 4804 Fill Online, Printable, Fillable, Blank pdfFiller

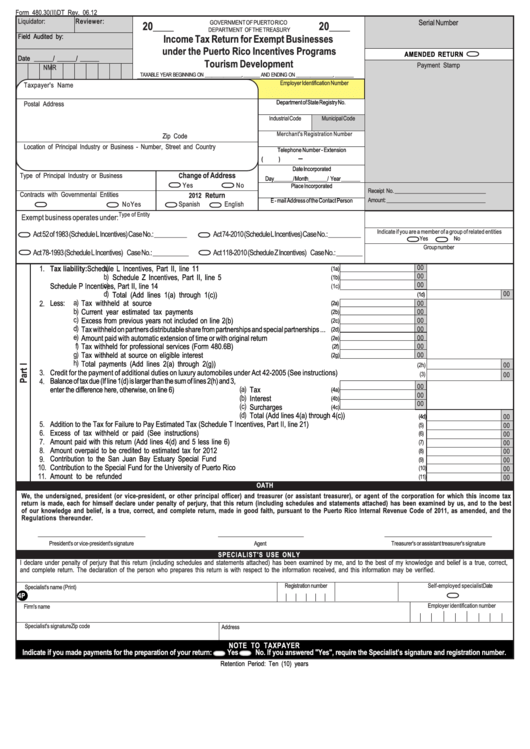

Form 480.30(Ii)dt Tax Return For Exempt Businesses Under The

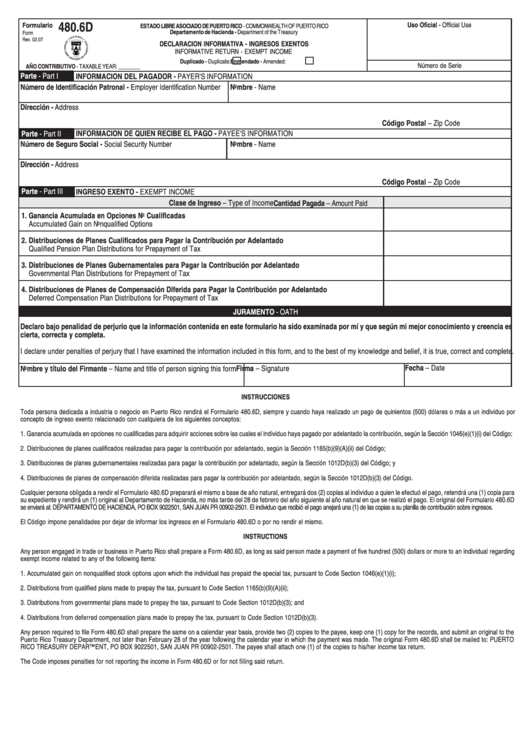

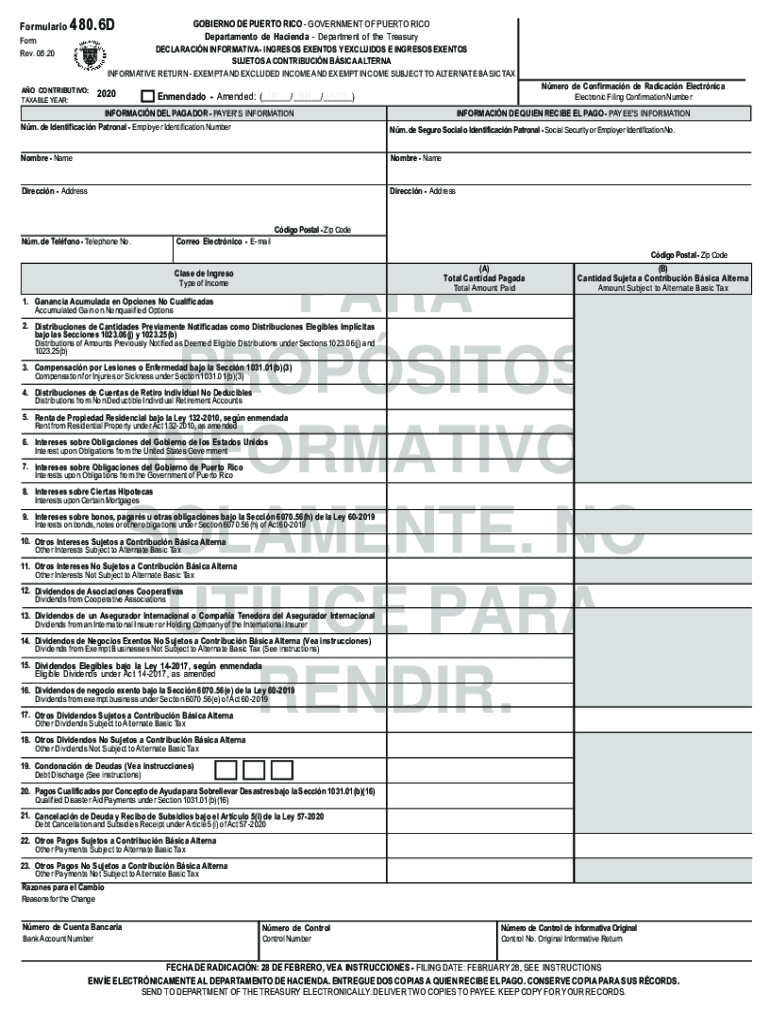

Form 480.6d Informative Return Exempt Puerto Rico

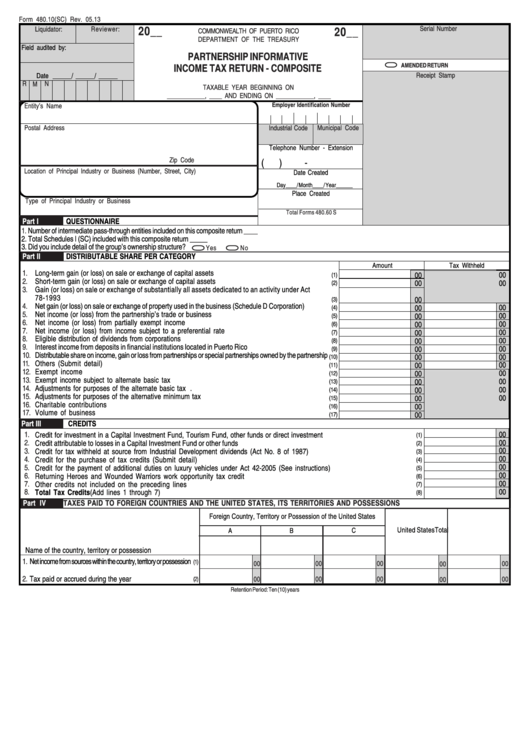

Form 480.10(Sc) Partnership Informative Tax Return Composite

Form 480 6d puerto rico Fill out & sign online DocHub

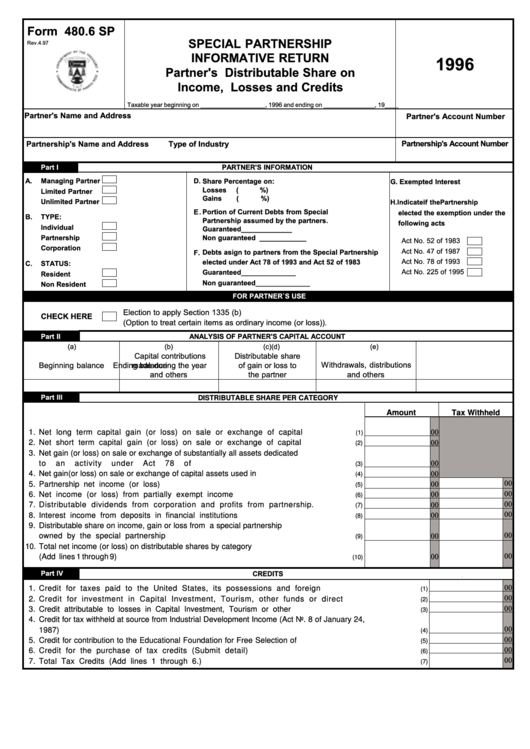

Form 480.6 Sp Partner'S Distributable Share On Losses And

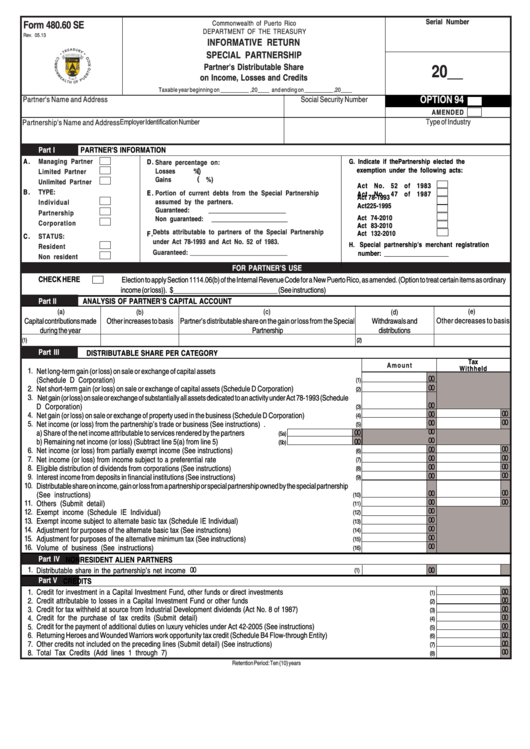

Form 480.60 Se Informative Return Special Partnership Partner'S

20172022 Form PR 480.7(OE) Fill Online, Printable, Fillable, Blank

480.7C 2019 Public Documents 1099 Pro Wiki

20192023 PR Form 480.20(U) Fill Online, Printable, Fillable, Blank

Related Post: