Form 4797 Vs 8949

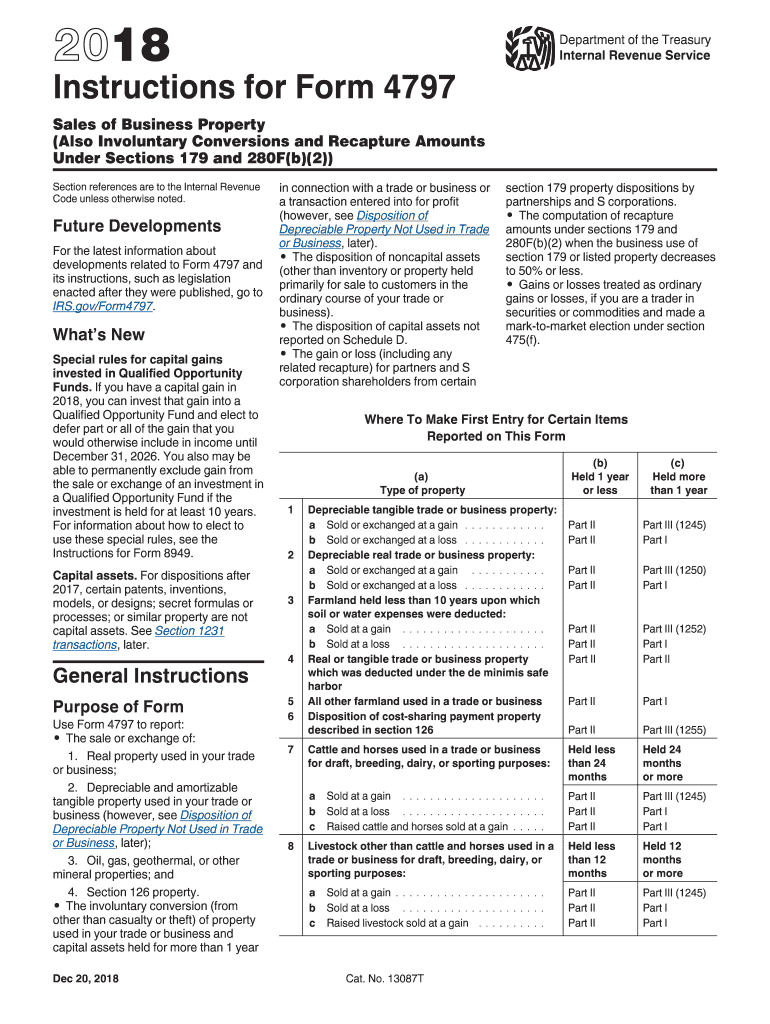

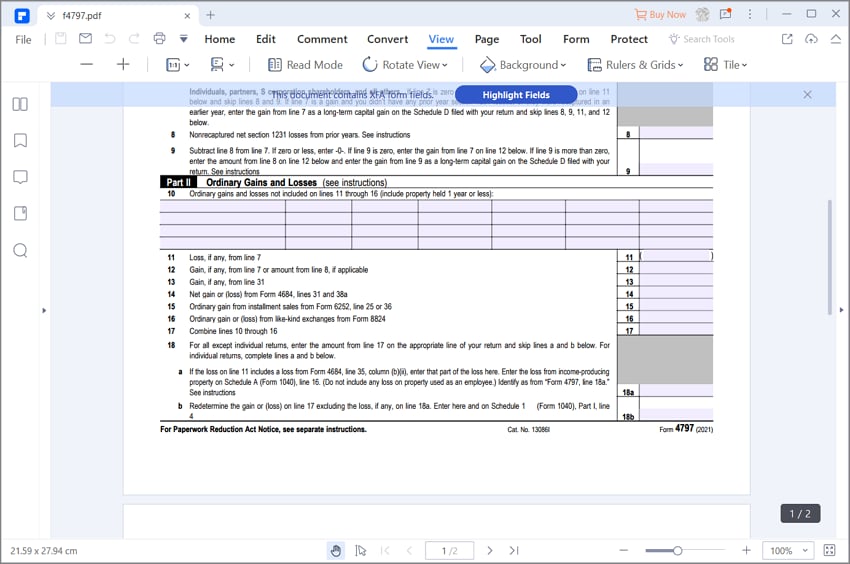

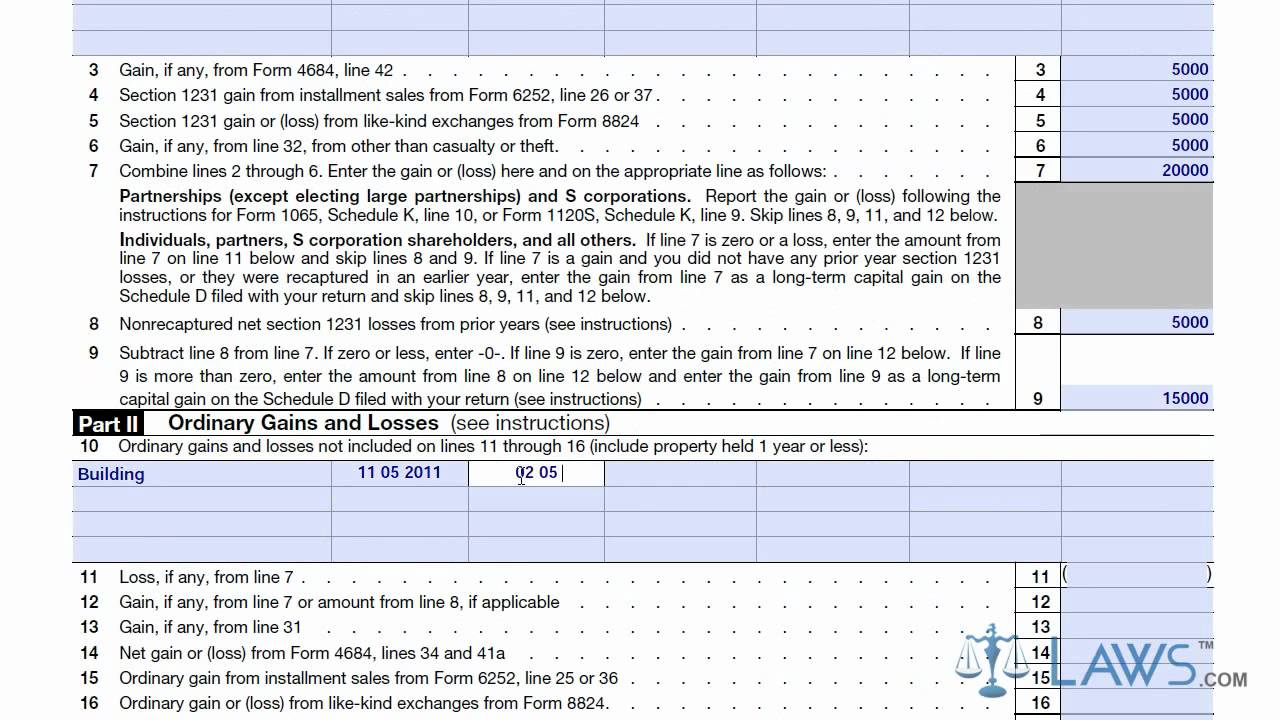

Form 4797 Vs 8949 - For further information, refer to: Web what is form 4797? Depreciable and amortizable tangible property used in your. About form 8949, sales and other dispositions of capital assets. Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of. On form 8949, enter “from. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral of a capital gain through investment in a qualified opportunity fund or the. Use form 8949 to reconcile amounts that were reported to you and the. Entering sale or disposition of assets; About form 8949, sales and other dispositions of capital assets. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Ad access irs tax forms. It’s common to file form 8949 with. Entering sale or disposition of assets; About form 8949, sales and other dispositions of capital assets. Complete, edit or print tax forms instantly. It’s common to file form 8949 with. Under the form 4797 section, complete any applicable fields: Web use form 4797 to report the following. Web forms and instructions. Web from the top of the screen, click the three dots and choose sale of asset 4797, 6252. This might include any property used to generate rental income or even a. Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Complete,. Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Get ready for tax season deadlines by completing any required tax forms today. Real property used in your trade or business; Web most deals are reportable with form 4797, but some use 8949, mainly when reporting. As a convenience to customers, we offer generation of form 4797 in our application. Get ready for tax season deadlines by completing any required tax forms today. Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral of a capital gain through investment in a qualified opportunity fund or the. What is the. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Depreciable and amortizable tangible property used in your. Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral of a capital gain through investment in a qualified opportunity fund or the. Get ready for tax. Use form 8949 to reconcile amounts that were reported to you and the. Web use form 8949 to report sales and exchanges of capital assets. It’s common to file form 8949 with. Solved•by intuit•15•updated 1 year ago. Sales of assets may be entered in either the income. If the total gain for the depreciable property is more than the recapture amount, the excess is reported on form 8949. Complete, edit or print tax forms instantly. Generally, the gain is reported on form 8949 and schedule d. On form 8949, enter “from. This might include any property used to generate rental income or even a. Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of. Web forms and instructions. It’s common to file form 8949 with. Generally, the gain is reported on form 8949 and schedule d. Under the form 4797 section, complete any applicable fields: Sales of assets may be entered in either the income. If the total gain for the depreciable property is more than the recapture amount, the excess is reported on form 8949. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Web use form 8949 to report sales and exchanges of capital. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. Web from the top of the screen, click the three dots and choose sale of asset 4797, 6252. Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral of a capital gain through investment in a qualified opportunity fund or the. Complete, edit or print tax forms instantly. Under the form 4797 section, complete any applicable fields: Sales of assets may be entered in either the income. Get ready for tax season deadlines by completing any required tax forms today. Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral of a capital gain through investment in a qualified opportunity fund or the. Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Web see the instructions for part iii. However, part of the gain on the sale or exchange of the depreciable property may have to be recaptured as ordinary income on form 4797. This might include any property used to generate rental income or even a. Depreciable and amortizable tangible property used in your. On form 8949, enter “from. Entering sale or disposition of assets; Form 4797 input for sales of business property. For further information, refer to: For exchanges of real property. As a convenience to customers, we offer generation of form 4797 in our application. Generally, the gain is reported on form 8949 and schedule d.Irs Instructions Form 4797 Fill Out and Sign Printable PDF Template

2019 Form IRS 4797 Fill Online, Printable, Fillable, Blank pdfFiller

Online IRS Instructions 8949 2019 Fillable and Editable PDF Template

IRS Form 4797 Guide for How to Fill in IRS Form 4797

Learn How to Fill the Form 4797 Sales of Business Property YouTube

Fillable Online apps irs To review Tess's completed Form 8949 and

Form 8949 Fillable Printable Forms Free Online

Irs Form 4797 Fillable Printable Forms Free Online

Form 4797 Sales of Business Property Definition

irs form 8949 instructions 2020 Fill Online, Printable, Fillable

Related Post:

:max_bytes(150000):strip_icc()/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)