Form 4797 Part Ii

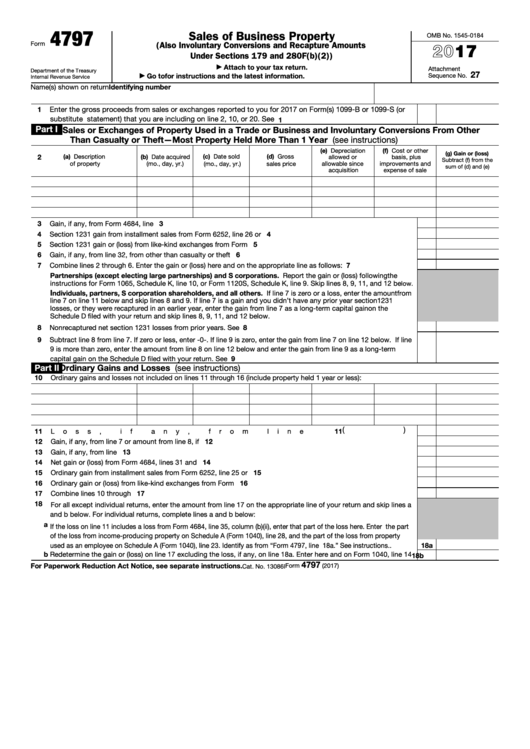

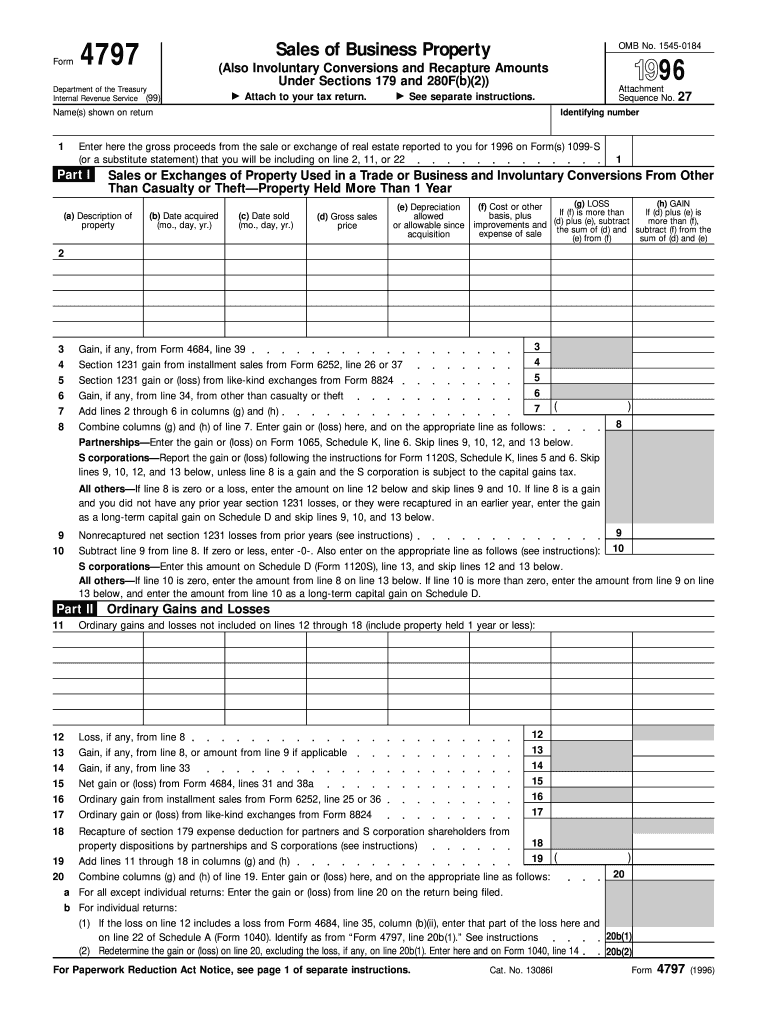

Form 4797 Part Ii - Web why is the sale of a farm animal showing on form 4797, part ii when it was held more than a year? If the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii),. Income from part iii, line 31. Web to enter a portion of the gain from the sale of a partnership interest, as ordinary income and capital gain, on form 4797, sales of business property, part ii,. Web part i sales or exchanges of property used in a trade or business and involuntary conversions from other than casualty or theft—most property held more than 1 year. Gain from disposition of property under sections 1245, 1250, 1252, 1254, and 1255; Web form 4797 department of the treasury. Web (if any) on form 4797, part i, ii, or iii, as applicable, and include the words “partial disposition election” in the description of the partially disposed asset. Web report the gain or loss (if any) on the following partial dispositions of macrs assets on form 4797, part i, ii, or iii, as applicable. Why isn't my sale flowing to form 4797? Web common questions for form 4797 in proseries below are the most popular support articles associated with form 4797.reporting bulk asset sales in proserieshow to dispose of a. Web (if any) on form 4797, part i, ii, or iii, as applicable, and include the words “partial disposition election” in the description of the partially disposed asset. If the loss on. If the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. It is reported in a. Gain from disposition of property under sections 1245, 1250, 1252, 1254, and 1255; Web in the final column labeled pt, choose ii (two). Ad download or email irs 4797 & more fillable. Assets held less than 1 year. Web common questions for form 4797 in proseries below are the most popular support articles associated with form 4797.reporting bulk asset sales in proserieshow to dispose of a. Why isn't my sale flowing to form 4797? Web form 4797 department of the treasury. Sale of a portion of a macrs asset. Sale of a portion of a macrs asset. All ordinary gains or losses. Web form 4797 department of the treasury. Web (if any) on form 4797, part i, ii, or iii, as applicable, and include the words “partial disposition election” in the description of the partially disposed asset. Get ready for tax season deadlines by completing any required tax forms. If the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii),. Web (if any) on form 4797, part i, ii, or iii, as applicable, and include the words “partial disposition election” in the description of the partially disposed asset. All ordinary gains or losses. Ad download or email irs 4797 & more fillable forms, register. Enter the loss from income. Web in the final column labeled pt, choose ii (two). Farmland held less than 10 years upon which soil or water expenses were deducted a: Usually on the disposition of a partnership interest, there's section 751 income to be reported. An ordinary income gain/loss reported on form 4797, part ii, line 10a capital gain reported. All ordinary gains or losses. Ad download or email irs 4797 & more fillable forms, register and subscribe now! It is reported in a. An ordinary income gain/loss reported on form 4797, part ii, line 10a capital gain reported on the s you. If the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter. An ordinary income gain/loss reported on form 4797, part ii, line 10a capital gain reported on the s you. Usually on the disposition of a partnership interest, there's section 751 income to be reported. Income from part iii, line 31. Web form 4797 department of the treasury. Gain from disposition of property under sections 1245, 1250, 1252, 1254, and 1255; Web (if any) on form 4797, part i, ii, or iii, as applicable, and include the words “partial disposition election” in the description of the partially disposed asset. Web part i sales or exchanges of property used in a trade or business and involuntary conversions from other than casualty or theft—most property held more than 1 year. Assets held less. Generally, assets held for more than a year carry to part i and items held for 1. Web why is the sale of a farm animal showing on form 4797, part ii when it was held more than a year? Web form 4797 department of the treasury. Income from part iii, line 31. All ordinary gains or losses. Web this article will help you with frequently asked questions about form 4797 in lacerte. Generally, assets held for more than a year carry to part i and items held for 1. Web report the gain or loss (if any) on the following partial dispositions of macrs assets on form 4797, part i, ii, or iii, as applicable. If the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii),. It is reported in a. Sale of a portion of a macrs asset. Web in the final column labeled pt, choose ii (two). Usually on the disposition of a partnership interest, there's section 751 income to be reported. Web common questions for form 4797 in proseries below are the most popular support articles associated with form 4797.reporting bulk asset sales in proserieshow to dispose of a. From there as you scroll through the form you can see it populates part ii ordinary gain/loss from the summary. Web a sale of a partnership interest requires two transactions: If the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Web to enter a portion of the gain from the sale of a partnership interest, as ordinary income and capital gain, on form 4797, sales of business property, part ii,. Assets held less than 1 year. Get ready for tax season deadlines by completing any required tax forms today. Web why is the sale of a farm animal showing on form 4797, part ii when it was held more than a year? Enter the loss from income. Web form 4797 department of the treasury. Web part i sales or exchanges of property used in a trade or business and involuntary conversions from other than casualty or theft—most property held more than 1 year. Farmland held less than 10 years upon which soil or water expenses were deducted a:Fillable Form 4797 Sales Of Business Property 2017 printable pdf

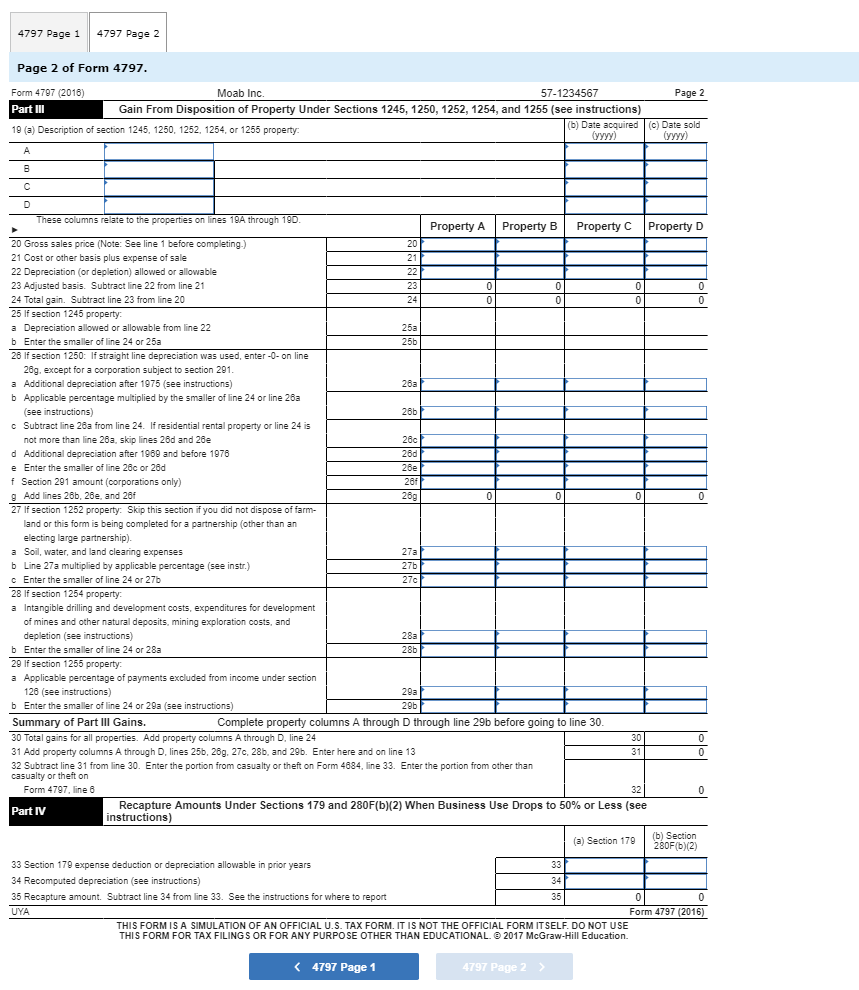

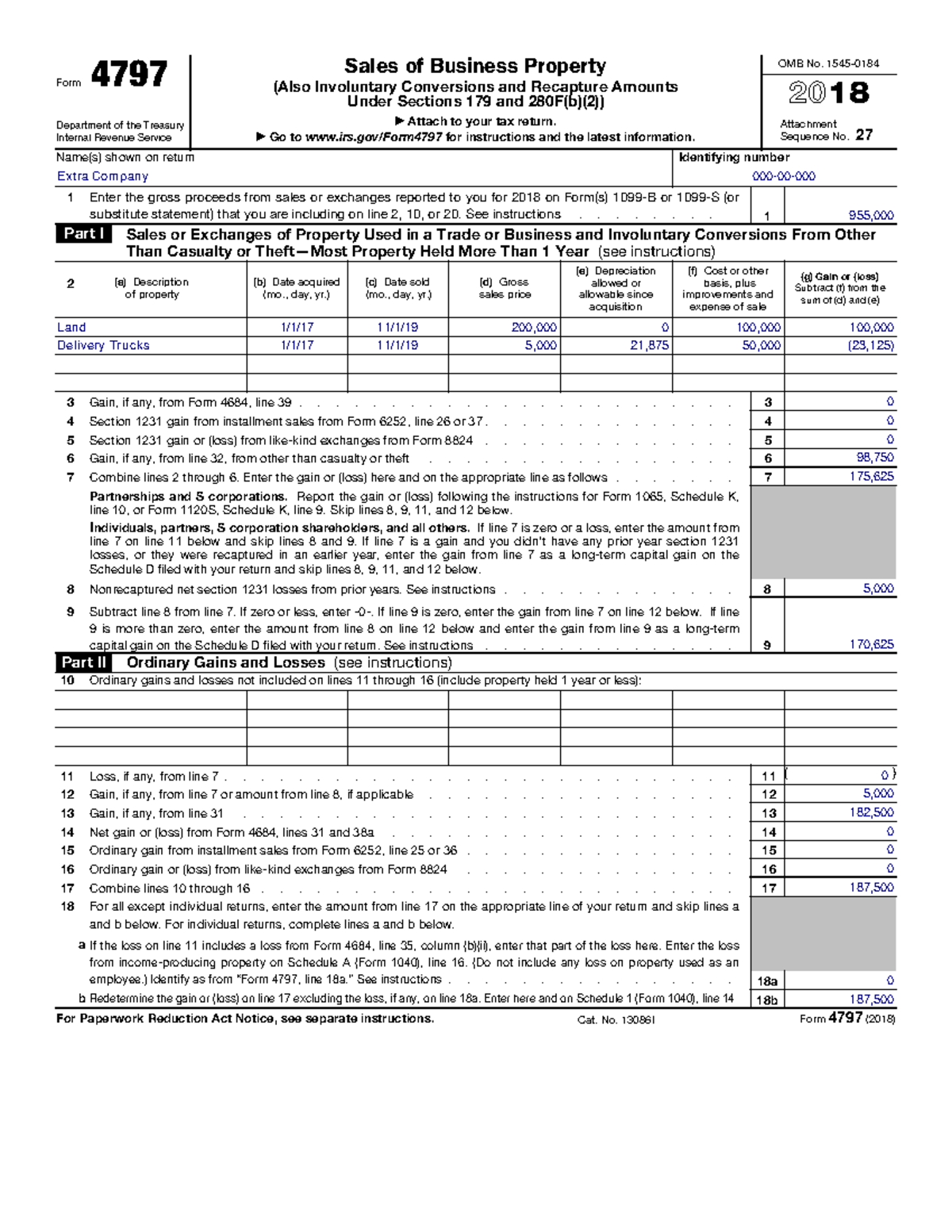

Complete Moab Inc S Form 4797 For The Year Aulaiestpdm Blog

IRS Form 4797 Instructions Sales of Business Property

IRS Form 4797 Instructions Sales of Business Property

Form 4797 Sales of Business Property and Involuntary Conversions

Form 4797 Fill Out and Sign Printable PDF Template signNow

IRS Form 4797 Instructions Sales of Business Property

Irs Form 4797 Instructions 2022 Fill online, Printable, Fillable Blank

Publication 925, Passive Activity and AtRisk Rules; Comprehensive Example

Form 4797 Final This Document has the filled out Form 4797 for the

Related Post: