Form 4562 Turbotax

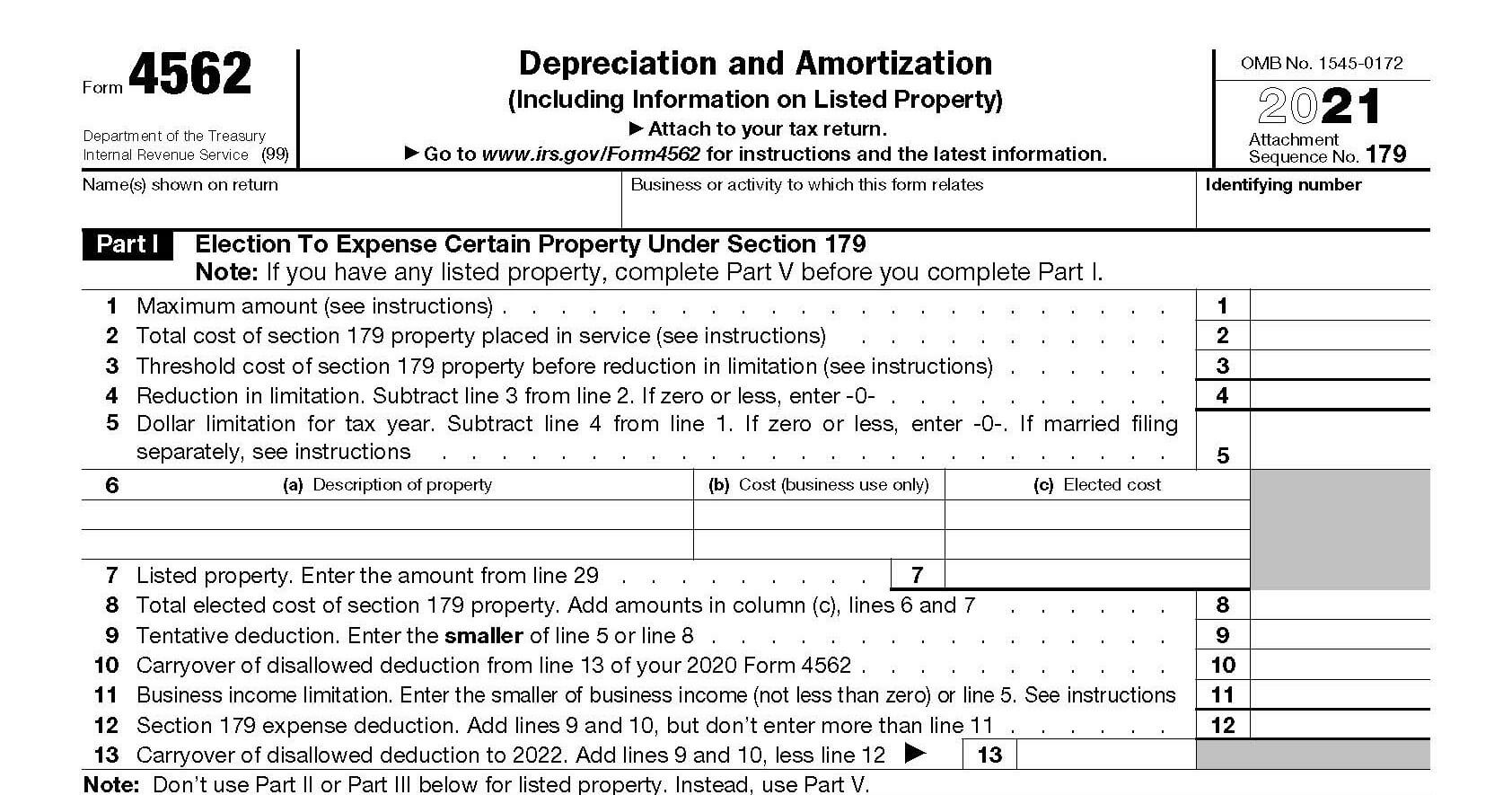

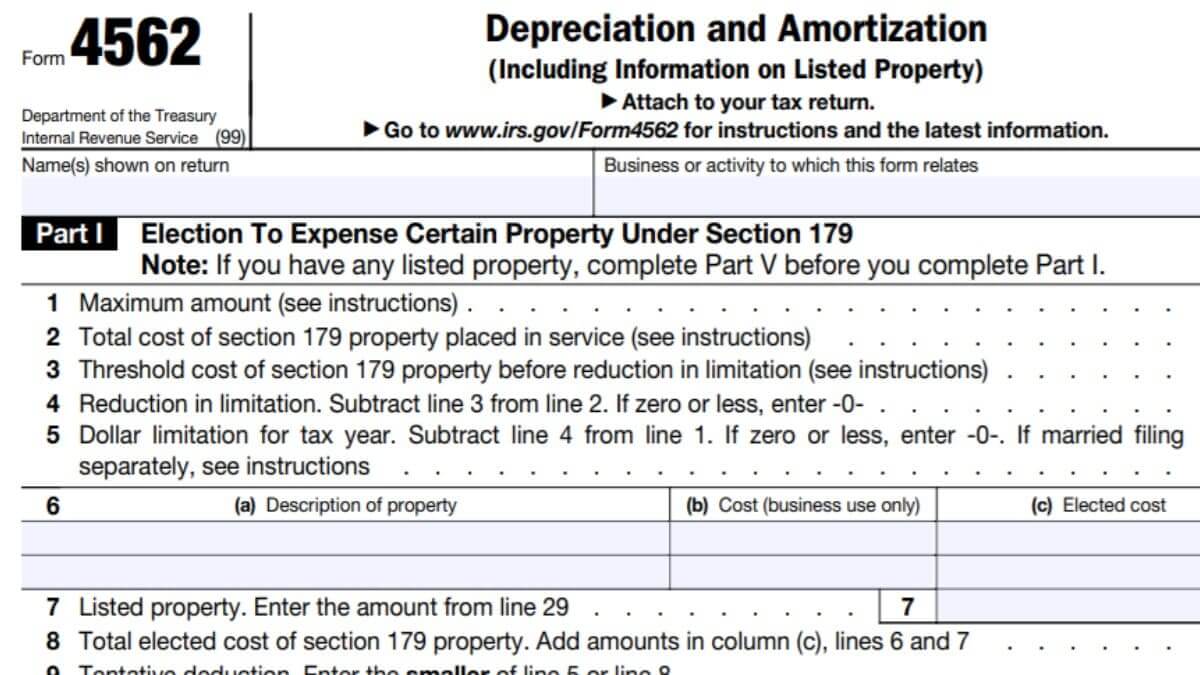

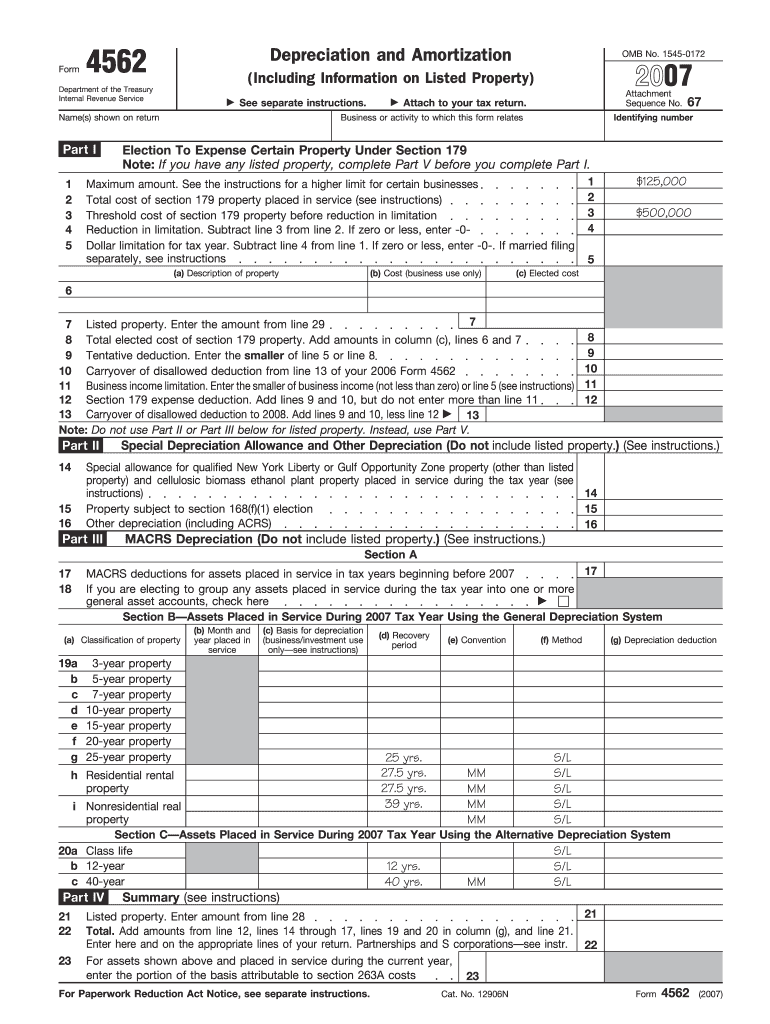

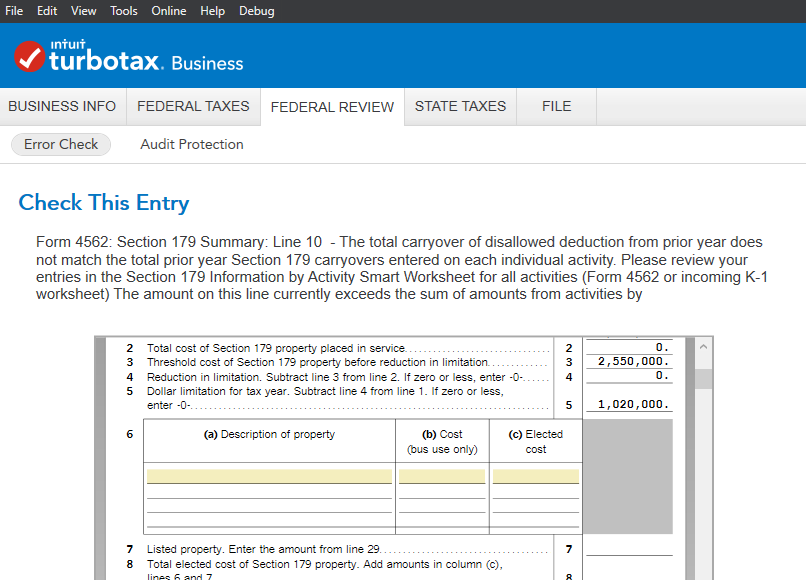

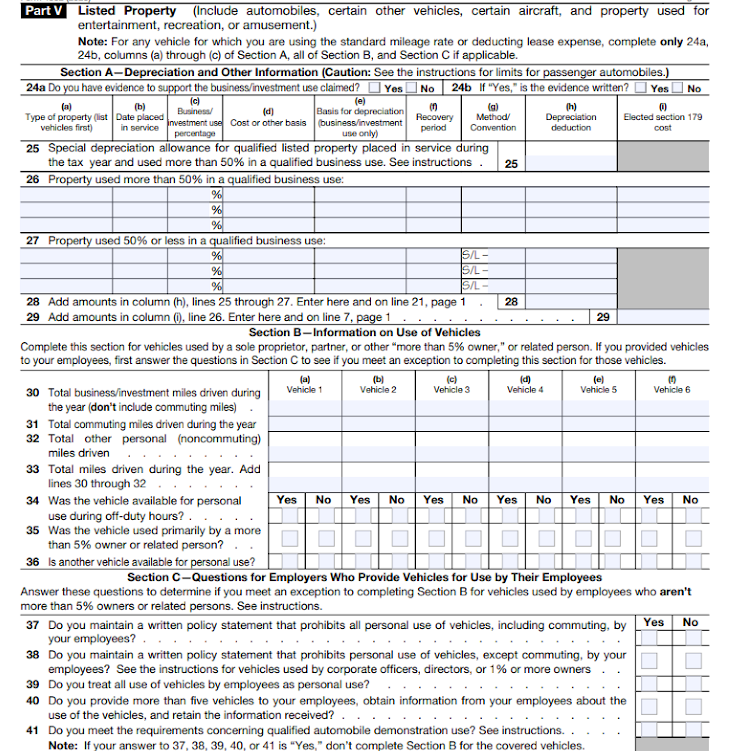

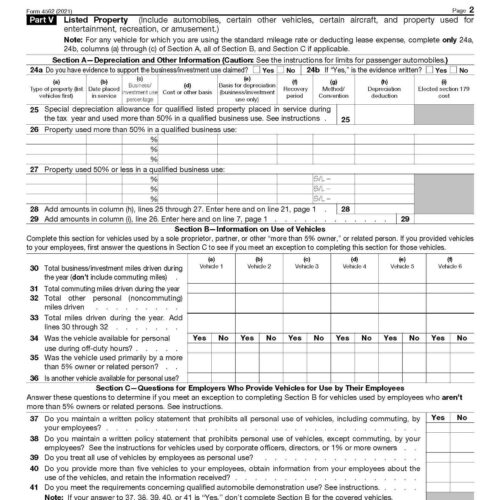

Form 4562 Turbotax - Web february 5, 2022 4:27 pm. Web a form 4562 depreciation and amortization would only be included with your tax return if you have entered an asset that you placed in service during the current tax. If you get a message that your software is up to date and you still cannot. Web making section 179 election on form 4562 will enable you to claim an immediate expense deduction but only for qualifying assets whose combined value. Depreciation and amortization is an internal revenue service (irs) form used to claim deductions for the depreciation or amortization of an. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. If you've purchased property to use in your business, you can deduct a portion of your costs by claiming a depreciation deduction and reporting it on irs form 4562. Form 4562 is currently showing available. Web f4562 and irs form 4562 are two physically different forms. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain property, and. Ad file form 4562 with 100% accuracy guaranteed. Web a form 4562 depreciation and amortization would only be included with your tax return if you have entered an asset that you placed in service during the current tax. Updated for tax year 2022 • june 2, 2023 8:54 am. Once you understand what each part. Web see what tax forms. Web irs form 4562, depreciation and amortization, is used to depreciate or amortize property you’ve bought for your business. No schedule e or 4562 in years 2018 until now. One of them prints in portrait format and is generated only if there is a change. Click on check for updates. Web click on online at the top of the desktop. Web february 5, 2022 4:27 pm. Web making section 179 election on form 4562 will enable you to claim an immediate expense deduction but only for qualifying assets whose combined value. Written by a turbotax expert • reviewed by a turbotax cpa. Irs form 4562is used to calculate and claim deductions for depreciation and amortization. Ad file form 4562 with. Web irs form 4562, depreciation and amortization, is used to depreciate or amortize property you’ve bought for your business. Irs form 4562is used to calculate and claim deductions for depreciation and amortization. Depreciation and amortization is an internal revenue service (irs) form used to claim deductions for the depreciation or amortization of an. Updated for tax year 2022 • june. To complete form 4562, you'll need to know the cost of assets like. This can come up for some users if the total carryover of disallowed deduction. Irs form 4562is used to calculate and claim deductions for depreciation and amortization. Web click on online at the top of the desktop program screen. If you've purchased property to use in your. This may be because i didn't go into the rental income part of. To complete form 4562, you'll need to know the cost of assets like. Web with turbotax, there can be up to three irs form 4562's for each rental property. Since you started renting out. If you've purchased property to use in your business, you can deduct a. Once you understand what each part. To complete form 4562, you'll need to know the cost of assets like. Irs form 4562is used to calculate and claim deductions for depreciation and amortization. Web with turbotax, there can be up to three irs form 4562's for each rental property. Since you started renting out. To complete form 4562, you'll need to know the cost of assets like. Form 4562 is used to. No schedule e or 4562 in years 2018 until now. One of them prints in portrait format and is generated only if there is a change. Last updated february 05, 2022 4:27 pm. Web with turbotax, there can be up to three irs form 4562's for each rental property. Claim your depreciating deduction from tax form 4562. Web making section 179 election on form 4562 will enable you to claim an immediate expense deduction but only for qualifying assets whose combined value. Web f4562 and irs form 4562 are two physically different forms.. Form 4562 is currently showing available. If you get a message that your software is up to date and you still cannot. Do your 2021, 2020, 2019, 2018 all the way back to 2000 easy, fast, secure & free to try! No schedule e or 4562 in years 2018 until now. Affordable form 4562 tax filing made easy. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. If you've purchased property to use in your business, you can deduct a portion of your costs by claiming a depreciation deduction and reporting it on irs form 4562. This may be because i didn't go into the rental income part of. Claim your depreciating deduction from tax form 4562. Since you started renting out. Updated for tax year 2022 • june 2, 2023 8:54 am. The total amount of section 179 you. Web i assume you mean 2019 tax return because 2020 isn't over until 12/31/2020 so you cant file a return until after this date. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Web f4562 and irs form 4562 are two physically different forms. Property ceased being rental in 2017. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Written by a turbotax expert • reviewed by a turbotax cpa. Web with turbotax, there can be up to three irs form 4562's for each rental property. Web a form 4562 depreciation and amortization would only be included with your tax return if you have entered an asset that you placed in service during the current tax. Ad file form 4562 with 100% accuracy guaranteed. To complete form 4562, you'll need to know the cost of assets like. If you get a message that your software is up to date and you still cannot. Form 4562 is used to. Web click on online at the top of the desktop program screen.About Form 4562, Depreciation and Amortization IRS tax forms

Cómo completar el formulario 4562 del IRS

4562 Form 2022 2023

Form 4562, Depreciation and Amortization IRS.gov Fill out & sign

Partnership’s Minnesota Form 4562 — Example 2

Formulario 4562 Definición de depreciación y amortización Traders Studio

Check This Entry Form 4562 Section 179 Summary L...

IRS Form 4562 Explained A StepbyStep Guide

How to Complete IRS Form 4562

IRS Form 4562 Explained A StepbyStep Guide

Related Post: