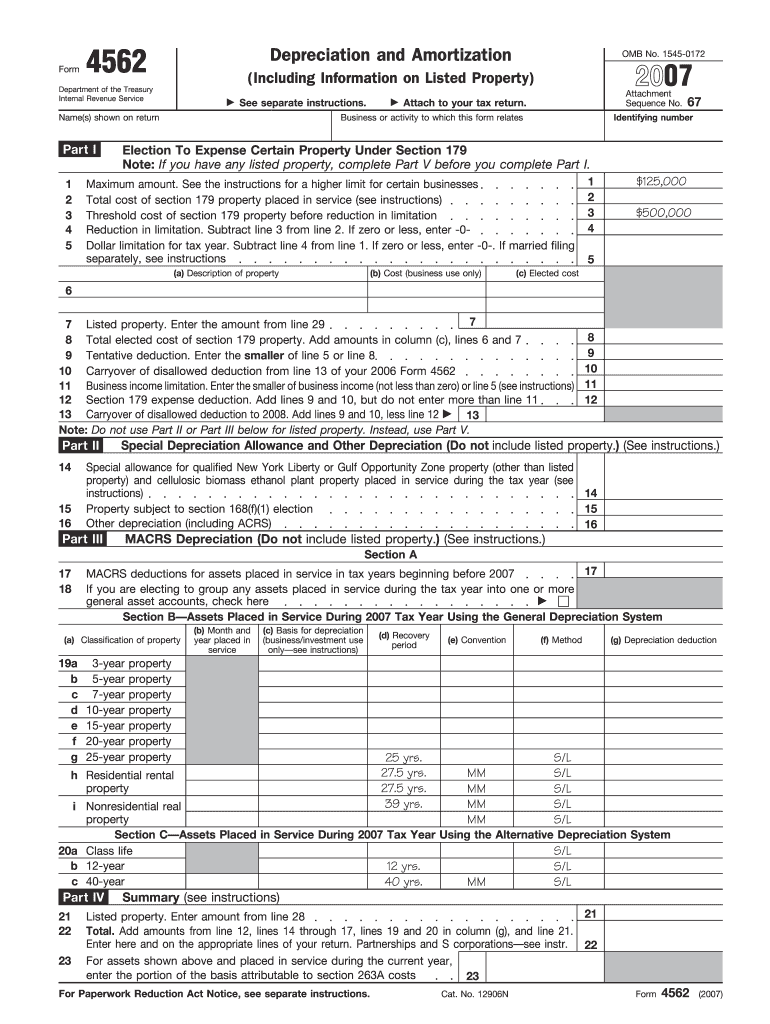

Form 4562 Tax

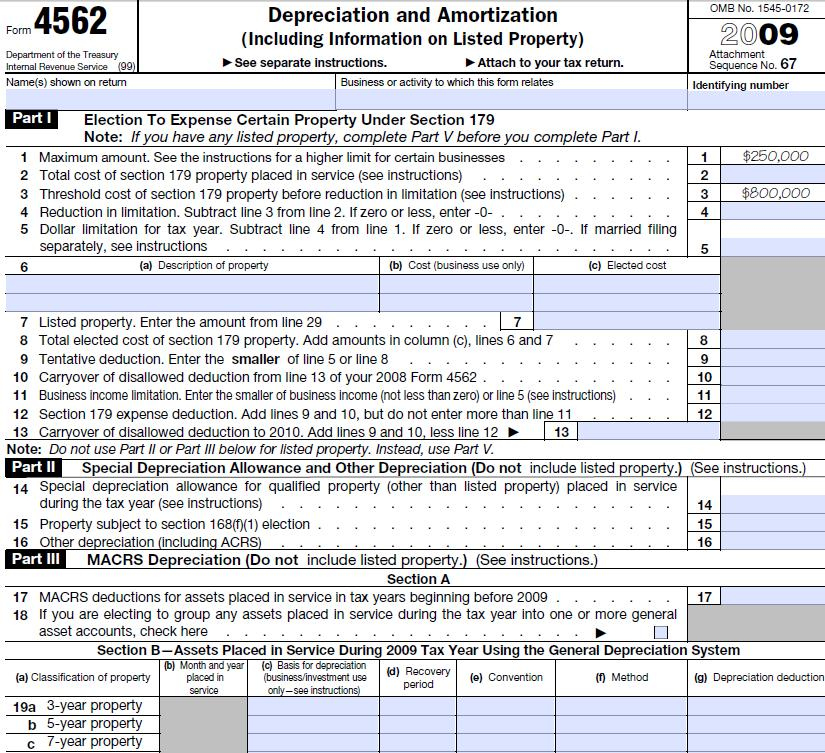

Form 4562 Tax - Web irs form 4562: Ad outgrow.us has been visited by 10k+ users in the past month Web form 4562 is the irs form used to report these deductions accurately and consistently. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. It appears you don't have a pdf plugin for this. In the asset list, click add.; It appears you don't have a pdf plugin for this. Form 4562, depreciation and amortization. Web irs form 4562 is used to calculate and claim deductions for depreciation and amortization. Web first, you’ll need to gather all the financial records regarding your asset. To properly fill out form 4562, you’ll need the following information: Ad complete irs tax forms online or print government tax documents. 2 total cost of section 179 property placed in service during the tax year (see instructions) 2 3 threshold cost of section 179 property before. Depreciation and amortization is a form that a business or individuals can use. Get ready for tax season deadlines by completing any required tax forms today. When you enter depreciable assets—vehicles, buildings, farm. Form 4562, depreciation and amortization. Web form 4562 is the irs form used to report these deductions accurately and consistently. Web first, you’ll need to gather all the financial records regarding your asset. You must make section 179 election on irs form. Web irs form 4562: When you enter depreciable assets—vehicles, buildings, farm. Web first, you’ll need to gather all the financial records regarding your asset. Depreciation and amortization is the name of this form, but it has additional uses beyond those two ways to claim expenses. To properly fill out form 4562, you’ll need the following information: Web form 4562 is the irs form used to report these deductions accurately and consistently. It appears you don't have a pdf plugin for this. Use irs form 4562 to claim depreciation and amortization deductions on your annual tax return. Web form 4562 department of the treasury internal revenue. Form 4562, depreciation and amortization. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain. It appears you don't have a pdf plugin for this. Web form 4562 is the irs form used to report these deductions accurately and consistently. When you enter depreciable assets—vehicles, buildings, farm. Web first, you’ll need to gather all the financial records regarding your asset. When you enter depreciable assets—vehicles, buildings, farm. Use irs form 4562 to claim depreciation and amortization deductions on your annual tax return. Form 4562 is primarily required for business owners who plan to claim. Web generating form 4562 in proconnect. Web form 4562, page 1 of 2. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. It appears you don't have a pdf plugin for this. Ad outgrow.us has been visited by 10k+ users in the past month See the instructions if you are unclear as to what constitutes section. Web irs form 4562: Ad complete irs tax forms online or print government tax documents. Web generating form 4562 in proconnect. Web open screen 22, depreciation (4562). Get ready for tax season deadlines by completing any required tax forms today. Ad complete irs tax forms online or print government tax documents. To properly fill out form 4562, you’ll need the following information: You must make section 179 election on irs form. Form 4562, depreciation and amortization. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Form 4562 is primarily required for business owners who plan to claim. 2 total cost of section 179 property placed in service during the tax year (see instructions) 2 3 threshold cost of section 179 property before. To complete form 4562, you'll need to know the cost of assets like. This article will walk you through entering depreciable assets for. Form 4562, depreciation and amortization. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain. When you enter depreciable assets—vehicles, buildings, farm. Depreciation and amortization is the name of this form, but it has additional uses beyond those two ways to claim expenses. Web file form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a section 179 election. 2 total cost of section 179 property placed in service during the tax year (see instructions) 2 3 threshold cost of section 179 property before. You must make section 179 election on irs form. Web open screen 22, depreciation (4562). Form 4562 is primarily required for business owners who plan to claim. Ad outgrow.us has been visited by 10k+ users in the past month Web form 4562 is the irs form used to report these deductions accurately and consistently. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. It appears you don't have a pdf plugin for this. Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the. Price of the asset being. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Web federal depreciation and amortization (including information on listed property) form 4562 pdf. Get ready for tax season deadlines by completing any required tax forms today. Use irs form 4562 to claim depreciation and amortization deductions on your annual tax return.Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

IRS Form 4562 Explained A StepbyStep Guide

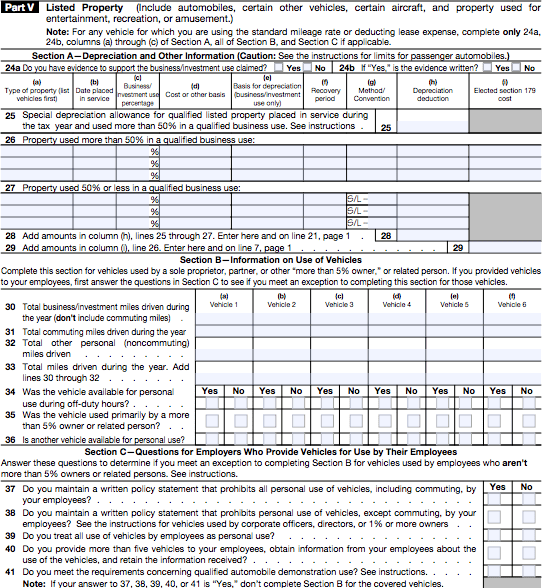

IRS Form 4562 Part 5

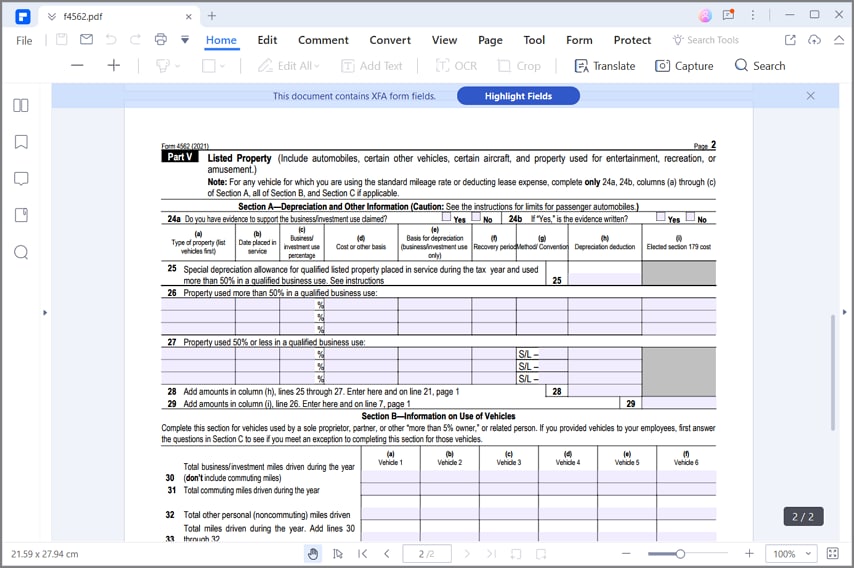

IRS Form 4562 Information And Instructions 2021 Tax Forms 1040 Printable

Form 4562 Depreciation and Amortization YouTube

4562 Form 2022 2023

Form 4562 Depreciation And Amortization Worksheet

for Fill how to in IRS Form 4562

Form 4562, Depreciation and Amortization IRS.gov Fill out & sign

How do I fill out Irs Form 4562 for this computer.

Related Post: