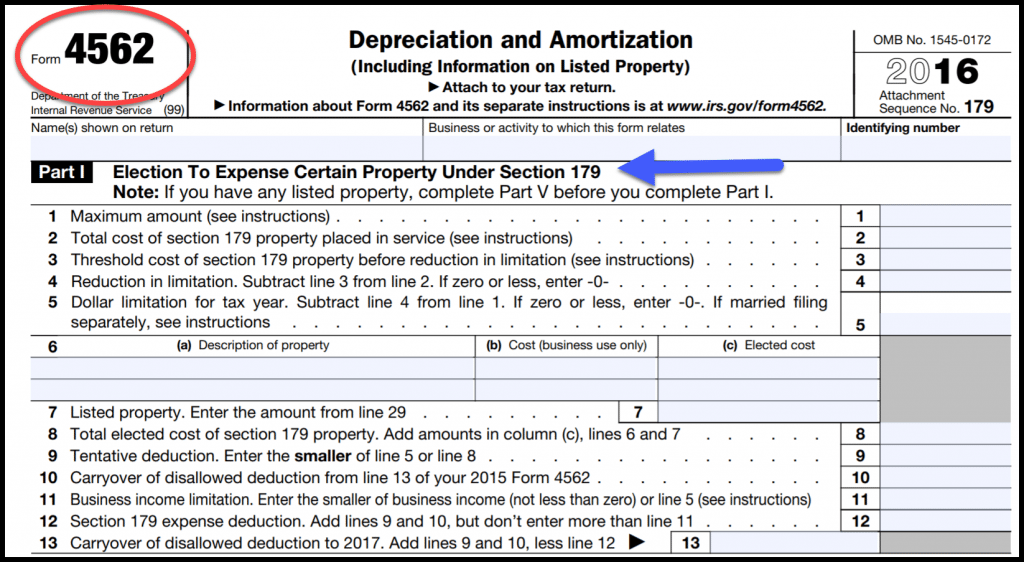

Form 4562 Section 179

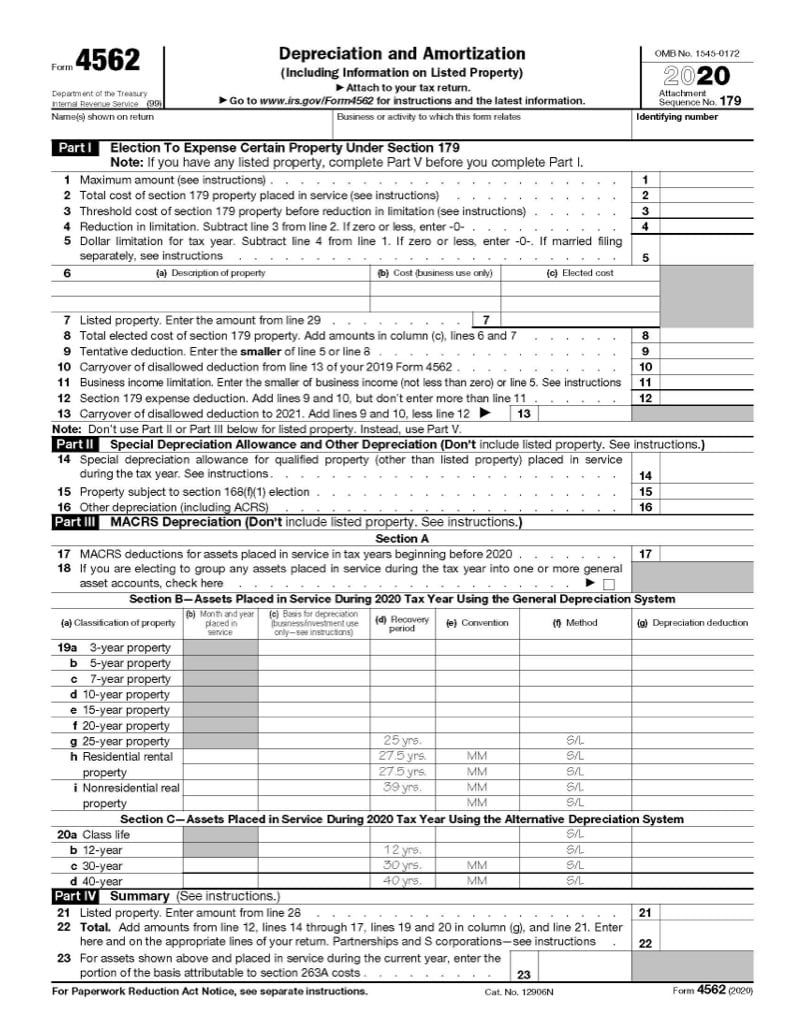

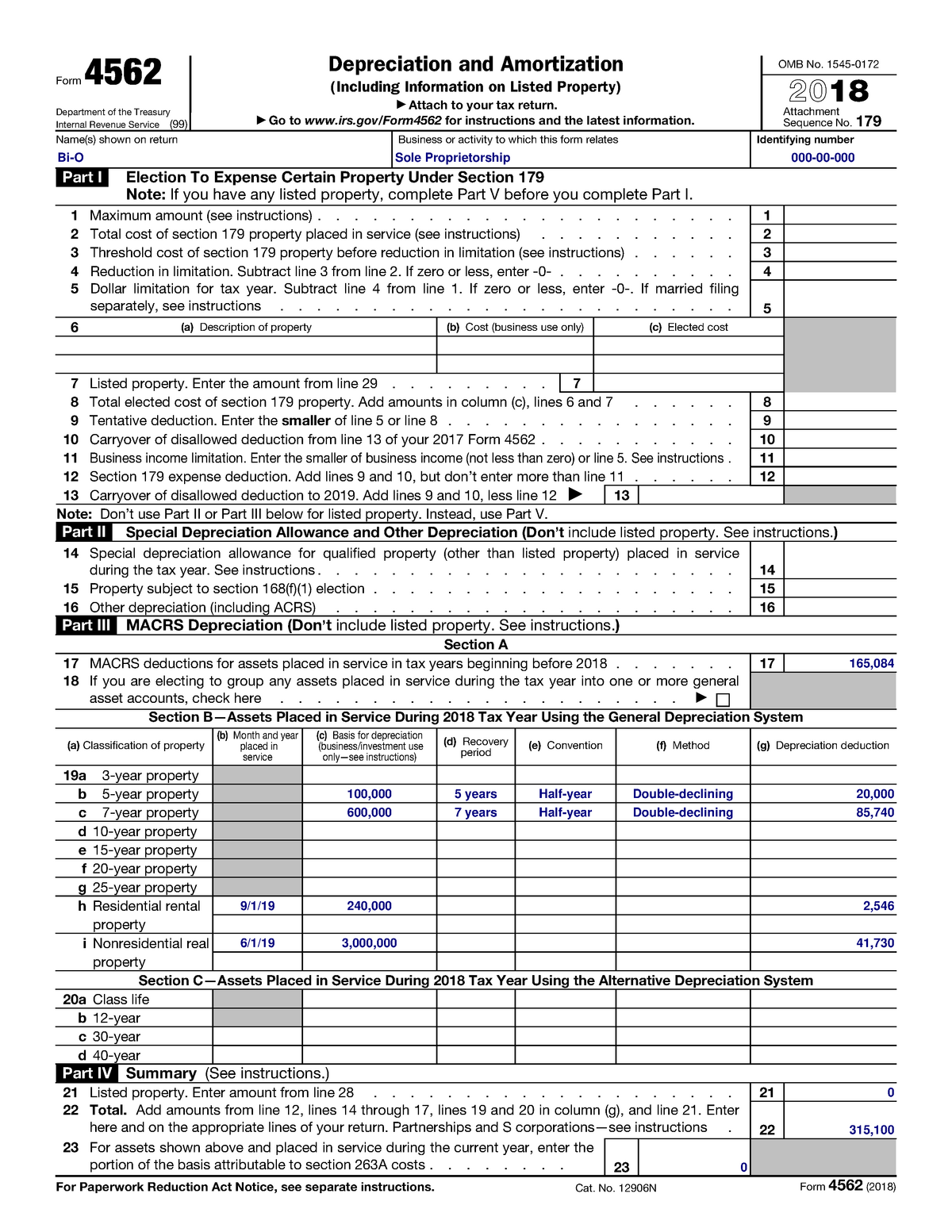

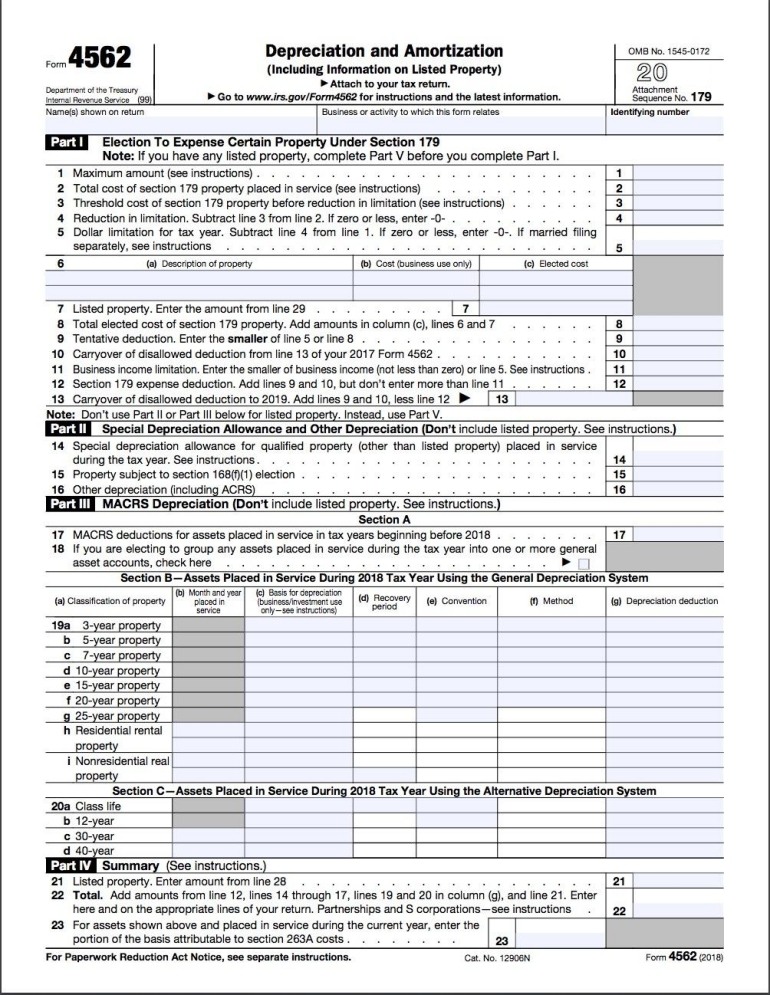

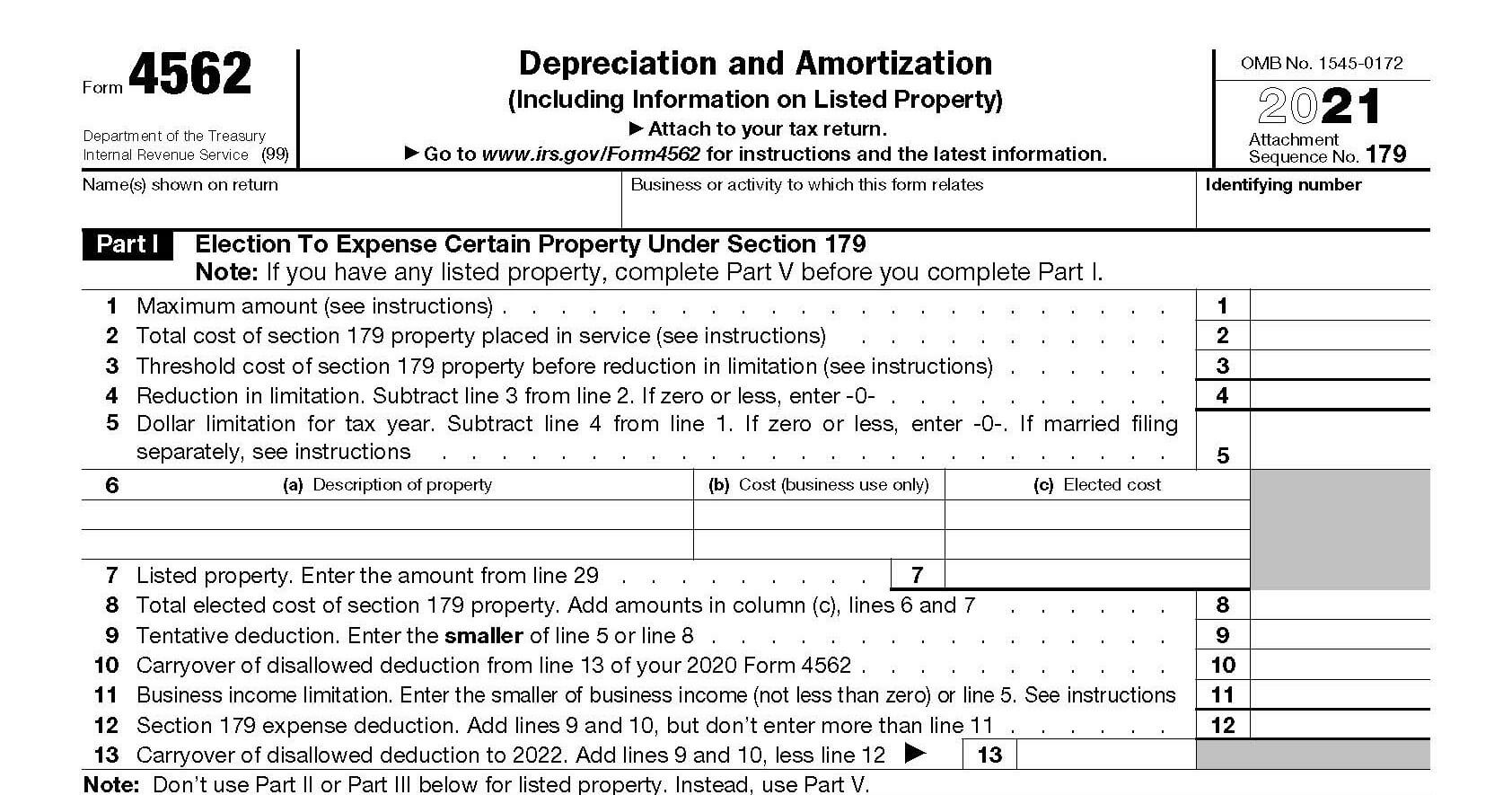

Form 4562 Section 179 - Error line 12 in 1120s and 1065. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain. Electing the section 179 deduction. If the section 179 business. This article will help you resolve the following final review. Section 179 allows for accelerated depreciation on certain types of. Web entering section 179 depreciation in business returns in proseries. Download instructions for irs form 4562. Web do you have to file form 4562? Despite that, they are the most current forms. Web if you can use the carryover amount, enter that amount on line 10 of your form 4562. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Select formsin the top right corner. Error line 12 in 1120s and 1065. It’s also used to expense certain. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Web to claim the section 179 deduction for heavy vehicles, business owners must complete irs form 4562. Web do you have to file form 4562? Web making section 179 election on form 4562 will enable you to. Web get answers to frequently asked questions about form 4562 and section 179 in proseries professional and proseries basic: Claim your deduction for depreciation and amortization. Web in resolve this issue, refer to the steps provided: Complete, edit or print tax forms instantly. File form 4562 with your individual or business tax return for any year you are claiming a. Web download irs form 4562. For tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. Web the first part of irs form 4562 deals with the section 179 deduction. Web use form 4562 to: Take note of the amounts on line. This form calculates the depreciation and the premise. Web in resolve this issue, refer to the steps provided: If the section 179 business. Electing the section 179 deduction. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Web do you have to file form 4562? Web use form 4562 to: When using form 1040, 1120, 1120s, 1065 and 990 in proseries, section 179 information. Web filing form 4562. Web irs form 4562 is used to claim deductions for depreciation and amortization. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain. Make the election under section 179 to expense certain property. Web proconnect tax uses entries throughout the program to calculate business income to be used for the section 179 limitation on form 4562, part i. Web use form 4562 to: Select sec 179 limitfrom. Web download irs form 4562. Ad uslegalforms.com has been visited by 100k+ users in the past month Make the election under section 179 to expense certain property. Section 179 allows for accelerated depreciation on certain types of. Despite that, they are the most current forms. Make the election under section 179 to expense certain property. Web a section 179 expense deduction (which may include a carryover from a previous year) depreciation on any vehicle or other listed property (regardless of when it. Web entering section 179 depreciation in business returns in proseries. Claim your deduction for depreciation and amortization. If the section 179 business. How do you correct depreciation deductions? This article will help you resolve the following final review. Web in resolve this issue, refer to the steps provided: This article will help you resolve the following error in proseries. Complete, edit or print tax forms instantly. Web to claim the section 179 deduction for heavy vehicles, business owners must complete irs form 4562. Both forms above may show prior years. Web entering section 179 depreciation in business returns in proseries. Select formsin the top right corner. For tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. Electing the section 179 deduction. Download instructions for irs form 4562. Web use form 4562 to: Web form 4562 department of the treasury internal revenue service (99) depreciation and amortization (including information on listed property). Despite that, they are the most current forms. This article will help you resolve the following error in proseries. If the section 179 business. Web irs form 4562 is used to claim deductions for depreciation and amortization. Get ready for tax season deadlines by completing any required tax forms today. Error line 12 in 1120s and 1065. Complete, edit or print tax forms instantly. Web get answers to frequently asked questions about form 4562 and section 179 in proseries professional and proseries basic: Ad access irs tax forms. Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,700,000.4562 Form 2022 2023

IRS Form 4562 Explained A StepbyStep Guide

Section 179 Deduction for Property, Equipment, & Vehicles

Section 179 Addback Example 1 Sole Proprietor Minnesota Department

Form 4562 IRS Tax Forms Jackson Hewitt

Form 4562 Final This Document has the filled out Form 4562 for the

Form 4562, Depreciation Expense

Cómo completar el formulario 4562 del IRS

Section 179 Depreciation Guru

Understanding Form 4562 How To Account For Depreciation And

Related Post: