Form 6198 Example

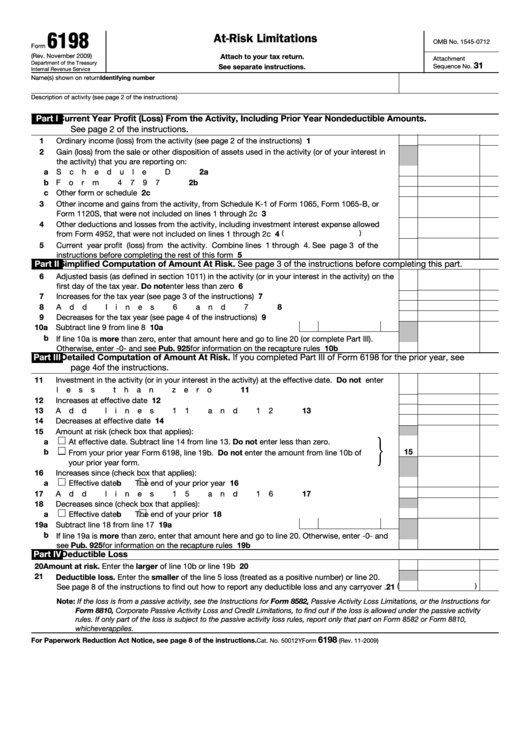

Form 6198 Example - Do not enter the amount from line 10b of the 2007 form. You can download or print current or past. (part i), the amount at risk for the current year (part ii or part iii), and. B increases since (check box that applies): The form 6198 instructions will help you in filling out the 21 lines with all the necessary data. If line 21 is less than line 5 of form 6198, losses on line 5 (form 6198) must be allocated and carried to next year. Use form 6198 to figure: They already reported the second part of this publication explains the $4,000 income from this activity on schedule. In this example, jerry spent $1,000 for. We have no way of. The amount at risk for the current. B increases since (check box that applies): Do not enter the amount from line 10b of the 2007 form. Attach to your tax return. They already reported the second part of this publication explains the $4,000 income from this activity on schedule. Form 6198 should be filed when a taxpayer has a loss in a business. Use form 6198 to figure: Attach to your tax return. The form 6198 instructions will help you in filling out the 21 lines with all the necessary data. Do not enter the amount from line 10b of the 2007 form. You can download or print current or past. Use form 6198 to figure: Form 6198 should be filed when a taxpayer has a loss in a business. Web use form 6198 to figure: Ad signnow.com has been visited by 100k+ users in the past month Web form 6198, page 1 of 2 (page 2 is blank) margins: Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year. Register and subscribe now to work on your irs instructions 6198 & more fillable forms. (part i), the amount at risk for the current. Form 6198 should be filed. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Form 6198 is filed with the individual return of business owners. Do not enter the amount from line 10b of the 2007 form. Use form 6198 to figure: Use form 6198 to figure: B increases since (check box that applies): We have no way of. Web use form 6198 to figure: The deductible loss for the current year (part iv). The form 6198 instructions will help you in filling out the 21 lines with all the necessary data. Only certain taxpayers are eligible. December 2020) department of the treasury internal revenue service. Form 6198 is filed with the individual return of business owners. 16 16 a effective date 17 b the end of your. Complete form 6198 before form 8582. Do not enter the amount from line 10b of the 2007 form. They already reported the second part of this publication explains the $4,000 income from this activity on schedule. If lines 1, 2, and 3. Use form 6198 to figure: Web use form 6198 to figure: The deductible loss for the current year (part iv). Complete form 6198 before form 8582. Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year. In this example, jerry spent $1,000 for. Form 6198 is used by individuals, estates,. 16 16 a effective date 17 b the end of your. Web use form 6198 to figure: Use form 6198 to figure: You can download or print current or past. Do not enter the amount from line 10b of the 2007 form. December 2020) department of the treasury internal revenue service. Use form 6198 to figure: (part i), the amount at risk for the current year (part ii or part iii), and. Form 6198 is filed with the individual return of business owners. The deductible loss for the current year (part iv). If lines 1, 2, and 3. Form 6198 is used by individuals, estates,. 16 16 a effective date 17 b the end of your. Form 6198 should be filed when a taxpayer has a loss in a business. You can download or print current or past. We have no way of. The amount at risk for the current. B increases since (check box that applies): Complete form 6198 before form 8582. Form 6198 should be filed. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Ad signnow.com has been visited by 100k+ users in the past month Complete, edit or print tax forms instantly. Web from 2007 form 6198, line 19b.Fillable Form 6198 AtRisk Limitations printable pdf download

Guide to Understanding the AtRisk Basis Rules and Form 6198 (UARB

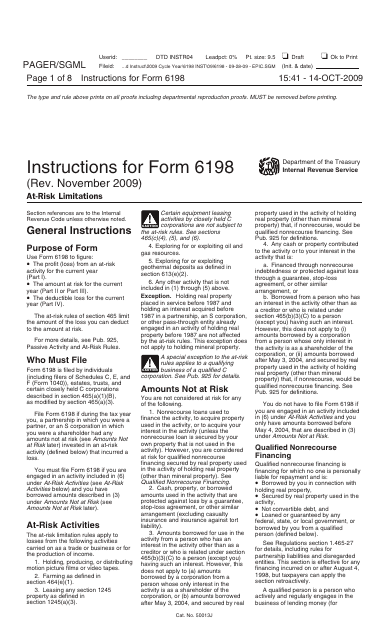

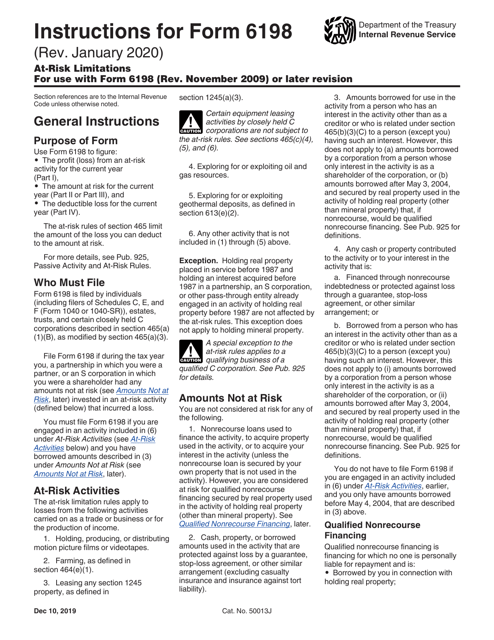

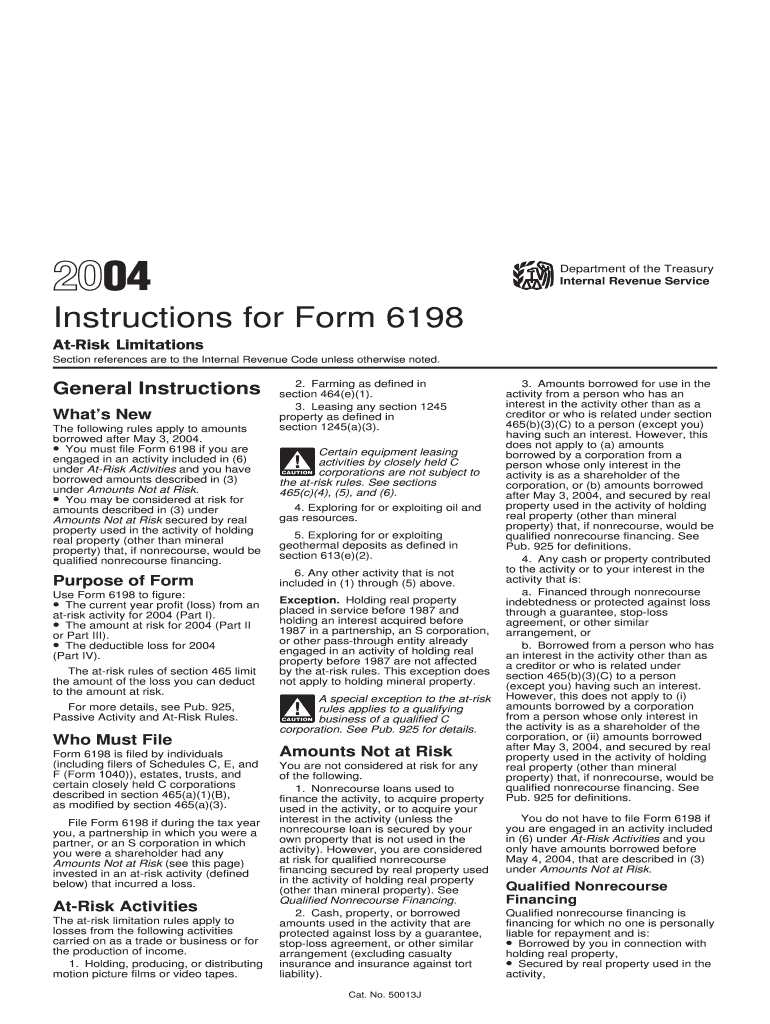

Download Instructions for IRS Form 6198 AtRisk Limitations PDF

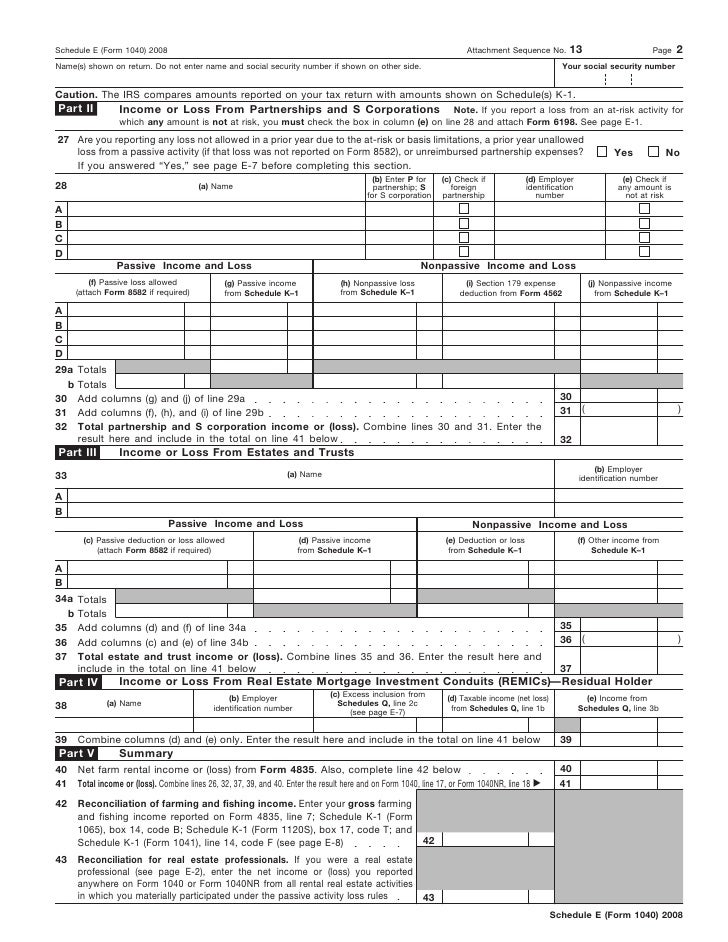

Form 1040, Schedule ESupplemental and Loss

Fill Free fillable AtRisk Limitations Form 6198 (Rev. November 2009

Download Instructions for IRS Form 6198 AtRisk Limitations PDF

IRS Form 8990 walkthrough (Limitation on Business Interest Expenses

Form 6198 AtRisk Limitations (2009) Free Download

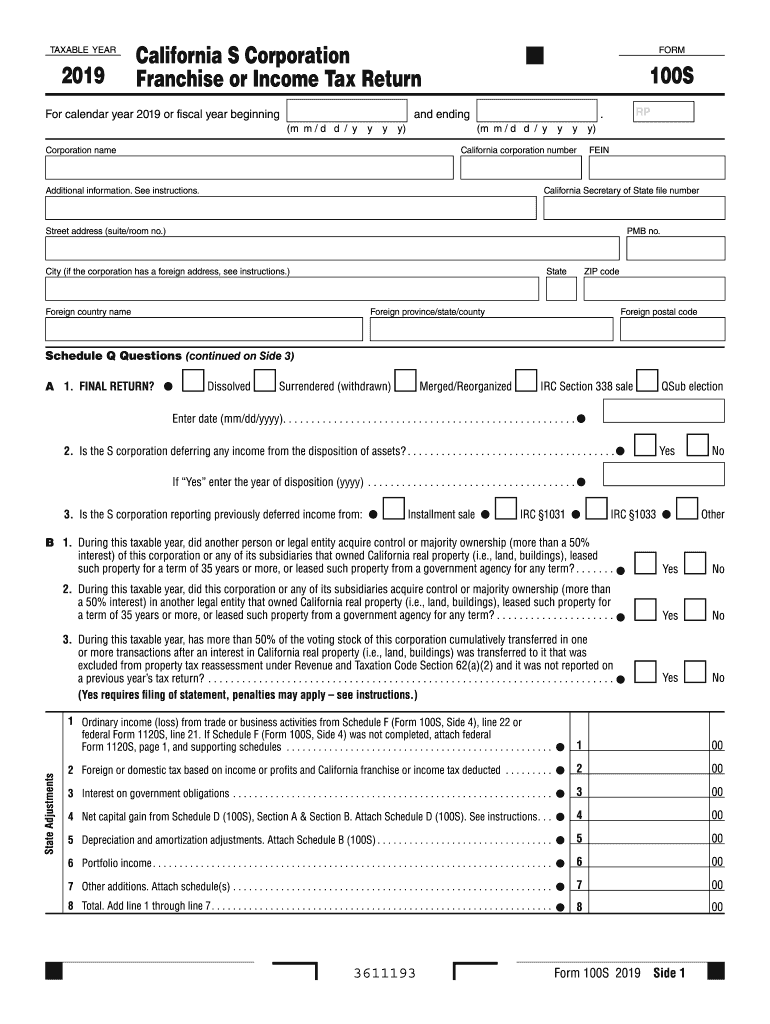

2019 Form CA FTB 100S Fill Online, Printable, Fillable, Blank pdfFiller

Form 6198 Instructions Fill Out and Sign Printable PDF Template signNow

Related Post: