Form 3922 Vs 3921

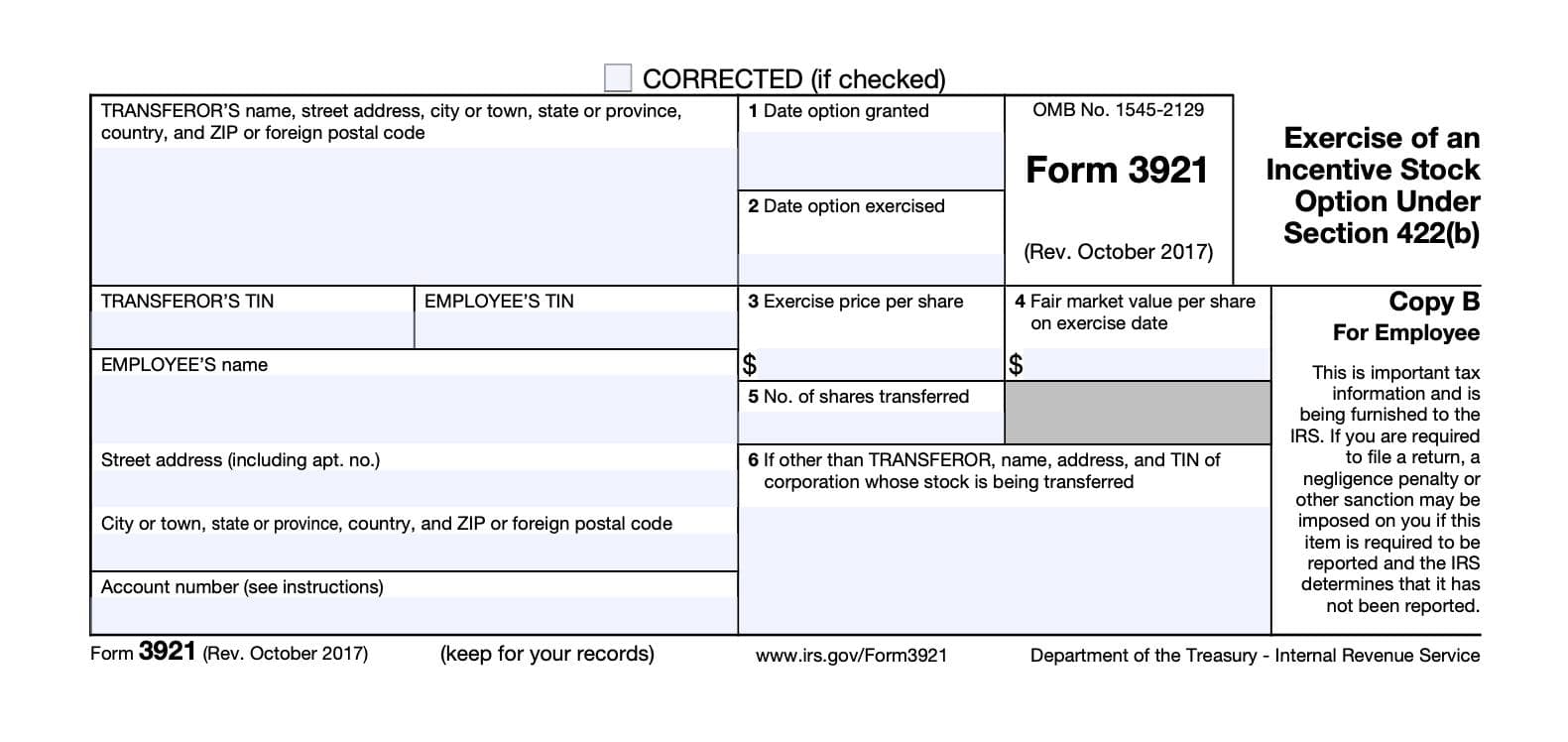

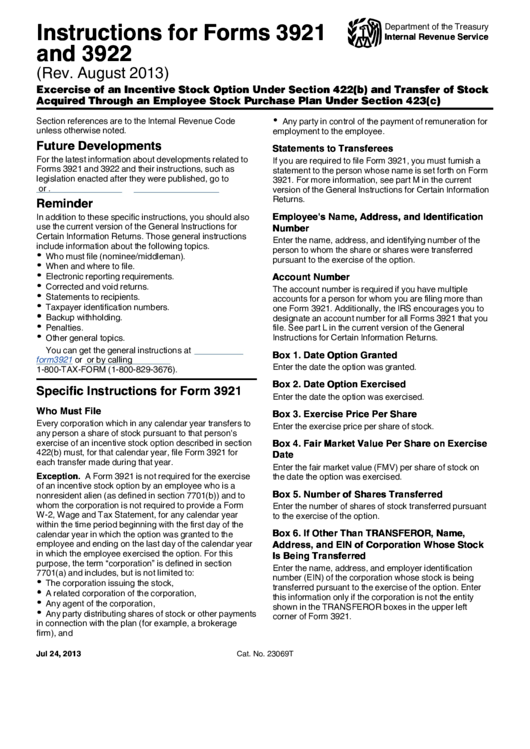

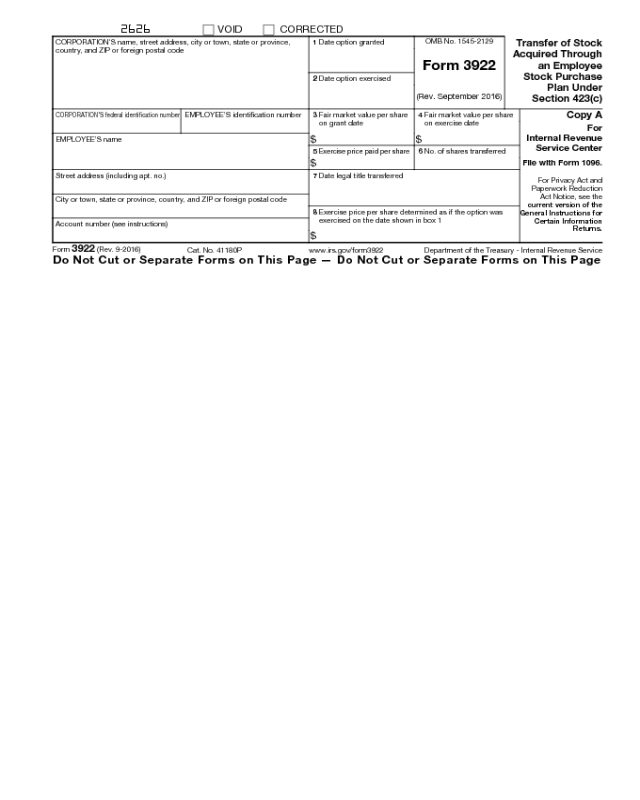

Form 3922 Vs 3921 - Contained on the appropriate form (i.e., form 3921 for iso. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section 422 (b) must, for that calendar year, file form 3921 for. Web form 3921 exercise of an incentive stock option under section 422(b), is for informational purposes only and should be kept with your records. Keep the form for your records because you’ll need the information when you sell, assign, or. Web this difference between the stock’s fair market value on the exercise date and the strike price is added to the person’s income when calculating the. Web corporations must use the official form 3921 and 3922 provided by the irs. Web instructions for forms 3921 and 3922 (rev. Web founded in 1989, our knowledge of tax compliance and our experience working with a wide variety of organizations, has enabled us to compile the finest collection of software. Companies utilize form 3921 to notify the irs that a shareholder has just exercised the iso. Web october 2, 2023 the carta team form 3921 is an irs form that must be filed by a company when an employee has exercised an incentive stock option (iso) in the last tax. Web form of employee information statement. Web irs form 3922 is for informational purposes only and isn't entered into your return. October 2017) department of the treasury internal revenue service exercise of an incentive stock option under section 422(b). Contained on the appropriate form (i.e., form 3921 for iso. Complete, edit or print tax forms instantly. Web this difference between the stock’s fair market value on the exercise date and the strike price is added to the person’s income when calculating the. October 2017) department of the treasury internal revenue service exercise of an incentive stock option under section 422(b). Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2018, corporations. Get ready for tax season deadlines by completing any required tax forms today. Web the irs requires that a separate form 3921 or form 3922 as applicable be filed with the irs for each transaction ( i.e., each iso exercise is reported on its own form), even if. Order 3921 and 3922 tax forms for employee stock purchase or exercise. It is important to print the form. Web corporations must use the official form 3921 and 3922 provided by the irs. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), if you purchased espp stock. Web who must file. October 2017) department of the treasury internal revenue service. Web form 3921 includes such information as the date the option was granted, the date the employee exercised the option, the number of shares of stock transferred to the. Web as soon as the company fills the form, a copy has to be sent to the shareholder applicable and the form 3921 has to be sent to the irs. Web. Only one transaction may be reported on each form 3921 or form 3922. Web the irs requires that a separate form 3921 or form 3922 as applicable be filed with the irs for each transaction ( i.e., each iso exercise is reported on its own form), even if. Web form 3921 and form 3922 are two forms that form an. Web who must file. Web irs form 3922 is for informational purposes only and isn't entered into your return. Web as soon as the company fills the form, a copy has to be sent to the shareholder applicable and the form 3921 has to be sent to the irs. Order 3921 and 3922 tax forms for employee stock purchase or. For the latest information about developments related to form 3921 and its instructions, such as legislation enacted after they were published, go to. Order 3921 and 3922 tax forms for employee stock purchase or exercise of incentive stock options. Ad access irs tax forms. Web instructions for forms 3921 and 3922 (rev. It does not need to be entered into. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section 422 (b) must, for that calendar year, file form 3921 for. Web form 3921 is not the same as form 3922. Web form 3921 exercise of an incentive stock option under section. The employee information statement must either be: Web official forms for reporting stock option information in 2022. It does not need to be entered into. Web about form 3921, exercise of an incentive stock option under section 422 (b) corporations file this form for each transfer of stock to any person pursuant to that. Web form 3921 exercise of an. Web irs form 3922 is for informational purposes only and isn't entered into your return. Web form of employee information statement. Web form 3921 exercise of an incentive stock option under section 422(b), is for informational purposes only and should be kept with your records. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2018, corporations must file completed forms 3921 and forms 3922 with. Web this difference between the stock’s fair market value on the exercise date and the strike price is added to the person’s income when calculating the. This article serves to offer. August 2013) department of the treasury internal revenue service excercise of an incentive stock option under section 422(b). Keep the form for your records because you’ll need the information when you sell, assign, or. Web official forms for reporting stock option information in 2022. Web corporations must use the official form 3921 and 3922 provided by the irs. Web october 2, 2023 the carta team form 3921 is an irs form that must be filed by a company when an employee has exercised an incentive stock option (iso) in the last tax. Web about form 3921, exercise of an incentive stock option under section 422 (b) corporations file this form for each transfer of stock to any person pursuant to that. Web founded in 1989, our knowledge of tax compliance and our experience working with a wide variety of organizations, has enabled us to compile the finest collection of software. Contained on the appropriate form (i.e., form 3921 for iso. For the latest information about developments related to form 3921 and its instructions, such as legislation enacted after they were published, go to. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section 422 (b) must, for that calendar year, file form 3921 for. Web the irs requires that a separate form 3921 or form 3922 as applicable be filed with the irs for each transaction ( i.e., each iso exercise is reported on its own form), even if. This form is submitted in. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), if you purchased espp stock. Get ready for tax season deadlines by completing any required tax forms today.3922 Forms, Employee Stock Purchase, Employee Copy B DiscountTaxForms

3922 2018 Public Documents 1099 Pro Wiki

IRS Form 3922 Instructions 2022 How to Fill out Form 3922

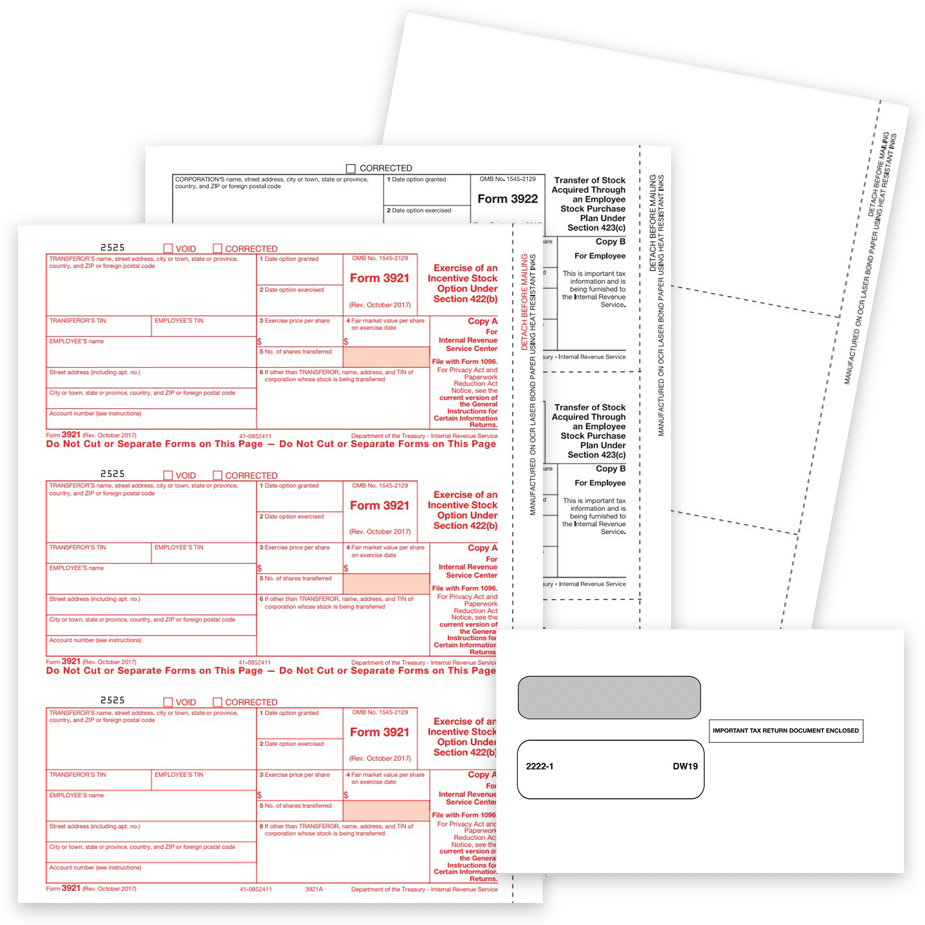

3921 & 3922 Tax Forms Discount Tax Forms

Form 3921 Everything you need to know

Requesting your TCC for Form 3921 & 3922

Form 3922, Transfer of Stock Acquired Through an Employee Stock

IRS Form 3922

Instructions For Forms 3921 And 3922 (Rev. August 2013) printable pdf

Form 3922 Edit, Fill, Sign Online Handypdf

Related Post: