Form 3903 Irs

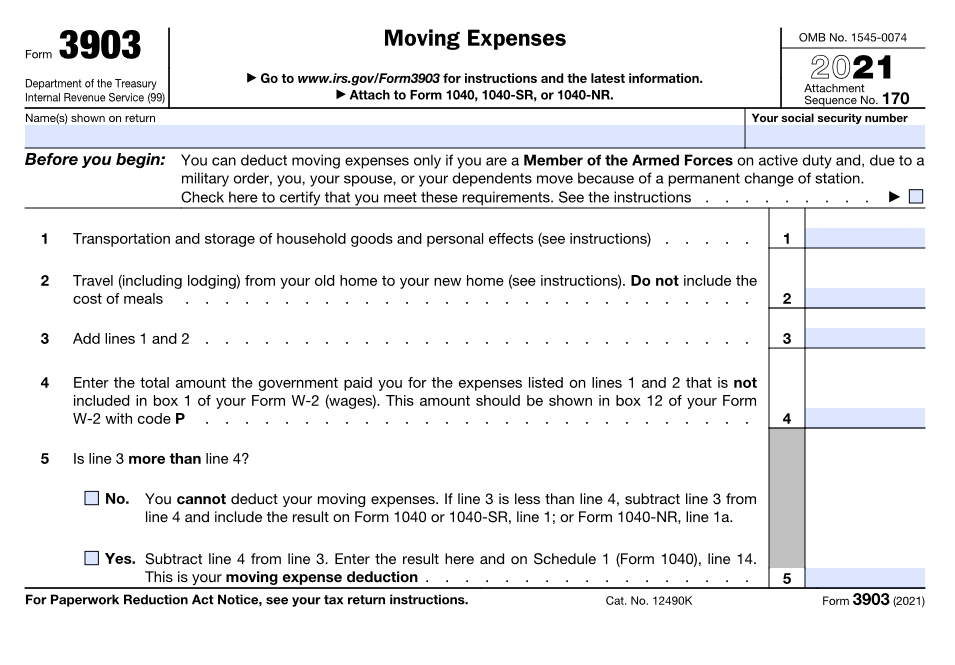

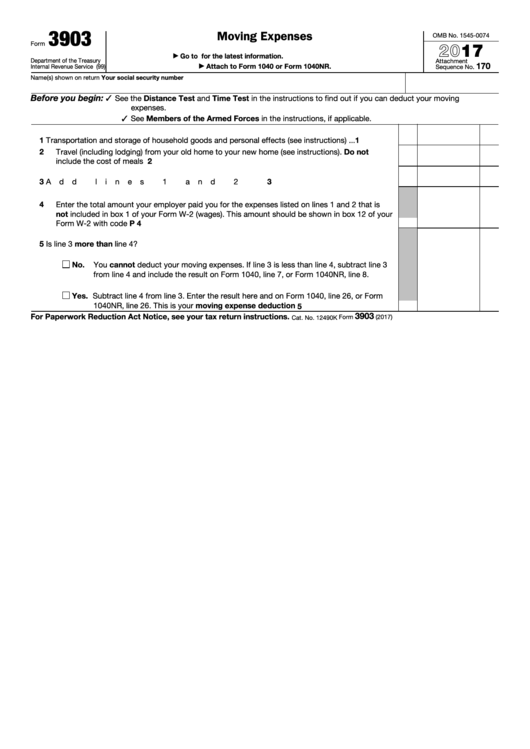

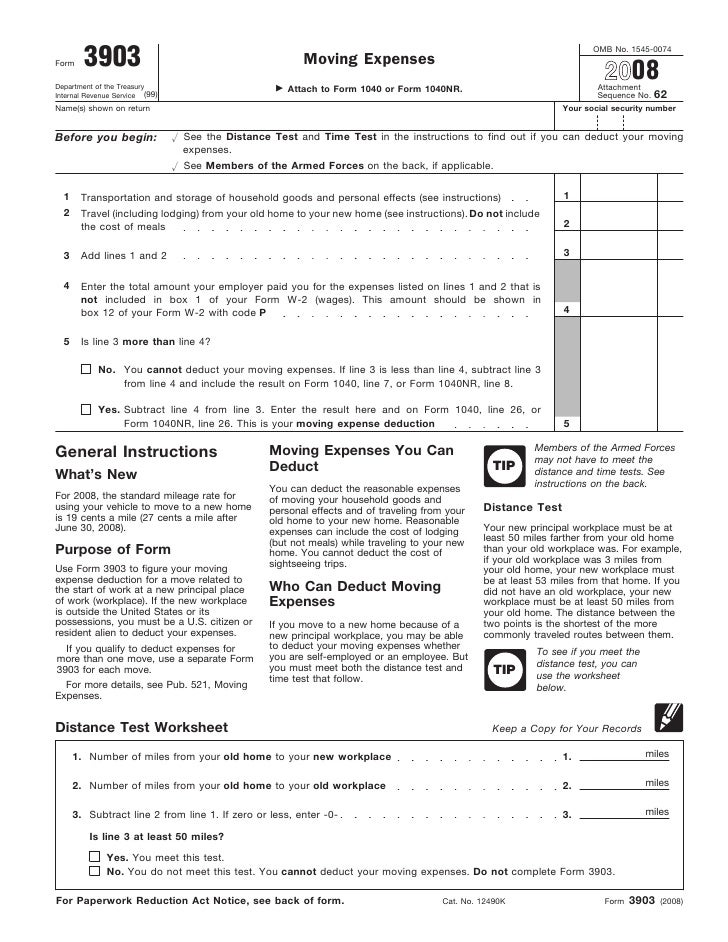

Form 3903 Irs - Web what is irs form 3903? Web moving expenses are deducted on form 3903 moving expenses. If the new workplace is outside the united states or its possessions, you must be a u.s. Ad iluvenglish.com has been visited by 10k+ users in the past month Attach to form 1040 or form 1040nr. Web use form 3903 to figure your moving expense deduction if you are a member of the armed forces on active duty and, due to a military order, you move because of a permanent change of station. Department of the treasury internal revenue service (99) moving expenses. Tax years 2018 and forward. The deduction for moving expenses is only available to active military moving due to a permanent change of station. Form 3903 helps members of the armed forces, who often relocate based on orders rather than personal choice, recoup some of the costs associated with moving. See the distance test and time test in the instructions to find out if you can deduct your moving. To enter or edit form 3903 in the taxact program: Where can i find a copy of irs form 3903? If you qualify to deduct expenses for more than one move, use a separate form 3903 for each move. Go to. Web moving expenses are deducted on form 3903 moving expenses. Go to www.irs.gov/form3903 for instructions and the latest information. Web form 3903 department of the treasury internal revenue service (99) moving expenses attach to form 1040 or form 1040nr. Beginning in 2018, the moving expense deduction is temporarily suspended, unless you are a member of the armed forces on active. Moving costs are no longer deductible for tax years starting after 2017 unless you are an active duty member of the military who is moving as a result of a permanent change of station as per. Per instructions for form 3903 moving expenses, page 2: Go to www.irs.gov/form3903 for instructions and the latest information. Department of the treasury internal revenue. Permanent change of station includes: If the new workplace is outside the united states or its possessions, you must be a u.s. Web form 3903 department of the treasury internal revenue service (99) moving expenses attach to form 1040 or form 1040nr. As of 2017, only members of the armed forces can claim such deductions on their taxes. How do. To enter or edit form 3903 in the taxact program: For paperwork reduction act notice, see your tax return instructions. If you qualify to deduct expenses for more than one move, use a separate form 3903 for each move. Web use form 3903 to figure your moving expense deduction if you are a member of the armed forces on active. For lists of deductible and nondeductible moving expenses, see the irs instructions for form 3903. Web to claim the deduction, you must report all relocation expenses on irs form 3903 and attach it to the personal tax return that covers the year of your move. Beginning in 2018, the moving expense deduction is temporarily suspended, unless you are a member. Use form 3903 to figure your moving expense deduction for a move related to the start of work at a. Ad iluvenglish.com has been visited by 10k+ users in the past month The deduction for moving expenses is only available to active military moving due to a permanent change of station. Web to claim the deduction, you must report all. Where can i find a copy of irs form 3903? Beginning in 2018, the moving expense deduction is temporarily suspended, unless you are a member of the armed forces on active duty, and due to a military order, you move because of a permanent change of station. How do i complete irs form 3903? This means eligible taxpayers can claim. 170 name(s) shown on return your social security number before you begin: Web form 3903 department of the treasury internal revenue service (99) moving expenses attach to form 1040 or form 1040nr. Attach to form 1040 or form 1040nr. Web you can deduct moving expenses only if you are a member of the armed forces on active duty and, due. Moving costs are no longer deductible for tax years starting after 2017 unless you are an active duty member of the military who is moving as a result of a permanent change of station as per. Web what is form 3903? Complete, edit or print tax forms instantly. Where can i find a copy of irs form 3903? Use form. How do i complete irs form 3903? Web information about form 3903, moving expenses, including recent updates, related forms, and instructions on how to file. For lists of deductible and nondeductible moving expenses, see the irs instructions for form 3903. Which moving expenses can i deduct on my federal tax return? Web what is irs form 3903? For paperwork reduction act notice, see your tax return instructions. Complete, edit or print tax forms instantly. The deduction for moving expenses is only available to active military moving due to a permanent change of station. Department of the treasury internal revenue service (99) moving expenses. Web form 3903 is a tax form produced by the internal revenue service (irs) that people use to write off moving expenses associated with new employment. Web moving expenses are deducted on form 3903 moving expenses. Use form 3903 to figure your moving expense deduction for a move related to the start of work at a. Form 3903 helps members of the armed forces, who often relocate based on orders rather than personal choice, recoup some of the costs associated with moving. For tax years 2018 and later: A move from your home to your first post of active duty, Web use form 3903 to figure your moving expense deduction if you are a member of the armed forces on active duty and, due to a military order, you move because of a permanent change of station. Web what is form 3903? Go to www.irs.gov/form3903 for instructions and the latest information. Web you can deduct moving expenses only if you are a member of the armed forces on active duty and, due to a military order, you, your spouse, or your dependents move because of a permanent change of station. Beginning in 2018, the moving expense deduction is temporarily suspended, unless you are a member of the armed forces on active duty, and due to a military order, you move because of a permanent change of station.Fill Free fillable Form 3903 Moving Expenses 170 include the cost

New Tax Twists and Turns for Moving Expense Deductions

Fillable Form 3903 Moving Expenses 2017 printable pdf download

Form 3903Moving Expenses

Fillable Online IRS Form 3903 Are Moving Expenses Tax Deductible? Fax

Fillable Form 3903 Printable Forms Free Online

irs form 3903 instructions 2017 Fill Online, Printable, Fillable

IRS Form 3903 Are Moving Expenses Tax Deductible? Moving expenses

U.S. TREAS Form treasirs39031992

7 Form 3903 Templates free to download in PDF, Word and Excel

Related Post: