Form 3804 Cr Turbotax

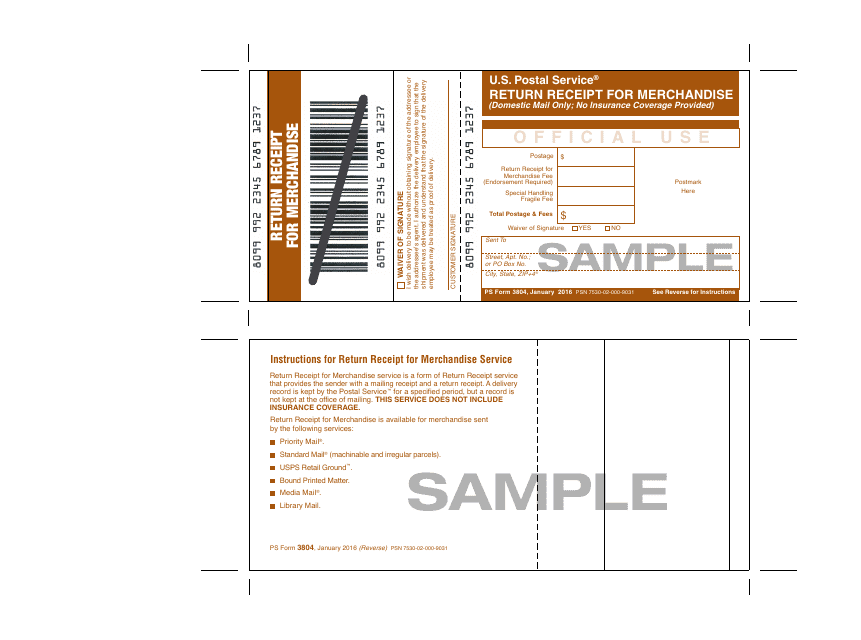

Form 3804 Cr Turbotax - Web form 1040 schedule 4 was used in the 2018 tax year for reporting other taxes you may have owed above and beyond your federal income taxes. Web section 1445 (a) or 1445 (e) tax withheld from or paid by the partnership filing this schedule a (form 8804) during the tax year for a disposition of a u.s. Attach to your california tax return. Tax returns in less time. Web schedule a (form 8804) even if it doesn’t owe a penalty. Form 568, limited liability co. Click forms in the turbotax header. Name(s) as shown on your california tax return (smllcs see instructions). Save time and money with professional tax planning & preparation services I am working on an s corp return for. Save time and money with professional tax planning & preparation services Web schedule a (form 8804) even if it doesn’t owe a penalty. Web you can trigger the creation of form 3804 (and related worksheet) in turbotax business using forms mode. About form 8804, annual return for partnership withholding tax (section 1446) use form 8804 to report the total liability. Attach to your california tax return. Web section 1445 (a) or 1445 (e) tax withheld from or paid by the partnership filing this schedule a (form 8804) during the tax year for a disposition of a u.s. The partnership is using the. I elective tax credit amount. Web you can trigger the creation of form 3804 (and related worksheet) in. Save time and money with professional tax planning & preparation services Web section 1445 (a) or 1445 (e) tax withheld from or paid by the partnership filing this schedule a (form 8804) during the tax year for a disposition of a u.s. Attach to your california tax return. Click forms in the turbotax header. The partnership is using the adjusted. Web section 1445 (a) or 1445 (e) tax withheld from or paid by the partnership filing this schedule a (form 8804) during the tax year for a disposition of a u.s. Save time and money with professional tax planning & preparation services Web what is form 3804 cr? Return of income, sides 4 & 5 (rentals) available. Web you can. Attach to your california tax return. Form 568, limited liability co. I elective tax credit amount. If this does not apply you will have. Name(s) as shown on your california tax return (smllcs see instructions). I elective tax credit amount. The partnership is using the. Form 568, limited liability co. Tools and resources to help you prepare and file more u.s. Save time and money with professional tax planning & preparation services About form 8804, annual return for partnership withholding tax (section 1446) use form 8804 to report the total liability under section 1446 for the partnership’s tax. Save time and money with professional tax planning & preparation services Tools and resources to help you prepare and file more u.s. Tax returns in less time. If the tax year is the last. I elective tax credit amount. Ad prepare more tax returns with greater accuracy and efficiency with taxwise®. Tax returns in less time. Web section 1445 (a) or 1445 (e) tax withheld from or paid by the partnership filing this schedule a (form 8804) during the tax year for a disposition of a u.s. If this does not apply you will. Save time and money with professional tax planning & preparation services I elective tax credit amount. Return of income, sides 4 & 5 (rentals) available. Web section 1445 (a) or 1445 (e) tax withheld from or paid by the partnership filing this schedule a (form 8804) during the tax year for a disposition of a u.s. Web schedule a (form. Tax returns in less time. If this does not apply you will have. Also, to the extent it is relevant, i. If the tax year is the last tax year to which the amount of carryforward (of loss, deduction, or credit) may be carried, the line 3 adjustments and line 5 tax shall be figured Web section 1445 (a) or. About form 8804, annual return for partnership withholding tax (section 1446) use form 8804 to report the total liability under section 1446 for the partnership’s tax. Attach to your california tax return. Tax returns in less time. I am working on an s corp return for. Also, to the extent it is relevant, i. If the tax year is the last tax year to which the amount of carryforward (of loss, deduction, or credit) may be carried, the line 3 adjustments and line 5 tax shall be figured Web you can trigger the creation of form 3804 (and related worksheet) in turbotax business using forms mode. Attach to your california tax return. Form 568, limited liability co. The partnership is using the. If this does not apply you will have. Return of income, sides 4 & 5 (rentals) available. Attach to form 100s, form 565, or form 568. Web for more information, go to ftb.ca.gov and search for pte elective tax and get the following new pte elective tax forms and instructions: Name(s) as shown on your california tax return (smllcs see instructions). Web schedule a (form 8804) even if it doesn’t owe a penalty. Web section 1445 (a) or 1445 (e) tax withheld from or paid by the partnership filing this schedule a (form 8804) during the tax year for a disposition of a u.s. Tools and resources to help you prepare and file more u.s. Web what is form 3804 cr? Web form 1040 schedule 4 was used in the 2018 tax year for reporting other taxes you may have owed above and beyond your federal income taxes.Sample PS Form 3804 Download Printable PDF or Fill Online Return

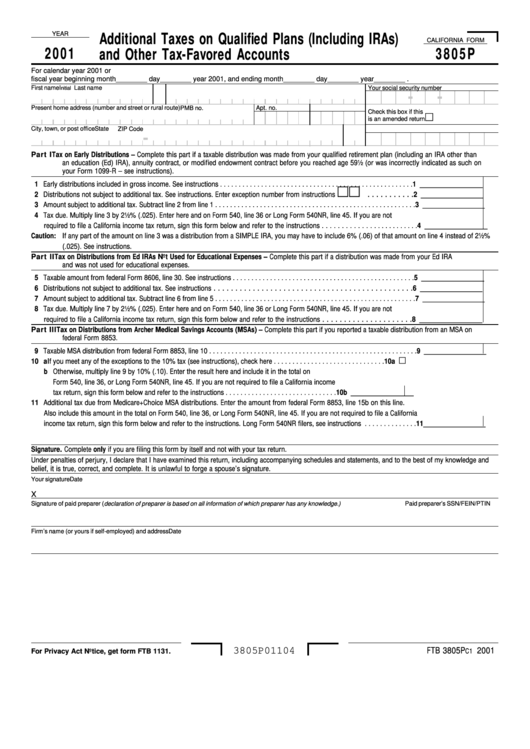

California Form 3805p Additional Taxes On Qualified Plans (Including

What Is Irs Form W 9 Turbotax Tax Tips Videos W9 Template W9 Template

Turbotax Carryover Worksheet

Turbotax Worksheet

How to file the *new* Form 1099NEC for independent contractors using

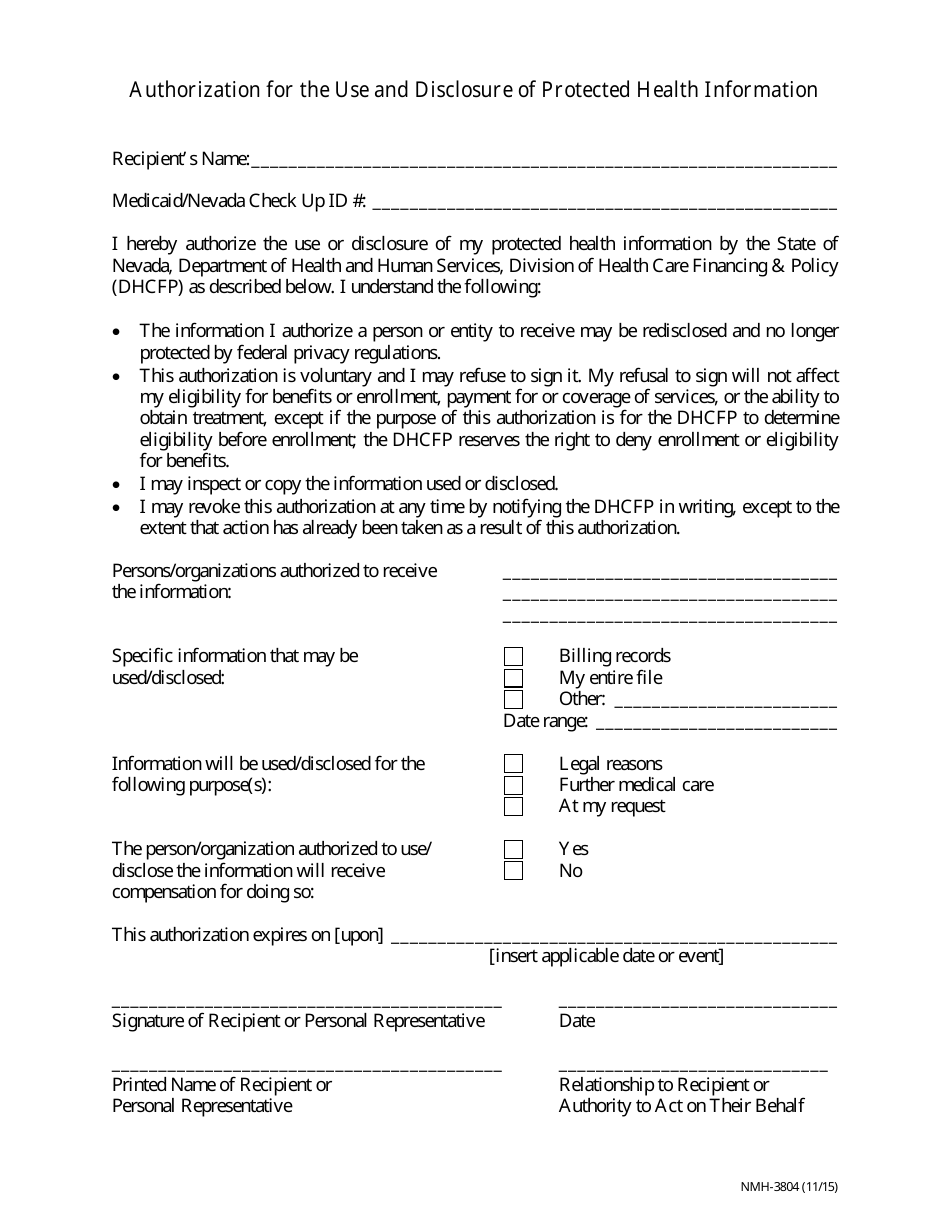

Form NMH3804 Fill Out, Sign Online and Download Fillable PDF, Nevada

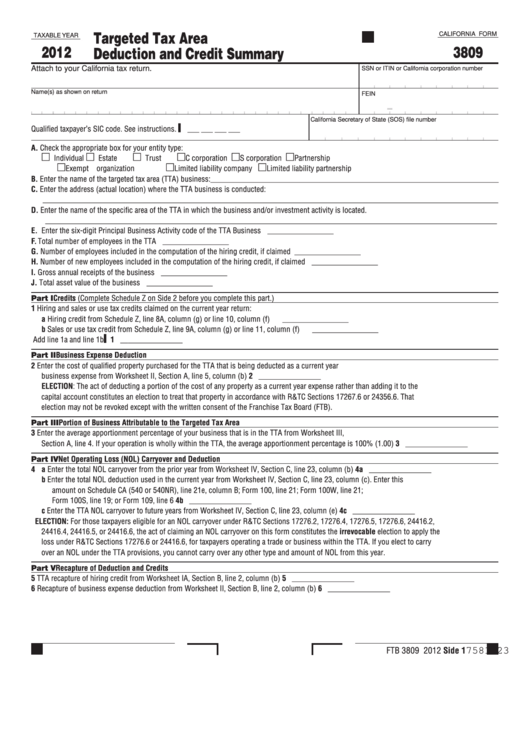

Fillable California Form 3809 Targeted Tax Area Deduction And Credit

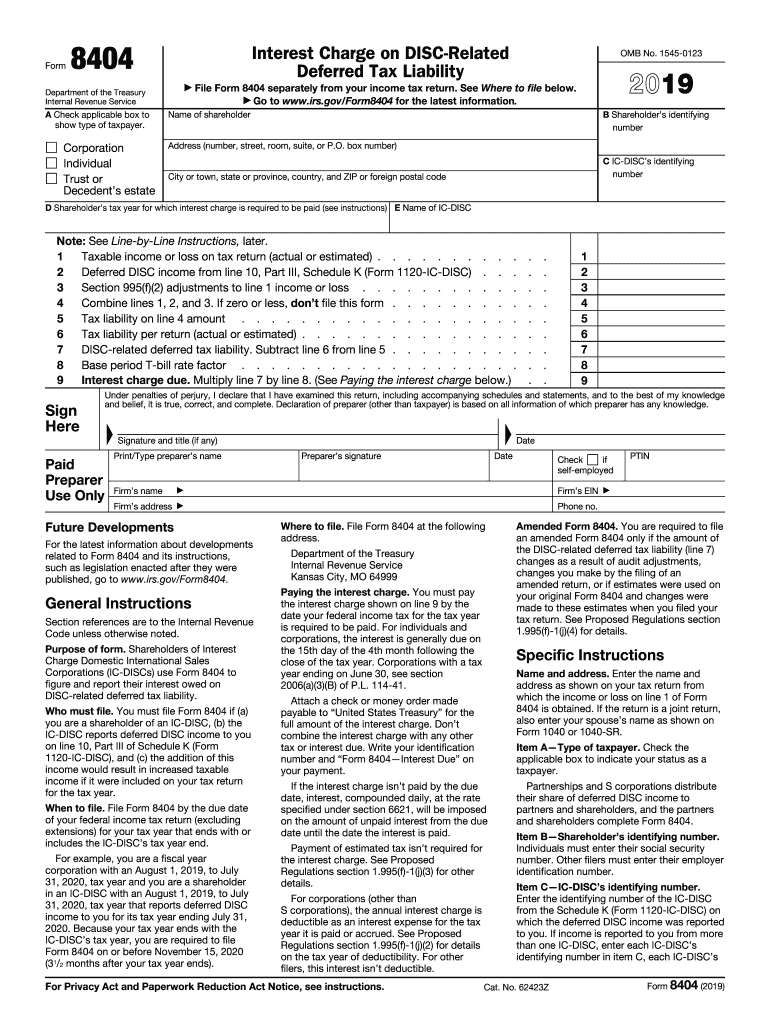

Form 8404 Fill Out and Sign Printable PDF Template signNow

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Related Post: