Form 3804 Cr Instructions

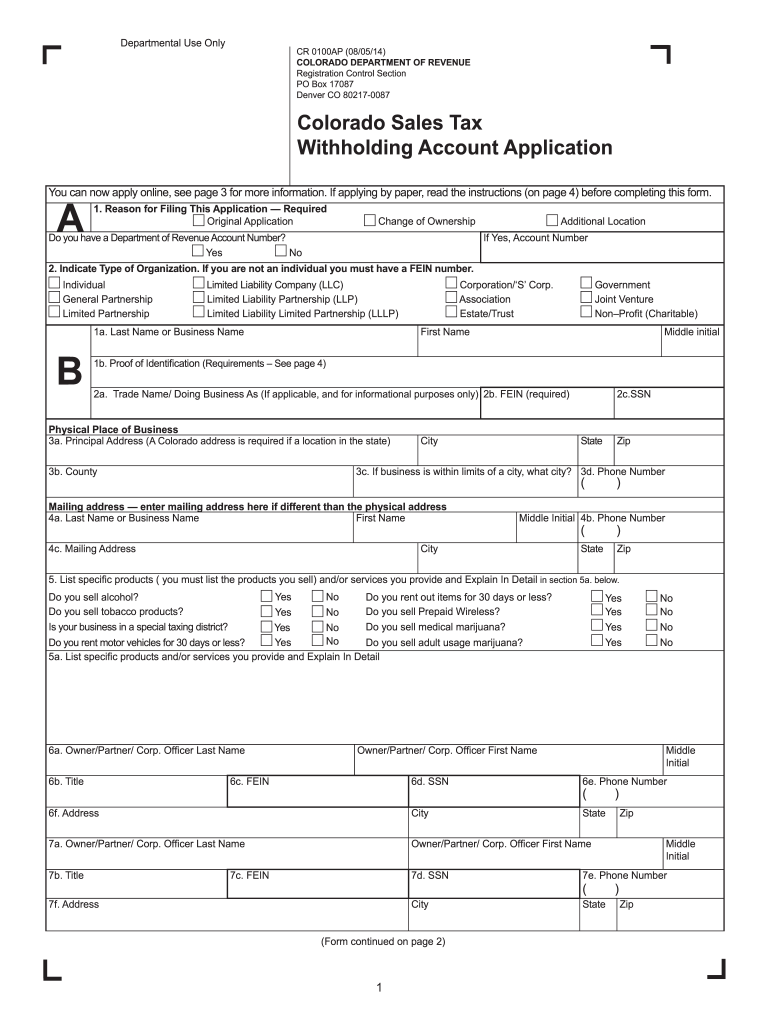

Form 3804 Cr Instructions - Click forms in the turbotax header. Web you can trigger the creation of form 3804 (and related worksheet) in turbotax business using forms mode. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Web see the instructions for form 8804, lines 6d and 6e, in the instructions for forms 8804, 8805, and 8813. In addition to entering the current year credit. When will the elective tax expire? Section 1446 (f) (1) tax withheld from the partnership filing. Name(s) as shown on your california tax return (smllcs see instructions) ssn. Attach to your california tax return. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Attach to your california tax return. Form 8804 and these instructions have been converted from an annual revision to continuous use. Attach to your california tax return. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Web see the instructions for form 8804, lines 6d and 6e, in the instructions for forms 8804, 8805, and 8813. Go to california > credits worksheet. Automatically include all shareholders go to california > other information worksheet. Attach to your california tax. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. In addition to entering the current year credit. Name(s) as shown on your california tax return (smllcs see instructions) ssn. I elective tax credit amount. Form 8804 and these instructions have been converted from an annual revision to continuous use. Section 1446 (f) (1) tax withheld from the partnership filing. Go to california > credits worksheet. I elective tax credit amount. Attach to your california tax return. Web you can trigger the creation of form 3804 (and related worksheet) in turbotax business using forms mode. Web the california franchise tax board (ftb) aug. Section 1446 (f) (1) tax withheld from the partnership filing. Automatically include all shareholders go to california > other information worksheet. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. In addition to entering the current year credit. Go to california > credits worksheet. Attach to your california tax return. Web you can trigger the creation of form 3804 (and related worksheet) in turbotax business using forms mode. Section 1446 (f) (1) tax withheld from the partnership filing. Web the california franchise tax board (ftb) aug. Go to california > credits worksheet. When will the elective tax expire? Form 8804 and these instructions have been converted from an annual revision to continuous use. Name(s) as shown on your california tax return (smllcs see instructions) ssn. Web you can trigger the creation of form 3804 (and related worksheet) in turbotax business using forms mode. Form 8804 and these instructions have been converted from an annual revision to continuous use. Automatically include all shareholders go to california > other information worksheet. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. When will the elective tax expire? Web you can trigger the creation of form 3804 (and. Web the california franchise tax board (ftb) aug. In addition to entering the current year credit. Click forms in the turbotax header. Attach to your california tax return. Automatically include all shareholders go to california > other information worksheet. Name(s) as shown on your california tax return (smllcs see instructions) ssn. Web you can trigger the creation of form 3804 (and related worksheet) in turbotax business using forms mode. Section 1446 (f) (1) tax withheld from the partnership filing. Automatically include all shareholders go to california > other information worksheet. When will the elective tax expire? Attach to your california tax return. Both the form and instructions. Name(s) as shown on your california tax return (smllcs see instructions) ssn. Click forms in the turbotax header. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Web see the instructions for form 8804, lines 6d and 6e, in the instructions for forms 8804, 8805, and 8813. I elective tax credit amount. Go to california > credits worksheet. Automatically include all shareholders go to california > other information worksheet. Web you can trigger the creation of form 3804 (and related worksheet) in turbotax business using forms mode. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Attach to your california tax return. Web the california franchise tax board (ftb) aug. Section 1446 (f) (1) tax withheld from the partnership filing. In addition to entering the current year credit. When will the elective tax expire? Form 8804 and these instructions have been converted from an annual revision to continuous use.2014 Form CO CR 0100AP Fill Online, Printable, Fillable, Blank pdfFiller

Form FTB3804. PassThrough Entity Elective Tax Calculations Forms

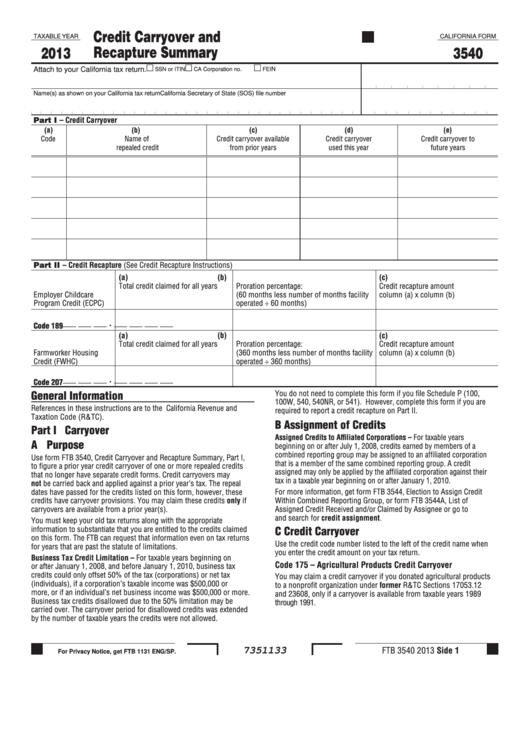

Fillable California Form 3540 Credit Carryover And Recapture Summary

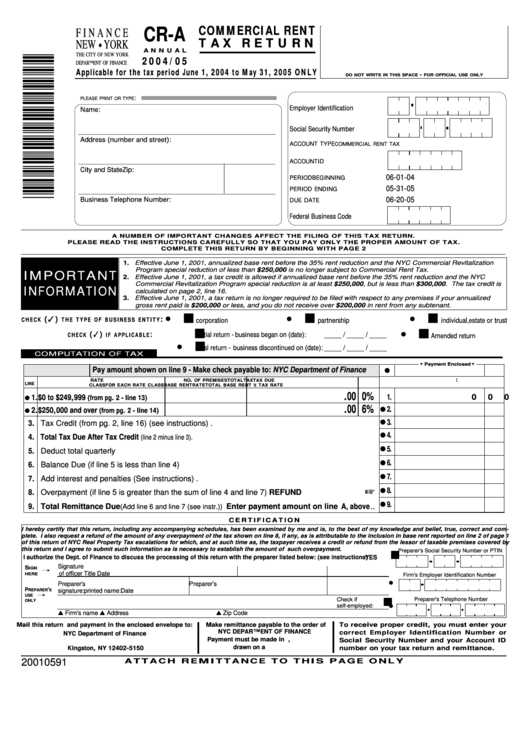

Form CrA Commercial Rent Tax Return 2004/05 printable pdf download

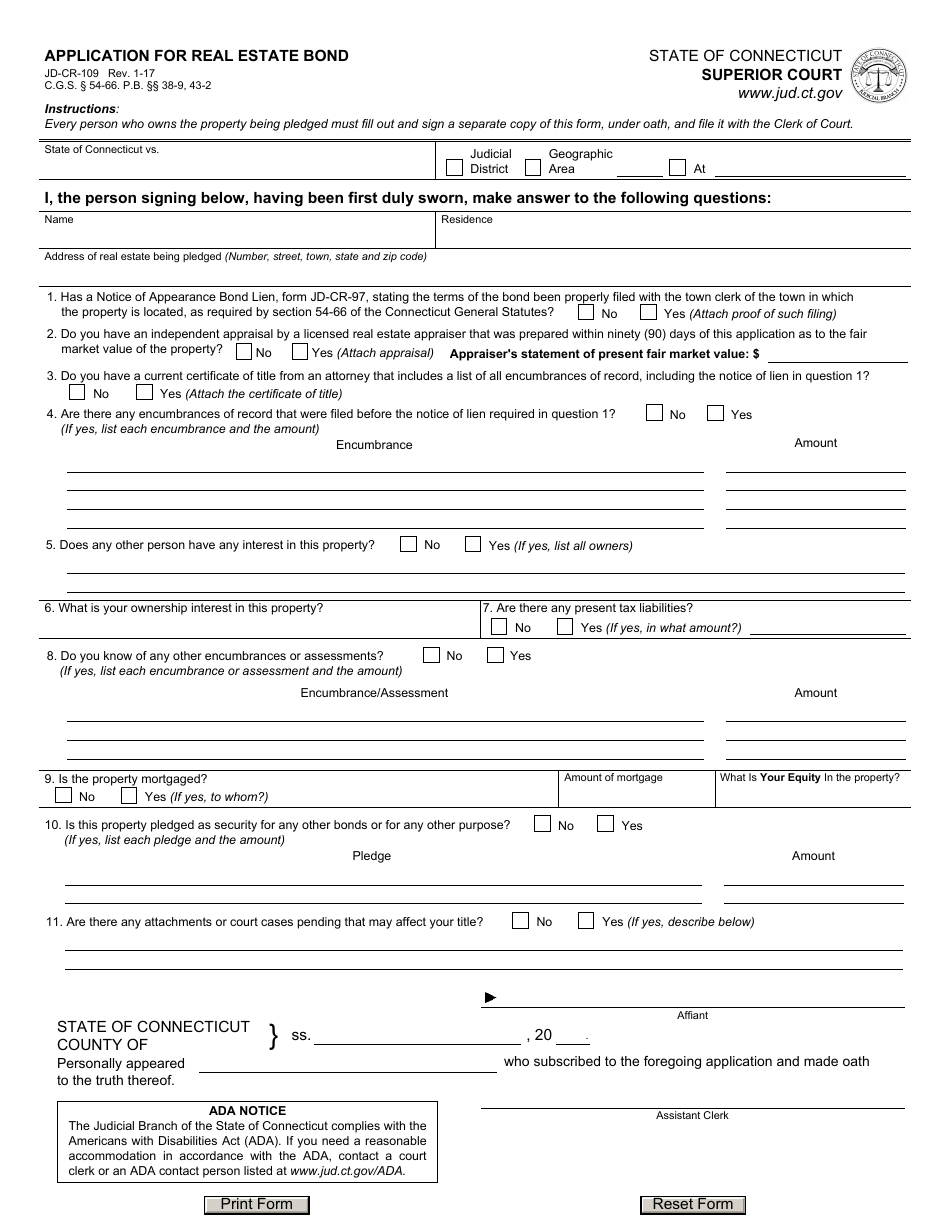

Form JDCR109 Download Fillable PDF or Fill Online Application for

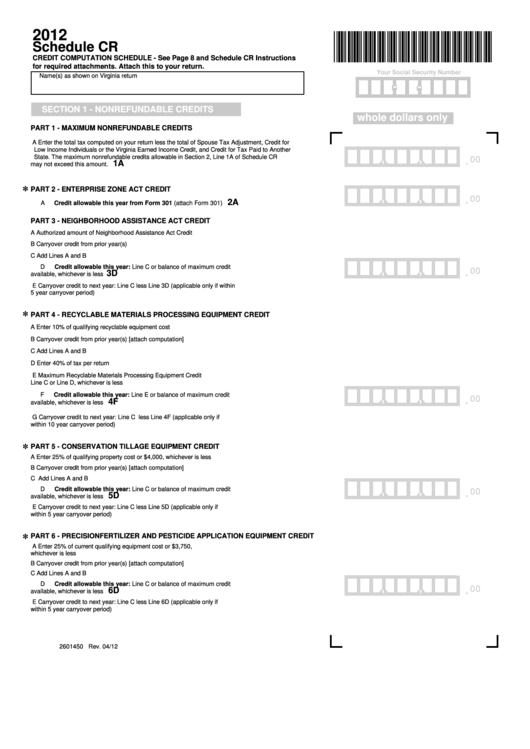

Fillable Schedule Cr (Form 2601450) Credit Computation Schedule

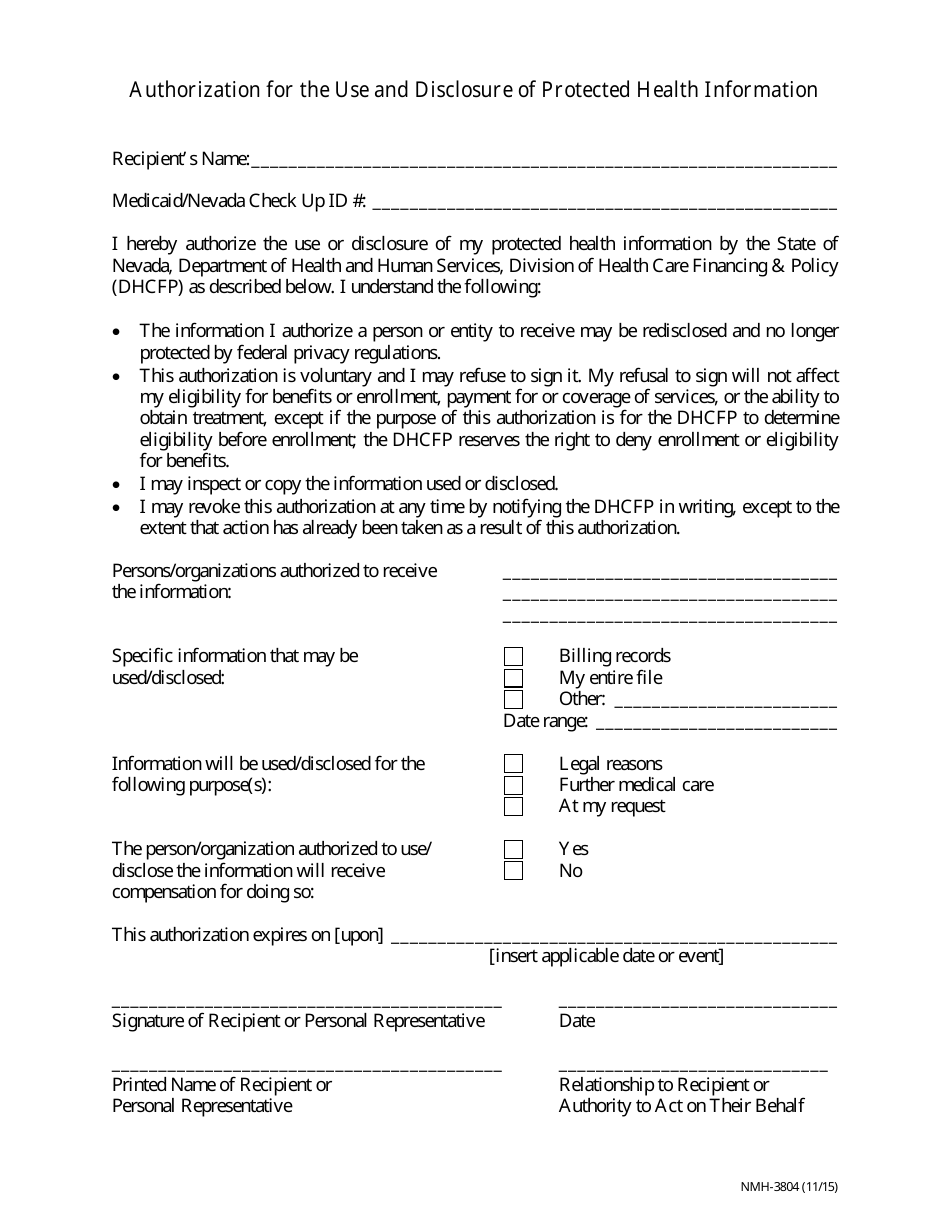

Form NMH3804 Fill Out, Sign Online and Download Fillable PDF, Nevada

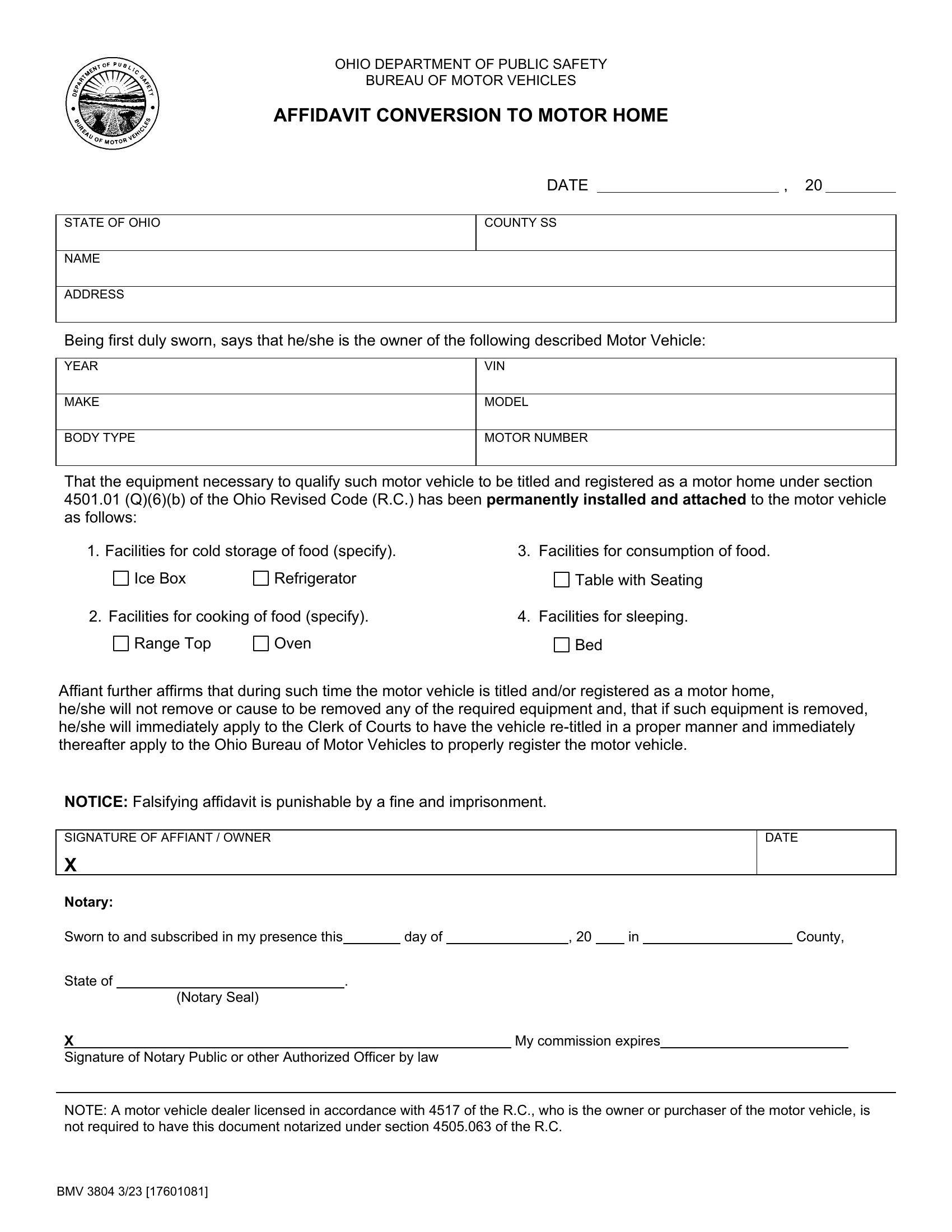

Form BMV 3804. Affidavit Conversion to Motor Home Forms Docs 2023

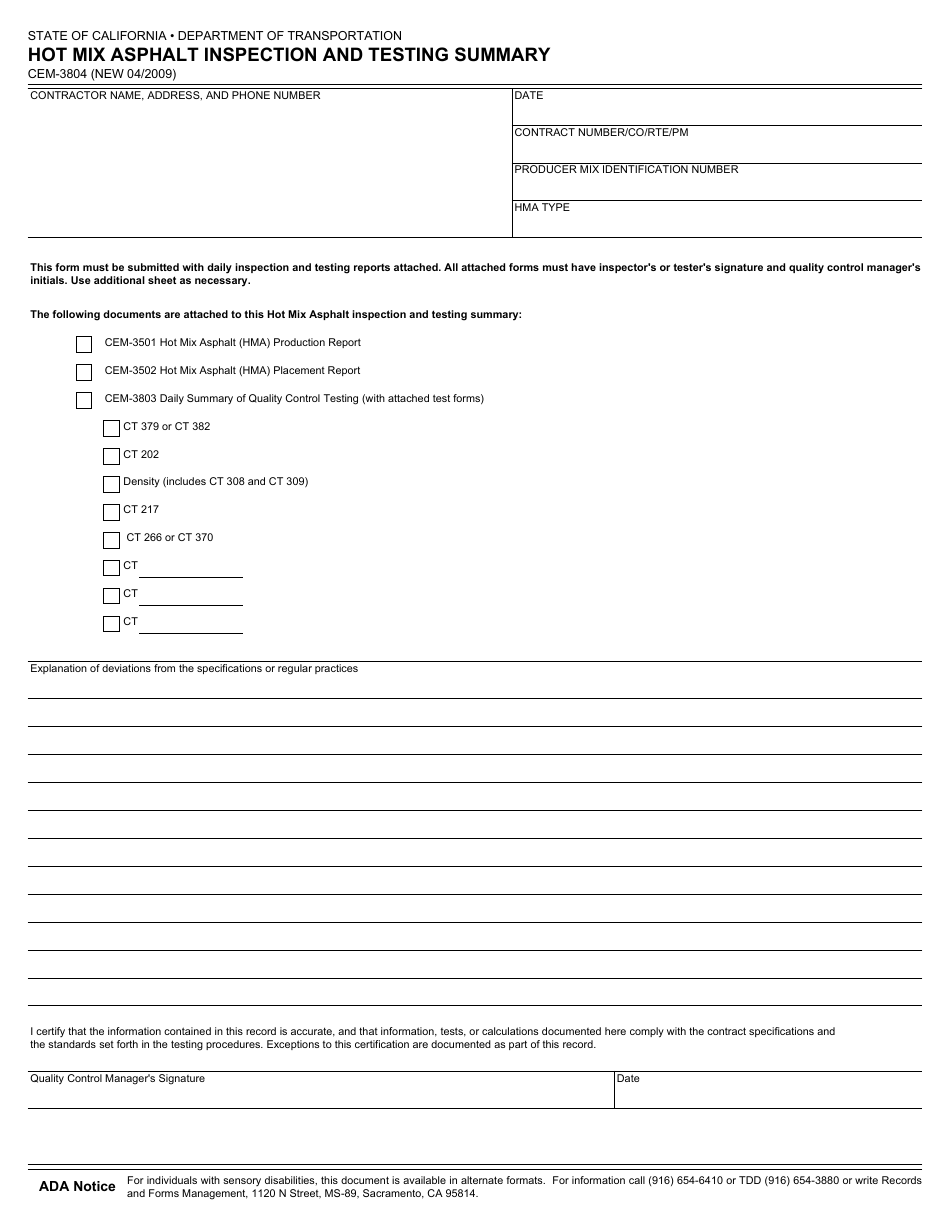

Form CEM3804 Download Fillable PDF or Fill Online Hot Mix Asphalt

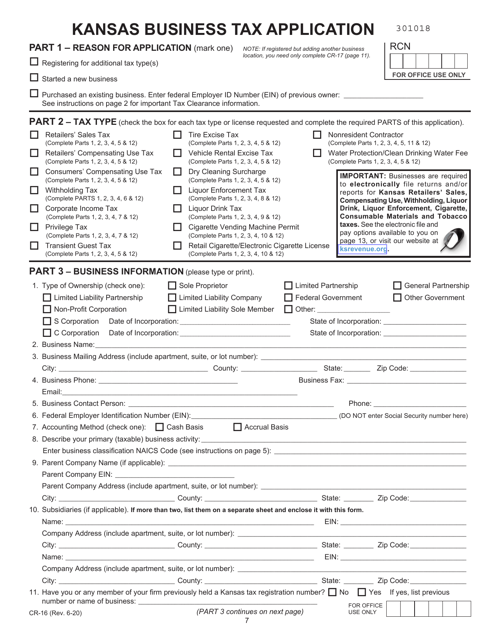

Form CR16 Fill Out, Sign Online and Download Fillable PDF, Kansas

Related Post: