Form 3531 Where To Send

Form 3531 Where To Send - Web page last reviewed or updated: Form 3531, page 1this represents the front page of form 3531, request for signature or missing information to complete return, with an example of. Web the letter said, that i can send it to the return address, but there is no return address on the mail, the only address written on the upper left of the envelop is (internal revenue. Page last reviewed or updated: Turn on the wizard mode in the top toolbar to have more recommendations. If so use this link for addresses on where to send forms. Web frequently asked questions (faqs): Printing and scanning is no longer the best way to manage documents. Form name (for a copy of a form, instruction or publication) address to mail form to irs: Web the following addresses indicate where to send form 3531 based on your state of residence: Ensure that the info you fill in. Web page last reviewed or updated: If so use this link for addresses on where to send forms. Form 3531, page 1this represents the front page of form 3531, request for signature or missing information to complete return, with an example of. Normally that would be your. Please send all correspondence to the irs by certified mail or. Form name (for a copy of a form, instruction or publication) address to mail form to irs: Return related document, use the address for where you would. Web page last reviewed or updated: This page provides a quick guide for. Turn on the wizard mode in the top toolbar to have more recommendations. Web addresses for forms beginning with the number 3; Page last reviewed or updated: Web select the get form button to begin editing. This page provides a quick guide for. Web usually form 3531 has an address in the upper left corner to send the form. Please send all correspondence to the irs by certified mail or. Web addresses for forms beginning with the number 3; Web that means you need to send the irs the actual form from which you obtained the numbers you used for federal taxes withheld.. Web addresses for forms beginning with the number 3; Fill out each fillable area. If so use this link for addresses on where to send forms. Web frequently asked questions (faqs): Web page last reviewed or updated: This page provides a quick guide for. Posted on dec 2, 2020. No, you should only send your form 3531 to the specific address provided on the notice you. Ensure that the info you fill in. Where to send certain payments and applications other than tax returns. Normally that would be your. (january 2020) request for signature or missing information to complete return. Web usually form 3531 has an address in the upper left corner to send the form. Web select the get form button to begin editing. Web where to mail a form 3531 request for signature or missing information to complete return. i was trying. Where to send certain payments and applications other than tax returns. Web addresses for forms beginning with the number 3; (january 2020) request for signature or missing information to complete return. Form name (for a copy of a form, instruction or publication) address to mail form to irs: Web page last reviewed or updated: Web page last reviewed or updated: Handy tips for filling out form 3531 online. Web frequently asked questions (faqs): This page provides a quick guide for. If so use this link for addresses on where to send forms. Web the following addresses indicate where to send form 3531 based on your state of residence: Ad uslegalforms.com has been visited by 100k+ users in the past month Fill out each fillable area. (january 2020) request for signature or missing information to complete return. Web to find the mailing address to send form 3531, you have a few options: Web 1 attorney answer. Web send out signed form 3531 from irs or print it. Web to find the mailing address to send form 3531, you have a few options: Posted on dec 2, 2020. Web the following addresses indicate where to send form 3531 based on your state of residence: Return related document, use the address for where you would. Form name (for a copy of a form, instruction or publication) address to mail form to irs: Web addresses for forms beginning with the number 3; Can i send irs form 3531 to any irs office? Handy tips for filling out form 3531 online. No, you should only send your form 3531 to the specific address provided on the notice you. (january 2020) request for signature or missing information to complete return. Web select the get form button to begin editing. Web page last reviewed or updated: Request for transcript of tax return. Web that means you need to send the irs the actual form from which you obtained the numbers you used for federal taxes withheld. Turn on the wizard mode in the top toolbar to have more recommendations. Please send all correspondence to the irs by certified mail or. A valid legal signature is an original. Where to send certain payments and applications other than tax returns.Tax Return Filing Under Section 119(2)(b) TAXP

Army Chapter 14 12c Discharge Army Military

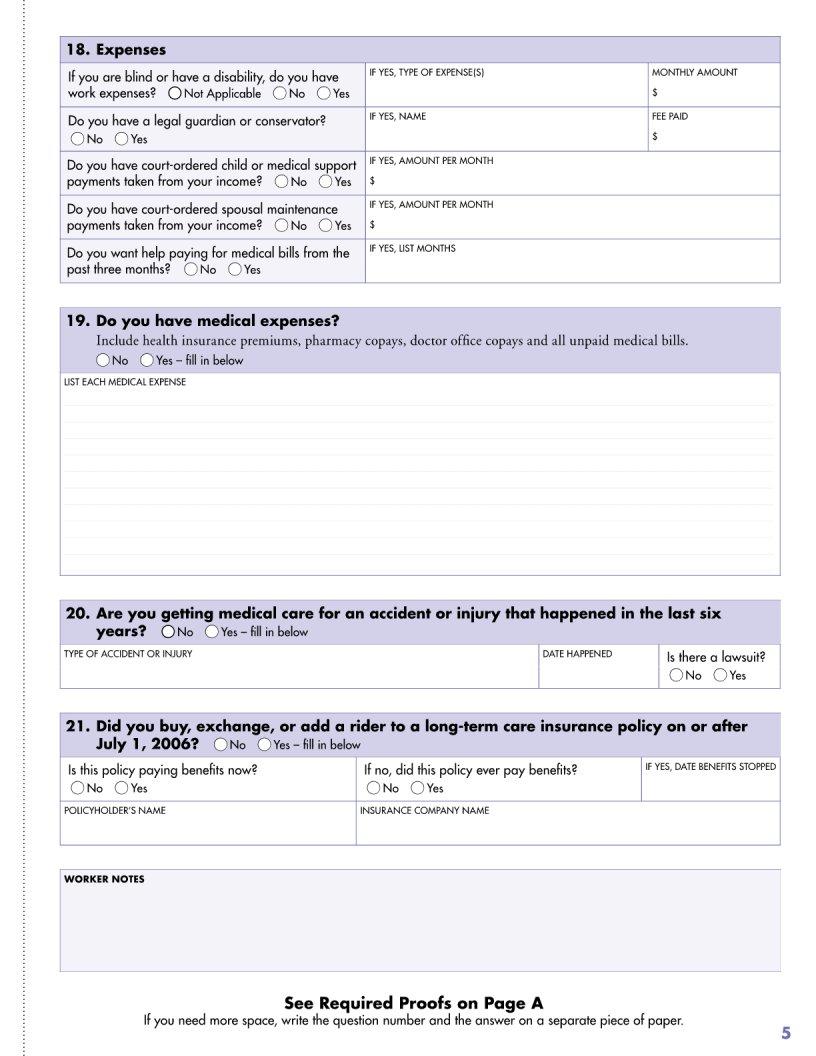

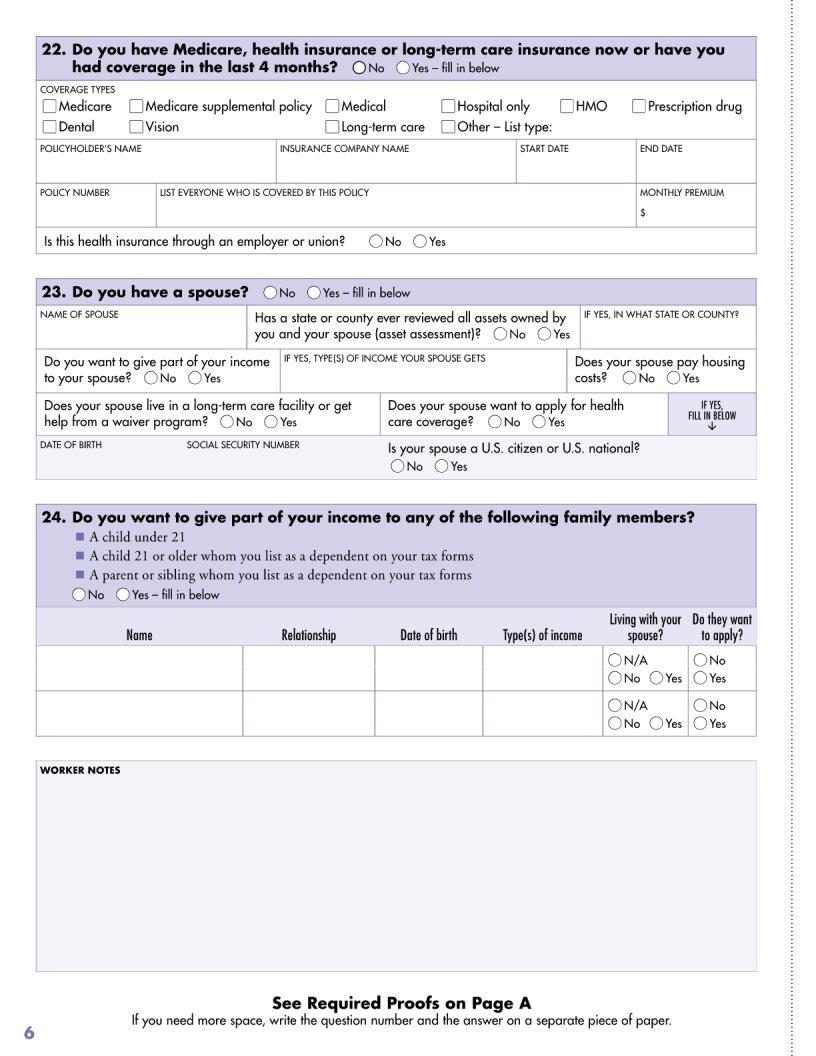

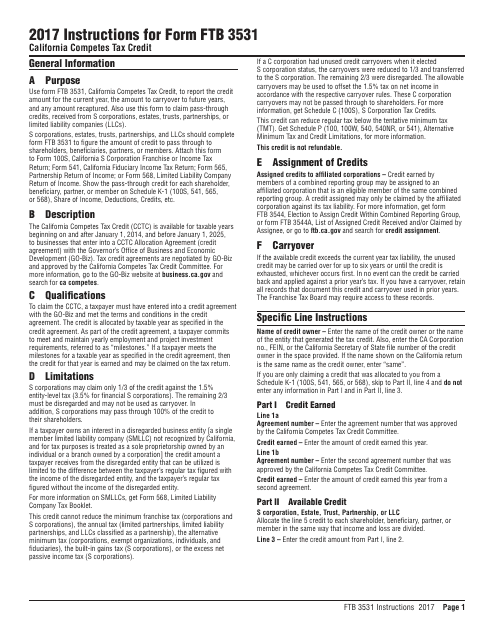

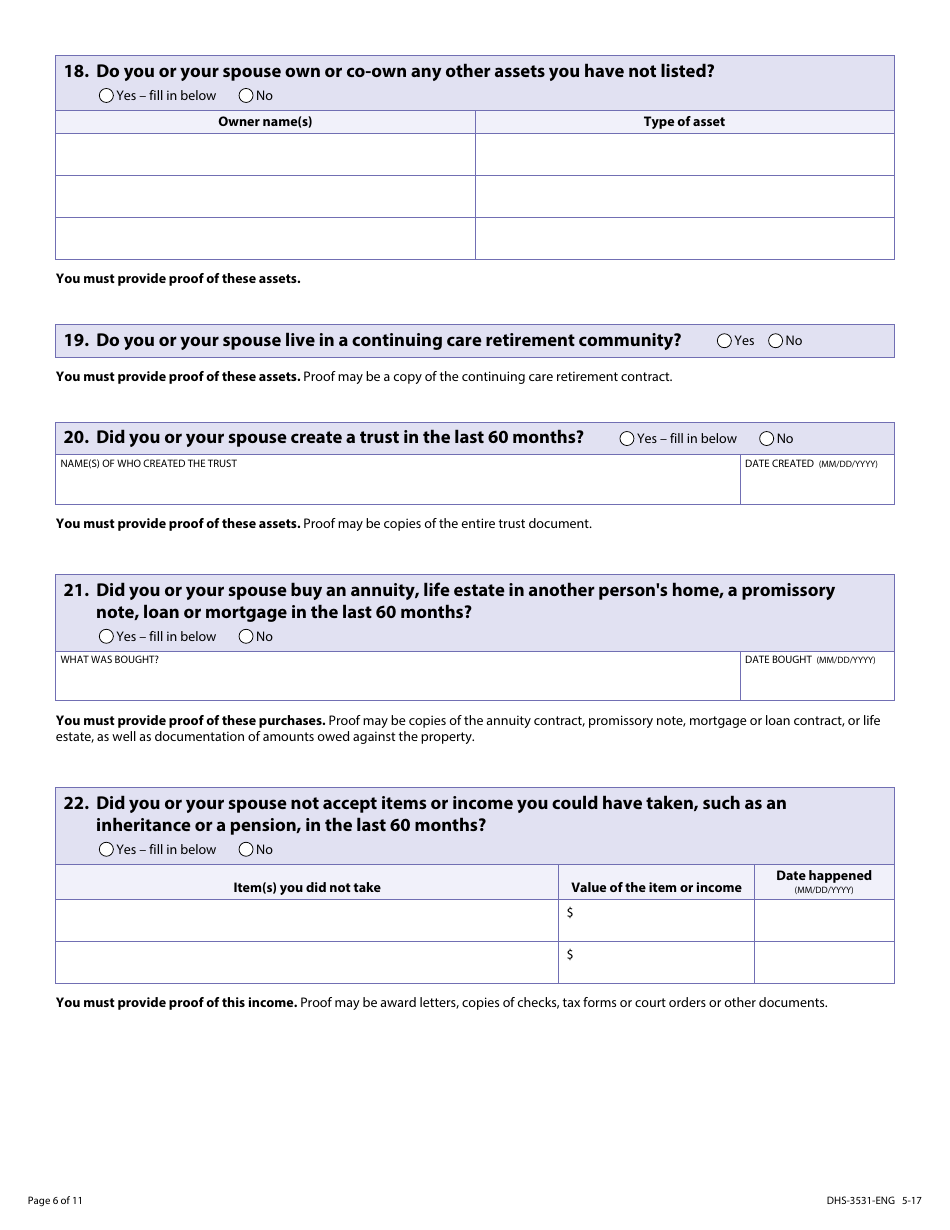

Dhs 3531 Form ≡ Fill Out Printable PDF Forms Online

Dhs 3531 Form ≡ Fill Out Printable PDF Forms Online

Form 3531 what to do and where to send r/IRS

Form DHS3531ENG Fill Out, Sign Online and Download Fillable PDF

IRS Audit Letter 3531 Sample 1

IRS sent taxes back to me with Form 3531 (request for missing

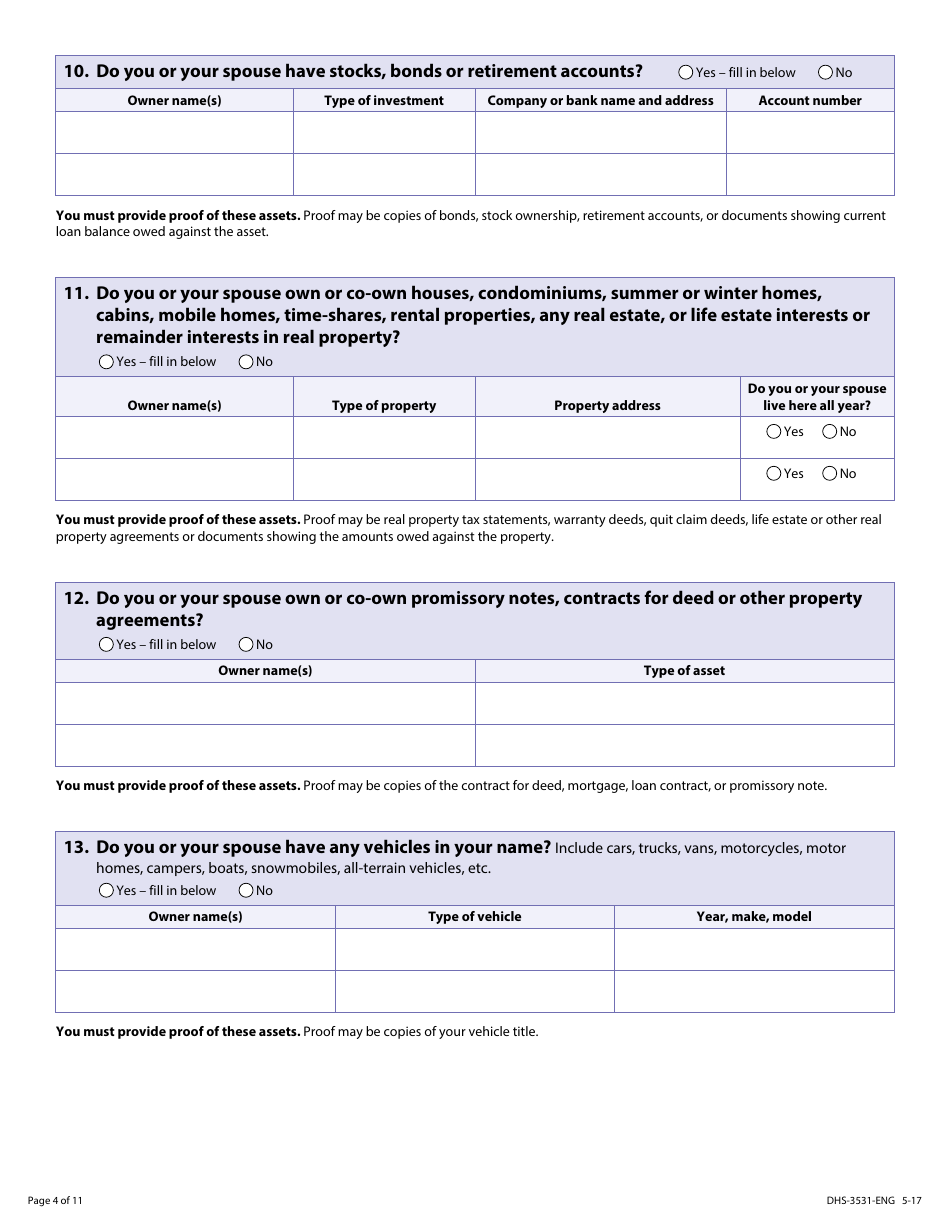

Instructions for Form Ftb 3531 California Competes Tax Credit

Form DHS3531ENG Download Fillable PDF or Fill Online Application for

Related Post: