California Withholding Form

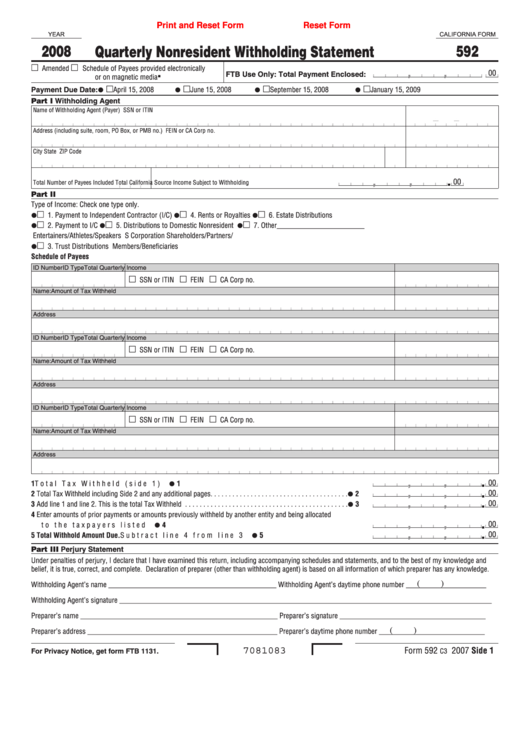

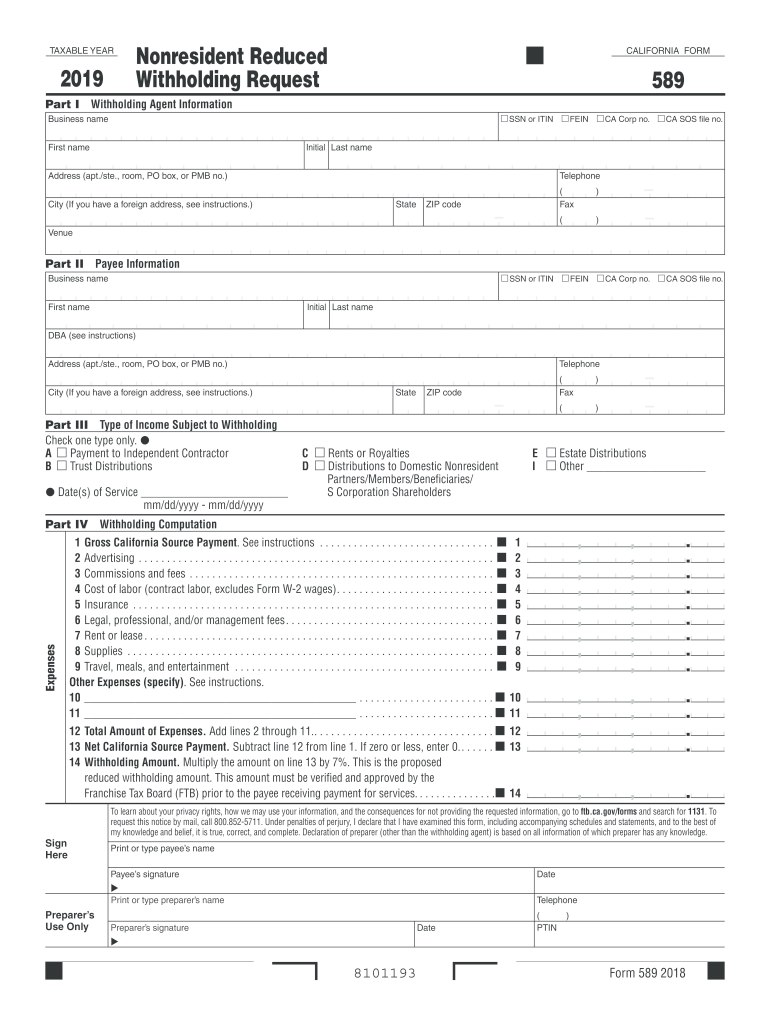

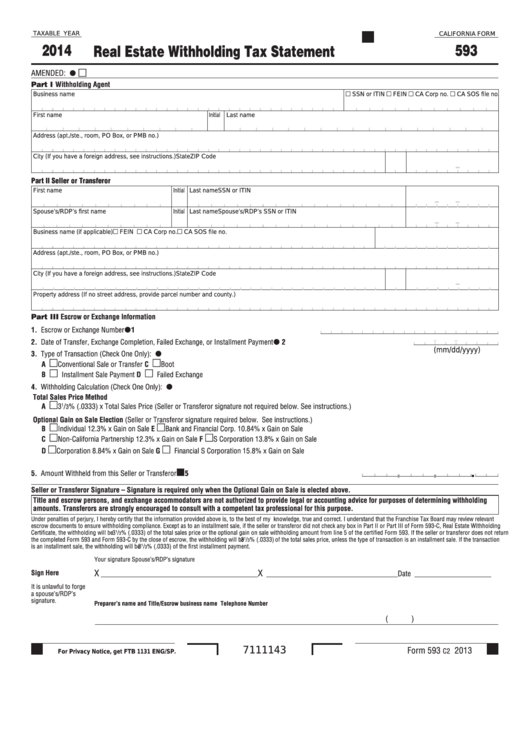

California Withholding Form - Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web simplified income, payroll, sales and use tax information for you and your business Web employee’s withholding allowance certificate complete this form so that your employer can withhold the correct california state income tax from your paycheck. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. Use this form to certify exemption from withholding; Web california provides two methods for determining the withholding amount from wages and salaries for state personal income tax. Ad pdffiller allows users to edit, sign, fill and share all type of documents online. Use the calculator or worksheet to determine the number of. Web the california income tax withholding form, also known as the de 4, is used to calculate the amount of taxes that should be withheld from an employee’s. California has four state payroll taxes which we manage. Withholding exemption certificate (form 590) submit form 590 to your withholding agent; California has four state payroll taxes which we manage. Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Web. Web backup withholding (resident and nonresident withholding) backup withholding is a type of income tax withheld on specific income types when a payee fails to: Web this article will assist you with entering the california real estate withholding reported on form 593 to print on the individual return form 540, line 73. Web filling out the california withholding form de. Web simplified income, payroll, sales and use tax information for you and your business Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. The form helps your employer. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web of. Web payroll tax deposit (de 88) is used to report and pay unemployment insurance (ui), employment training tax (ett), state disability insurance (sdi) withholding, and. Web the california income tax withholding form, also known as the de 4, is used to calculate the amount of taxes that should be withheld from an employee’s. Use the calculator or worksheet to determine. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Withholding exemption certificate (form 590) submit form 590 to your withholding agent; The form helps your employer. Use this form to certify exemption from withholding; Web payroll tax deposit (de 88) is used to report. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Ad pdffiller allows users to edit, sign, fill and share all type of documents online. Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. Web backup. Ad pdffiller allows users to edit, sign, fill and share all type of documents online. California has four state payroll taxes which we manage. It also issued regulations updating the federal. Use the calculator or worksheet to determine the number of. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web backup withholding (resident and nonresident withholding) backup withholding is a type of income tax withheld on specific income types when a payee fails to: Web the california income tax withholding form, also known as the de 4, is used to calculate the amount of taxes that should be withheld from an employee’s. California has four state payroll taxes which. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Use the calculator or worksheet to determine the number of. Withholding exemption certificate (form 590) submit form 590 to your withholding agent; California has four state payroll taxes which we manage. Web get forms, instructions,. Use this form to certify exemption from withholding; Web california provides two methods for determining the withholding amount from wages and salaries for state personal income tax. Web payroll tax deposit (de 88) is used to report and pay unemployment insurance (ui), employment training tax (ett), state disability insurance (sdi) withholding, and. Web the california income tax withholding form, also. Withholding exemption certificate (form 590) submit form 590 to your withholding agent; Web simplified income, payroll, sales and use tax information for you and your business Employers contribute to unemployment insurance (ui) and employment training tax (ett). It also issued regulations updating the federal. Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Web get forms, instructions, and publications. Web the california income tax withholding form, also known as the de 4, is used to calculate the amount of taxes that should be withheld from an employee’s. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Form 590 does not apply to payments of backup. Web this article will assist you with entering the california real estate withholding reported on form 593 to print on the individual return form 540, line 73. The form helps your employer. Use the calculator or worksheet to determine the number of. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. Web backup withholding (resident and nonresident withholding) backup withholding is a type of income tax withheld on specific income types when a payee fails to: Ad pdffiller allows users to edit, sign, fill and share all type of documents online. California has four state payroll taxes which we manage. Web payroll tax deposit (de 88) is used to report and pay unemployment insurance (ui), employment training tax (ett), state disability insurance (sdi) withholding, and. Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed.California Tax Withholding Form 2022

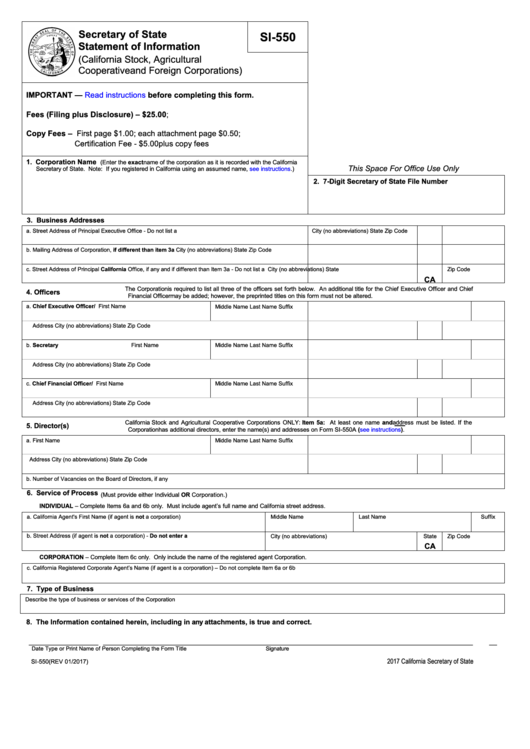

Filing California State Withholding Form

California Employee Withholding Tax Form 2022

california withholding Doc Template pdfFiller

Ca Withholding Form Fill Out and Sign Printable PDF Template signNow

1+ California State Tax Withholding Forms Free Download

Fillable California Form 592 Quarterly Nonresident Withholding

Ftb 589 Fill out & sign online DocHub

Filing California State Withholding Form

Ca State Withholding Form 2022

Related Post: