Form 3522 Vs 3536

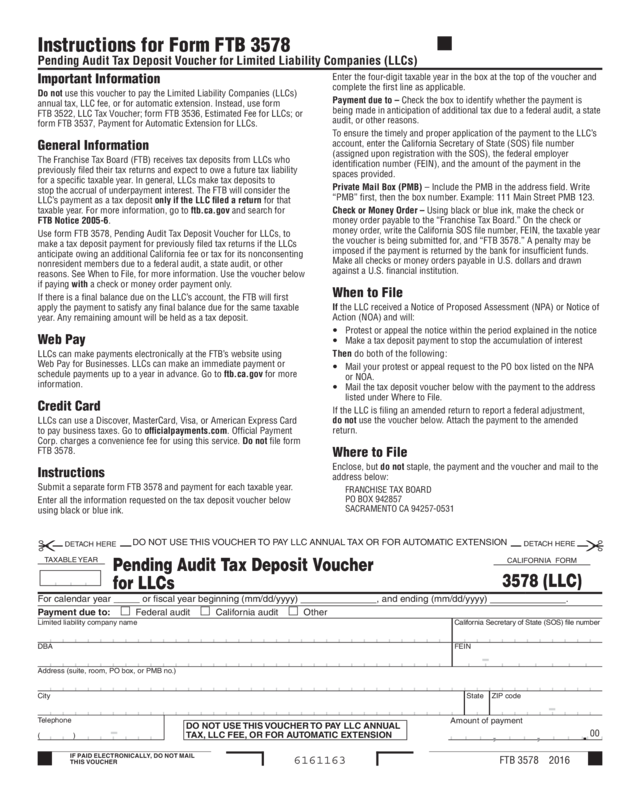

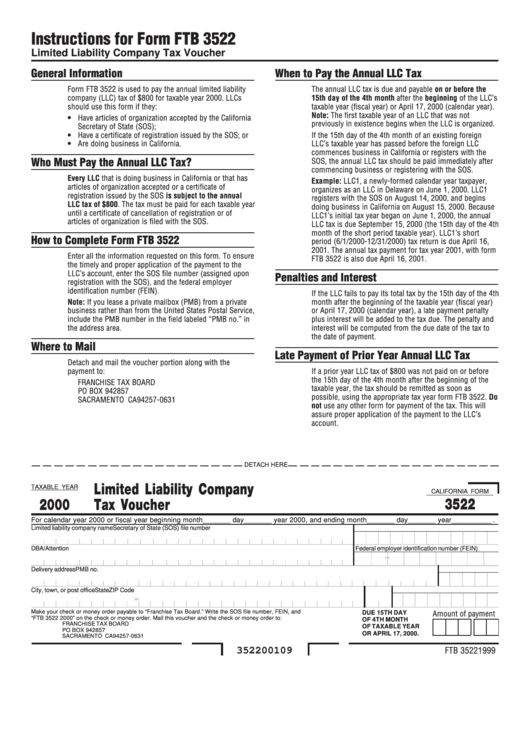

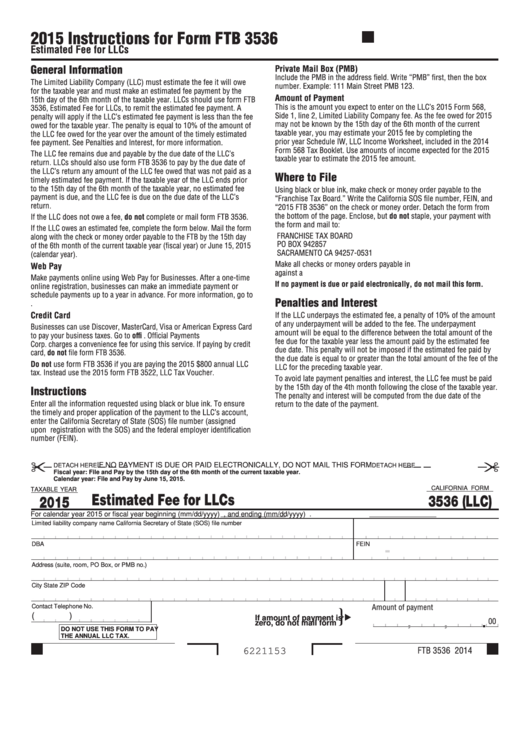

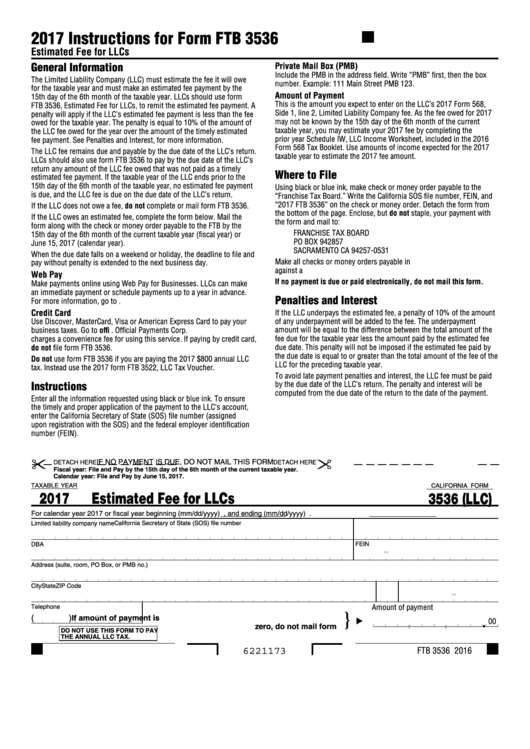

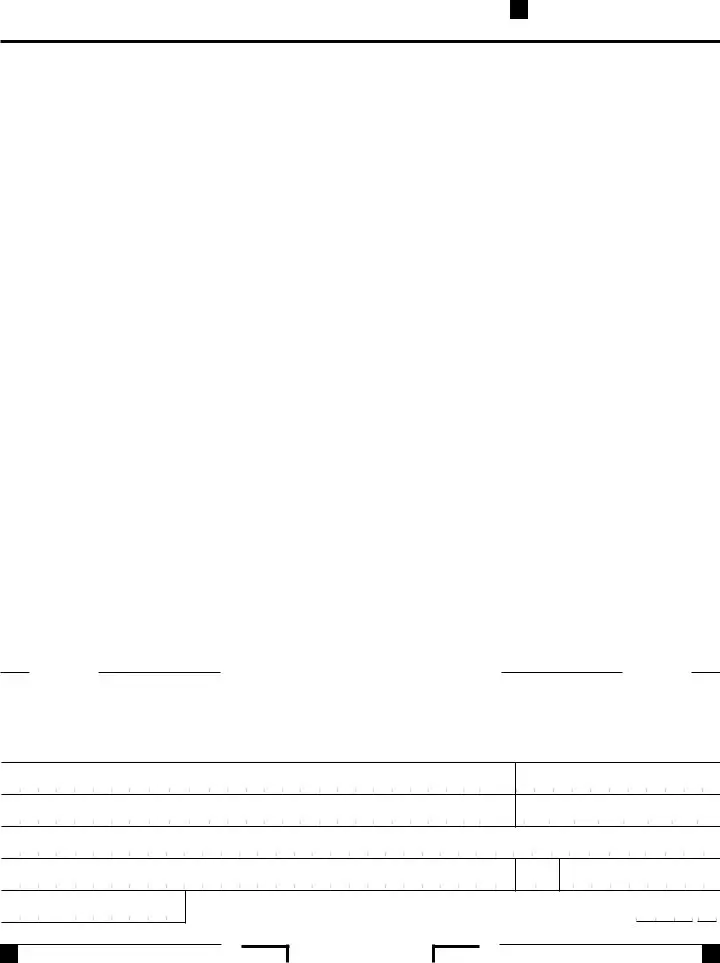

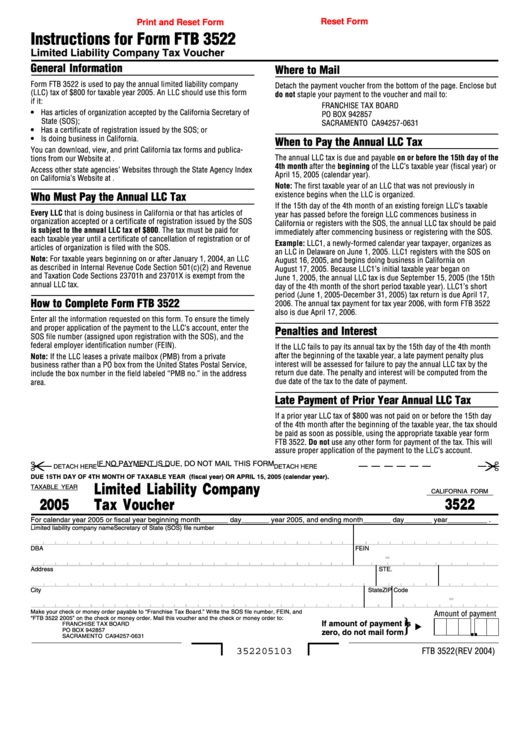

Form 3522 Vs 3536 - Web annual tax form ftb 3522 & llc fee form ftb 3536. Web yes, your california llc needs to file form 3536 and pay an estimated fee if it will make more than $250,000 in total revenue. Use form ftb 3536 if you are paying the 2022 $800 annual llc tax. Form ftb 3522 and form ftb 3536 represent the annual tax and llc fee respectively. You use form ftb 3522, llc tax voucher to pay the annual limited liability. Suppress printing of next year form 3522. Web look for form 3522 and click the link to download; All llcs in the state are required to. Amounts will carry to the ca 568, line 6 and produce a. Web do not file form ftb 3536. Web how did we do? Use form ftb 3536 if you are paying the 2022 $800 annual llc tax. Web annual tax form ftb 3522 & llc fee form ftb 3536. Return of information and authorization and consent of subsidiary corpor ation included in a consolidated income tax return of railroad corporati ons. Web how do i suppress california forms. Web yes, your california llc needs to file form 3536 and pay an estimated fee if it will make more than $250,000 in total revenue. Web look for form 3522 and click the link to download; Web general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and must make an estimated. Web llcs should use form ftb 3536, estimated fee for llcs, to remit the estimated fee. Web general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and must make an estimated fee payment by the 15th day of the 6th. Web annual tax form ftb 3522 & llc fee form ftb. Web form 1122 (1935) subject: Web annual tax form ftb 3522 & llc fee form ftb 3536. You can download or print current or past. Web file form ftb 3536. Web typically, form 3536 (estimated fee for llcs), form 3522 (llc tax voucher) and form 568 are required for each year that you are in business. Both of these are required for. Return of information and authorization and consent of subsidiary corpor ation included in a consolidated income tax return of railroad corporati ons. Do not use form ftb 3536 if you are paying the 2021 $800 annual llc tax. Web instructions for form 8582, passive activity loss limitations, for the definition of “rental activity.” if. Form 3536 only needs to be filed if your income is $250,000 or more. Web look for form 3522 and click the link to download; Web llc tax voucher general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Web form 1122 (1935) subject: Instead use. Web yes, your california llc needs to file form 3536 and pay an estimated fee if it will make more than $250,000 in total revenue. Web llcs should use form ftb 3536, estimated fee for llcs, to remit the estimated fee. Suppress printing of next year form 3522. Return of information and authorization and consent of subsidiary corpor ation included. Do not use form ftb 3536 if you are paying the 2021 $800 annual llc tax. Web file form ftb 3536. Amount of current year overpayment to apply to next year’s tax. Web do not file form ftb 3536. Web llcs should use form ftb 3536, estimated fee for llcs, to remit the estimated fee. Web how do i suppress california forms 3522 and 3536 in a 1065 return using interview forms? Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Web llc tax voucher general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company. Web llc tax voucher general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Web do not file form ftb 3536. You can download or print current or past. Form 3536 only needs to be filed if your income is $250,000 or more. Amount of current. Do not use form ftb 3536 if you are paying the 2021 $800 annual llc tax. Web look for form 3522 and click the link to download; Your california llc will need to file form 3536 if your llcs make. Suppress printing of next year form 3522. Web llcs should use form ftb 3536, estimated fee for llcs, to remit the estimated fee. Web file form ftb 3536. Web general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and must make an estimated fee payment by the 15th day of the 6th. Web form 1122 (1935) subject: Web annual tax form ftb 3522 & llc fee form ftb 3536. You use form ftb 3522, llc tax voucher to pay the annual limited liability. A penalty in the amount of 10% of the underpayment of the estimated fee will apply if the. Form 3536 only needs to be filed if your income is $250,000 or more. Instead use the 2022 form ftb 3522, llc tax voucher. Amount of current year overpayment to apply to next year’s tax. All llcs in the state are required to. Web instructions for form 8582, passive activity loss limitations, for the definition of “rental activity.” if you have net income on line 32, your tax may be less if you figure it using. Amounts will carry to the ca 568, line 6 and produce a. Web typically, form 3536 (estimated fee for llcs), form 3522 (llc tax voucher) and form 568 are required for each year that you are in business. Return of information and authorization and consent of subsidiary corpor ation included in a consolidated income tax return of railroad corporati ons. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax.2016 Form 3578 Pending Audit Tax Deposit Voucher For Ll Cs Edit

Business CA LLC entity 800 minimum Annual Tax Payment (Form 3522

Form Ftb 3522 Limited Liability Company Tax Voucher 2000 printable

Fillable Form 3536 (Llc) Estimated Fee For Llcs 2015 printable pdf

Fillable Form Ftb 3536 Estimated Fee For Llcs 2017 printable pdf

Ca Form 3522 amulette

2022 Form CA FTB 3536 Fill Online, Printable, Fillable, Blank pdfFiller

Form 3522 California ≡ Fill Out Printable PDF Forms Online

Fillable California Form 3522 Limited Liability Company Tax Voucher

Ftb 3582 Fill Out and Sign Printable PDF Template signNow

Related Post: