Form 3520 怎么填

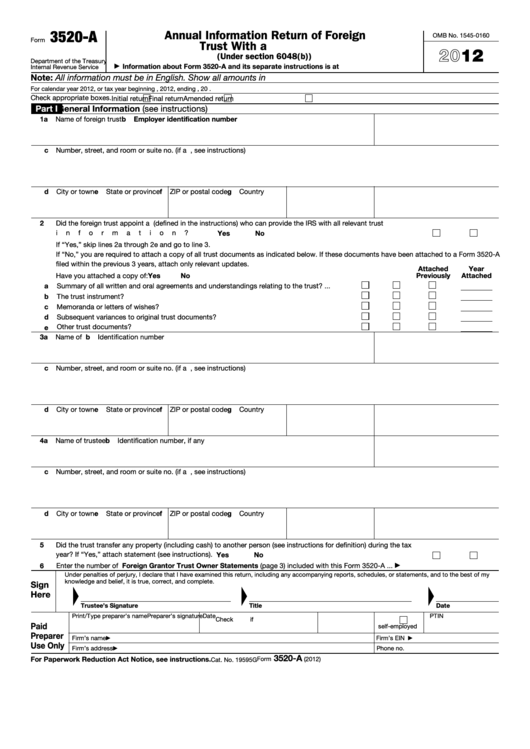

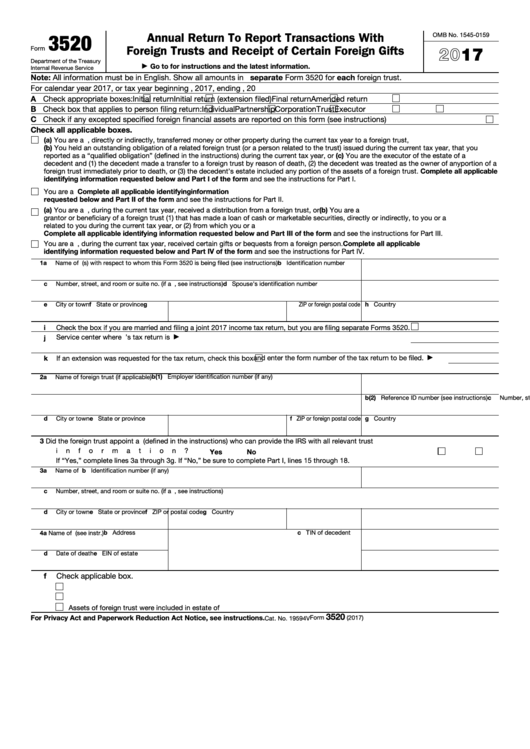

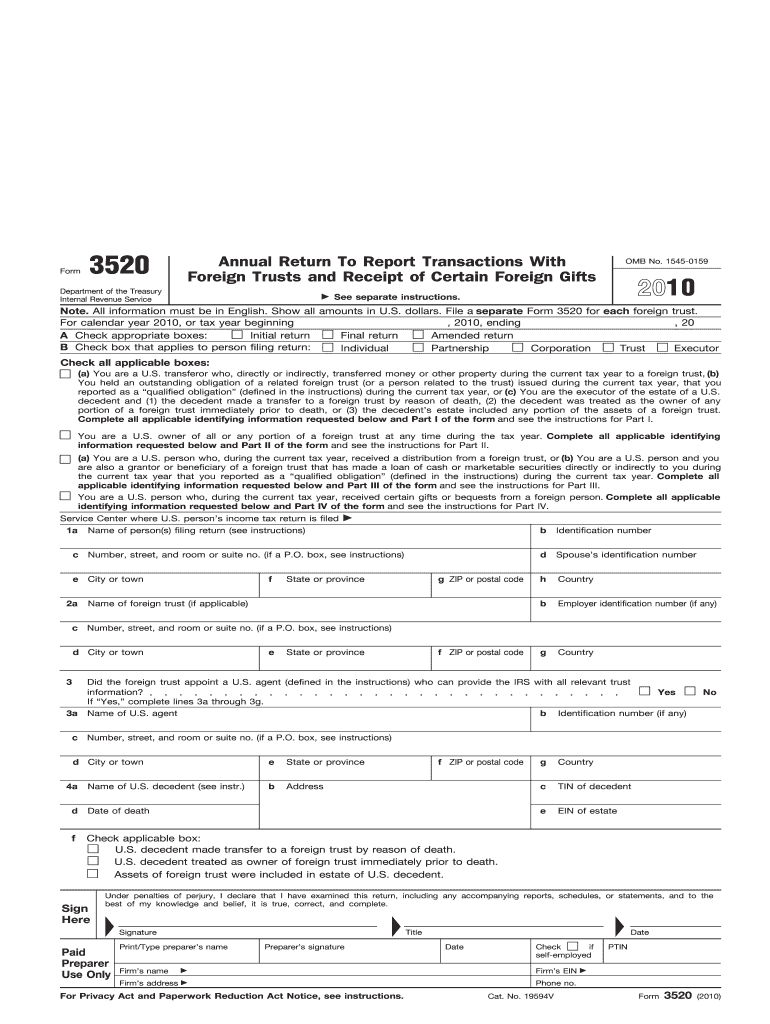

Form 3520 怎么填 - Web 我和老公的银行账户各自接受超过$10万的从国内汇来的钱。我们联合报税,那3520表只填他的名字?还是我俩人应该一人填一份?service center where us. Send form 3520 to the. Web 去年国内和老婆各收到国内汇款15万,今年报税是married filing jointly同时给老婆申请itin, 现在打算填3520,发现可以file joint 3520。 有两个问题我不太清楚: 1.我. Get ready for tax season deadlines by completing any required tax forms today. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Ownership of foreign trusts under the rules. Persons (and executors of estates of u.s. Decedents) file form 3520 with the irs to report: Web speaking strictly of form 3520 being used to disclose a foreign gift (form 3520 has other purposes as well), you would want to fill out only the sections indicated. Certain transactions with foreign trusts. Web 常见的主要海外信息申报表包括fbar(海外金融账户申报表),form 8938(海外金融资产申报表),form 5471(海外股权申报表)和form 3520(境外信托及赠与申报表)。为了让读者全. Department of the treasury internal revenue service. Web 10月15日寄出3520已经晚了,就是当天收到,也是过了5个月的上限,即最高2 irs网站说 if a u.s. Talk to our skilled attorneys by scheduling a free consultation today. Web 去年国内和老婆各收到国内汇款15万,今年报税是married filing jointly同时给老婆申请itin, 现在打算填3520,发现可以file joint 3520。 有两个问题我不太清楚: 1.我. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts. Persons (and executors of estates of u.s. Web 常见的主要海外信息申报表包括fbar(海外金融账户申报表),form 8938(海外金融资产申报表),form 5471(海外股权申报表)和form 3520(境外信托及赠与申报表)。为了让读者全. Persons (and executors of estates of u.s. Certain transactions with foreign trusts. Web form 3520 is one of the most common forms besides the fbar is form 3520. Talk to our skilled attorneys by scheduling a free consultation today. Get ready for tax season deadlines by completing any required tax forms today. Form 3520 is an international reporting forum that requires us persons to report certain foreign gift. Web speaking strictly of form 3520 being used to disclose a foreign gift (form 3520 has other purposes as well),. The form provides information about the foreign trust, its u.s. Certain transactions with foreign trusts, ownership of foreign trusts. Send form 3520 to the. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Talk to our skilled attorneys by scheduling a free consultation today. Ownership of foreign trusts under the rules. Persons (and executors of estates of u.s. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Persons (and executors of estates. Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with. Web 10月15日寄出3520已经晚了,就是当天收到,也是过了5个月的上限,即最高2 irs网站说 if a u.s. Annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web in particular, late filers of form 3520, “annual return to report transactions with. The form provides information about the foreign trust, its u.s. Person is granted an extension of time to file an income tax return,. Department of the treasury internal revenue service. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Talk to our skilled attorneys by scheduling a free consultation today. The form provides information about the foreign trust, its u.s. Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found. Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with. Decedents) file form 3520 with the irs to report: The form provides information about the foreign trust, its u.s. The form provides information about the foreign trust, its u.s. Web 我和老公的银行账户各自接受超过$10万的从国内汇来的钱。我们联合报税,那3520表只填他的名字?还是我俩人应该一人填一份?service center where us. Certain transactions with foreign trusts. Person is granted an extension of time to file an income tax return,. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Persons (and executors of estates of u.s. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Talk to our skilled attorneys by scheduling a free consultation today. Web speaking strictly of form 3520 being used to disclose a foreign gift (form 3520 has other purposes as well), you would want to fill out only the sections indicated. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web if you are a u.s. Talk to our skilled attorneys by scheduling a free consultation today. Decedents) file form 3520 with the irs to report: Form 3520 is an international reporting forum that requires us persons to report certain foreign gift. Decedents) file form 3520 to report: Web 我和老公的银行账户各自接受超过$10万的从国内汇来的钱。我们联合报税,那3520表只填他的名字?还是我俩人应该一人填一份?service center where us. Web 常见的主要海外信息申报表包括fbar(海外金融账户申报表),form 8938(海外金融资产申报表),form 5471(海外股权申报表)和form 3520(境外信托及赠与申报表)。为了让读者全. Get ready for tax season deadlines by completing any required tax forms today. Ownership of foreign trusts under the rules. Web 去年国内和老婆各收到国内汇款15万,今年报税是married filing jointly同时给老婆申请itin, 现在打算填3520,发现可以file joint 3520。 有两个问题我不太清楚: 1.我. Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with.Fillable Form 3520A Annual Information Return Of Foreign Trust With

Understanding Form 3520 for Foreign Trusts and Gifts & Penalties YouTube

Form 3520 A Fillable Printable Forms Free Online

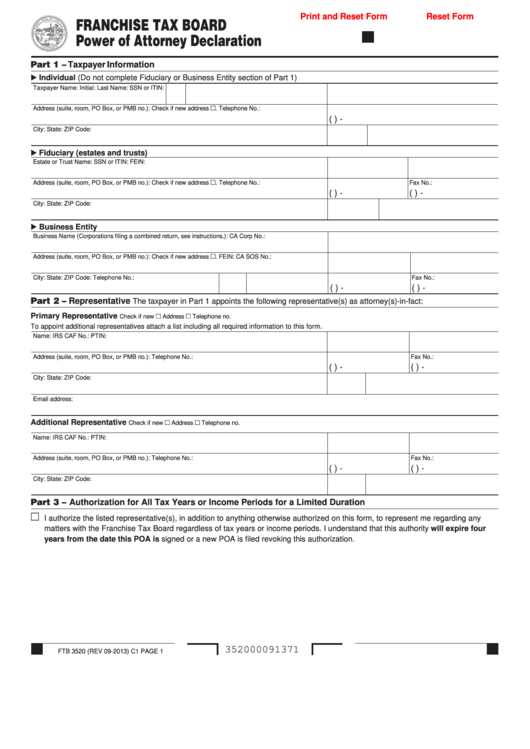

Top 9 California Ftb Form 3520 Templates free to download in PDF format

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Fillable Form 3520 Annual Return To Report Transactions With Foreign

Form 3520 Blank Sample to Fill out Online in PDF

Form 3520 Fill Out and Sign Printable PDF Template signNow

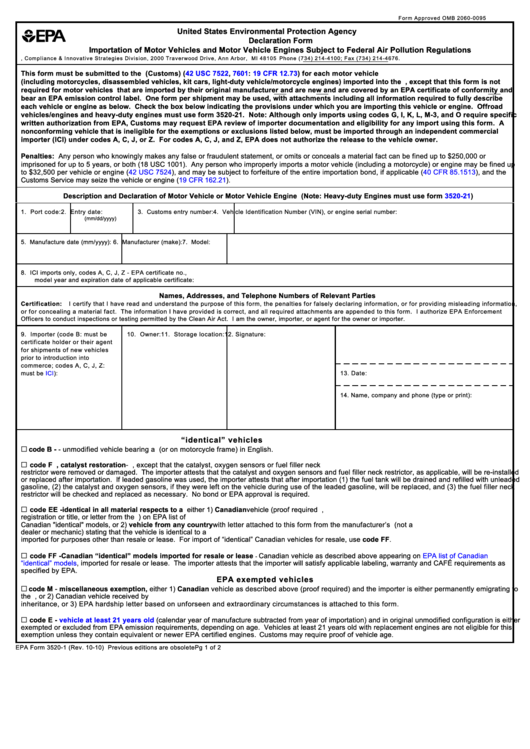

Top Epa Form 35201 Templates free to download in PDF format

IRS Form 3520Reporting Transactions With Foreign Trusts

Related Post: