Form 3115 Turbotax

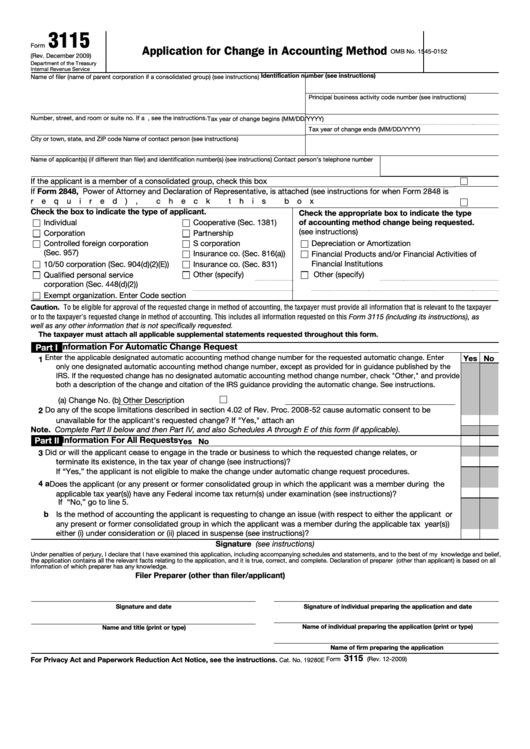

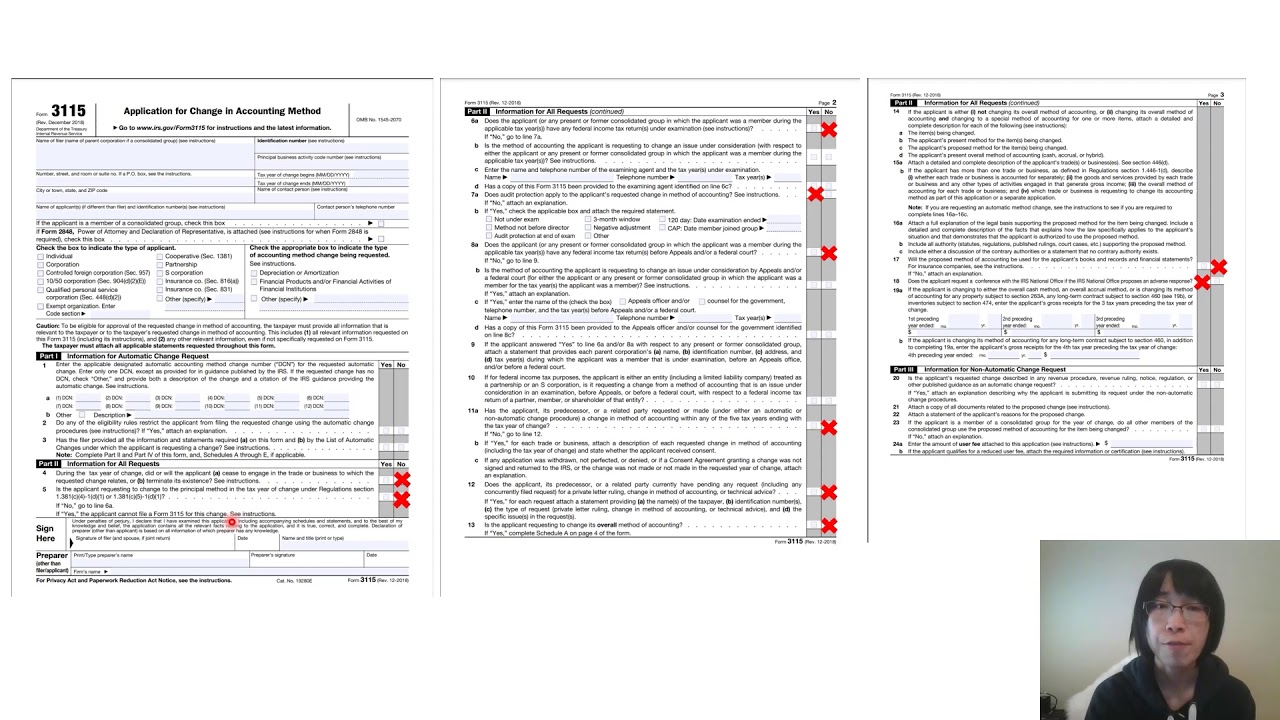

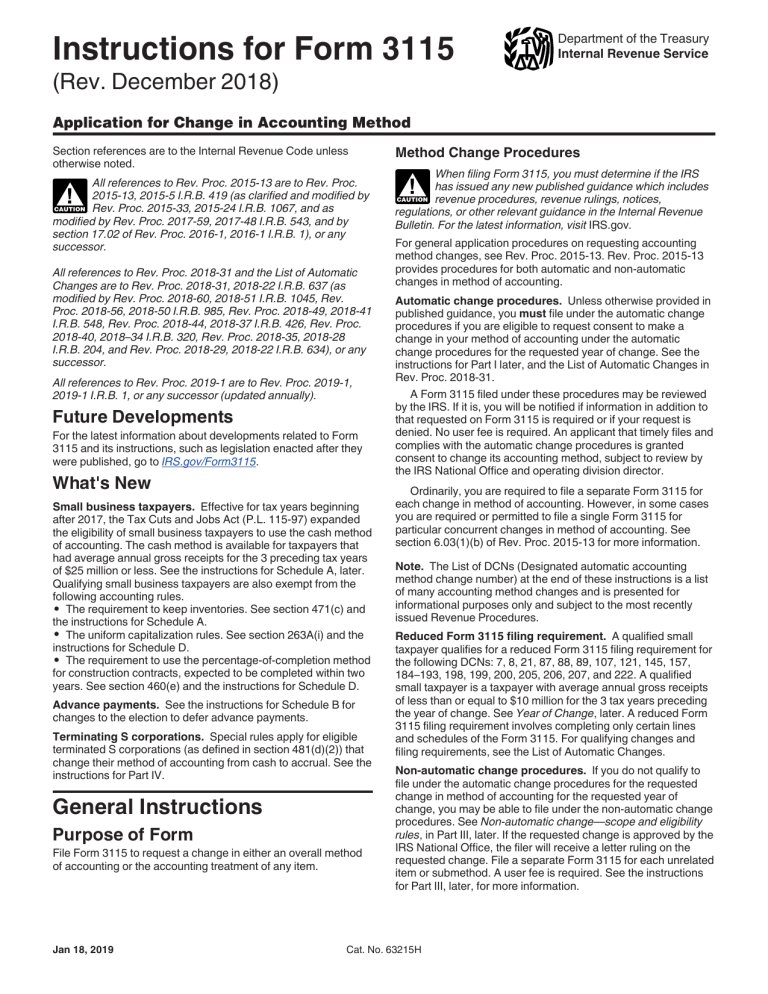

Form 3115 Turbotax - Web what is irs form 3115? Yes, that's exactly where it should go. Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Minimize potential audit risks and save time when filing taxes each year Web 231 rows when filing form 3115, you must determine if the irs has issued any new. A person or applicant who needs to change the method of accounting for themselves or on behalf of another entity will need to file form. Taxpayers filing forms 3115 after april 18, 2023, must use the december 2022 form 3115. Web to get irs approval to change an accounting method, you'll need to file form 3115, application for change in accounting method. Web level 15 you will have to purchase a desktop version of turbotax for form 3115 and, basically, start over with that version. Web common questions about form 3115 and regulation change. Form 3115, change in accounting method, is used to correct most other depreciation errors, including the omission of depreciation. Until further notice, the irs is implementing the temporary procedure. I may need to submit form 3115 for rental depreciation unclaimed. Web taxpayers filing form 3115, application for change in accounting method,. Web 231 rows when filing form 3115, you must determine if the irs has issued any new. Web level 15 you will have to purchase a desktop version of turbotax for form 3115 and, basically, start over with that version. Taxact helps you maximize your deductions with easy to use tax filing software. Minimize potential audit risks and save time. Web level 15 you will have to purchase a desktop version of turbotax for form 3115 and, basically, start over with that version. Web form 3115 is not supported by the program. Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. Application for change in accounting method. However, even. However, even with the desktop. Ad explore the collection of software at amazon & take your skills to the next level. We offer a variety of software related to various fields at great prices. Web what is irs form 3115? The form is required for both changing. After sign into your account, select take me to my return 2. Taxact helps you maximize your deductions with easy to use tax filing software. Solved•by intuit•24•updated july 27, 2023. Yes, that's exactly where it should go. Also known as application for change in accounting method, irs form 3115 is required for any taxpayer that changes their accounting method or. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. December 2022) department of the treasury internal revenue service. Attach the original form 3115 to filer's timely filed (including extensions) federal. Web 231 rows when filing form 3115, you must determine if the irs has issued any new.. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Is it a manual process? Minimize potential audit risks and save time when filing taxes each year Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. You. Application for change in accounting method. Web yes, fax a copy of the form and the statement (separate from your return) to the irs. At the right upper corner, in the search box, type in 3115 and enter 3. Ad import tax data online in no time with our easy to use simple tax software. Solved•by intuit•24•updated july 27, 2023. Yes, that's exactly where it should go. Taxpayers filing forms 3115 after april 18, 2023, must use the december 2022 form 3115. Web to get irs approval to change an accounting method, you'll need to file form 3115, application for change in accounting method. Attach the original form 3115 to filer's timely filed (including extensions) federal. Web form 3115, otherwise. Web what is irs form 3115? Web if i fill out a form 3115 in turbo tax, does turbo tax bring the form 3115 amounts into the tax return to compute the tax? Is it a manual process? After sign into your account, select take me to my return 2. Until further notice, the irs is implementing the temporary procedure. Web file form 3115 under the automatic change procedures in duplicate as follows. I may need to submit form 3115 for rental depreciation unclaimed. Web to get irs approval to change an accounting method, you'll need to file form 3115, application for change in accounting method. At the right upper corner, in the search box, type in 3115 and enter 3. You might as well simply print and mail your entire federal income tax return. Minimize potential audit risks and save time when filing taxes each year Select jump to form 3115 4. Taxact helps you maximize your deductions with easy to use tax filing software. We offer a variety of software related to various fields at great prices. Web level 15 you will have to purchase a desktop version of turbotax for form 3115 and, basically, start over with that version. Until further notice, the irs is implementing the temporary procedure. Attach the original form 3115 to filer's timely filed (including extensions) federal. Web change in accounting method form 3115: Regardless of the version of form 3115 used,. Web form 3115 is not supported by the program. Ad import tax data online in no time with our easy to use simple tax software. Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. If you pay an irs or state penalty or interest because of a turbotax calculation error,. But i don't recall ever seeing this in tt. Web form 3115 is used when you want to change your overall accounting method and also if you need to change the accounting treatment of any particular item.Fillable Form 3115 Application For Change In Accounting Method

How to catch up missed depreciation on rental property (part I) filing

Form 3115 Application for Change in Accounting Method(2015) Free Download

Form 3115 Depreciation Guru

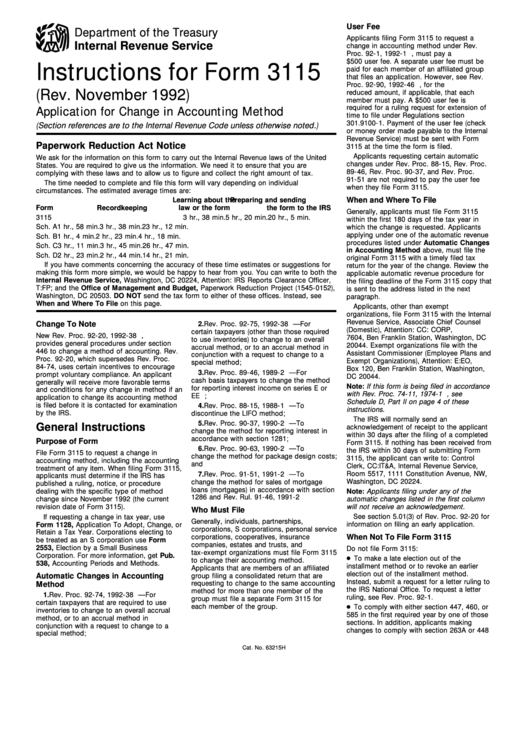

Instructions For Form 3115 printable pdf download

Form 3115 Applying a Cost Segregation Study on a Tax Return The

Instructions for Form 3115

Form 3115 Edit, Fill, Sign Online Handypdf

Form 3115 Application for Change in Accounting Method(2015) Free Download

Re When will form 8915E 2020 be available in tur... Page 19

Related Post: