Ct Form 1040Es

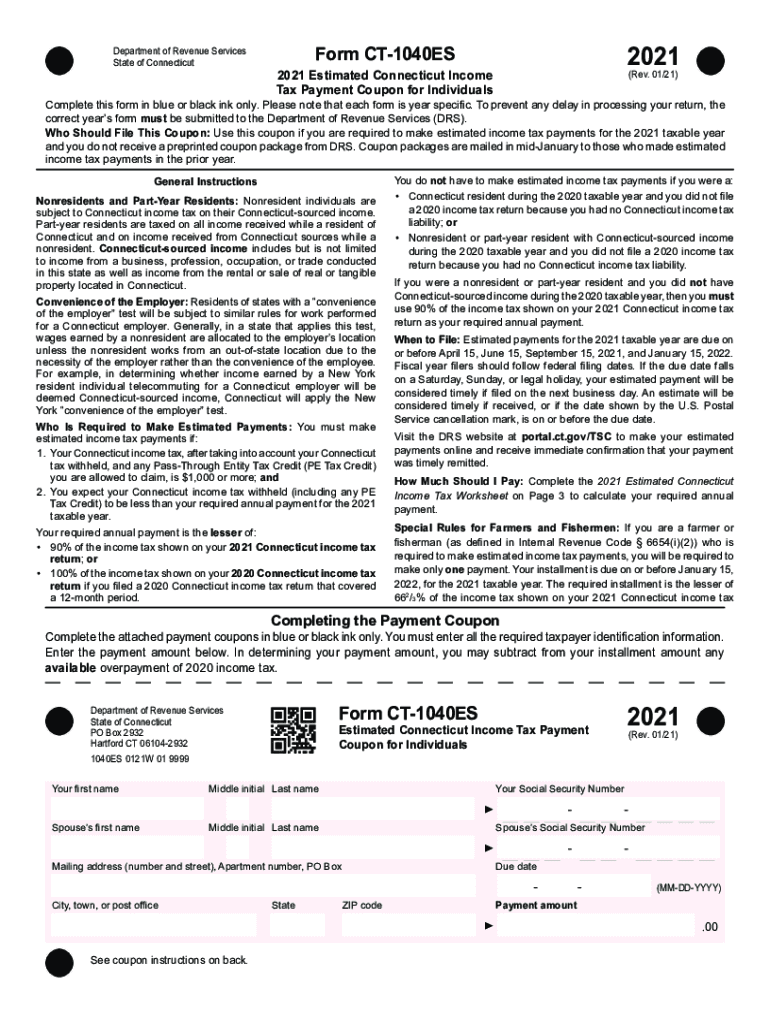

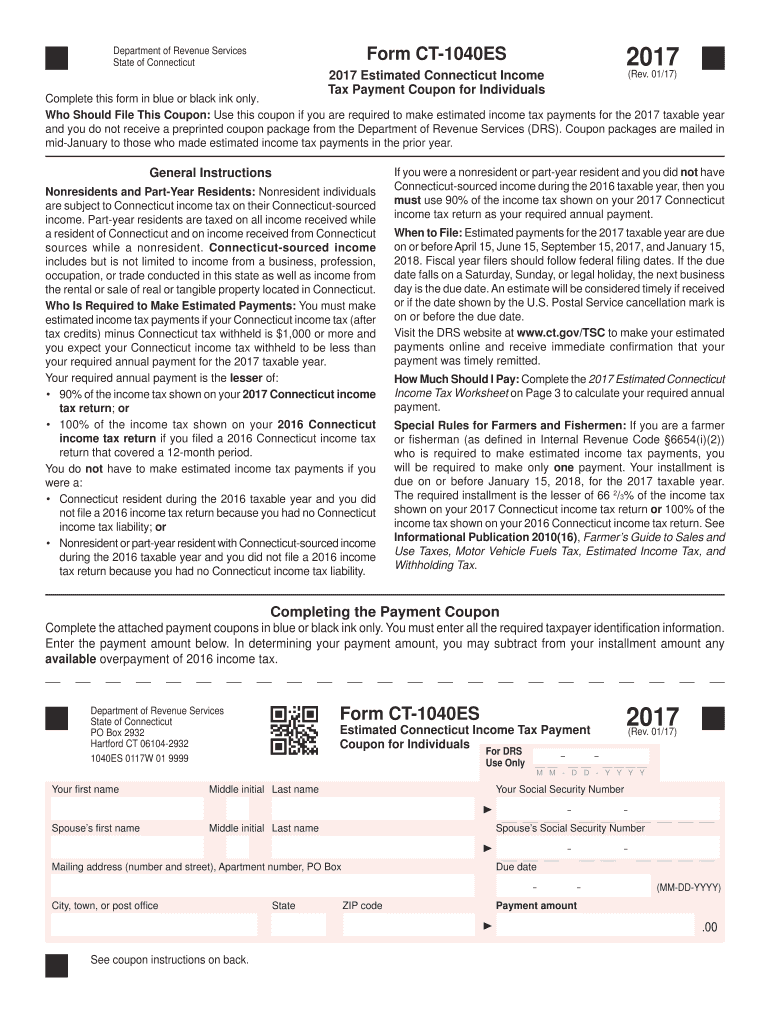

Ct Form 1040Es - 01/20) page 2 of 8 • see payment options, on page 8. General rule in most cases, you must pay estimated tax for 2023 if both of the following apply. 01/21) tax payment coupon for individuals. Connecticut — estimated connecticut income tax payment coupon for individuals. You expect to owe at least $1,000. It appears you don't have a pdf. For additional information on the. Web department of revenue services state of connecticut (rev. Ad discover helpful information and resources on taxes from aarp. For payments without tax forms: You expect to owe at least $1,000. 2020 estimated connecticut income tax payment coupon for individuals: Department of the treasury internal revenue service. Use this form to request a monthly installment plan if. 2019 estimated connecticut income (rev. Connecticut resident income tax return. 2023 estimated connecticut income tax payment coupon for individuals: For payments without tax forms: Web an electronic filing or electronic payment requirement. Use this form to request a monthly installment plan if. Form ct‑1040es is available on the drs website. Enter your status, income, deductions and credits and estimate your total taxes. 2021 estimated connecticut income tax payment coupon for. Web department of revenue services. Ad discover helpful information and resources on taxes from aarp. Please note that each form. You expect to owe at least $1,000. Include your spouse’s ssn, if married filing jointly. General rule in most cases, you must pay estimated tax for 2023 if both of the following apply. Web department of revenue services state of connecticut (rev. Web department of revenue services. Connecticut — estimated connecticut income tax payment coupon for individuals. Form ct‑1040es is available on the drs website. 2020 estimated connecticut income tax payment coupon for individuals: Connecticut resident income tax return. Enter your status, income, deductions and credits and estimate your total taxes. Department of the treasury internal revenue service. Use this form to request a monthly installment plan if. 2023 estimated connecticut income tax payment coupon for trusts and estates. For payments without tax forms: For payments without tax forms: 01/20) page 2 of 8 • see payment options, on page 8. Web department of revenue services. Connecticut — estimated connecticut income tax payment coupon for individuals. Ad discover helpful information and resources on taxes from aarp. Connecticut resident income tax return. Use this form to request a monthly installment plan if. You expect to owe at least $1,000. Web department of revenue services. Web an electronic filing or electronic payment requirement. Web if you did not make estimated tax payments in 2022, use form ct‑1040es to make your first estimated income tax payment. General rule in most cases, you must pay estimated tax for 2023 if both of the following apply. Department of the treasury internal revenue service. 01/20) page 2 of 8 • see payment options, on page 8. You. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Web connecticut electronic withdrawal payment record : Department of the treasury internal revenue service. Web visit us at portal.ct.gov/drs for more information. 2023 estimated connecticut income tax payment coupon for trusts and estates. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Connecticut resident income tax return instructions. 2019 estimated connecticut income (rev. Web visit us at portal.ct.gov/drs for more information. For additional information on the. Form ct‑1040es is available on the drs website. Department of the treasury internal revenue service. 2022 estimated connecticut income tax payment coupon for trusts and estates. 2023 estimated connecticut income tax payment coupon for individuals: 2020 estimated connecticut income tax payment coupon for individuals: Use this form to request a monthly installment plan if. Web department of revenue services. 2023 estimated connecticut income tax payment coupon for trusts and estates. Web department of revenue services. Web connecticut electronic withdrawal payment record : Complete this form in blue or black ink only. You expect to owe at least $1,000. Include your spouse’s ssn, if married filing jointly. 01/21) tax payment coupon for individuals. General rule in most cases, you must pay estimated tax for 2023 if both of the following apply.Form Ct1040 Ext Application For Extension Of Time To File

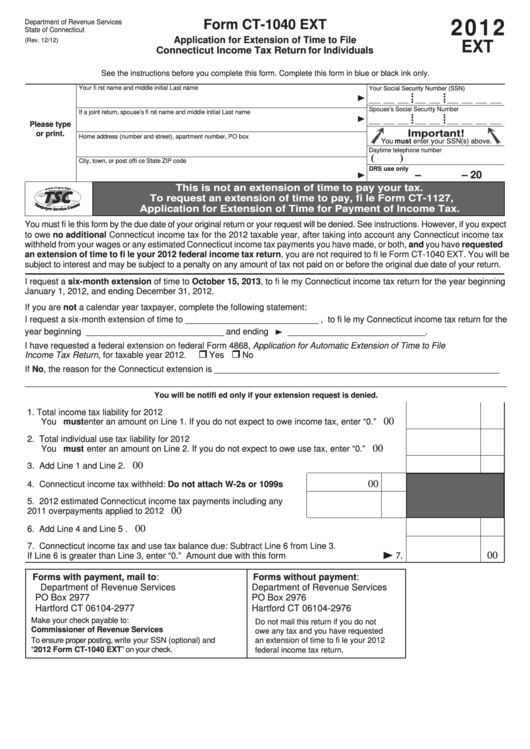

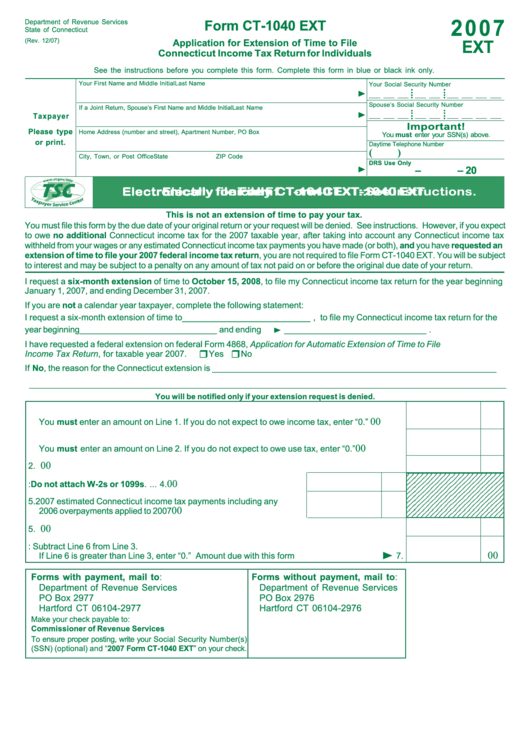

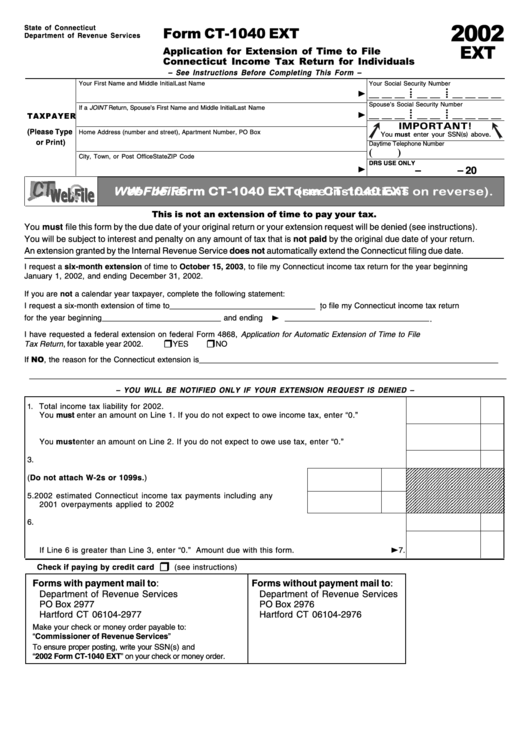

Form Ct1040 Ext Application For Extension Of Time To File

Ct 1040Es Fill Out and Sign Printable PDF Template signNow

Form 1040ES Online PDF Template

Form Ct1040 Ext Application For Extension Of Time To File

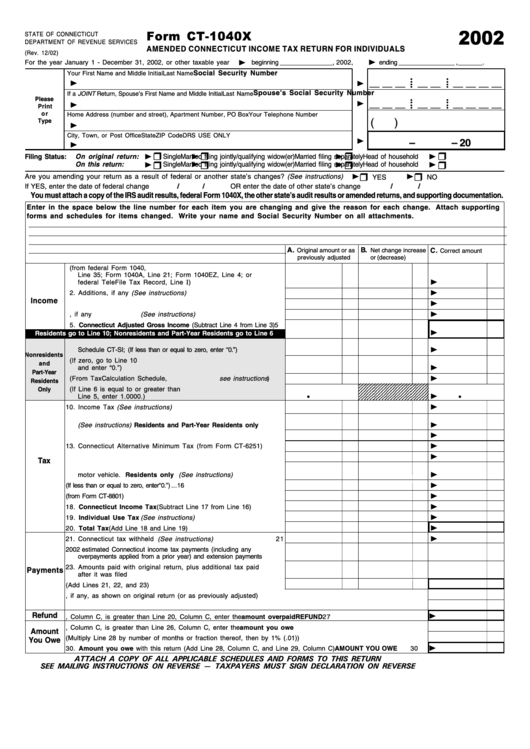

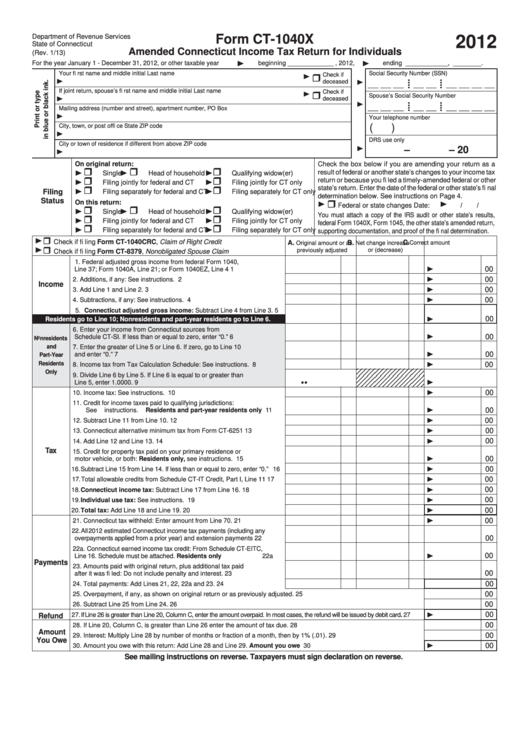

Form Ct1040x Amended Connecticut Tax Return For Individuals

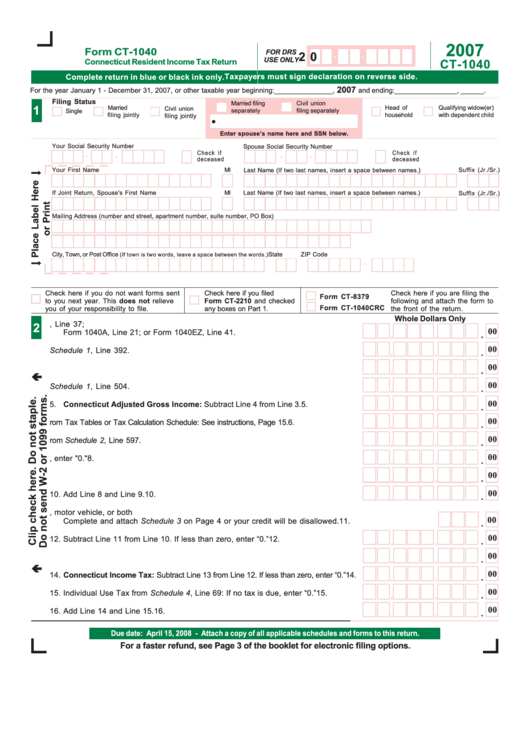

Form Ct 1040 Connecticut Resident Tax Return 2007 printable

Form Ct1040x Amended Connecticut Tax Return For Individuals

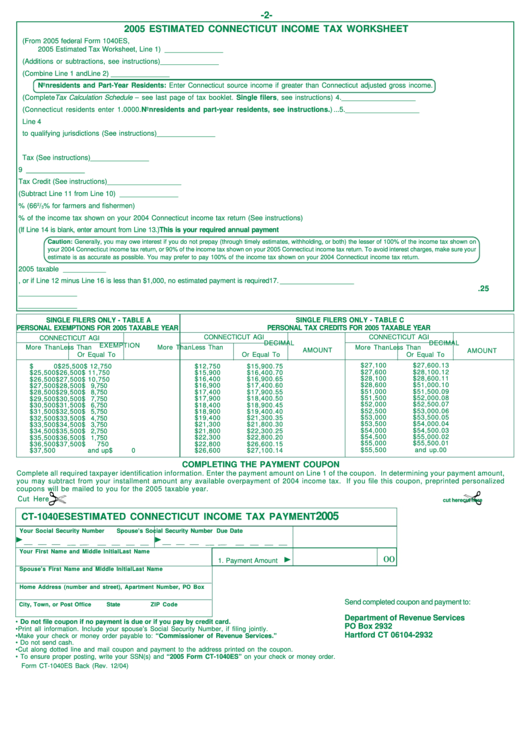

Form Ct 1040es Estimated Connecticut Tax Payment 2005

Ct 1040Es Fill Out and Sign Printable PDF Template signNow

Related Post: