Form 2441 Care Provider The Yes Cbx

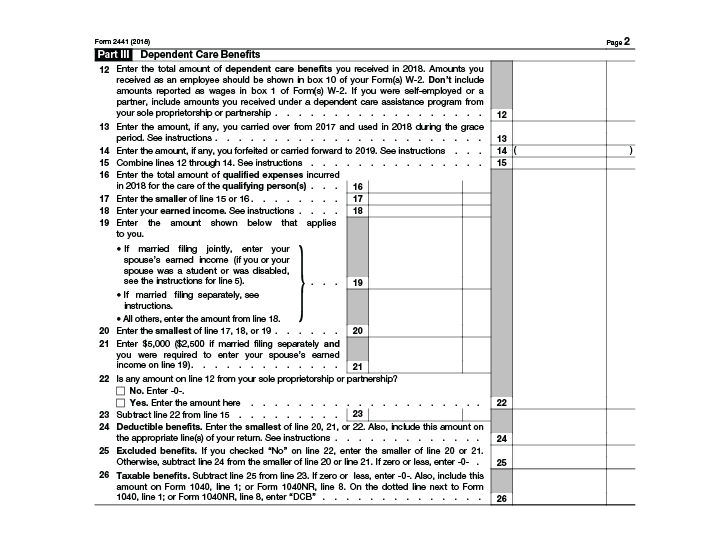

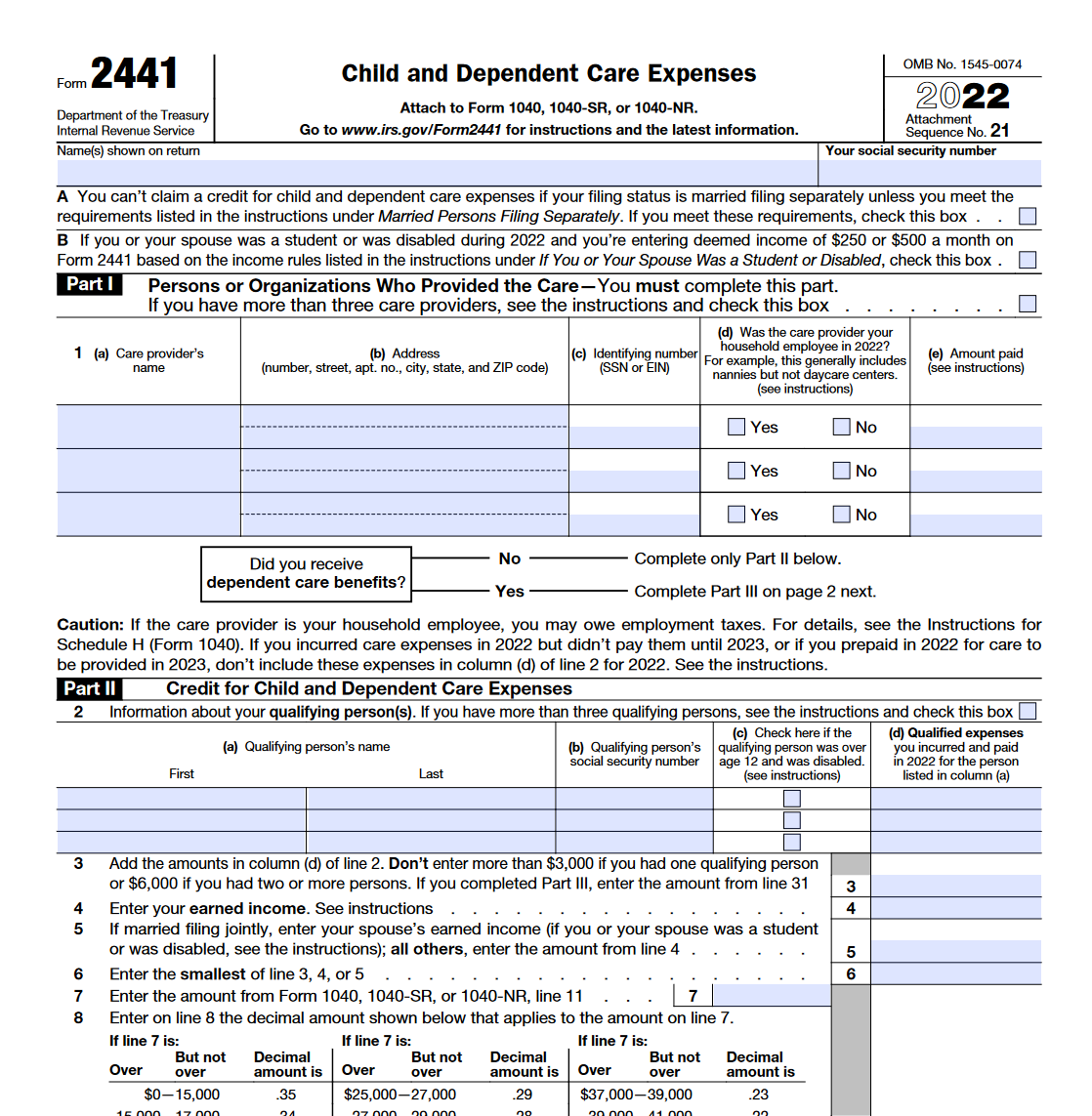

Form 2441 Care Provider The Yes Cbx - Web section 1557 of the patient protection and affordable care act. Only check the “qualifying person had no expenses” box if the person is both a qualifying person for the credit and had no expenses. Web information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Web in order to claim the child and dependent care credit, form 2441, you must: The adjustments will be based on your earned income, the benefits that you. Web as you prepare form 2441, you will notice that you must use the smaller of your earned income or care provider expenses to calculate the credit. (1) an epo is a form of ppo, in which patients must visit a caregiver that is specified on its panel of providers. Child and dependent care credit form 2441 instructions form 2441 calculator child and. Use the links below to jump straight to the answer: Web common questions for form 2441 child and dependent care expenses in lacerte solved • by intuit • 61 • updated december 20, 2022 below, you'll find. Web for the child care provider. No complete only part ii below. Web follow the instructions for form 2441 to adjust your benefits on lines 15 to 26. Web in order to claim the child and dependent care credit, form 2441, you must: If the care provider is your household employee, you. Web the child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents (qualifying persons). On form 2441 there is a yes/no checkbox for care provider hhe. what is hhe? If you paid to an individual, you needed to enter caregiver's. Child and dependent care credit form 2441. Child and dependent care credit form 2441 instructions form 2441 calculator child and. Web part i persons or organizations who provided the care—you must complete this part. I just want to know what hhe stands for so that i can check yes. (1) an epo is a form of ppo, in which patients must visit a caregiver that is specified. If you paid to an individual, you needed to enter caregiver's. (if you have more than two care providers, see the instructions.) 1 (a) care provider’s. Web as you prepare form 2441, you will notice that you must use the smaller of your earned income or care provider expenses to calculate the credit. • providers must ensure that members have. Web the total number of npi records is 7, , all registered as organizations. If the care provider is your household employee, you. The adjustments will be based on your earned income, the benefits that you. Web your care provider for the care of your qualifying person(s) while you worked, • the fair market value of care in a daycare. Web information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Web form 2441, page 2 of 2 margins: If you're married, your spouse must also have earned income. Web your care provider for the care of your qualifying person(s) while you worked, •the fair market value of care in. Web follow the instructions for form 2441 to adjust your benefits on lines 15 to 26. Only check the “qualifying person had no expenses” box if the person is both a qualifying person for the credit and had no expenses. By checking this box, i understand i am required to include specialist records and an active. Web part i persons. Web yes no has the person making the referral notified the child’s parent/representative? Ad download or email irs 2441 & more fillable forms, register and subscribe now! Web your care provider for the care of your qualifying person(s) while you worked, •the fair market value of care in a daycare facility provided or sponsored by your employer, and. Web part. Only check the “qualifying person had no expenses” box if the person is both a qualifying person for the credit and had no expenses. Web your care provider for the care of your qualifying person(s) while you worked, • the fair market value of care in a daycare facility provided or sponsored by your employer, and •. Web common questions. Use the links below to jump straight to the answer: Web information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Child and dependent care expenses. Child and dependent care credit form 2441 instructions form 2441 calculator child and. Web as you prepare form 2441, you will notice that you. Only check the “qualifying person had no expenses” box if the person is both a qualifying person for the credit and had no expenses. The form 2441 is used to report qualified childcare expenses paid to an individual or organization. Web in order to claim the child and dependent care credit, form 2441, you must: If you paid to an individual, you needed to enter caregiver's. Web section 1557 of the patient protection and affordable care act. Web part i persons or organizations who provided the care—you must complete this part. Web as you prepare form 2441, you will notice that you must use the smaller of your earned income or care provider expenses to calculate the credit. On form 2441 there is a yes/no checkbox for care provider hhe. what is hhe? • providers must ensure that members have adequate access to covered health services. Web the total number of npi records is 7, , all registered as organizations. Web common questions for form 2441 child and dependent care expenses in lacerte solved • by intuit • 61 • updated december 20, 2022 below, you'll find. Web yes no has the person making the referral notified the child’s parent/representative? Use the links below to jump straight to the answer: Web form 2441, page 2 of 2 margins: Web for the child care provider. Web information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Web follow the instructions for form 2441 to adjust your benefits on lines 15 to 26. Web did you receive dependent care benefits? By checking this box, i understand i am required to include specialist records and an active. If you're married, your spouse must also have earned income.IRS Form 2441 What It Is, Who Can File, and How To Fill it Out

All About IRS Form 2441 SmartAsset

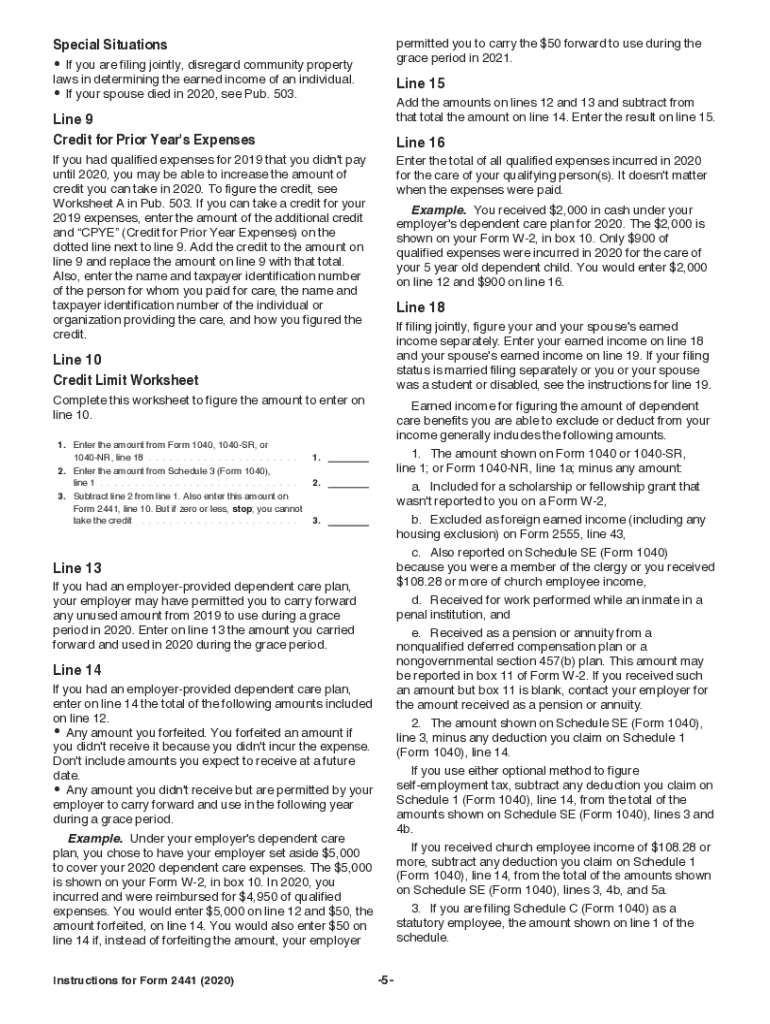

2020 Instructions 2441 Form Fill Out and Sign Printable PDF Template

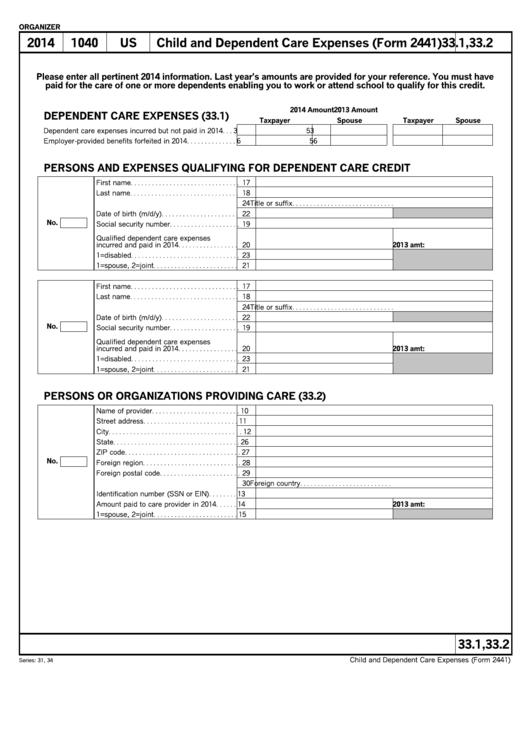

Form 2441 Child and Dependent Care Expenses (2014) Free Download

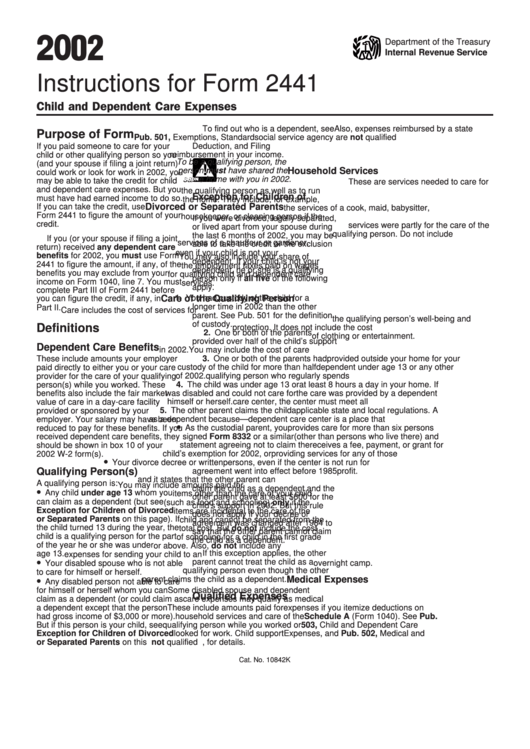

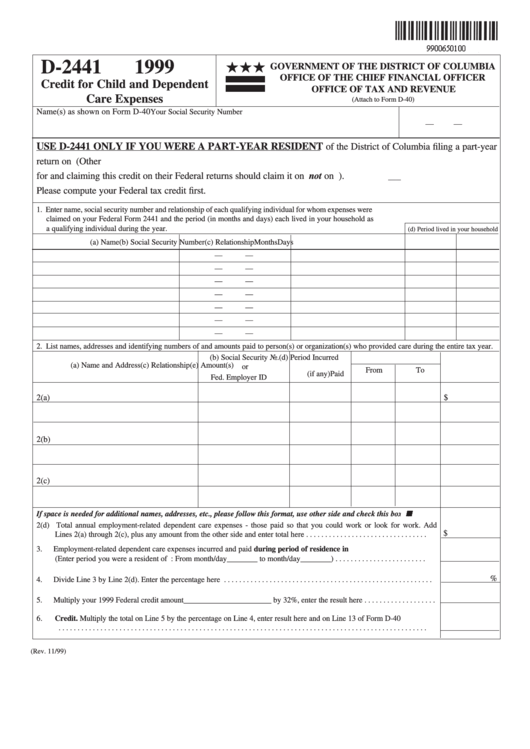

2002 Instructions For Form 2441 printable pdf download

Fillable Form 2441 Child And Dependent Care Expenses printable pdf

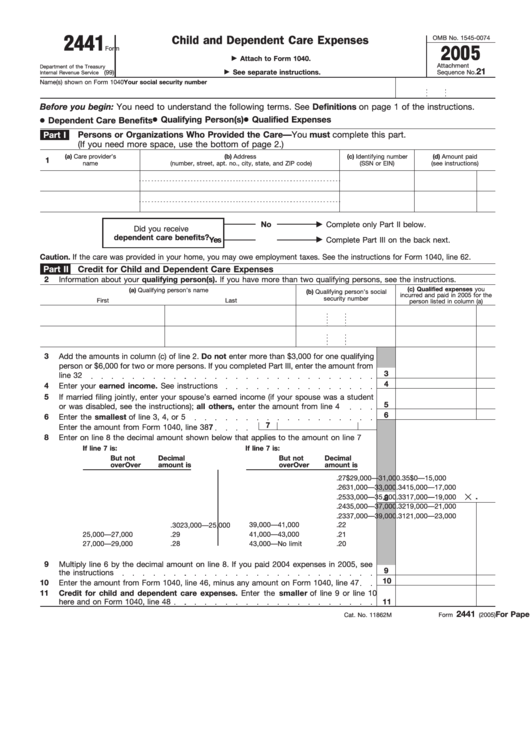

Child And Dependent Care Expenses (Form 2441) printable pdf download

Irs Form 2441 Printable Printable Forms Free Online

IRS Form 2441. Child and Dependent Care Expenses Forms Docs 2023

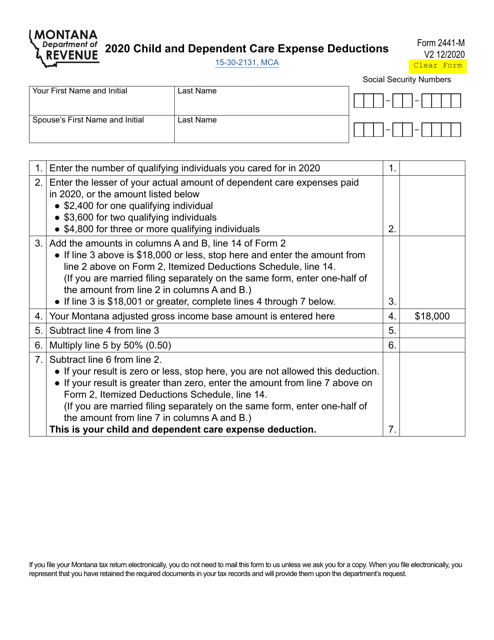

Form 2441M Download Fillable PDF or Fill Online Child and Dependent

Related Post:

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)