Form 2210 Worksheet

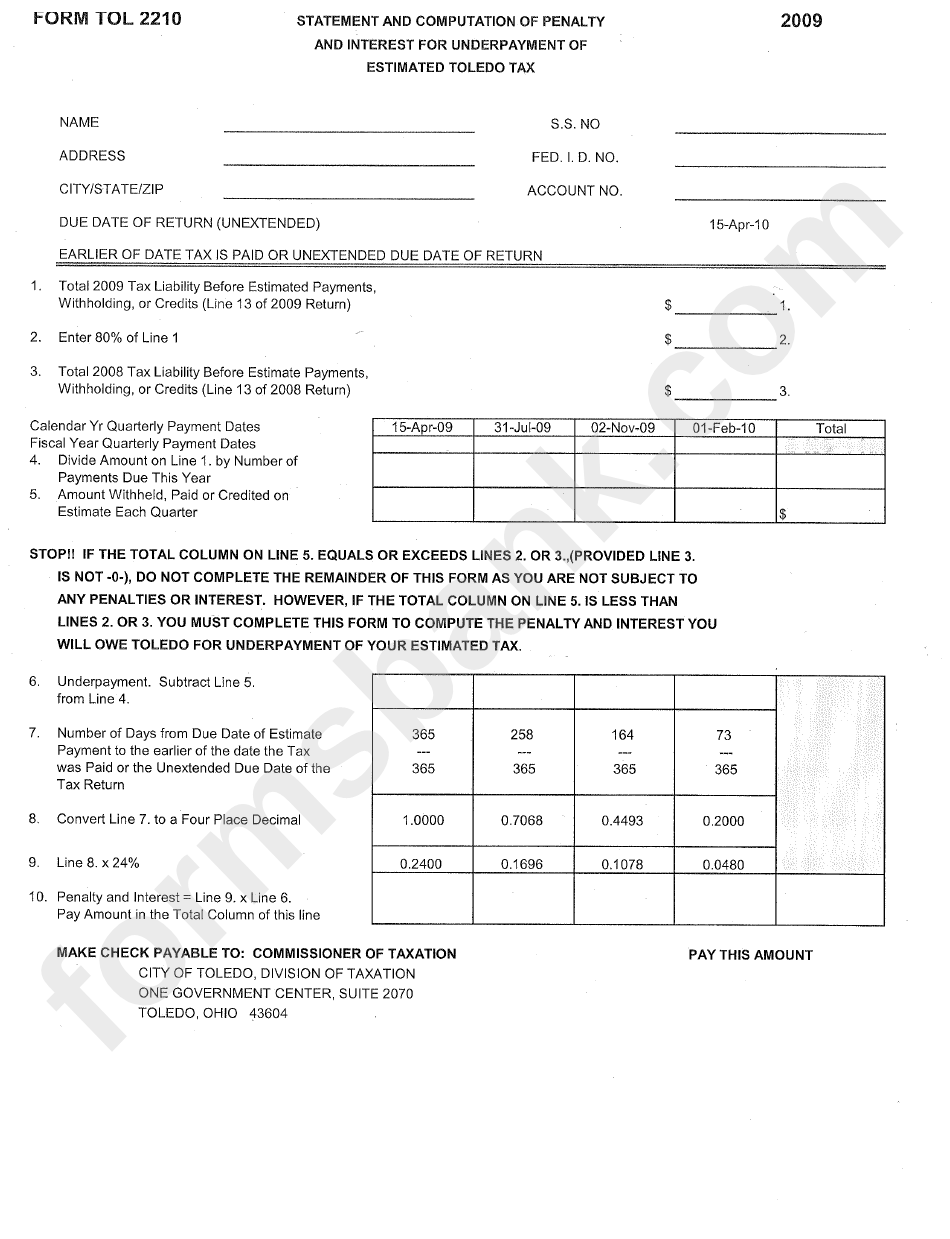

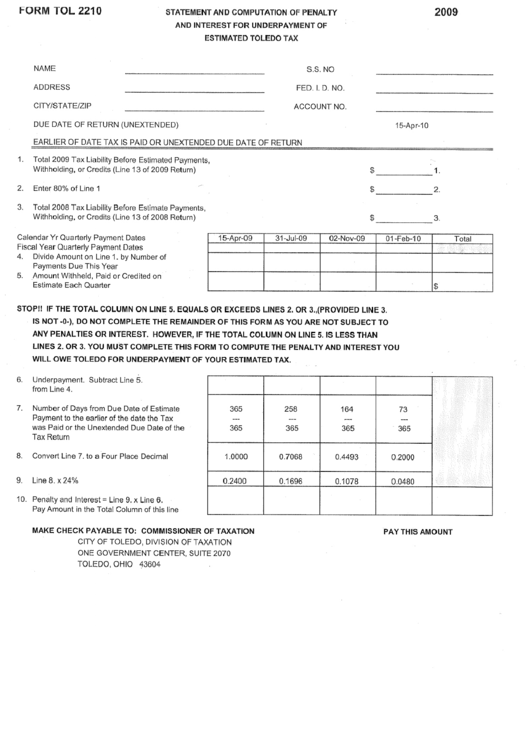

Form 2210 Worksheet - Web worksheet (worksheet for form 2210, part iii, section b—figure the penalty), later. In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. It can be used to determine if there is a penalty and you. Also include this amount on. Web schedule ai, complete part iv, section a, and the penalty worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Web you can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as well as a worksheet from the form 2210 instructions to. Department of the treasury internal revenue service. Web department of the treasury internal revenue service. Enter the penalty on form 2210,. If you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form. Underpayment of estimated tax by individuals, estates, and trusts. Web schedule ai, complete part iv, section a, and the penalty worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Web worksheet for. Underpayment of estimated tax by individuals, estates, and trusts. Department of the treasury internal revenue service. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax. Web section b—figure the penalty (use the worksheet for form 2210, part iii, section b—figure the penalty in the instructions.) 19 the penalty. Enter the penalty. Web form 2210 is not generated unless there is an underpayment and the form is required. It can be used to determine if there is a penalty and you. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax. Web form 2210 can be used as a worksheet and doesn't need to. Web follow these steps to view how the underpayment of estimated tax is calculated: Underpayment of estimated tax by individuals, estates, and trusts. Enter the penalty on form 2210,. Web form 2210 is not generated unless there is an underpayment and the form is required. Underpayment of estimated tax by individuals, estates, and trusts. Go to the check return tab.; Select 2210 from the list (if it's not. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax. In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by. Form 2210 is used by individuals (as well as estates. Web if your income is subject to fluctuation, part iv and section b of form 2210 provides a worksheet to compute the variances in your taxable income. Ad signnow.com has been visited by 100k+ users in the past month Web schedule ai, complete part iv, section a, and the penalty worksheet (worksheet for form 2210, part iv, section b—figure the. Ad signnow.com has been visited by 100k+ users in the past month Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. For the latest information about developments related to form 2210 and its instructions, such as legislation enacted. Form 2210 is used by individuals (as well as estates. It can be used to determine if there is a penalty and you. Underpayment of estimated tax by individuals, estates, and trusts. Web section b—figure the penalty (use the worksheet for form 2210, part iii, section b—figure the penalty in the instructions.) 19 the penalty. Web we last updated the. Ad signnow.com has been visited by 100k+ users in the past month Web if your income is subject to fluctuation, part iv and section b of form 2210 provides a worksheet to compute the variances in your taxable income. Go to the check return tab.; Department of the treasury internal revenue service. Underpayment of estimated tax by individuals, estates, and. Go to the check return tab.; Web schedule ai, complete part iv, section a, and the penalty worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Underpayment of estimated tax by individuals, estates, and trusts. This default setting can be changed for a single return on screen 1 under 2210 options, and. Web form 2210 is not. For the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were. Department of the treasury internal revenue service. Department of the treasury internal revenue service. Web department of the treasury internal revenue service. It can be used to determine if there is a penalty and you. Select 2210 from the list (if it's not. Web worksheet (worksheet for form 2210, part iii, section b—figure the penalty), later. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax. Select forms from the left menu.; Go to the check return tab.; Also include this amount on. Web if your income is subject to fluctuation, part iv and section b of form 2210 provides a worksheet to compute the variances in your taxable income. Web section b—figure the penalty (use the worksheet for form 2210, part iii, section b—figure the penalty in the instructions.) 19 the penalty. Underpayment of estimated tax by individuals, estates, and trusts. Enter the penalty on form 2210,. Web you can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as well as a worksheet from the form 2210 instructions to. Web when an underpayment penalty applies, but form 2210 isn't required, lacerte will generate the 2210 worksheets to figure the penalty amount so that you can. Worksheet for form 2210, part iii, section b—figure the penalty (penalty worksheet) see more Web form 2210 is not generated unless there is an underpayment and the form is required. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year.Form Tol 2210 Statement And Computation Of Penalty And Interest

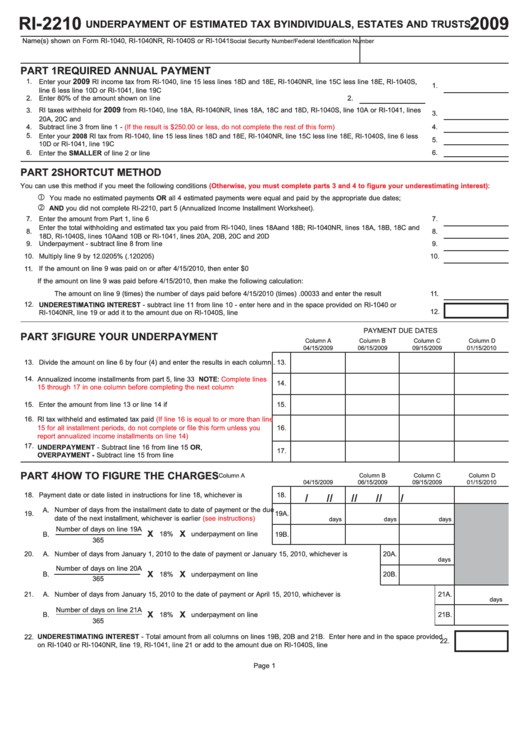

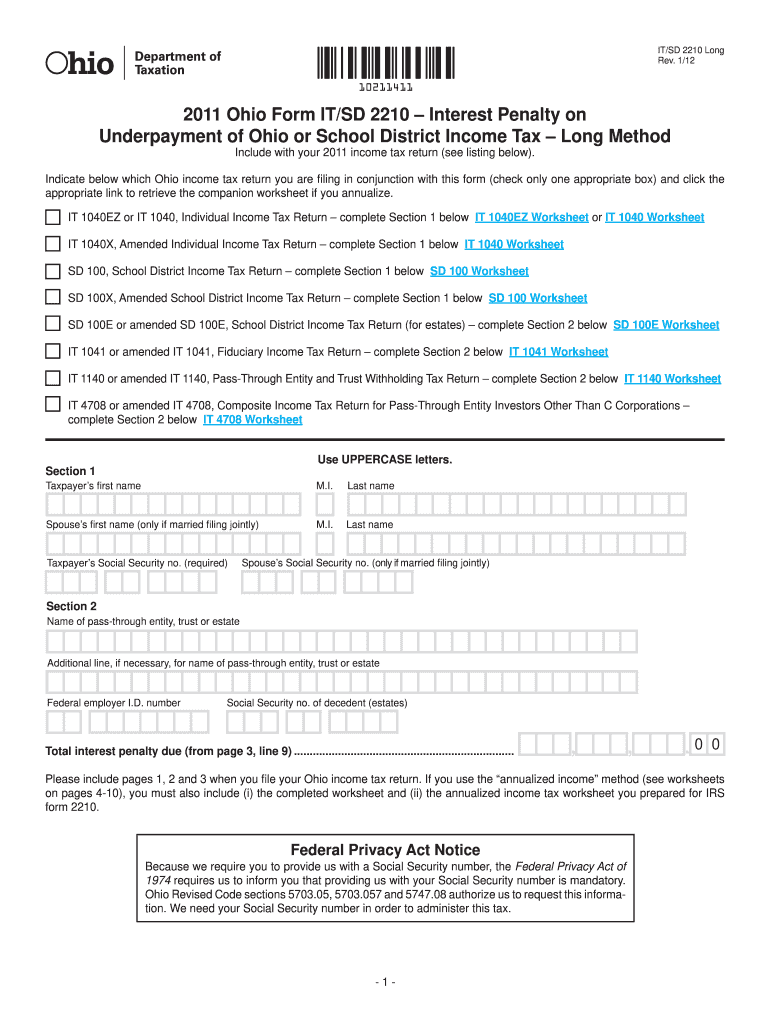

Form Ri2210 Underpayment Of Estimated Tax By Individuals, Estates

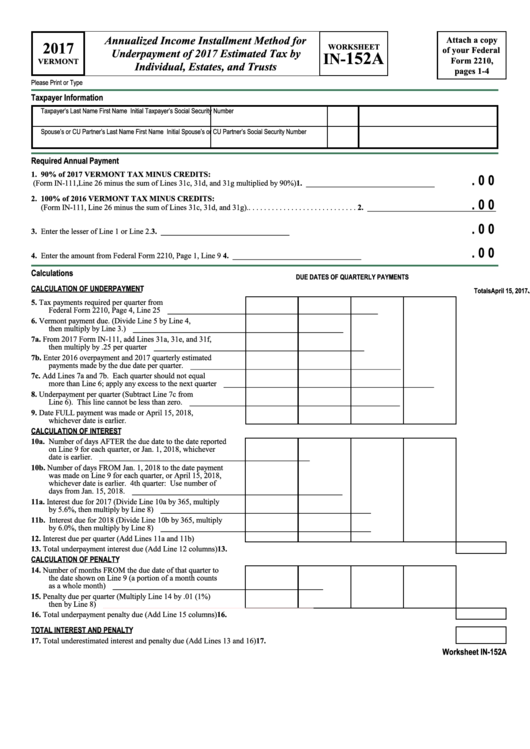

Form 2210 Worksheet In152a Annualized Installment Method

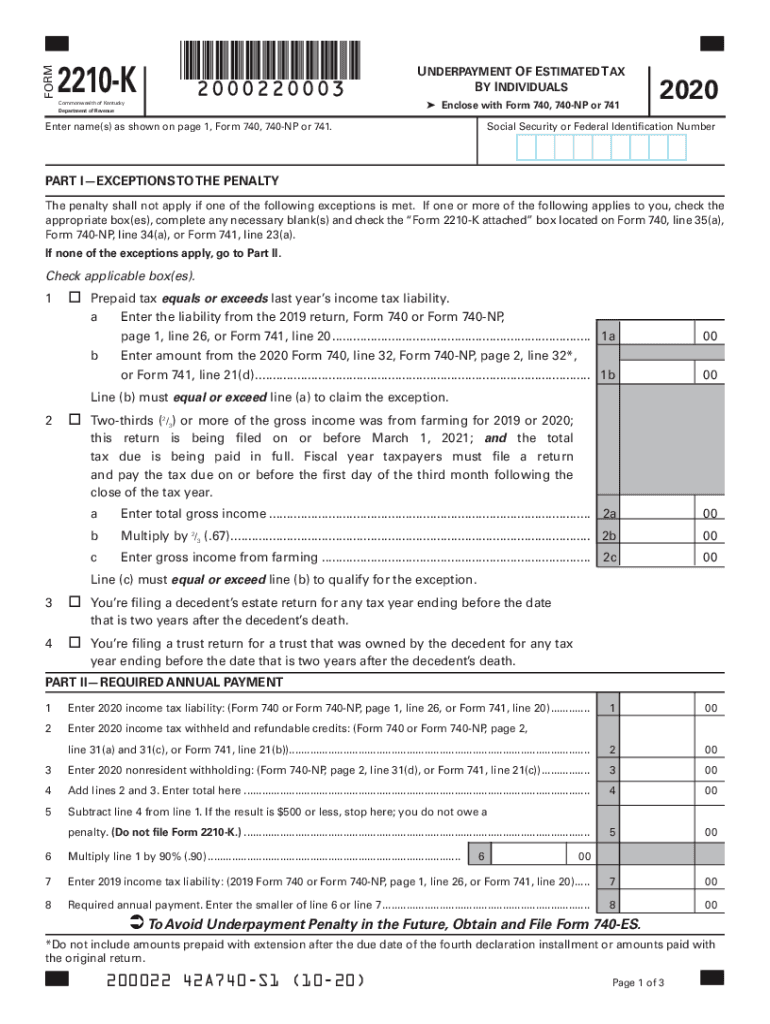

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

IRS Form 2210 A Guide to Underpayment of Tax

Form 2210 K Fill Out and Sign Printable PDF Template signNow

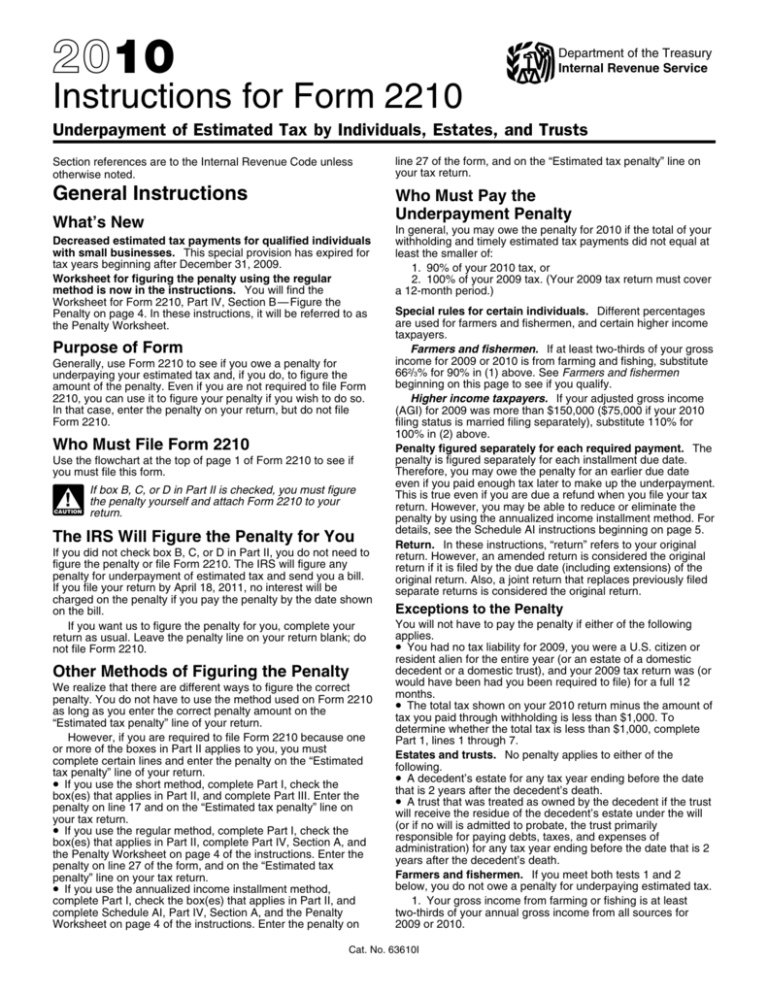

Instructions for Form 2210

Form Tol 2210 Statement And Computation Of Penalty And Interest

2210 Form Fill Out and Sign Printable PDF Template signNow

Form 2210 Fill Online, Printable, Fillable, Blank pdfFiller

Related Post: