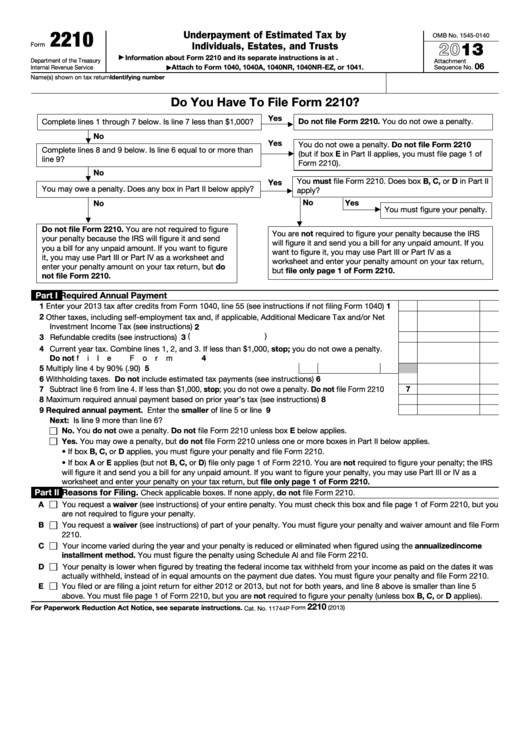

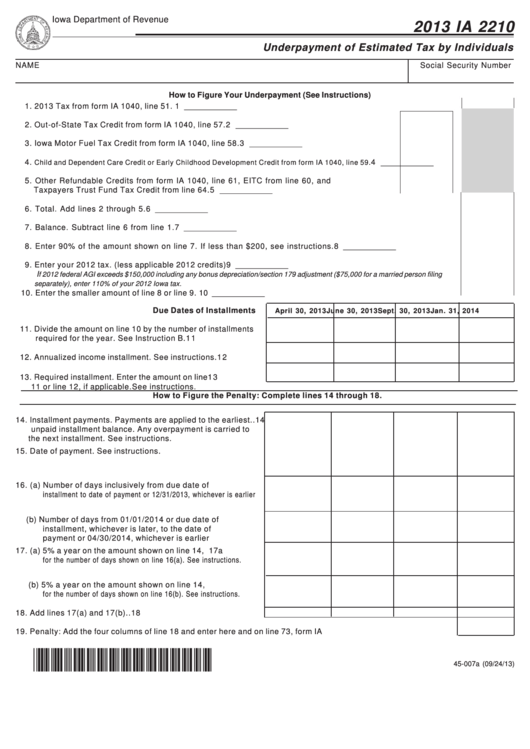

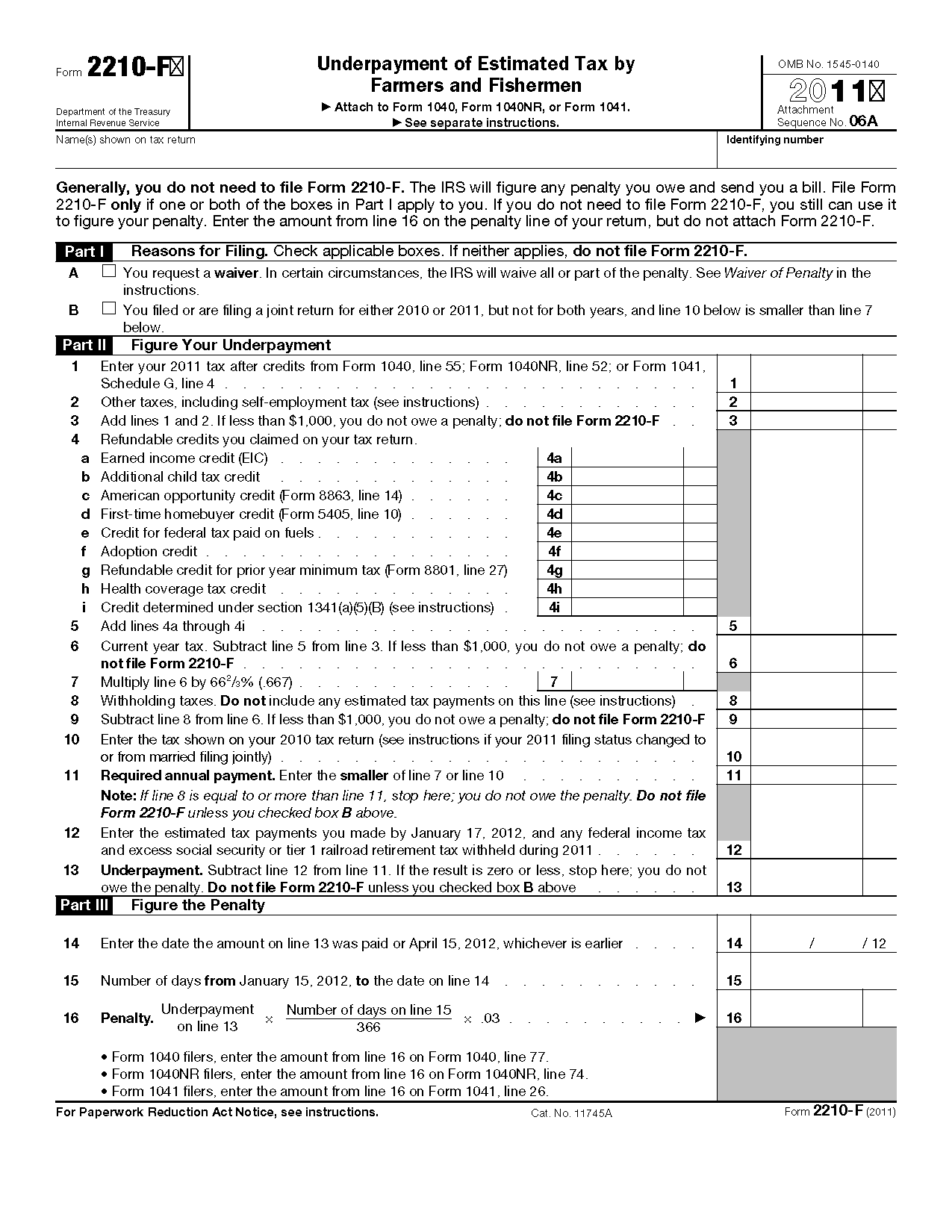

Form 2210 Underpayment Of Estimated Tax

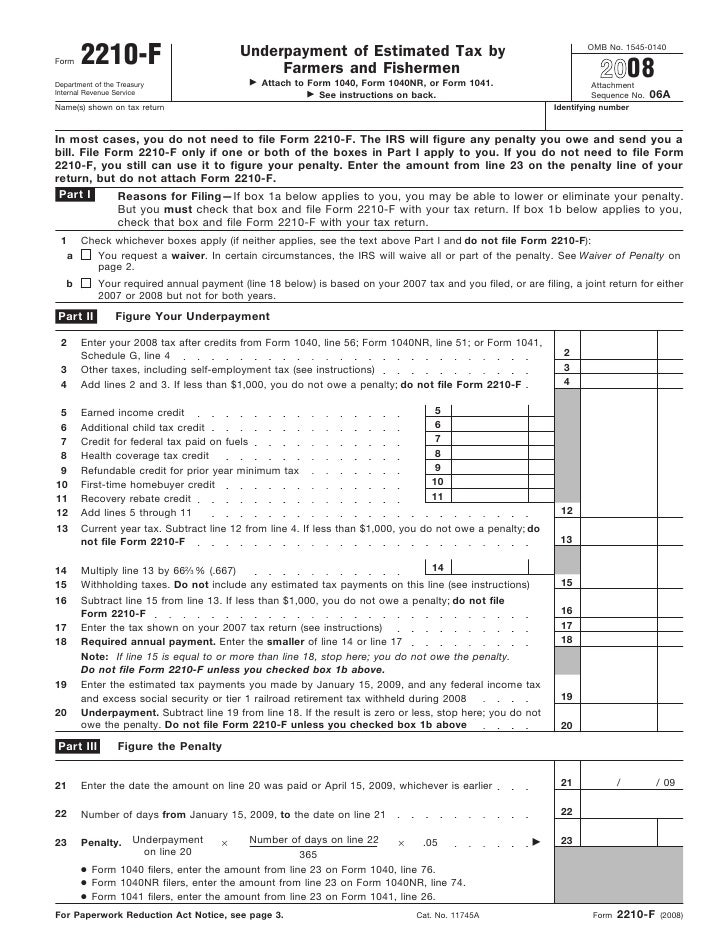

Form 2210 Underpayment Of Estimated Tax - Solved • by turbotax • 2479 • updated january 13, 2023 irs form 2210 (underpayment of estimated tax by individuals, estates,. Web if you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form 2210. Fill out the underpayment of estimated tax by individuals, estates, and trusts online and. Web if you failed to pay or underpaid your previous year's estimated income tax, use form 2210 to calculate, file, and pay any penalties or fees due with your late payment. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. The irs will generally figure your penalty for you and you should not file form 2210. Federal — underpayment of estimated tax by individuals, estates, and trusts. Web tax return and elected to apply it as a credit to its 2023 estimated tax, the payment will be credited as of april 15, 2023, which is the 2022 return due date and about one month. Web follow these steps to view how the underpayment of estimated tax is calculated:go to the check return tab.select forms from the left menu.select 2210 from the l. Enter the 2021 adjusted gross income. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. Web if you failed to pay or underpaid your previous year's estimated income tax, use form 2210 to calculate, file, and pay any. Fill out the underpayment of estimated tax by individuals, estates, and trusts online and. You aren’t required to figure your penalty because the irs will figure it and send you a bill for any unpaid amount. Web if you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out. This is done either through withholdings from your. While everyone living in the. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. The form. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Web but if you want to determine beforehand the penalty amount, you may use form 2210 (underpayment of estimated tax by individuals, estates, and trusts) as a. Web form 2210 underpayment of estimated. The irs requires that you pay the taxes you owe throughout the year. Solved • by turbotax • 2479 • updated january 13, 2023 irs form 2210 (underpayment of estimated tax by individuals, estates,. Enter the 2021 adjusted gross income. Web locate the underpayment penalty (2210) section. Web use form 2210 to determine the amount of underpaid estimated tax and. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. If you want to figure it, you may. The irs will generally figure your penalty for you and you should not file form 2210. Federal — underpayment of estimated. Underpayment of estimated tax by individuals, estates and trusts. Fill out the underpayment of estimated tax by individuals, estates, and trusts online and. Web form 2210 department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts go to www.irs.gov/form2210 for. Web if you’re filing an income tax return and haven’t paid enough in income. You aren’t required to figure your penalty because the irs will figure it and send you a bill for any unpaid amount. Your income varies during the year. This is done either through withholdings from your. Section references are to the internal revenue code unless otherwise noted. The irs will generally figure your penalty for you and you should not. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web follow these steps to view how the underpayment of estimated tax is calculated:go to the check return tab.select forms from the left menu.select 2210 from the l. Web use form 2210, underpayment of estimated tax by individuals, estates, and trusts to. Web use form 2210, underpayment of estimated tax by individuals, estates, and trusts to see if you owe a penalty for underpaying your estimated tax. Fill out the underpayment of estimated tax by individuals, estates, and trusts online and. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. You aren’t required to figure your penalty because the irs will figure it and send you a bill for any unpaid amount. Web but if you want to determine beforehand the penalty amount, you may use form 2210 (underpayment of estimated tax by individuals, estates, and trusts) as a. Web page last reviewed or updated: The irs will generally figure your penalty for you and you should not file form 2210. Fill out the underpayment of estimated tax by individuals, estates, and trusts online and. Web use form 2210, underpayment of estimated tax by individuals, estates, and trusts to see if you owe a penalty for underpaying your estimated tax. Solved • by turbotax • 2479 • updated january 13, 2023 irs form 2210 (underpayment of estimated tax by individuals, estates,. This is done either through withholdings from your. Enter on line 46 the amount of interest. It appears you don't have a pdf plugin for. Web locate the underpayment penalty (2210) section. The form doesn't always have to be. If you want to figure it, you may. While everyone living in the. Web if you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form 2210. Enter the 2021 adjusted gross income. Section references are to the internal revenue code unless otherwise noted. The irs requires that you pay the taxes you owe throughout the year. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty.Form 2210F Underpayment of Estimated Tax by Farmers and Fishermen

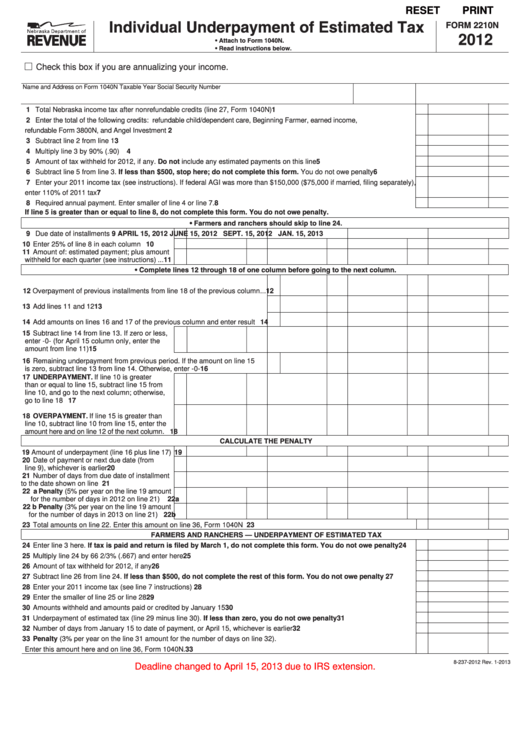

Fillable Form 2210n Individual Underpayment Of Estimated Tax 2012

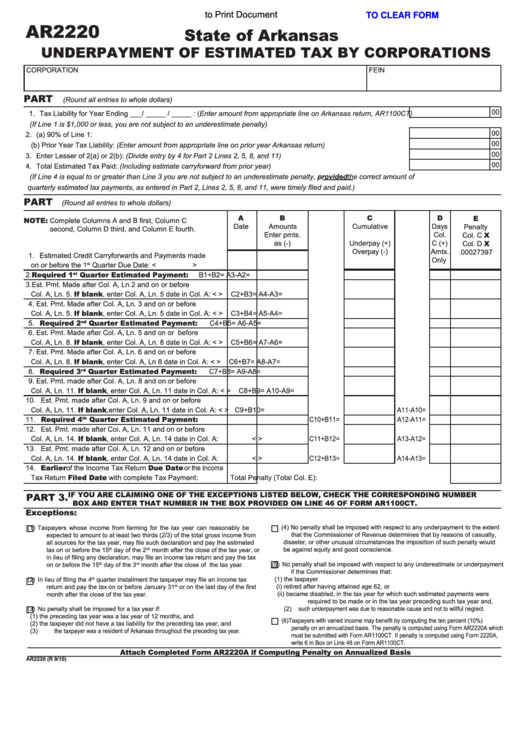

Form Ar2220 Underpayment Of Estimated Tax By Corporations 2010

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

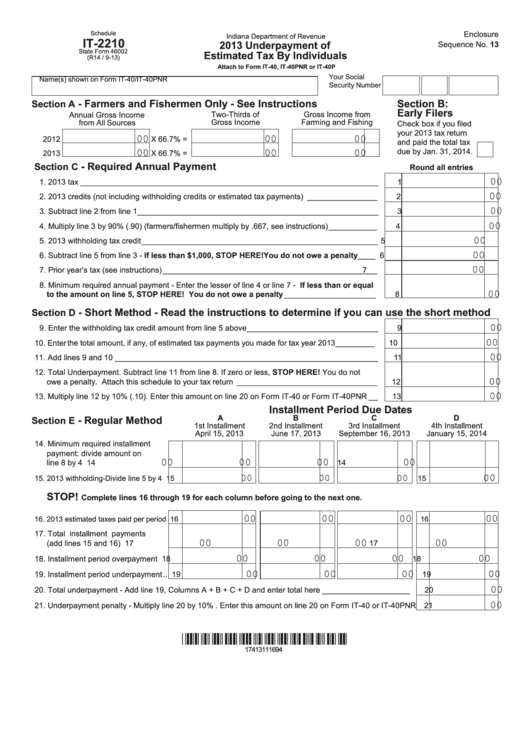

Fillable State Form 46002 Schedule It2210 Underpayment Of

Form 2210FUnderpayment of Estimated Tax Farmers and Fishermen

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

Fillable Form Ia 2210 Underpayment Of Estimated Tax By Individuals

Form 2210 F Underpayment Of Estimated Tax By Farmers And 1040 Form

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Related Post: