Purdue Tax Exempt Form

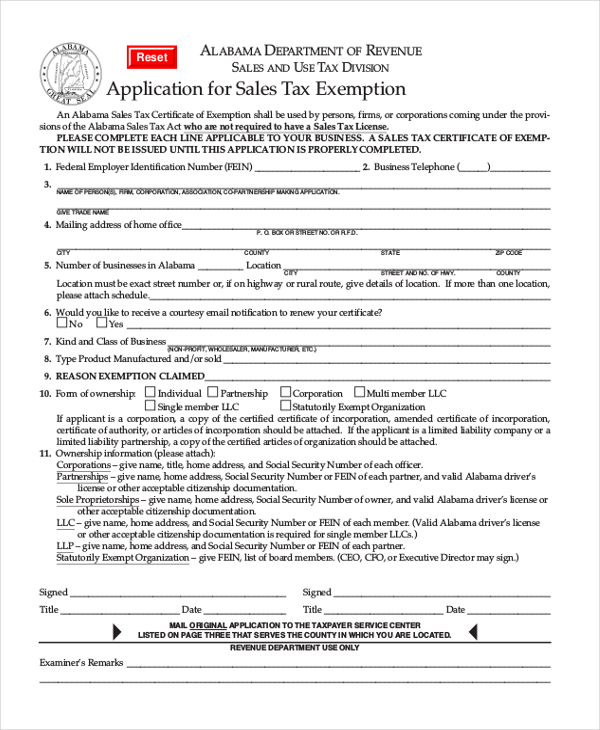

Purdue Tax Exempt Form - Web if you are a u.s. Web tax services and forms. Indiana sales and use tax. • a nonresident alien is. The indiana department of revenue partners with indiana university and purdue university to give tax practitioners updates. Web united states tax exemption form. Web tax exemption forms wire transfer info form (new) wire transfer info form (qrg) Ad collect and report on exemption certificates quickly to save your company time and money. United states tax exemption form; Web in many states, nonprofit organizations are exempt from paying sales tax. Exemption from facta reporting code (if any) applies to accounts. Please see jennifer see your departmental secretary to assist you. Indiana sales and use tax. Web the irs requires purdue, as an employer, to report whether an employee and dependents (if applicable) had health coverage in 2018. Companies obtaining personal services from purdue request this form to. Web exempt payee code (if any) yes no exemptions (apply only to certain entities, not individuals): Orders $1,000 or greater 765‐494‐5378; Web if you are a u.s. Web tax exemption forms wire transfer info form (new) wire transfer info form (qrg) The purdue university payroll department will notify international students of the procedures to follow to obtain this exemption. Orders $1,000 or greater 765‐494‐5378; This form replaces earlier forms: The purdue university payroll department will notify international students of the procedures to follow to obtain this exemption. Streamline the entire lifecycle of exemption certificate management. This qrc outlines when the university is charged or pays sales tax and when it is exempt. Web for orders under $1,000 please ([email protected]; This qrc outlines when the university is charged or pays sales tax and when it is exempt. The purdue university payroll department will notify international students of the procedures to follow to obtain this exemption. Ad collect and report on exemption certificates quickly to save your company time and money. By mail or. Ad collect and report on exemption certificates quickly to save your company time and money. Web the irs requires purdue, as an employer, to report whether an employee and dependents (if applicable) had health coverage in 2018. In arizona, what is often thought of as a sales tax is, technically, a transaction privilege and use tax and. Streamline the entire. Web in many states, nonprofit organizations are exempt from paying sales tax. Web for orders under $1,000 please ([email protected]; Companies obtaining personal services from purdue request this form to. • a nonresident alien is. Web if you **were not** paid by purdue university during calendar year 2022 and don’t already have a glacier account, but you need to file a. Audits are required to be submitted by. State utilities receipts tax (urt) taxes on telephone bills. Tax services for business @ purdue. Orders $1,000 or greater 765‐494‐5378; Web tax services and forms. Web exempt payee code (if any) yes no exemptions (apply only to certain entities, not individuals): Resident alien who is relying on an exception contained in the saving clause of a tax treaty to claim an exemption from u.s. Web dod preferred hotels are required to provide the required tax exempt forms in states where the federal government is tax. Web for orders under $1,000 please ([email protected]; Web if you **were not** paid by purdue university during calendar year 2022 and don’t already have a glacier account, but you need to file a tax return and/or complete the form. Audits are required to be submitted by. Companies obtaining personal services from purdue request this form to. United states tax exemption. Web united states tax exemption form. Streamline the entire lifecycle of exemption certificate management. Orders $1,000 or greater 765‐494‐5378; In arizona, what is often thought of as a sales tax is, technically, a transaction privilege and use tax and. Indiana sales and use tax. Exemption from facta reporting code (if any) applies to accounts. This exemption does not affect the. Audits are required to be submitted by. United states tax exemption form; Web for orders under $1,000 please ([email protected]; Streamline the entire lifecycle of exemption certificate management. Companies obtaining personal services from purdue request this form to. The purdue university payroll department will notify international students of the procedures to follow to obtain this exemption. Tax services for business @ purdue. In arizona, what is often thought of as a sales tax is, technically, a transaction privilege and use tax and. Web only one form of exemption can be claimed on a certifi cate. Please see jennifer see your departmental secretary to assist you. Resident alien who is relying on an exception contained in the saving clause of a tax treaty to claim an exemption from u.s. Web tax exemption forms wire transfer info form (new) wire transfer info form (qrg) Web tax services and forms. Web if you **were not** paid by purdue university during calendar year 2022 and don’t already have a glacier account, but you need to file a tax return and/or complete the form. Web united states tax exemption form. Ad collect and report on exemption certificates quickly to save your company time and money. Web in many states, nonprofit organizations are exempt from paying sales tax. Web if you are a u.s.FREE 8+ Sample Tax Exemption Forms in PDF MS Word

Bupa Tax Exemption Form / We do not accept sales tax permits, articles

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

Tax Exempt Form 2350 Fillable Fill Out and Sign Printable PDF

Ohio Resale Certificate Master of Documents

Fillable Tax Exemption Form Printable Forms Free Online

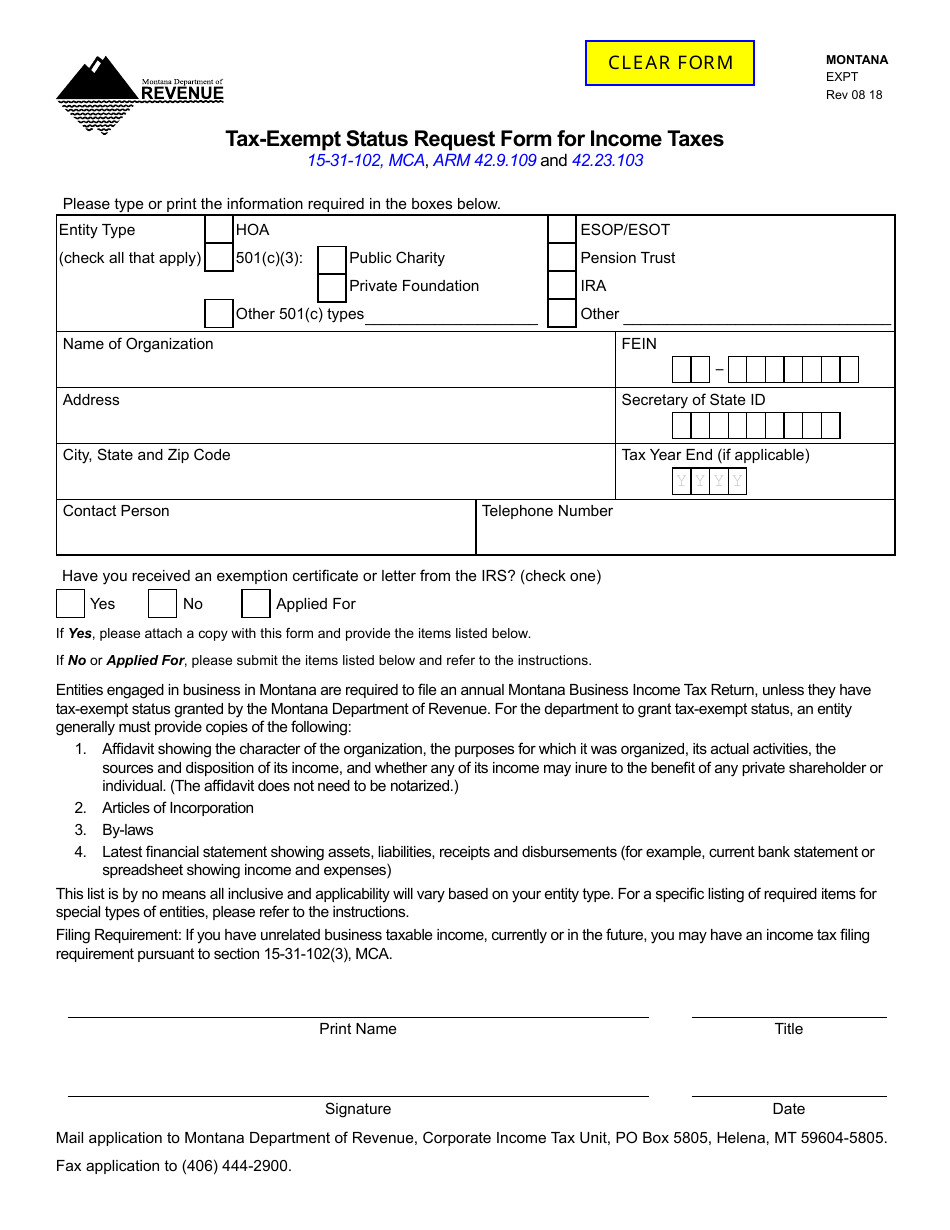

Form EXPT Download Fillable PDF or Fill Online TaxExempt Status

AZ ADEQ Out of State Exemption Form 2013 Fill and Sign Printable

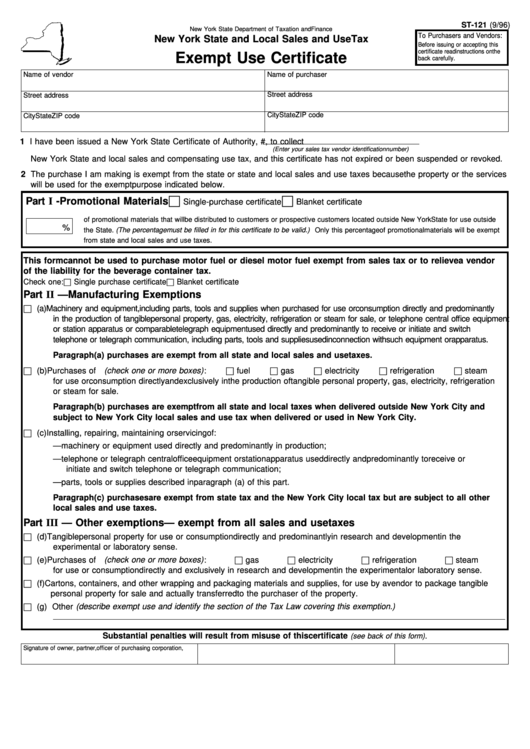

Fillable Form St121 Exempt Use Certificate printable pdf download

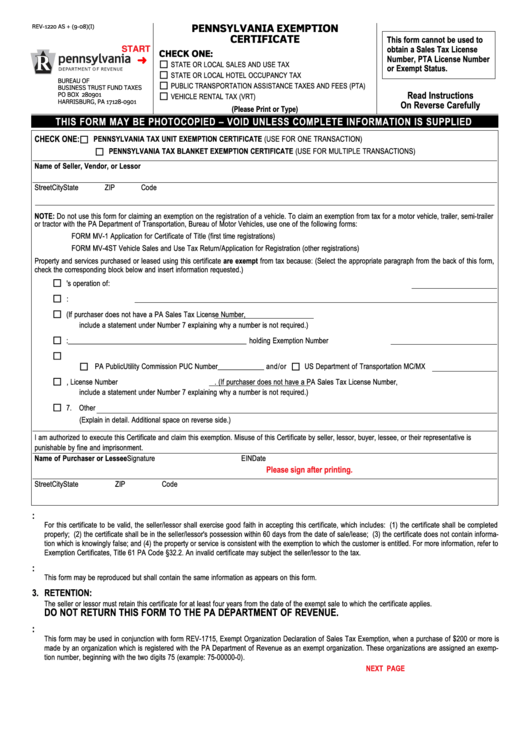

Fillable Form Rev1220 Pennsylvania Exemption Certificate printable

Related Post: