Form 1120-X Instructions

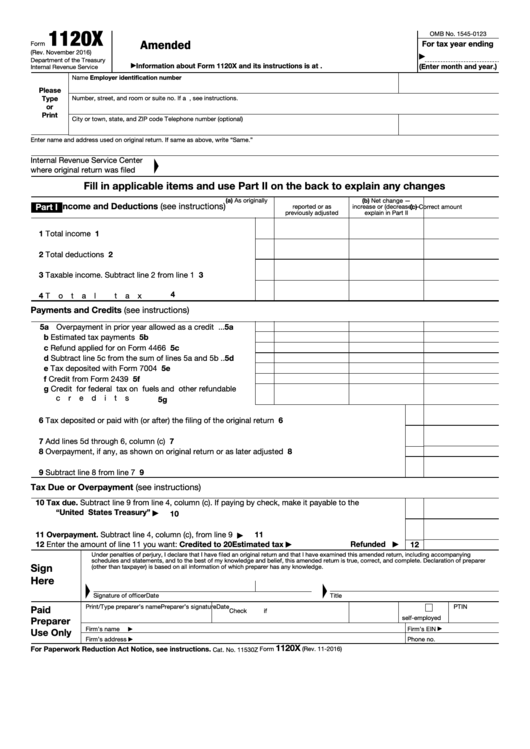

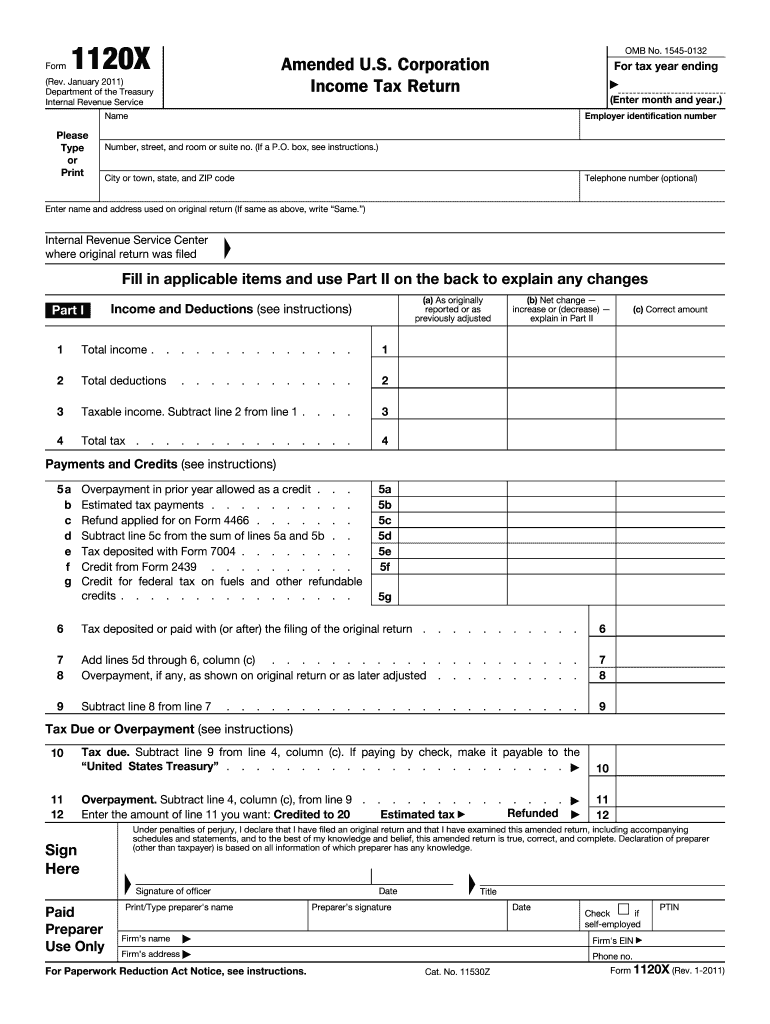

Form 1120-X Instructions - Income tax return for an s corporation, including recent updates, related forms, and instructions on how. We are providing tax year 2023 extensible markup language. Web other items you may find useful. Web a form 1120x based on an nol carryback, a capital loss carryback, or general business credit carryback generally must be filed within 3 years after the due. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Once this step is completed, and the original. Form 1120 is the u.s. Corporation income tax return, to correct a previously filed form 1120. Web facts and filing tips for small businesses. Web lacerte generates form 1120x based on the input on screen 55, amended return. For calendar year 2022 or tax year beginning, 2022, ending. Web 1120x ty2023v4.0 release memo. And the total assets at the end of the tax year are:. Before you start, we recommend creating a copy of the original form 1120 to save the. Solved • by intuit • 12 • updated 1 year ago. Web 1120x ty2023v4.0 release memo. Web lacerte generates form 1120x based on the input on screen 55, amended return. Solved • by intuit • 12 • updated 1 year ago. If the corporation’s principal business, office, or agency is located in: Web 2022 instructions for form 1120 userid: It is best to wait to amend a return until the irs has accepted the original return and you have received your refund, if applicable. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Web generating form 1120x in proconnect tax. To avoid confusion, it is usually best to wait and amend. Form 1120 is the u.s. Once this step is completed, and the original. Web general instructions section references are to the internal revenue code unless otherwise noted. It is an internal revenue service (irs) document that. The form instructions provide an overview of who should file form 1120, including c corporations, certain foreign corporations, and corporations engaged in. Purpose of form use form 1120x to: Income tax return for an s corporation, including recent updates, related forms, and instructions on how. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became. Web. Web general instructions section references are to the internal revenue code unless otherwise noted. Web other items you may find useful. The form instructions provide an overview of who should file form 1120, including c corporations, certain foreign corporations, and corporations engaged in. Income tax return for an s corporation, including recent updates, related forms, and instructions on how. Solved. Corporation income tax return, including recent updates, related forms, and instructions on how to file. We are providing tax year 2023 extensible markup language. Corporation income tax return, to correct a previously filed form 1120. Solved • by intuit • 12 • updated 1 year ago. To avoid confusion, it is usually best to wait and amend a return after. Web mailing addresses for forms 1120. Before you start, we recommend creating a copy of the original form 1120 to save the. Solved • by intuit • 12 • updated 1 year ago. Complete the form by entering the amounts from the original return on screen. Corporation income tax return, to correct a previously filed form 1120. Web general instructions section references are to the internal revenue code unless otherwise noted. Complete the form by entering the amounts from the original return on screen. Department of the treasury internal revenue service. To avoid confusion, it is usually best to wait and amend a return after the irs has accepted the original return and you have received. Web. Web general instructions section references are to the internal revenue code unless otherwise noted. Web 2022 instructions for form 1120 userid: 9 draft ok to print ah xsl/xmlfileid:. And the total assets at the end of the tax year are:. Web other items you may find useful. Complete the form by entering the amounts from the original return on screen. Department of the treasury internal revenue service. Solved • by intuit • 12 • updated 1 year ago. Web other items you may find useful. Web a form 1120x based on an nol carryback, a capital loss carryback, or general business credit carryback generally must be filed within 3 years after the due. It is an internal revenue service (irs) document that. Corporation income tax return, to correct a previously filed form 1120. If the corporation’s principal business, office, or agency is located in: Web facts and filing tips for small businesses. Once this step is completed, and the original. Purpose of form use form 1120x to: The form instructions provide an overview of who should file form 1120, including c corporations, certain foreign corporations, and corporations engaged in. Web general instructions section references are to the internal revenue code unless otherwise noted. We are providing tax year 2023 extensible markup language. Form 1120 is the u.s. For calendar year 2022 or tax year beginning, 2022, ending. Web mailing addresses for forms 1120. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. And the total assets at the end of the tax year are:.F 1120x Instructions

IRS Form 1120 Complete this Form with PDFelement

Fillable Form 1120X Amended U.s. Corporation Tax Return

Form 1120 Instructions Printable PDF Sample

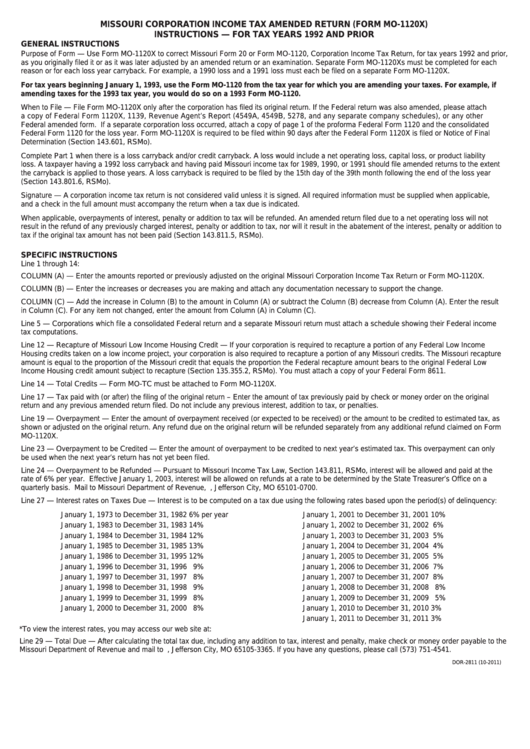

Instructions For Form Mo1120x Missouri Corporation Tax

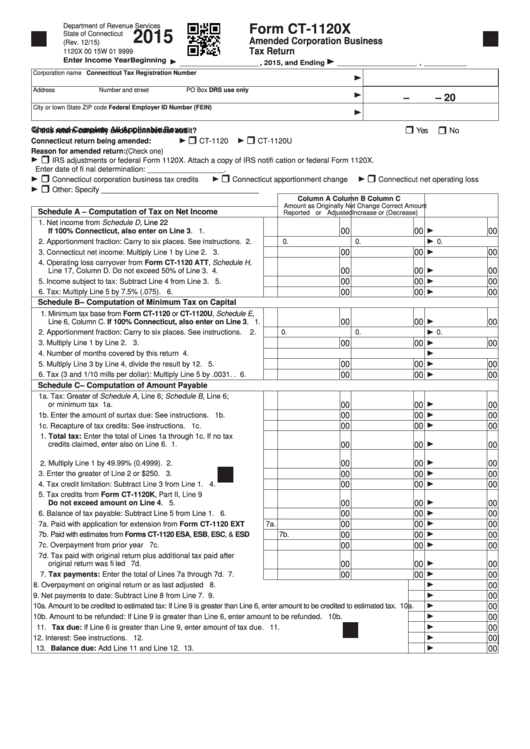

Form Ct1120x Amended Corporation Business Tax Return 2015

Form 1120X Fill Out and Sign Printable PDF Template signNow

F 1120x Instructions

Form 1120X Amended U.S. Corporation Tax Return (2012) Free

What is Form 1120S and How Do I File It? Ask Gusto

Related Post: