Form 1120 W Instructions

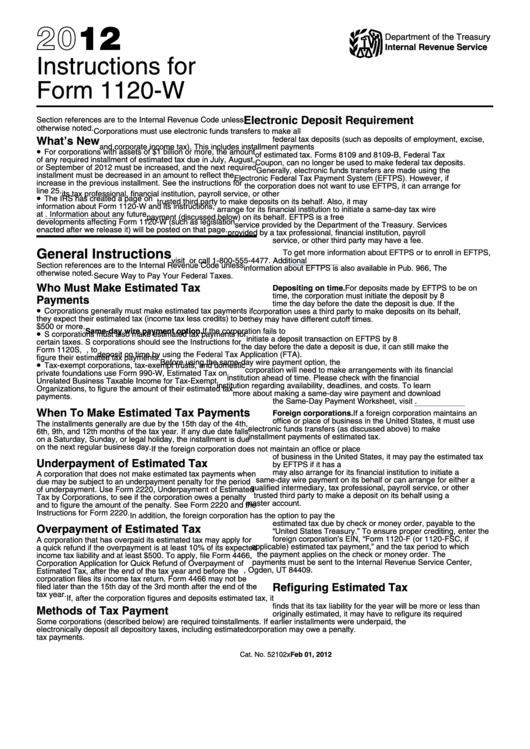

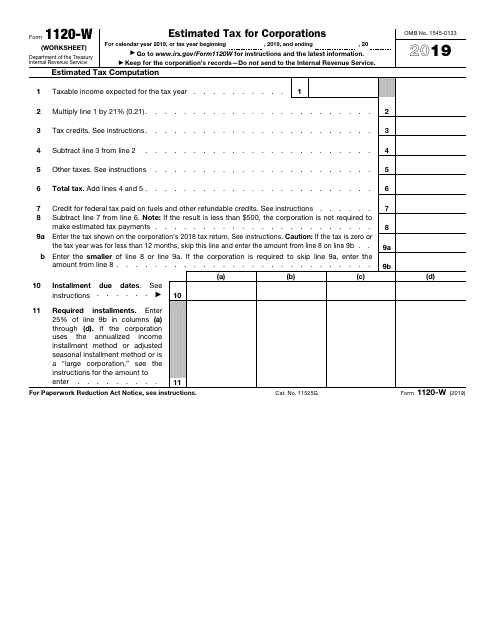

Form 1120 W Instructions - Web federal estimated tax for corporations. It appears you don't have a pdf plugin for this browser. For calendar year 2022 or tax year beginning, 2022, ending. This post includes the critical steps to take to file the. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Find out where to mail your completed. Ad make office life easier with efficient recordkeeping supported by appropriate forms. The no double benefit rules continue to apply. Enjoy great deals and discounts on an array of products from various brands. Web see the march 2022 revision of the instructions for form 941 and the 2022 instructions for form 944 for more information. Ad easy guidance & tools for c corporation tax returns. General instructions who must make estimated tax payments • corporations must generally. Web federal estimated tax for corporations. Use this form to report the. See estimated tax penalty below. (worksheet) department of the treasury internal revenue service. Ad easy guidance & tools for c corporation tax returns. Enjoy great deals and discounts on an array of products from various brands. Web information about form 1120, u.s. This post includes the critical steps to take to file the. Please use the link below to. Penalties may apply if the corporation does not make required estimated tax payment deposits. (worksheet) department of the treasury internal revenue service. The no double benefit rules continue to apply. Web information about form 1120, u.s. Web see the march 2022 revision of the instructions for form 941 and the 2022 instructions for form 944 for more information. Please use the link below to. Penalties may apply if the corporation does not make required estimated tax payment deposits. Ad make office life easier with efficient recordkeeping supported by appropriate forms. Corporation income tax return, to report. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. The no double benefit rules continue to apply. Web federal estimated tax for corporations. For calendar year 2022 or tax year beginning, 2022, ending. Find out where to mail your completed. Web federal estimated tax for corporations. The no double benefit rules continue to apply. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Web see the march 2022 revision of the instructions for form 941 and the 2022 instructions for form 944 for more information. (worksheet) department of the treasury internal revenue. Ad easy guidance & tools for c corporation tax returns. See estimated tax penalty below. For calendar year 2021, or tax year beginning , 2021,. Web for instructions and the latest information. The no double benefit rules continue to apply. Web about publication 542, corporations. Find out where to mail your completed. Page last reviewed or updated: Ad easy guidance & tools for c corporation tax returns. Department of the treasury internal revenue service. Web for instructions and the latest information. Where to file your taxes (for forms 1120) page last reviewed or updated: Web information about form 1120, u.s. Page last reviewed or updated: Ad make office life easier with efficient recordkeeping supported by appropriate forms. General instructions who must make estimated tax payments • corporations must generally. Enjoy great deals and discounts on an array of products from various brands. This post includes the critical steps to take to file the. Please use the link below to. Department of the treasury internal revenue service. For calendar year 2021, or tax year beginning , 2021,. Where to file your taxes (for forms 1120) page last reviewed or updated: For calendar year 2022 or tax year beginning, 2022, ending. Estimated tax for corporations keywords: (worksheet) department of the treasury internal revenue service. Corporation income tax return, including recent updates, related forms and instructions on how to file. It appears you don't have a pdf plugin for this browser. The no double benefit rules continue to apply. Web about publication 542, corporations. Use this form to report the. Ad make office life easier with efficient recordkeeping supported by appropriate forms. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! See estimated tax penalty below. Penalties may apply if the corporation does not make required estimated tax payment deposits. Enjoy great deals and discounts on an array of products from various brands. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. General instructions who must make estimated tax payments • corporations must generally. If you are an s corporation expecting to owe federal tax of. Please use the link below to. Department of the treasury internal revenue service.Instructions For Form 1120W 2012 printable pdf download

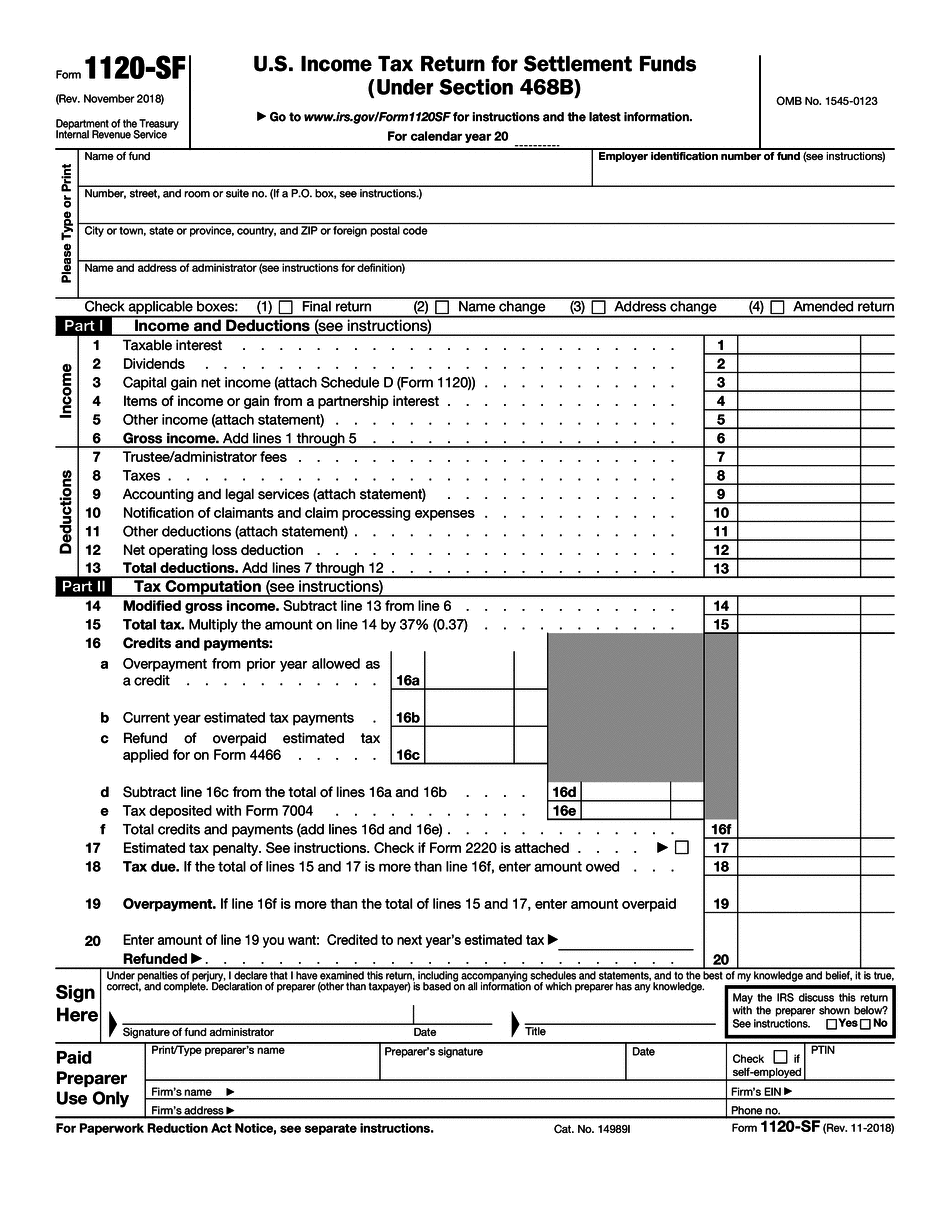

Form 1120 Fill Out and Sign Printable PDF Template signNow

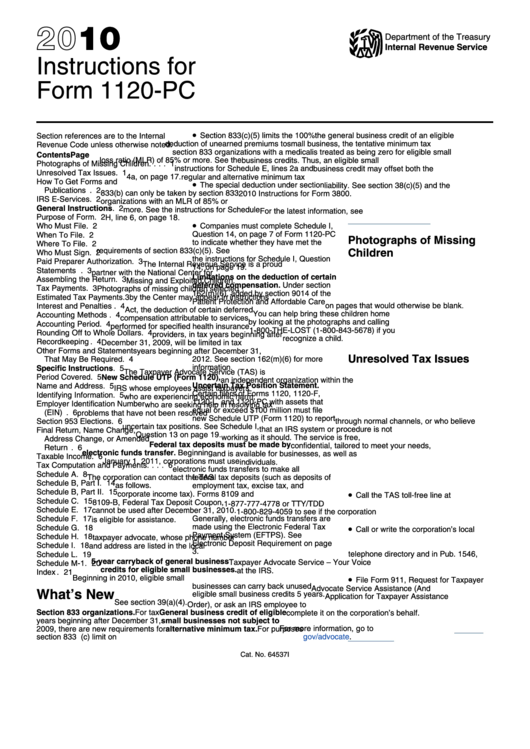

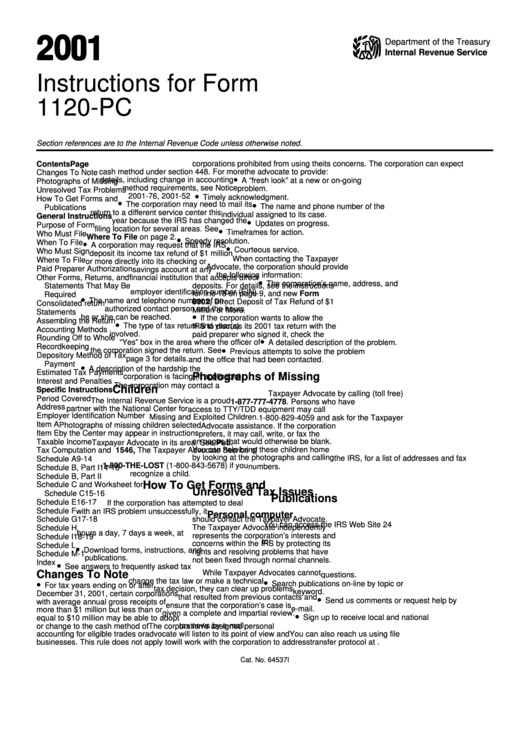

Instructions For Form 1120Pc 2010 printable pdf download

What is Form 1120S and How Do I File It? Ask Gusto

2020 Form IRS Instructions 1120 Fill Online, Printable, Fillable, Blank

Irs Form 1120 Pol Fill Out And Sign Printable Pdf Template 090

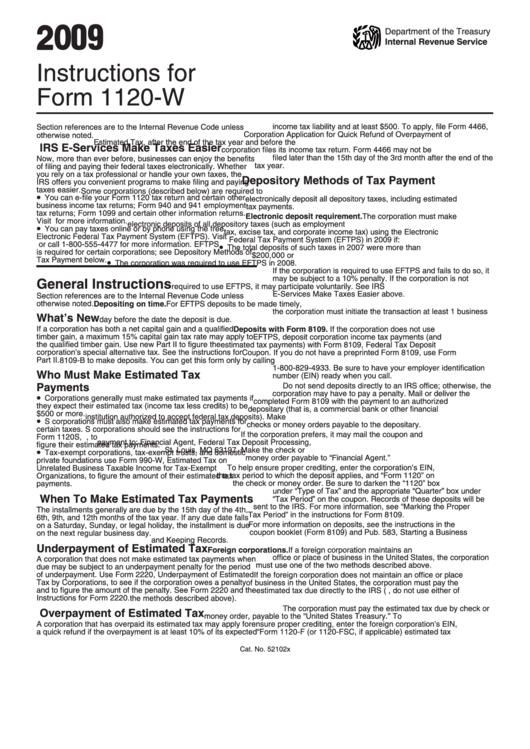

Instructions For Form 1120W 2009 printable pdf download

Form 1120 Filing Instructions

IRS Form 1120W Download Fillable PDF or Fill Online Estimated Tax for

Instructions For Form 1120Pc 2001 printable pdf download

Related Post: