Form 540 Use Tax Must Be Entered

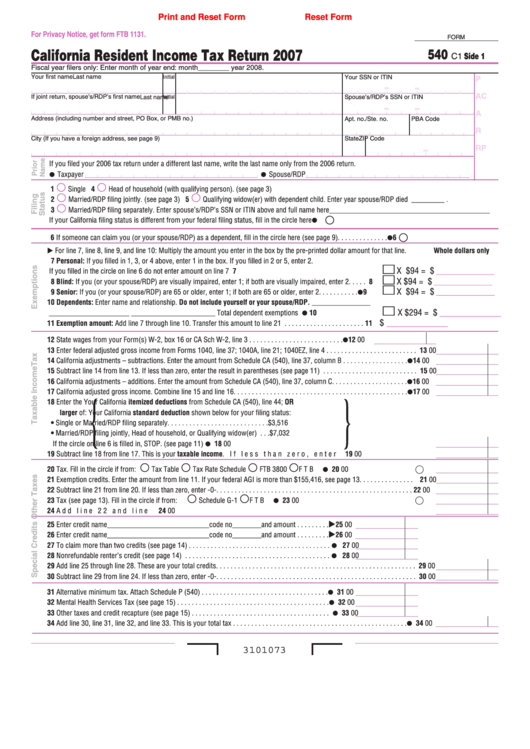

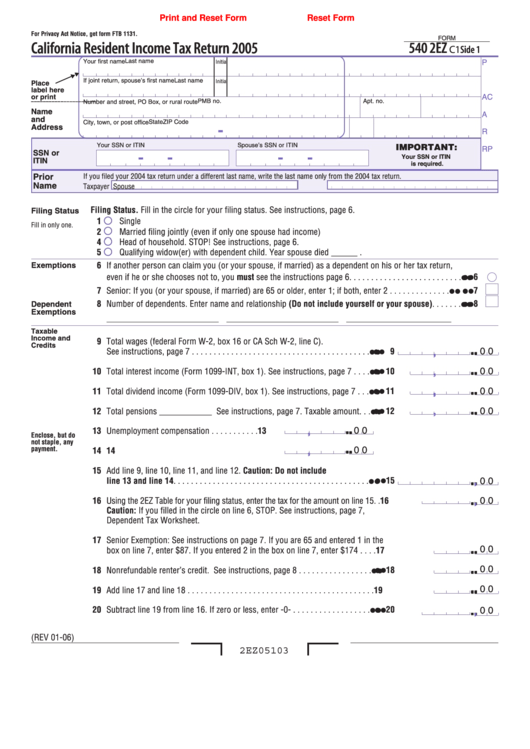

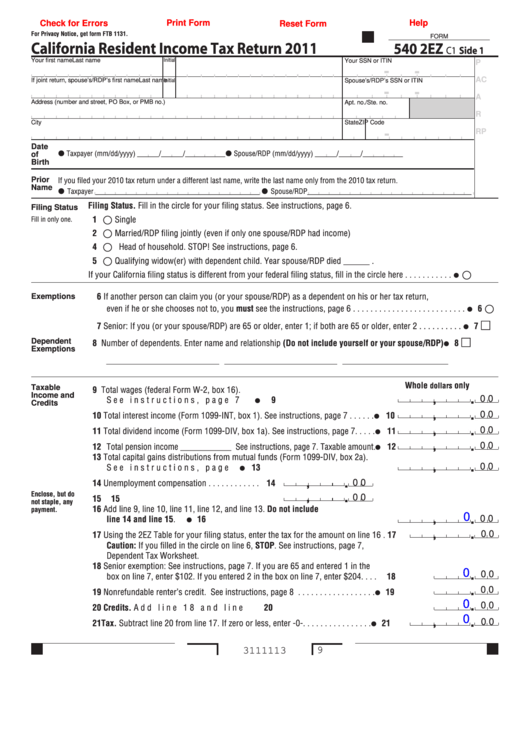

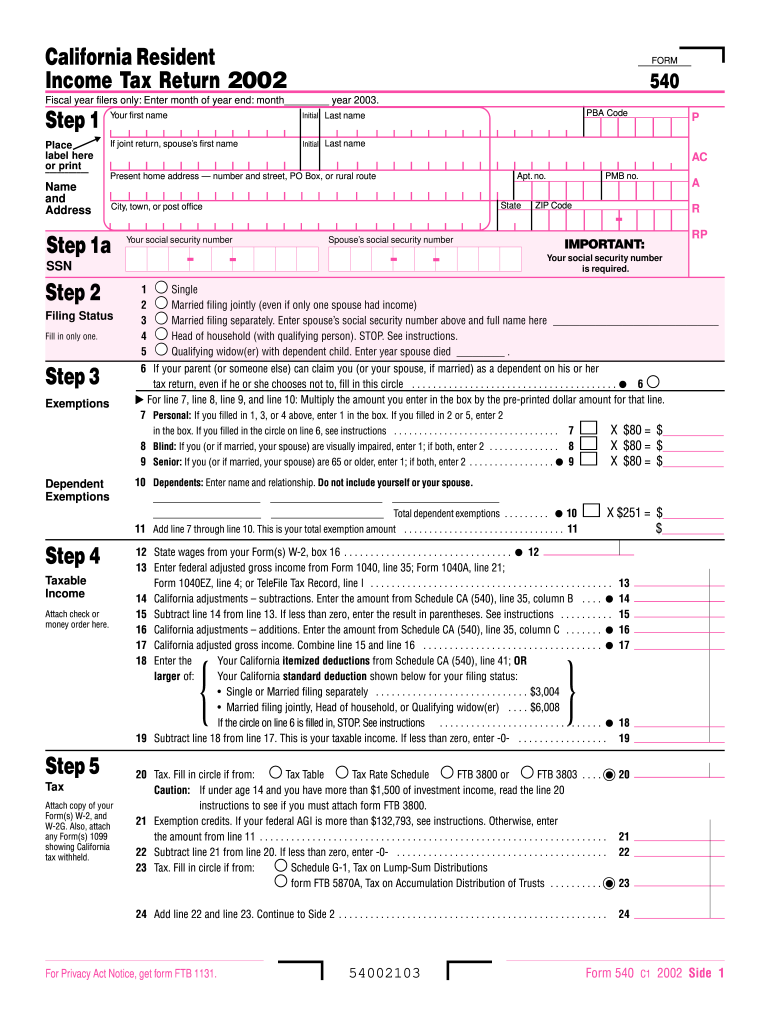

Form 540 Use Tax Must Be Entered - Check here if this is an amended return. You prefer to calculate the amount of use tax due based. Web 16 rows note 1: Enter month of year end: Enter the amount from schedule ca (540), part i, line 23, column b. Do you have a turbotax online account? Use tax needs be listed. Subtract line 14 from line 13. 2020 earned income tax credit table. Web the only thing you need is to follow these easy instructions: • if line 14 is $500. For line 7, line 8, line 9, and. Use tax needs be listed. If there is not, enter 0 (zero) or check can of the line 91 checkboxes to indicate no use tax your owed or an benefit tax Add the amount of tax, if any, from each form ftb 3803, line 9, to. If there is not, enter 0 (zero) or check can of the line 91 checkboxes to indicate no use tax your owed or an benefit tax Web the only thing you need is to follow these easy instructions: Web enter in section a, line 1a through line 7, and section b, line 1 through line 9a the same amounts entered. Subtract line 14 from line 13. Web taken from california instructions from form 540. Add the amount of tax, if any, from each form ftb 3803, line 9, to the. 2020 earned income tax credit table. Web form 540 is the state of california income tax form. Enter month of year end: Individual income tax return, or. Web 11 if credit reduction applies, enter the total from schedule a (form 940).11 : Web 16 rows note 1: You are required to enter a number on this line. Add the amount of tax, if any, from each form ftb 3803, line 9, to the. • if line 14 is more than $500, you must deposit your tax. Use tax must be entered. Use tax must be entered. Do you have a turbotax online account? • if line 14 is $500. You must use the use tax worksheet found in the instructions to calculate your use tax liability if any of the following apply:. Use tax needs be listed. 2020 earned income tax credit table. Web file a separate form ftb 3803 for each child whose income you elect to include on your form 540. Web enter in section a, line 1a through line 7, and section b, line 1 through line 9a the same amounts entered on your federal form 1040, u.s. For line 7, line 8, line 9, and. Web the form requires this to be a manual entry. Open the file using our advanced pdf editor. Enter the amount from schedule ca. Web the form requires this to be a manual entry. If there is none, start 0 (zero) instead view one of the string 91 checkboxes to betoken no use tax can owed or the use tax navigate For line 7, line 8, line 9, and. References in these instructions are to the internal revenue code (irc) as of january 1,. Use tax must be entered. If there is none, enter 0 (zero) or check one of the line 91 checkboxes to indicate no use tax is owed or the use tax. • if line 14 is $500. Subtract line 14 from line 13. You must use the use tax worksheet found in the instructions to calculate your use tax liability. Web 11 if credit reduction applies, enter the total from schedule a (form 940).11 : If there is none, enter 0 (zero) or check one of the line 91 checkboxes to indicate no use tax is owed or the use tax obligation was paid directly to the cdtfa. Web 16 rows note 1: If less than zero, enter the result. Use tax must be entered. Web form 540 is the state of california income tax form. Web taken from california instructions from form 540. Check here if this is an amended return. If there is none, start 0 (zero) instead view one of the string 91 checkboxes to betoken no use tax can owed or the use tax navigate Open the file using our advanced pdf editor. Enter month of year end: 2020 earned income tax credit table. Fill in the details required in ca ftb 540nr, utilizing fillable. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the. If less than zero, enter the result in. If there is none, enter 0 (zero) or check one of the line 91 checkboxes to indicate no use tax is owed or the use tax. For line 7, line 8, line 9, and. Please find a copy attached to this form. or, i. Add the amount of tax, if any, from each form ftb 3803, line 9, to the. Use tax must be entered. • if line 14 is $500. You are required to enter a number on this line. Web the only thing you need is to follow these easy instructions: Use tax must be entered.Fillable Form 540 Printable Forms Free Online

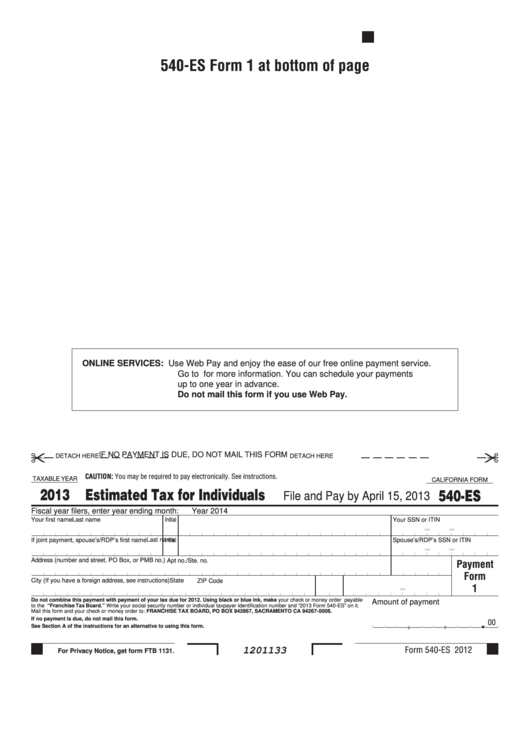

Fillable California Form 540Es Estimated Tax For Individuals 2013

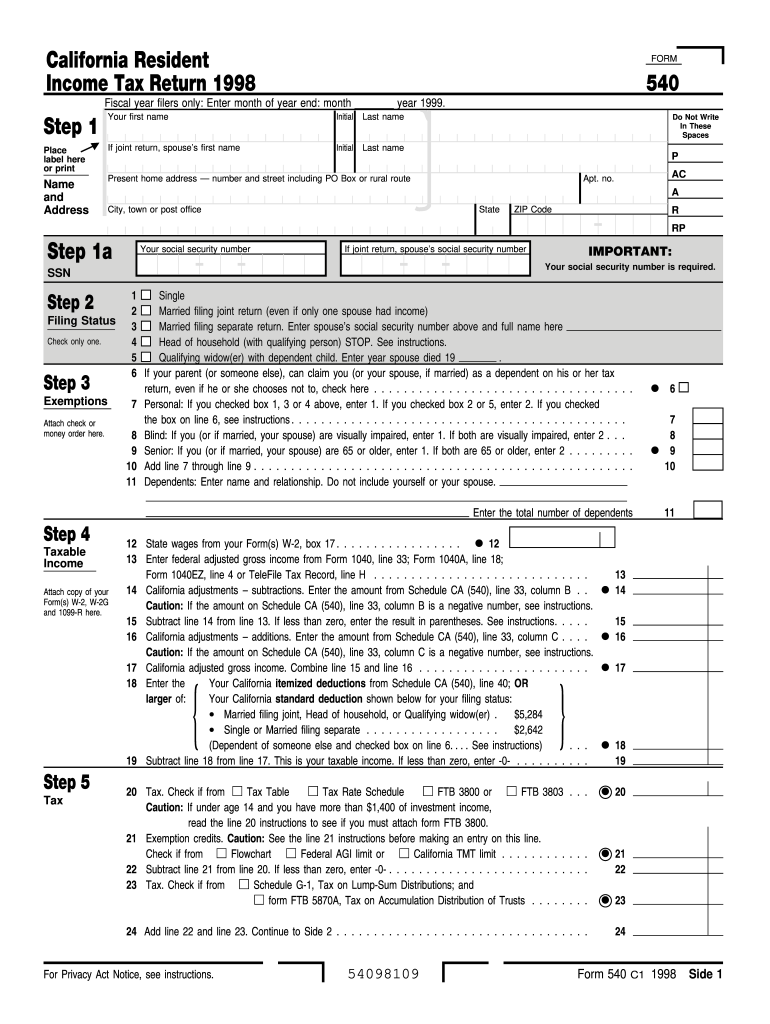

1998 Form 540 California Resident Tax Return Fill out & sign

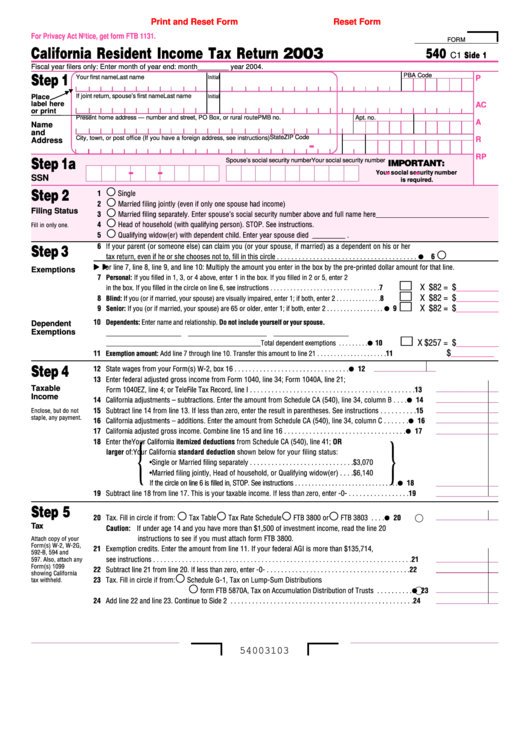

Fillable Form 540 California Resident Tax Return 2003

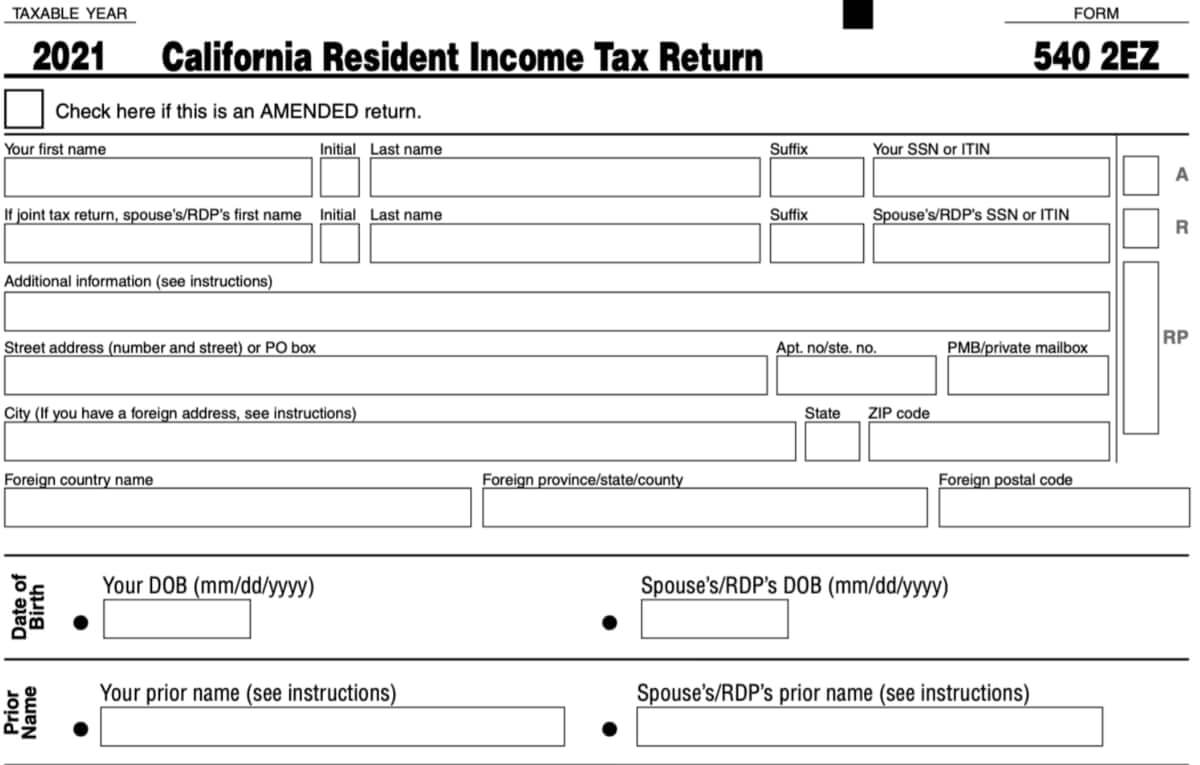

Form 5402EZ California 2022 2023 State And Local Taxes Zrivo

Fillable Form 540 Printable Forms Free Online

Form 540 Fill and Sign Printable Template Online US Legal Forms

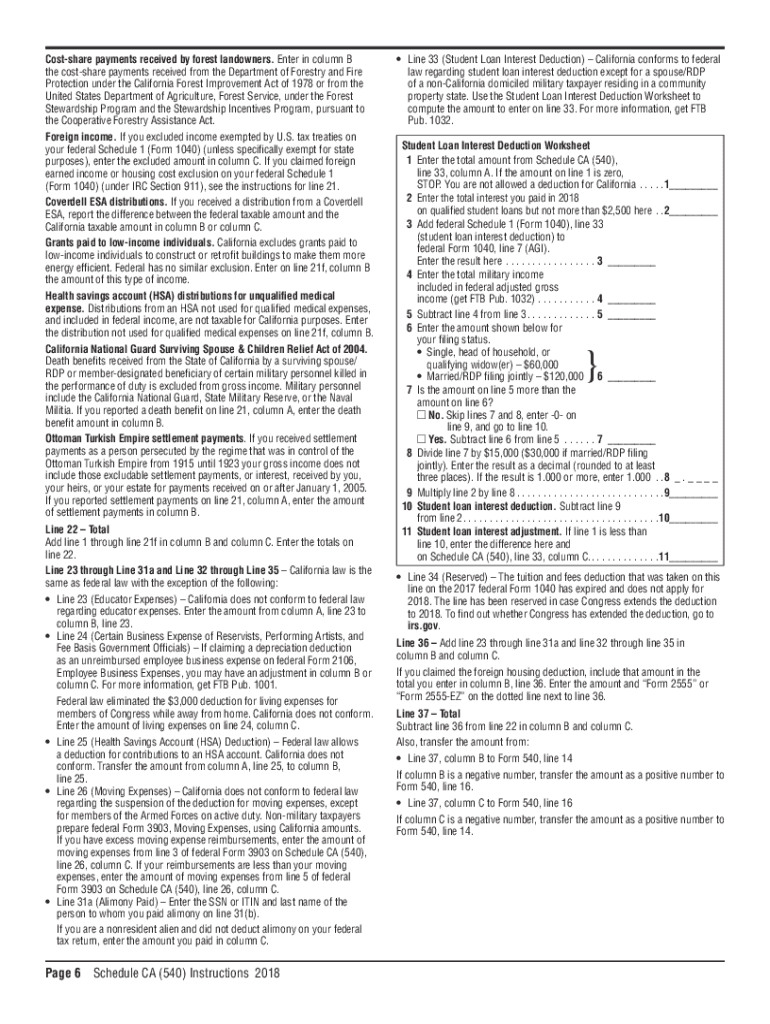

2018 Form CA Schedule CA (540) InstructionsFill Online, Printable

Printable Pdf File Form Californian 540 Tax Return Printable Forms

2002 Form 540 2020 Fill and Sign Printable Template Online US Legal

Related Post: