Form 1120 Schedule J

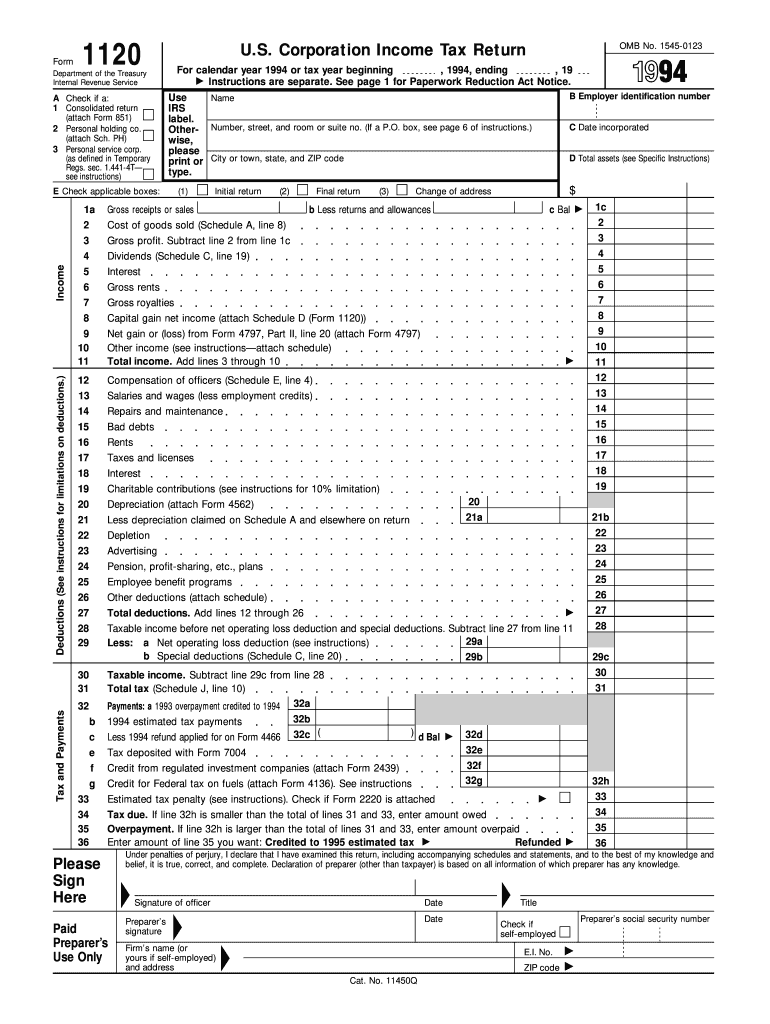

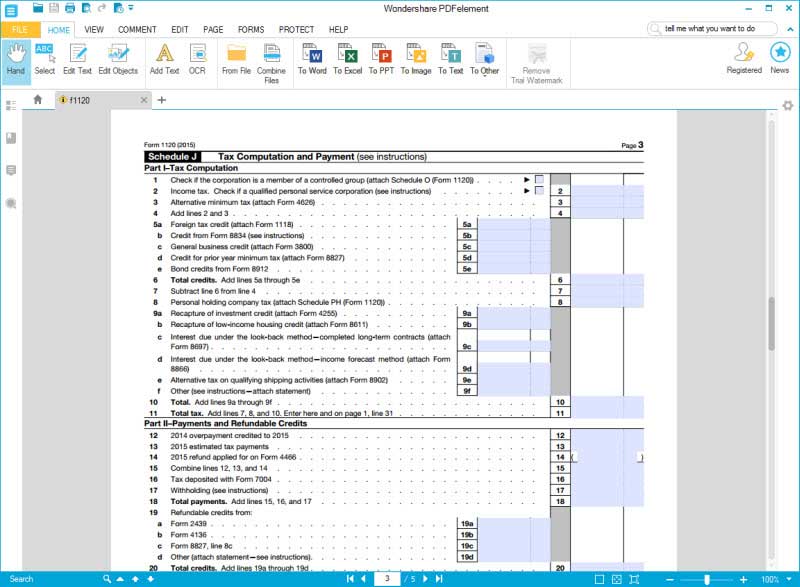

Form 1120 Schedule J - Tax computation and payment.19 schedule k. A foreign corporation is any corporation. If the corporation is a qualified personal service corporation, check the box on line 3,. You’ll start by multiplying the taxable income calculated on page 1 by the. Web fincen form 114 is not a tax form, do not file it with your return. Dividends, inclusions, and special deductions. Check the “yes” box if the corporation is a specified domestic entity that is required to file form. Schedule j is where you’ll calculate the corporation’s tax liability. On schedule j the tax computation for the corporation is. B did any individual or estate own directly 20% or more, or own, directly or indirectly, 50% or more. Web enter the combined tax on form 1120, schedule j, line 2. For other form 1120 tutorials, see our playlist below: You enter your tax credits on schedule j. Here’s where you calculate your c corporation’s tax liability. If the corporation is a qualified personal service corporation, check the box on line 3,. Web for more information: Check the “yes” box if the corporation is a specified domestic entity that is required to file form. Check the “yes” box if the corporation is a specified domestic entity that is required to file form. If the corporation is a qualified personal service corporation, check the box on line 3,. You enter your tax credits. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or. Web fincen form 114 is not a tax form, do not file it with your return. If the corporation is a qualified personal service corporation,. Web fincen form 114 is not a tax form, do not file it with your return. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or. Schedule j is where you’ll calculate the corporation’s tax. Schedule j is where you’ll calculate the corporation’s tax liability. On schedule j the tax computation for the corporation is. • form 1120 tutorials for 2022 tax year how to fill out form 1120 for the 2021. Web enter the combined tax on form 1120, schedule j, line 2. Web a qualified personal service corporation is taxed at a flat. Tax computation and payment.19 schedule k. Web if “yes,” complete part i of schedule g (form 1120) (attach schedule g). Web fincen form 114 is not a tax form, do not file it with your return. Here’s where you calculate your c corporation’s tax liability. Web total tax (schedule j, part i, line 11) 2020 net 965 tax liability paid. Here’s where you calculate your c corporation’s tax liability. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or. Web fincen form 114 is not a tax form, do not file it with your return.. Web for more information: Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or. You enter your tax credits on schedule j. Web fincen form 114 is not a tax form, do not file it. Web for more information: Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or. Dividends, inclusions, and special deductions. Web if “yes,” complete part i of schedule g (form 1120) (attach schedule g). B did. You enter your tax credits on schedule j. Web a qualified personal service corporation is taxed at a flat rate of 35% on taxable income. Here’s where you calculate your c corporation’s tax liability. Check the “yes” box if the corporation is a specified domestic entity that is required to file form. You’ll start by multiplying the taxable income calculated. A foreign corporation is any corporation. For other form 1120 tutorials, see our playlist below: You enter your tax credits on schedule j. Web for more information: Web fincen form 114 is not a tax form, do not file it with your return. On schedule j the tax computation for the corporation is. Schedule j is where you’ll calculate the corporation’s tax liability. B did any individual or estate own directly 20% or more, or own, directly or indirectly, 50% or more. You’ll start by multiplying the taxable income calculated on page 1 by the. Web total tax (schedule j, part i, line 11) 2020 net 965 tax liability paid (schedule j, part ii, line 12) total payments, credits, and section 965 net tax liability. Check the “yes” box if the corporation is a specified domestic entity that is required to file form. Web fincen form 114 is not a tax form, do not file it with your return. Dividends, inclusions, and special deductions. Web if “yes,” complete part i of schedule g (form 1120) (attach schedule g). • form 1120 tutorials for 2022 tax year how to fill out form 1120 for the 2021. Here’s where you calculate your c corporation’s tax liability. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or. Web enter the combined tax on form 1120, schedule j, line 2. Check the “yes” box if the corporation is a specified domestic entity that is required to file form. If the corporation is a qualified personal service corporation, check the box on line 3,.Form 1120 Fill Out and Sign Printable PDF Template signNow

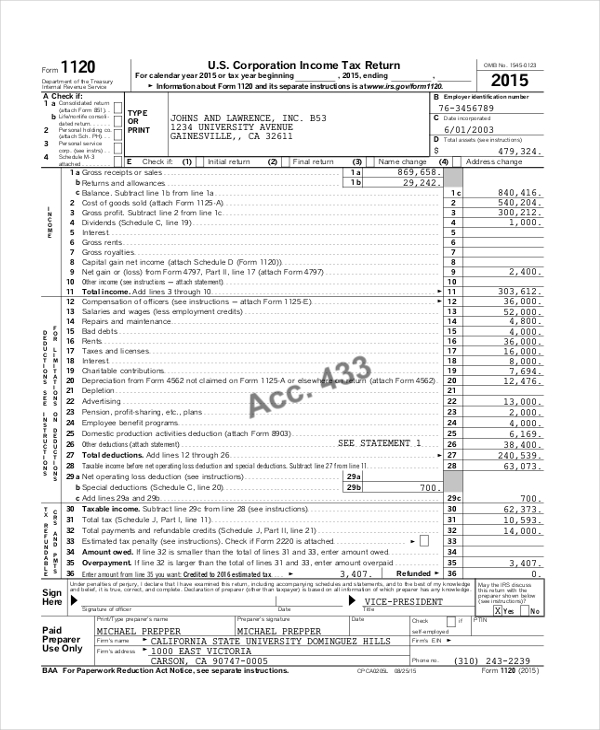

IRS Form 1120 Complete this Form with Wondershare PDFelement

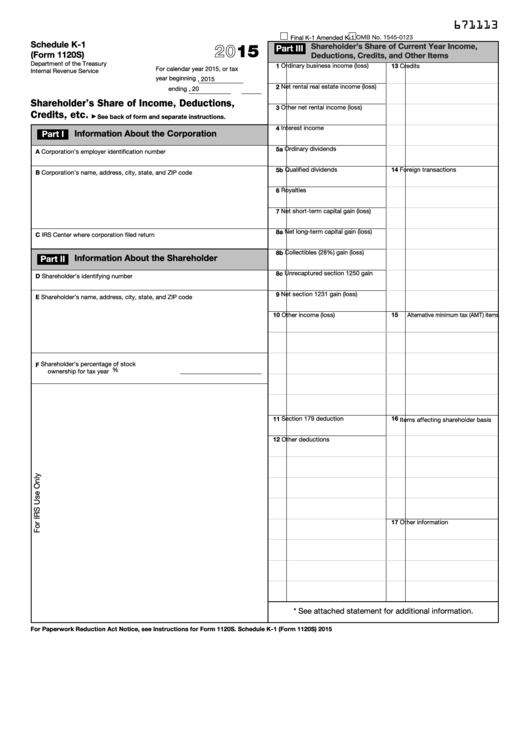

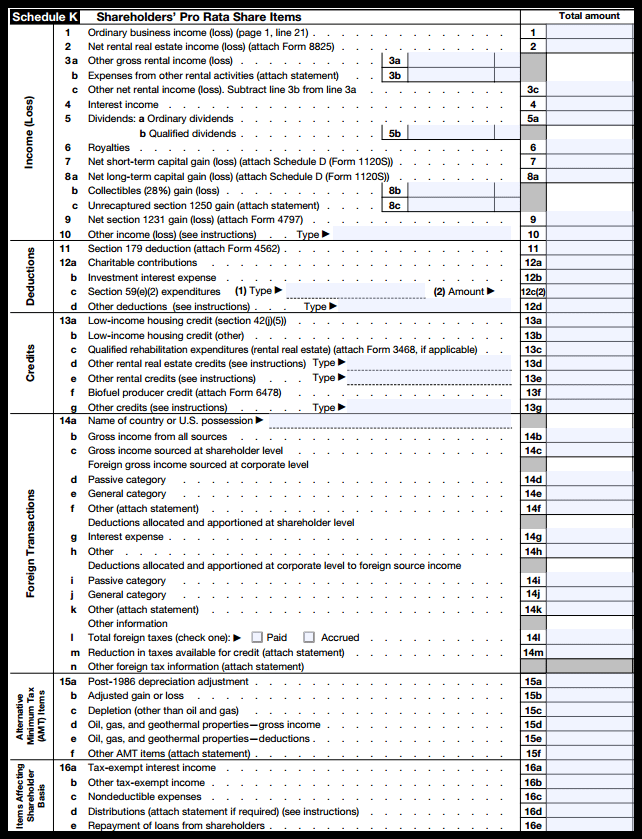

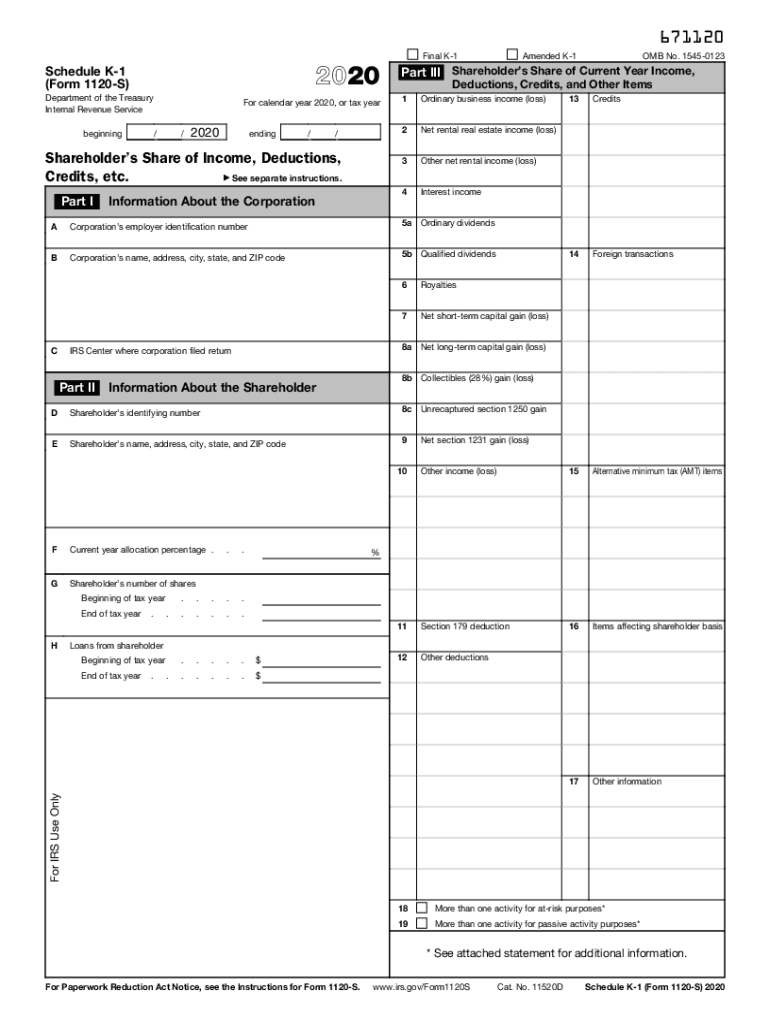

Fillable Schedule K1 (Form 1120s) Shareholder'S Share Of

1120s Other Deductions Worksheet Promotiontablecovers

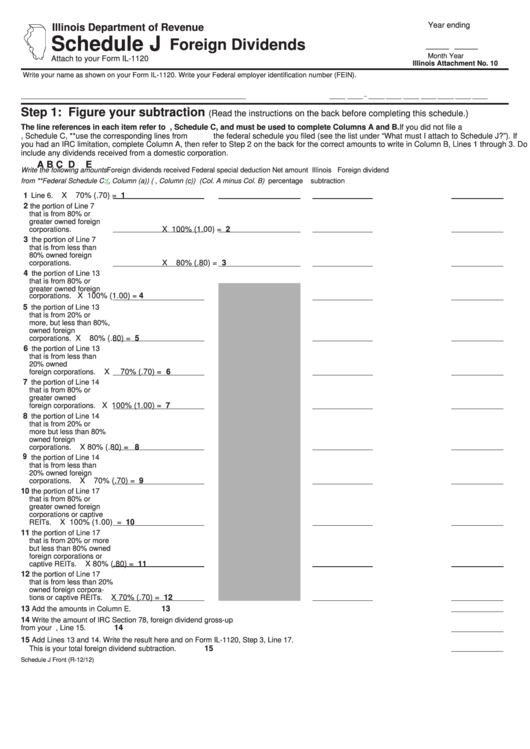

Schedule J Attach To Your Form Il1120 Foreign Dividends printable

K1 Basis Worksheet

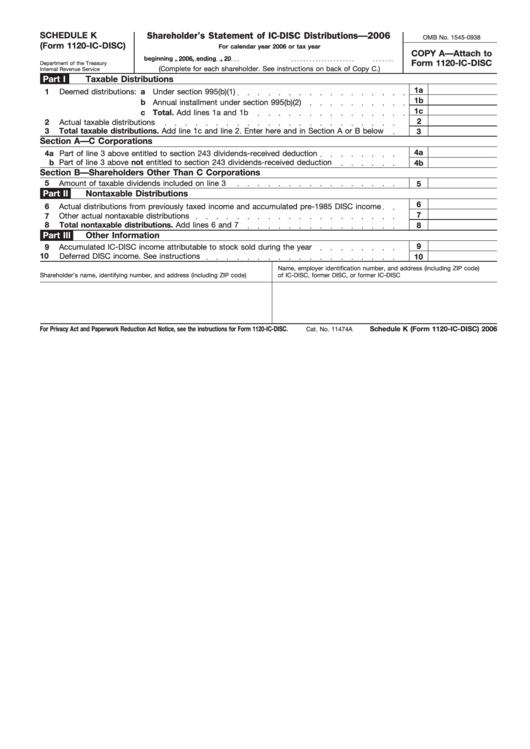

Fillable Form 1120IcDisc Schedule K Shareholder'S Statement Of Ic

How to Complete Form 1120S Tax Return for an S Corp

FREE 17+ Sample Schedule Forms in PDF MS Word Excel

Fillable Federal 1120 Form Printable Forms Free Online

Related Post: