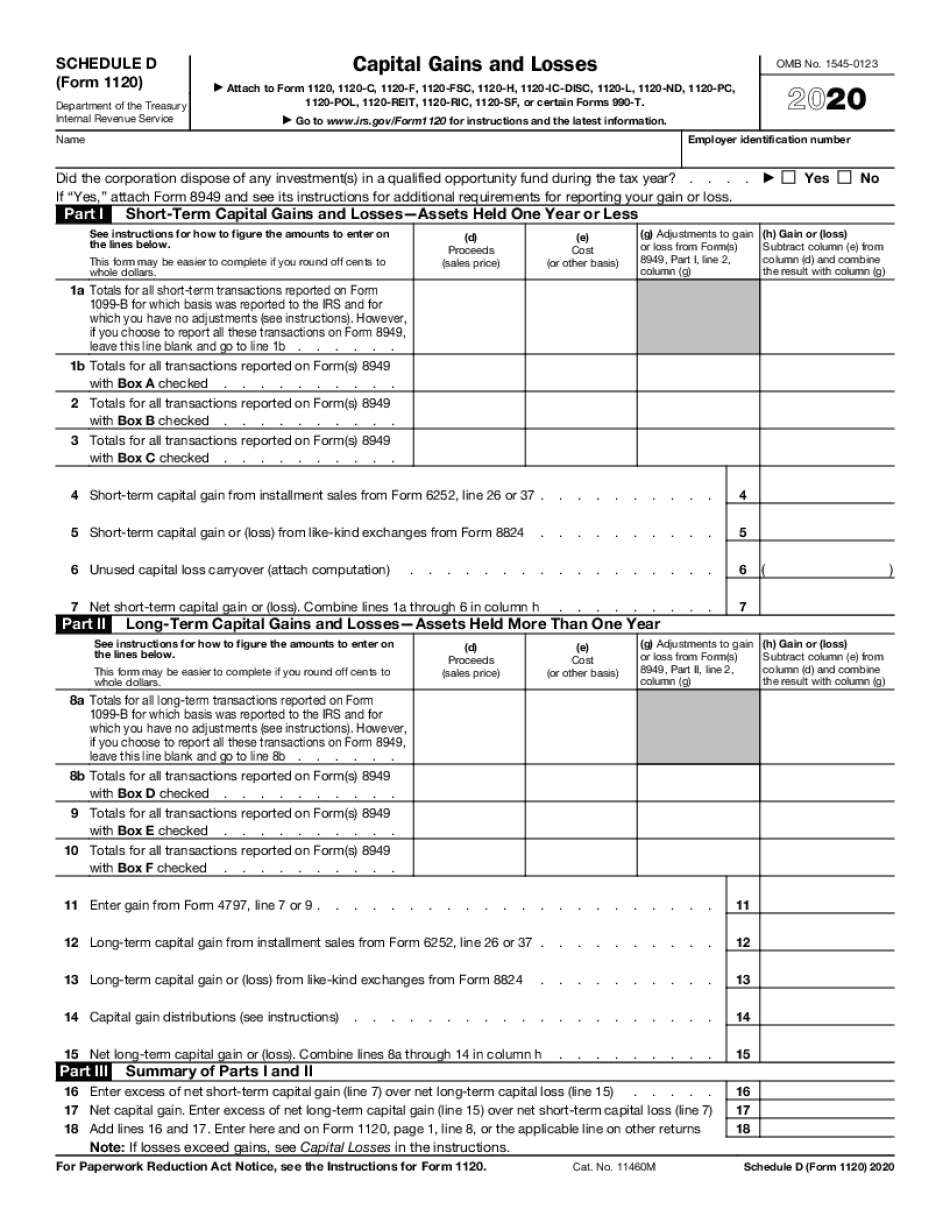

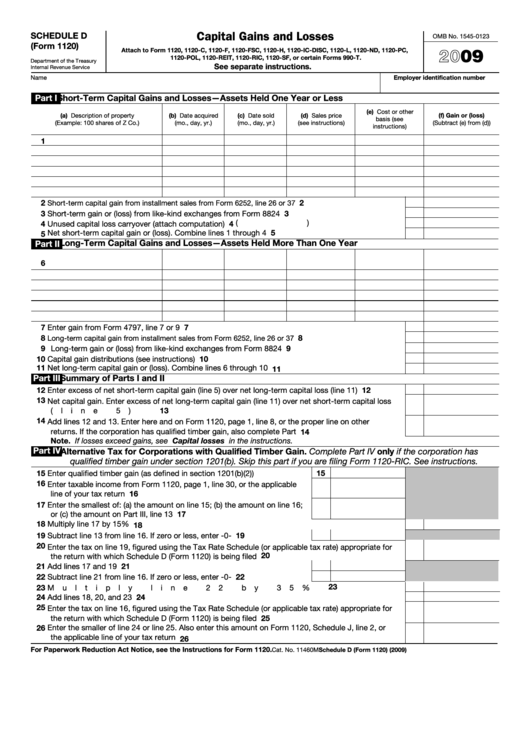

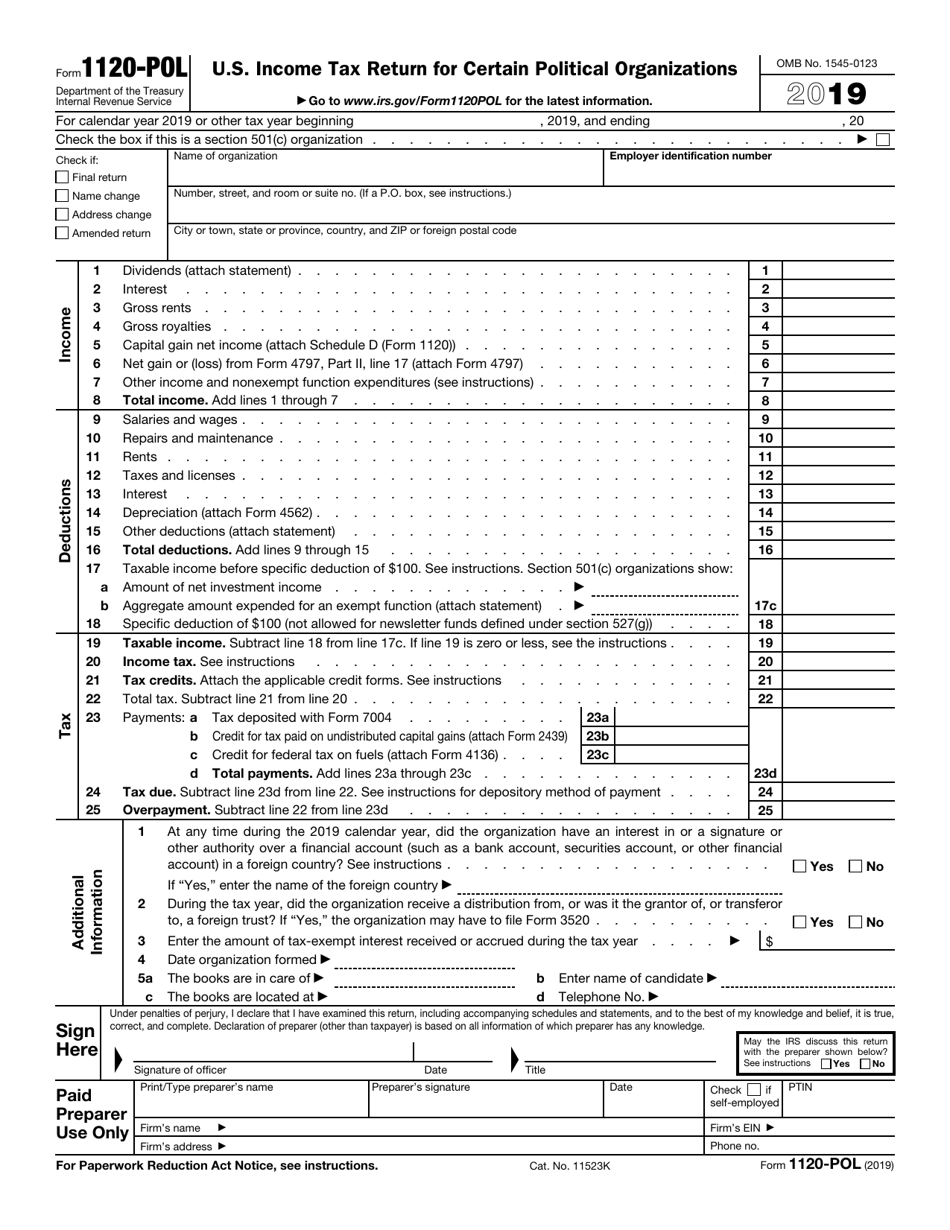

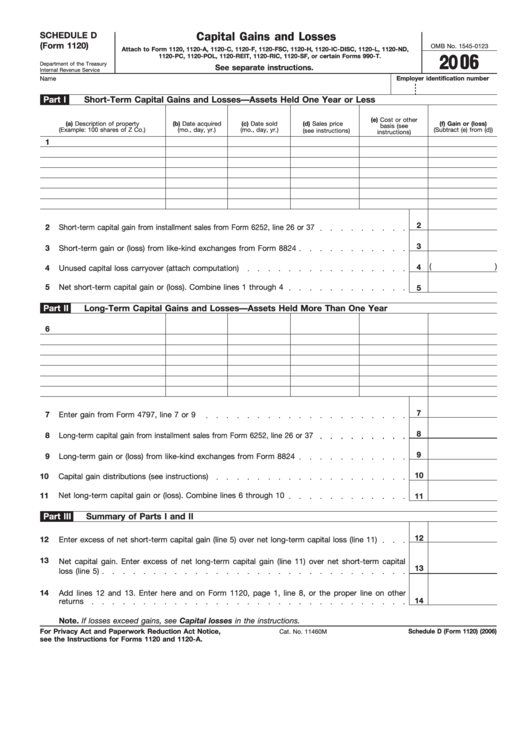

Form 1120 Schedule D

Form 1120 Schedule D - Ad access irs tax forms. Updated for tax year 2022 • june 2, 2023 8:43 am. General instructions purpose of schedule use. Web up to $40 cash back schedule d (form 1120s) department of the treasury internal revenue servicecapital gains and losses and builtin gains omb no. Other forms the corporation may have to file; Information for certain persons owning the. Get ready for tax season deadlines by completing any required tax forms today. You can download or print. Web use schedule d to report the following. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Information for certain persons owning the. Schedule d is often used to report capital gains from the sale of. What is the form used for? Web 2022 instructions for schedule d (form 1120) capital gains and losses section references are to the internal revenue code unless otherwise noted. Get ready for tax season deadlines by completing any required tax forms. Web the schedule d for your form 1040 tax form is used to report capital gains and losses to the irs. October 05, 2023 tax year 2023 1120 mef ats scenario 3: Ad access irs tax forms. Web written by a turbotax expert • reviewed by a turbotax cpa. Web up to $40 cash back schedule d (form 1120s) department. What is the form used for? Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. The overall capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital assets. Information for certain persons owning the. Profit or loss from. What is the form used for? Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web use schedule d to report the following. Complete, edit or print tax forms instantly. Schedule d is often used to report capital gains from the sale of. Information for certain persons owning the. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Updated for tax year 2022 • june 2, 2023. Profit or loss from farming schedule g: Complete, edit or print tax forms instantly. Ad access irs tax forms. General instructions purpose of schedule use. Web 2022 instructions for schedule d (form 1120) capital gains and losses section references are to the internal revenue code unless otherwise noted. Web we last updated the capital gains and losses in december 2022, so this is the latest version of 1120 (schedule d), fully updated for tax year 2022. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web up to $40 cash. The overall capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital assets. Get ready for tax season deadlines by completing any required tax forms today. Web up to $40 cash back schedule d (form 1120s) department of the treasury internal revenue servicecapital gains and losses and builtin gains omb no. Updated for tax. Web use schedule d to report the following. Schedule d is often used to report capital gains from the sale of. Other forms the corporation may have to file; The schedule d form is what. Web up to $40 cash back schedule d (form 1120s) department of the treasury internal revenue servicecapital gains and losses and builtin gains omb no. Web schedule d (form 1120) department of the treasury internal revenue service. Web the schedule d for your form 1040 tax form is used to report capital gains and losses to the irs. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by. The schedule d form is what. Web we last updated the capital gains and losses in december 2022, so this is the latest version of 1120 (schedule d), fully updated for tax year 2022. You can download or print. Schedule d is often used to report capital gains from the sale of. Web the schedule d for your form 1040 tax form is used to report capital gains and losses to the irs. What is the form used for? Complete, edit or print tax forms instantly. Information for certain persons owning the. 52684s schedule g (form 1120) (rev. Updated for tax year 2022 • june 2, 2023 8:43 am. Web 2022 instructions for schedule d (form 1120) capital gains and losses section references are to the internal revenue code unless otherwise noted. Ad access irs tax forms. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Complete, edit or print tax forms instantly. Profit or loss from farming schedule g: General instructions purpose of schedule use. Web use schedule d to report the following. Get ready for tax season deadlines by completing any required tax forms today. Web written by a turbotax expert • reviewed by a turbotax cpa. Web up to $40 cash back schedule d (form 1120s) department of the treasury internal revenue servicecapital gains and losses and builtin gains omb no.2020 Form 1120 Printable & Fillable Sample in PDF

Can you look over this corporate tax return form 1120 I did based on

Form 1120S (Schedule D) Capital Gains and Losses and Builtin Gains

Form 1120 (Schedule D) Capital Gains and Losses (2014) Free Download

Form 1120S (Schedule D) Capital Gains and Losses and Builtin Gains

2022 Form IRS 1120S Schedule D Fill Online, Printable, Fillable

What is Form 1120S and How Do I File It? Ask Gusto

Fillable Schedule D (Form 1120) Capital Gains And Losses 2009

IRS Form 1120POL Download Fillable PDF or Fill Online U.S. Tax

Fillable Schedule D (Form 1120) Capital Gains And Losses 2006

Related Post: