Form 1120 Other Deductions Worksheet

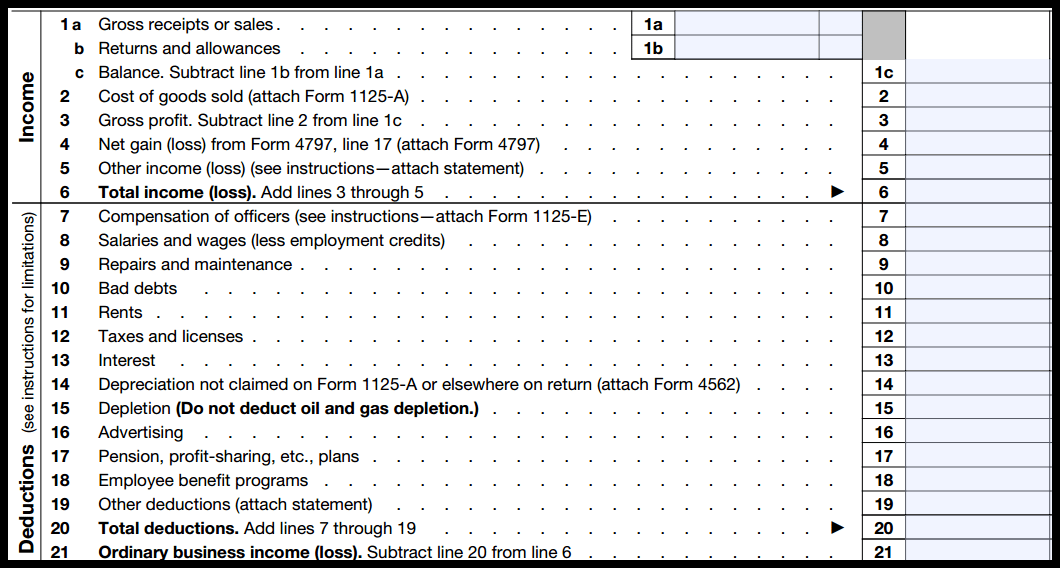

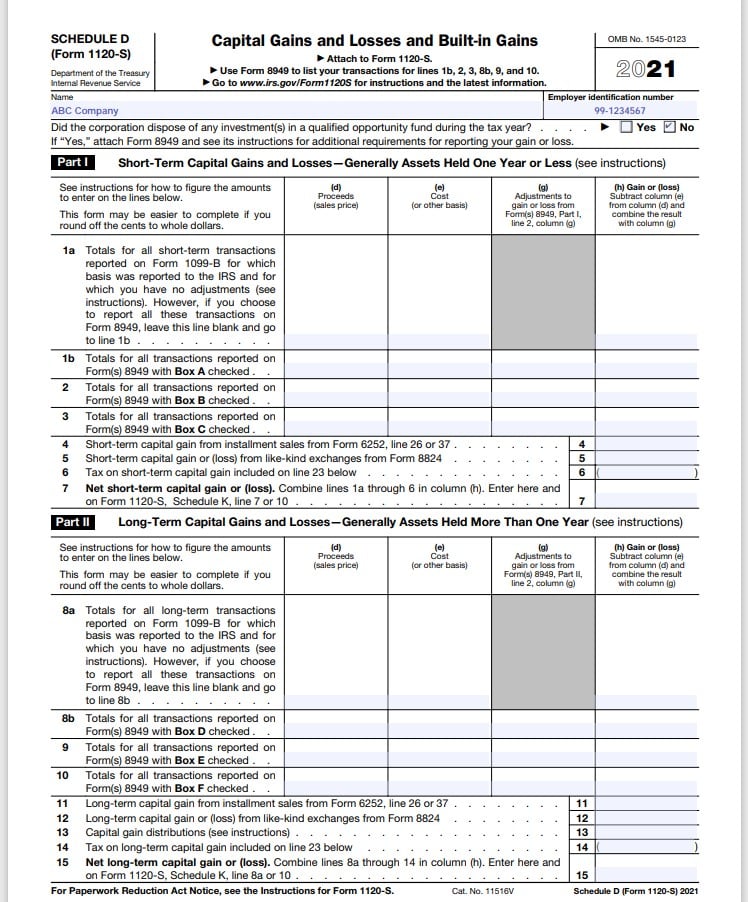

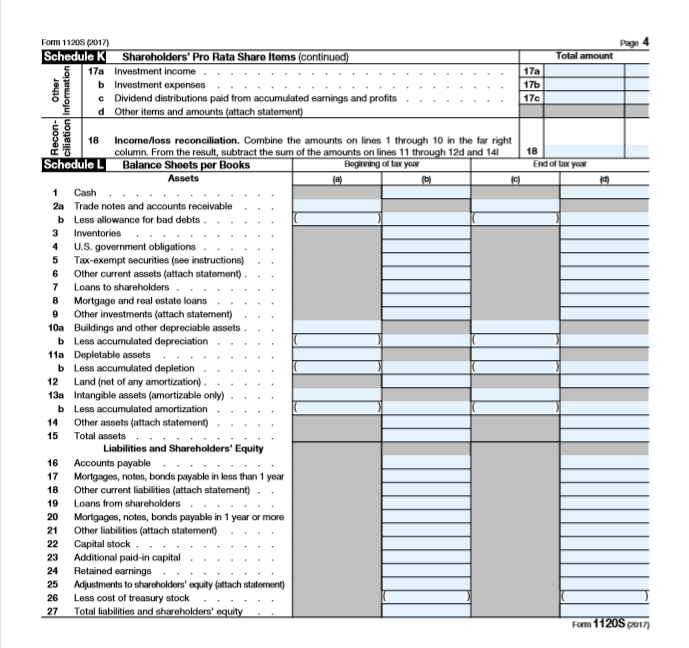

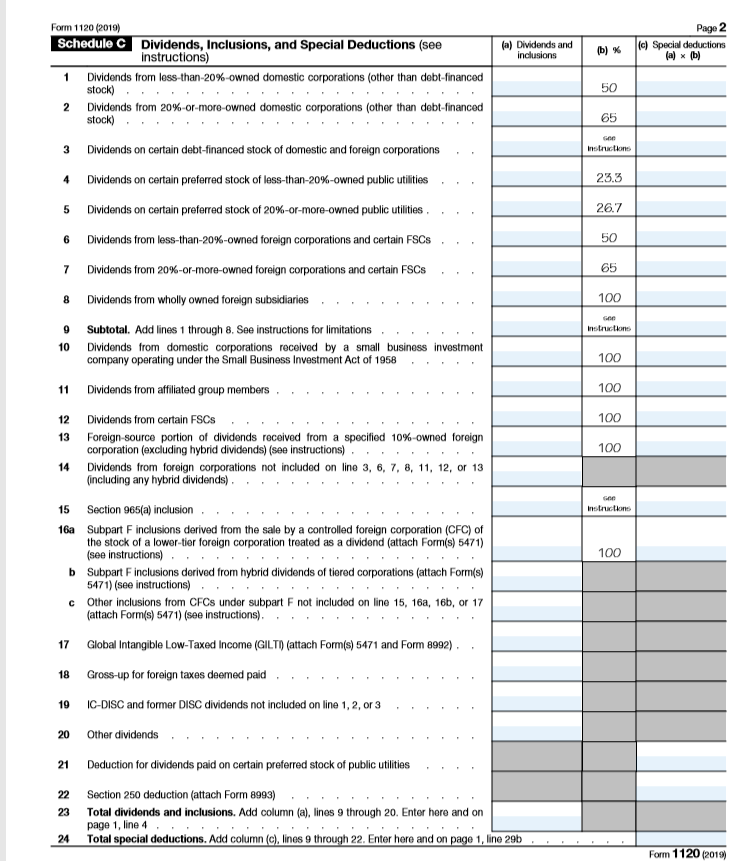

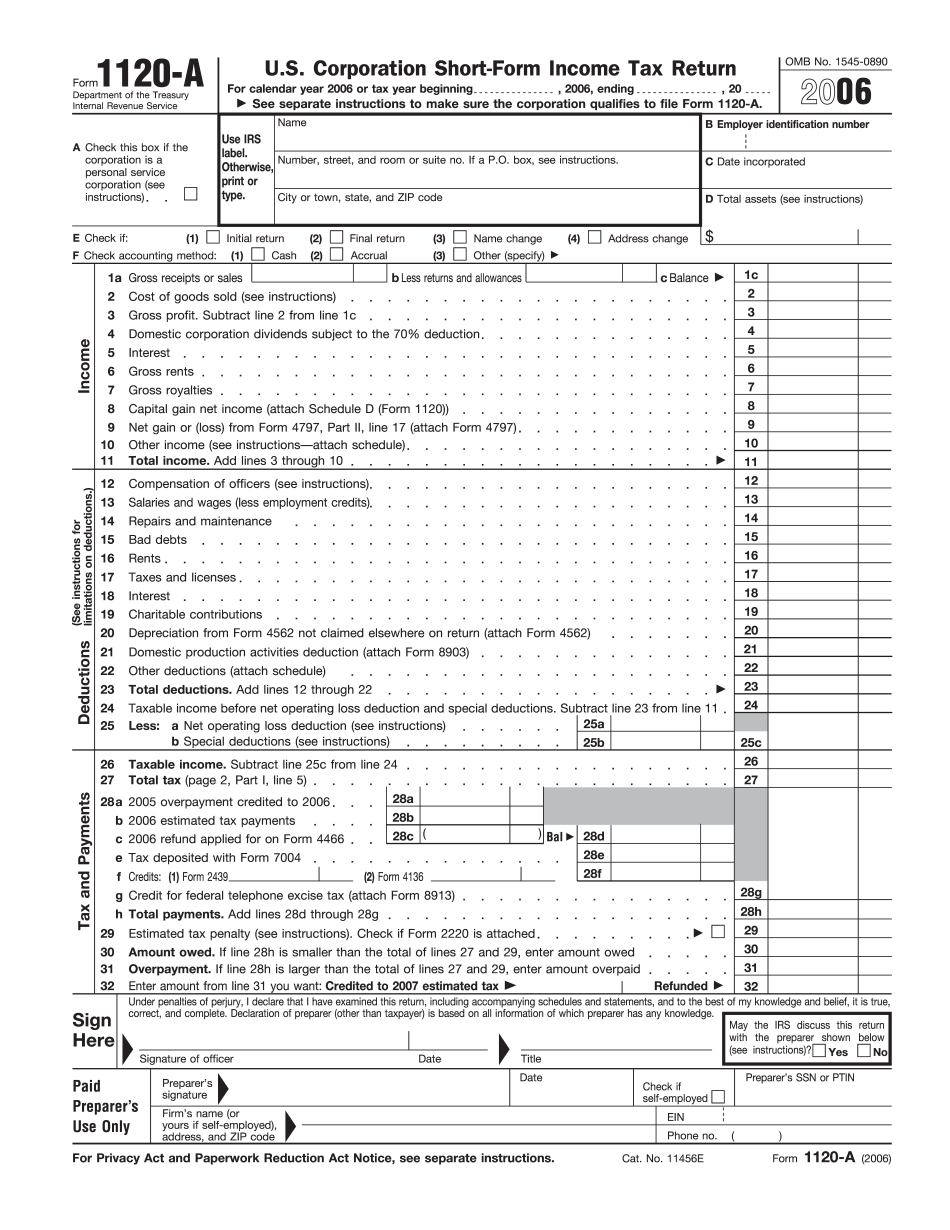

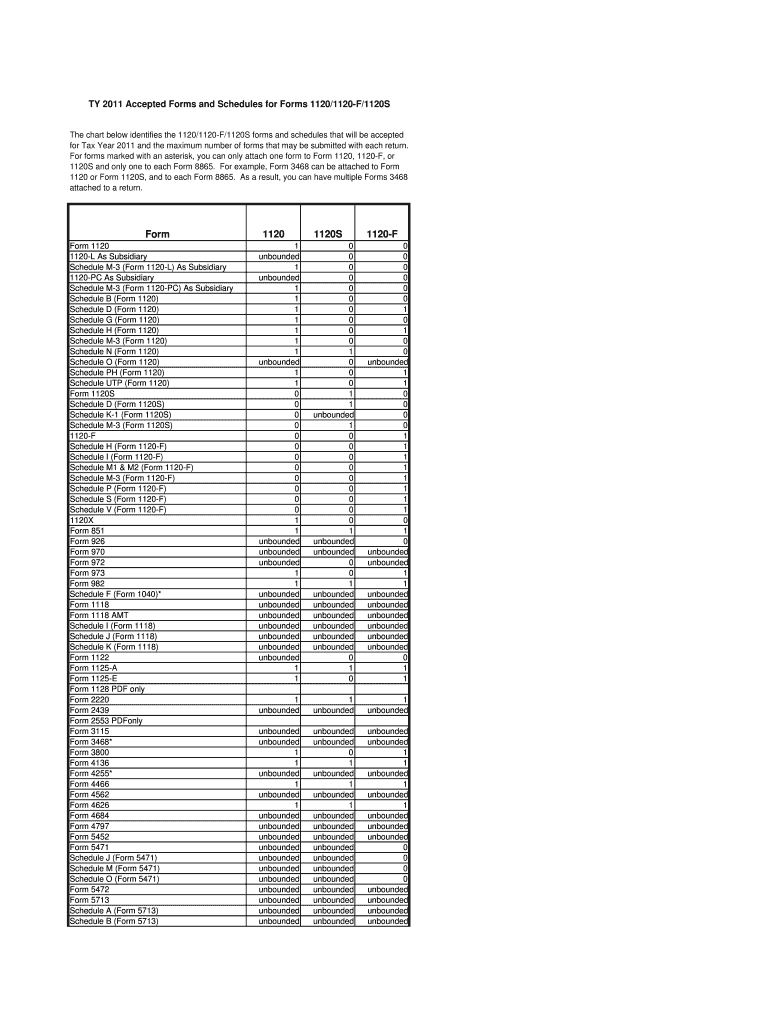

Form 1120 Other Deductions Worksheet - Line item 19 other deductions attachment. Increase in penalty for failure to file. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Department of the treasury internal revenue service. Line 19 is for other deductions that aren't covered in the lines above. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Complete, edit or print tax forms instantly. Send filled & signed 1120. This article will assist you with understanding general information about form 1120s in proseries professional. Income tax return for an s corporation. This article will assist you with understanding general information about form 1120s in proseries professional. So you'd just attach a separate sheet. Web the deductions and tax credits you can enter on form 1120 are as follows: Corporation income tax return, including recent updates, related forms and instructions on how to file. Go to the other deductions worksheet. These amounts will flow to: Ad easy guidance & tools for c corporation tax returns. Web an explanation is required when form 112, line 6 has an amount entered. Easily sign the forms 1120 f with your finger. This article focuses solely on the entry of the deduction items which are found on boxes 11 and 12. Web showing 8 worksheets for 1120s other deductions. Income tax return for an s corporation. Web solved•by intuit•7•updated 1 year ago. Worksheets are 2020 instructions for form 1120 s, forms required attachments, us 1120s line 19, arthu. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Web showing 8 worksheets for 1120s other deductions. This article will assist you with understanding general information about form 1120s in proseries professional. Some of the worksheets for this concept are us 1120s line 19, corporate 1120,. Web information about form 1120, u.s. Get ready for tax season deadlines by completing any required tax forms today. Corporation income tax return, including recent updates, related forms and instructions on how to file. Easily sign the forms 1120 f with your finger. Income tax return for an s corporation. Do not file this form unless the corporation has filed or is attaching form 2553 to. This article will assist you with understanding general information about form 1120s in proseries professional. Do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Line item 19 other deductions attachment. Increase in penalty for failure to file. Please enter information on colorado, income/deductions, additions, other additions, lin.. Web federal income tax information. Web an explanation is required when form 112, line 6 has an amount entered. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Web per irs instructions, lacerte generates a statement for form 1120, line 26, listing all allowable deductions that aren't deductible elsewhere on the form. Ad easy guidance. Worksheets are 2020 instructions for form 1120 s, forms required attachments, us 1120s line 19, ar. Use this form to report the income,. Increase in penalty for failure to file. Go to the other deductions worksheet. Income tax return for an s corporation. Worksheets are 2020 instructions for form 1120 s, forms required attachments, us 1120s line 19, ar. Some of the worksheets for this concept are us 1120s line 19, corporate 1120,. Web the deductions and tax credits you can enter on form 1120 are as follows: These amounts will flow to: Complete, edit or print tax forms instantly. Corporation income tax return section references are to the internal revenue code unless otherwise noted. Corporation income tax return, including recent updates, related forms and instructions on how to file. Complete, edit or print tax forms instantly. So you'd just attach a separate sheet. Get ready for tax season deadlines by completing any required tax forms today. Please enter information on colorado, income/deductions, additions, other additions, lin. in an. Get ready for tax season deadlines by completing any required tax forms today. Web per irs instructions, lacerte generates a statement for form 1120, line 26, listing all allowable deductions that aren't deductible elsewhere on the form. Worksheets are 2020 instructions for form 1120 s, forms required attachments, us 1120s line 19, ar. Complete, edit or print tax forms instantly. Increase in penalty for failure to file. Go to the other deductions worksheet. Web an explanation is required when form 112, line 6 has an amount entered. Web information about form 1120, u.s. Ad access irs tax forms. Corporation income tax return section references are to the internal revenue code unless otherwise noted. Ad easy guidance & tools for c corporation tax returns. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Web solved•by intuit•7•updated 1 year ago. Line item 19 other deductions attachment. Income tax return for an s corporation. This article will assist you with understanding general information about form 1120s in proseries professional. Line 19 is for other deductions that aren't covered in the lines above. So you'd just attach a separate sheet. These amounts will flow to:Form 1120F (Schedule H) Deductions Allocated to Effectively

Form 1120 Line 26 Other Deductions Worksheet Studying Worksheets

1120s Other Deductions Worksheet Promotiontablecovers

41 1120s other deductions worksheet Worksheet Works

1120s Other Deductions Worksheet Promotiontablecovers

41 1120s other deductions worksheet Worksheet Works

Form 1120 Line 26 Other Deductions Worksheet Studying Worksheets

Form 1120 other deductions worksheet Fill online, Printable, Fillable

FoRm 1120 line 26 other deductions worksheet Fill online, Printable

Form 1120 Line 26 Other Deductions Worksheet Fill Out and Sign

Related Post: