Form 5498-Qa

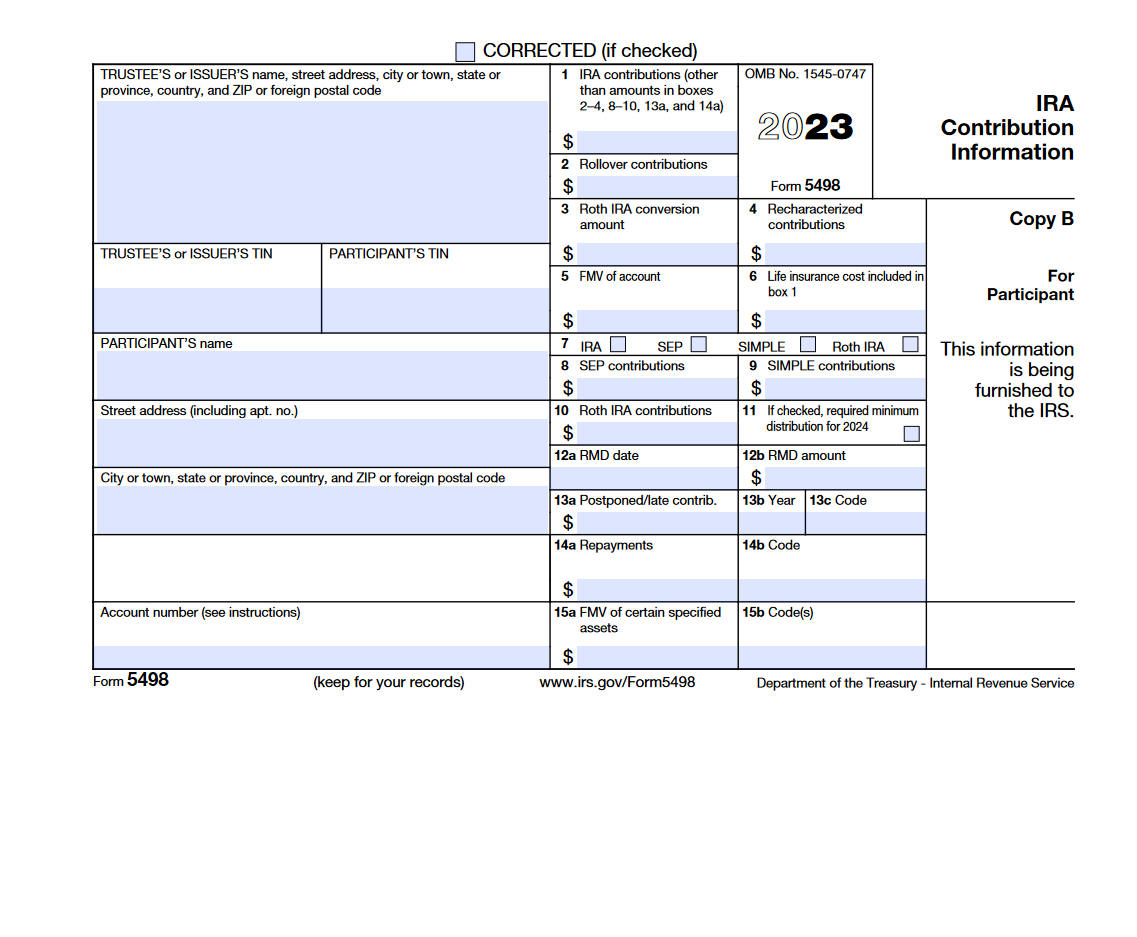

Form 5498-Qa - Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. Amount rolled over from qtp/529 plan. Web 1 best answer. File this form for each. Web solved•by intuit•1427•updated 1 year ago. The document is for informational. It is used when you need to determine the end of year. To get or to order these. Form 5498 is an informational form. What is irs form 5498? Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. The irs requires the form be filed by companies that maintain an individual retirement. What is irs form 5498? It is used when you need to determine the end of year. Ad signnow.com has been visited by 100k+ users in. Form 5498 is an informational form. It is important for taxpayers to fill out this template accurately,. The irs requires the form be filed by companies that maintain an individual retirement. The trustee or custodian of your ira reports. Web solved•by intuit•1427•updated 1 year ago. Any state or its agency or. The irs requires the form be filed by companies that maintain an individual retirement. The irs form 5498 exists so that financial institutions can report ira information. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. To get or to order these. Web filing form 5498 with the irs. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. File this form for each. It is used when you need to determine the end of year. The irs requires the form be filed by companies that maintain an individual retirement. Any state or its agency or. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. Web filing form 5498 with the irs. To get or to order these. The document is for informational. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. To get or to order these. Ad signnow.com has been visited by 100k+ users in the past month Amount rolled over from qtp/529 plan. Web solved•by intuit•1427•updated 1 year ago. The irs requires the form be filed by companies that maintain an individual retirement. The document is for informational. Web solved•by intuit•1427•updated 1 year ago. Web filing form 5498 with the irs. It is important for taxpayers to fill out this template accurately,. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. Any state or its agency or. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. It is used when you need to determine the end of year.. The document is for informational. Web 1 best answer. Web form 5498 reports your total annual contributions to an ira account and identifies the type of retirement account you have, such as a traditional ira, roth ira,. File this form for each. Contributing to your ira means you’re putting savings toward your. What is irs form 5498? Web filing form 5498 with the irs. The irs form 5498 exists so that financial institutions can report ira information. Contributing to your ira means you’re putting savings toward your. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. Form 5498 is an informational form. File this form for each. Ad signnow.com has been visited by 100k+ users in the past month Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. Web filing form 5498 with the irs. To get or to order these. The irs requires the form be filed by companies that maintain an individual retirement. What is irs form 5498? Web form 5498 reports your total annual contributions to an ira account and identifies the type of retirement account you have, such as a traditional ira, roth ira,. It is used when you need to determine the end of year. Web 1 best answer. Web solved•by intuit•1427•updated 1 year ago. The document is for informational. Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. To get or to order these. Any state or its agency or. Contributing to your ira means you’re putting savings toward your. The trustee or custodian of your ira reports. Amount rolled over from qtp/529 plan. It is important for taxpayers to fill out this template accurately,.All About IRS Tax Form 5498 for 2020 IRA for individuals

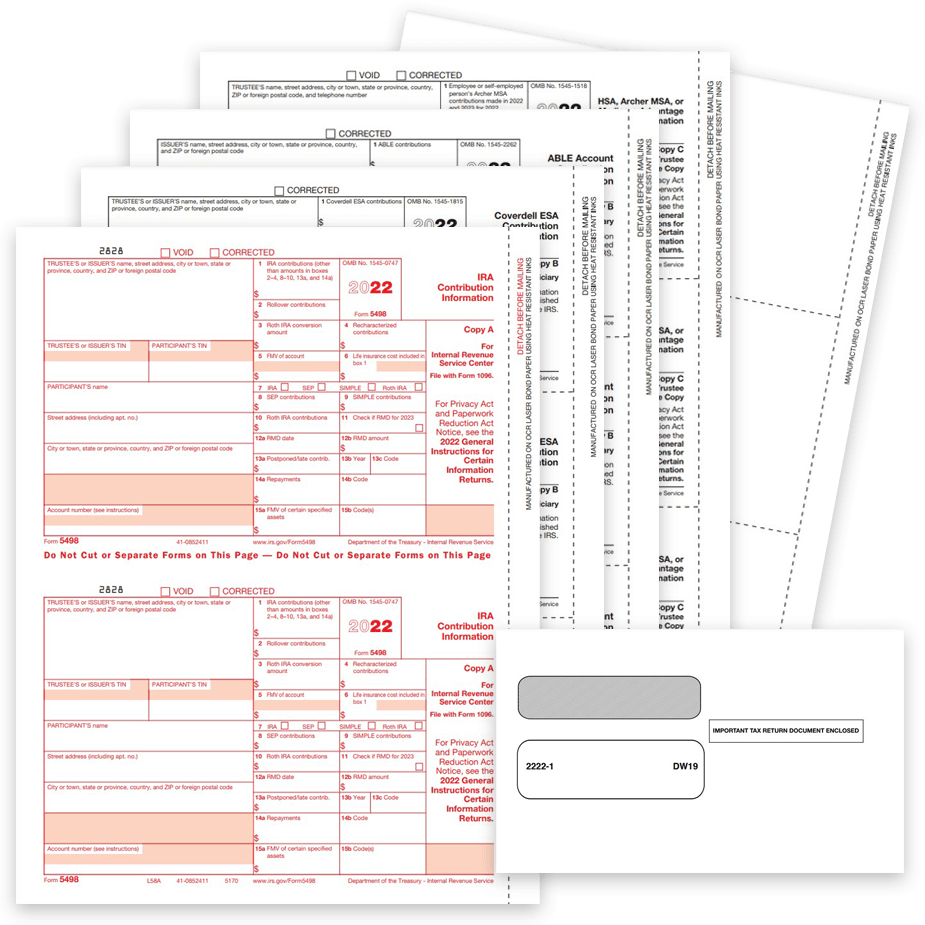

5498 Tax Forms and Envelopes for 2022

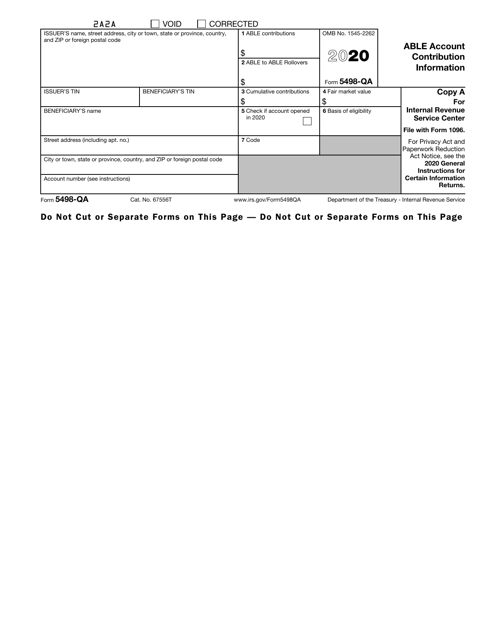

IRS Form 5498QA Download Fillable PDF or Fill Online Able Account

5498 Tax Forms for IRA Contributions, Participant Copy B

Form 5498 IRA Contribution Information Instructions and Guidelines

Form 5498QA, ABLE Account Contribution Information

A Guide to Filing Form 5498 for the 2020 Tax Year Blog TaxBandits

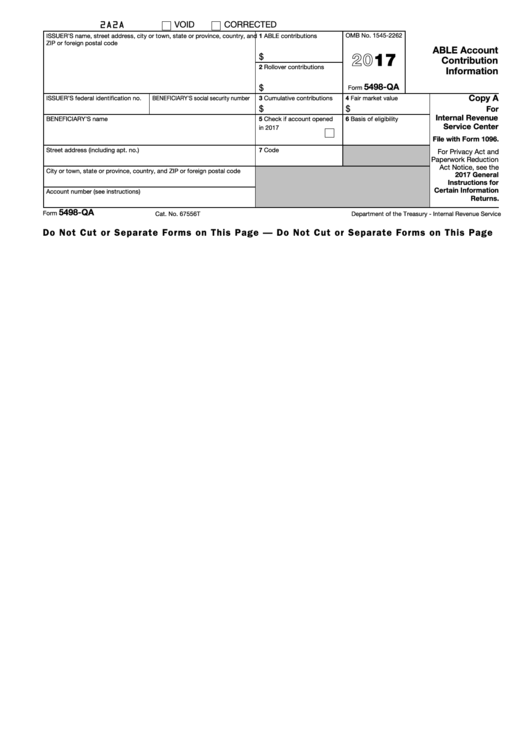

Fillable Form 5498Qa Able Account Contribution Information 2017

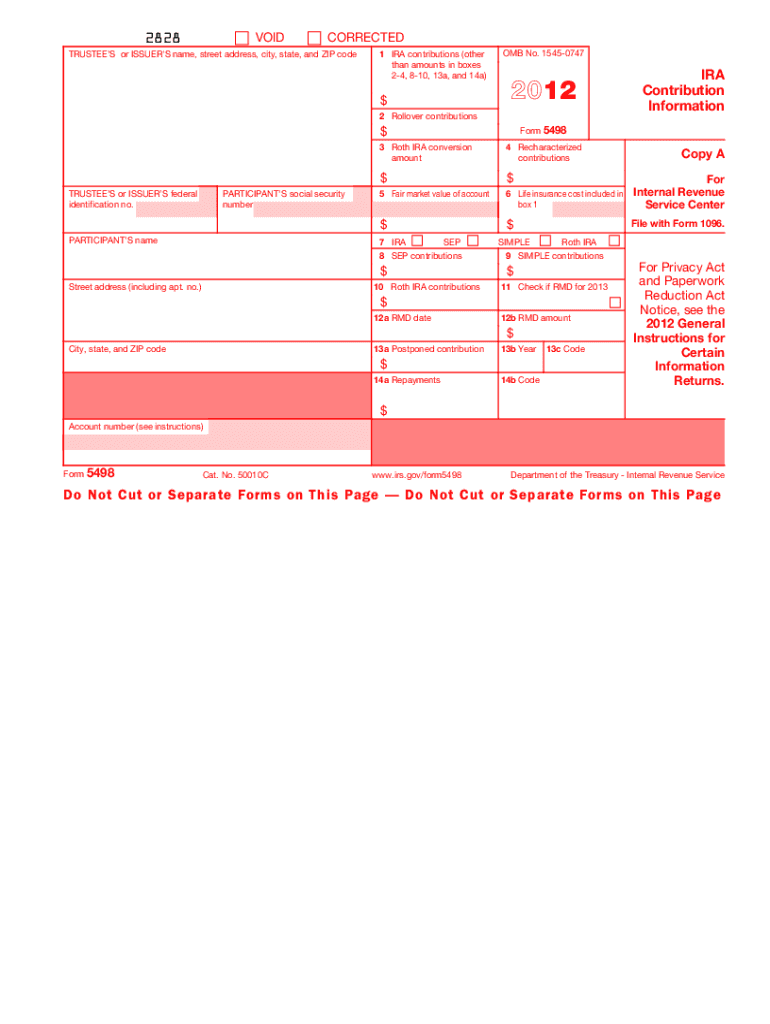

IRS Form 5498. IRA Contribution Information Forms Docs 2023

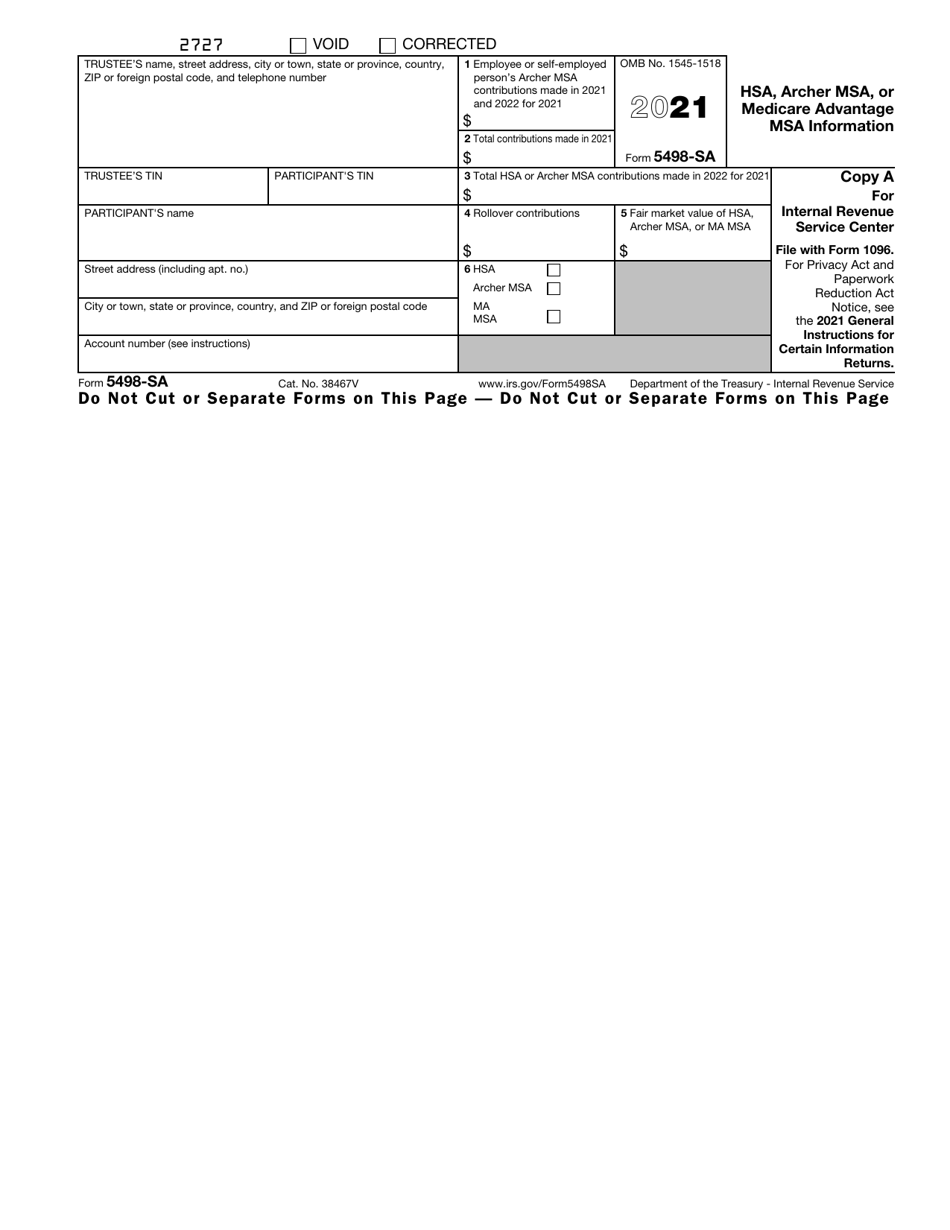

IRS Form 5498SA Download Fillable PDF or Fill Online Hsa, Archer Msa

Related Post: