Form 1120 Instructions

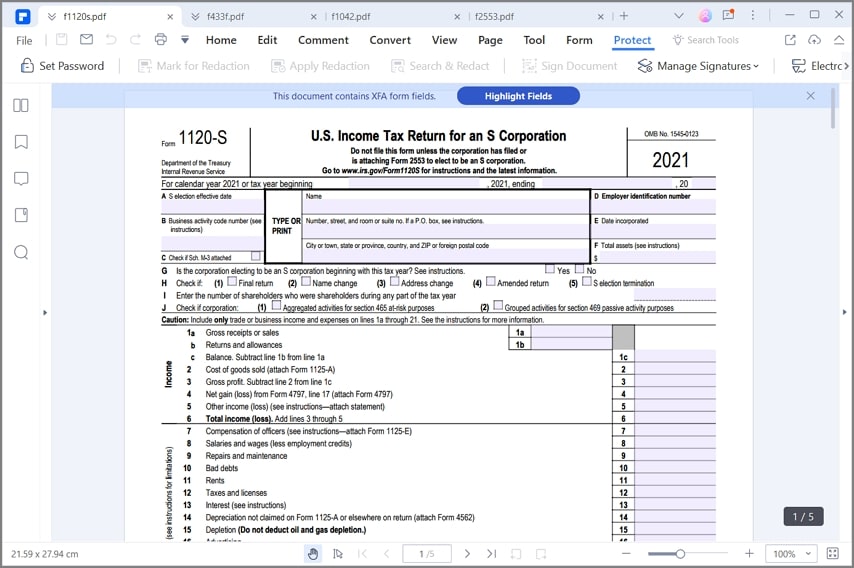

Form 1120 Instructions - Learn how to file, pay, and submit your return, as well as the. Llc that elects c corporation taxation; Bank or other final return, name change, financial institution, attach form 8050, address change, amended. Corporation income tax return, for the 2022 tax year. Web download the latest version of form 1120, a u.s. Web learn how to report your income, gains, losses, deductions, credits and income tax liability with form 1120, a u.s. Ad easy guidance & tools for c corporation tax returns. • form 1120 tutorials for 2022 tax year how to fill out form 1120 for the 2021 tax year. For calendar year 2022 or tax year beginning, 2022, ending. The cancellation of the appropriated retained earnings for cost of treasury stock will result in an increase in. For other form 1120 tutorials, see our playlist below: An extension of time will be void if: The cancellation of the appropriated retained earnings for cost of treasury stock will result in an increase in. Bank or other final return, name change, financial institution, attach form 8050, address change, amended. Ad a tax agent will answer in minutes! Llc that elects c corporation taxation; Questions answered every 9 seconds. Corporation income tax return, for the 2022 tax year. However, an association with a fiscal year ending. • form 1120 tutorials for 2022 tax year how to fill out form 1120 for the 2021 tax year. Learn how to file, submit, and interpret form 1120 with the latest. We will also cover the risks of each form, exempt and. Corporation income tax return, for the 2022 tax year. • form 1120 tutorials for 2022 tax year how to fill out form 1120 for the 2021 tax year. Ia 148 tax credits schedule. Questions answered every 9 seconds. Web download the latest version of form 1120, a u.s. Web you have to file form 1120 if your business is a(n): However, an association with a fiscal year ending. C corporation that doesn’t elect s corporation taxation; For calendar year 2022 or tax year beginning, 2022, ending. An extension of time will be void if: Llc that elects c corporation taxation; Web learn how to report your income, gains, losses, deductions, credits and income tax liability with form 1120, a u.s. For other form 1120 tutorials, see our playlist below: We will also cover the risks of each form, exempt and. Ad signnow.com has been visited by 100k+ users in the past month Web learn how to report your income, gains, losses, deductions, credits and income tax liability with form 1120, a u.s. For calendar year 2022 or tax year beginning, 2022, ending. Corporation income tax return, for the 2022. For other form 1120 tutorials, see our playlist below: Web learn how to report your income, gains, losses, deductions, credits and income tax liability with form 1120, a u.s. Learn how to file, submit, and interpret form 1120 with the latest. The ia 148 tax credits schedule must be. Ad a tax agent will answer in minutes! Bank or other final return, name change, financial institution, attach form 8050, address change, amended. Web see the instructions for form 1120. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Ad easy guidance & tools for c corporation tax returns. Learn how to file, pay, and submit your return, as well as the. For calendar year 2022 or tax year beginning, 2022, ending. The ia 148 tax credits schedule must be. Bank or other final return, name change, financial institution, attach form 8050, address change, amended. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Llc that elects c corporation taxation; Department of the treasury internal revenue service. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Ad a tax agent will answer in minutes! An extension of time will be void if: Llc that elects c corporation taxation; C corporation that doesn’t elect s corporation taxation; Web find the general and specific instructions for form 1120, a tax return for corporations and other entities. Questions answered every 9 seconds. Web learn how to report your income, gains, losses, deductions, credits and income tax liability with form 1120, a u.s. Web you have to file form 1120 if your business is a(n): The cancellation of the appropriated retained earnings for cost of treasury stock will result in an increase in. Bank or other final return, name change, financial institution, attach form 8050, address change, amended. Learn how to file, pay, and submit your return, as well as the. Web download the latest version of form 1120, a u.s. October 05, 2023 tax year 2023 1120 mef ats scenario 4: • form 1120 tutorials for 2022 tax year how to fill out form 1120 for the 2021 tax year. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! We will also cover the risks of each form, exempt and. Llc that elects c corporation taxation; For calendar year 2022 or tax year beginning, 2022, ending. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! For other form 1120 tutorials, see our playlist below: The ia 148 tax credits schedule must be. An extension of time will be void if: Ad signnow.com has been visited by 100k+ users in the past monthIrs Instructions Form 1120s Fillable and Editable PDF Template

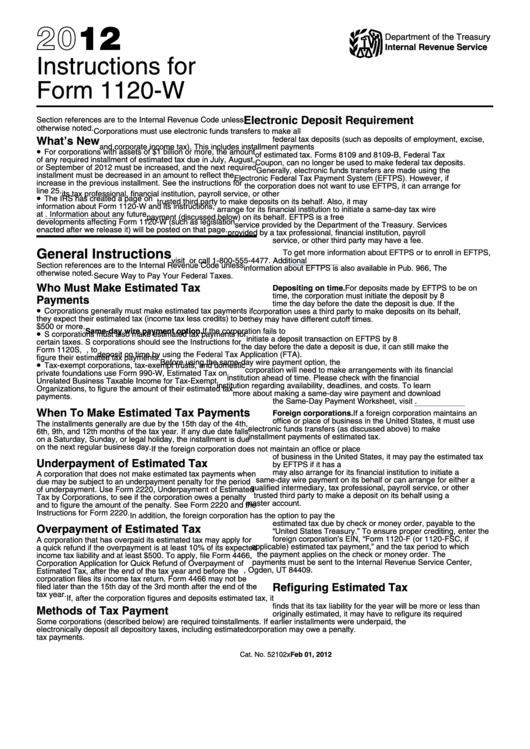

Instructions For Form 1120W 2009 printable pdf download

What is Form 1120S and How Do I File It? Ask Gusto

Instructions For Form 1120Pc 2004 printable pdf download

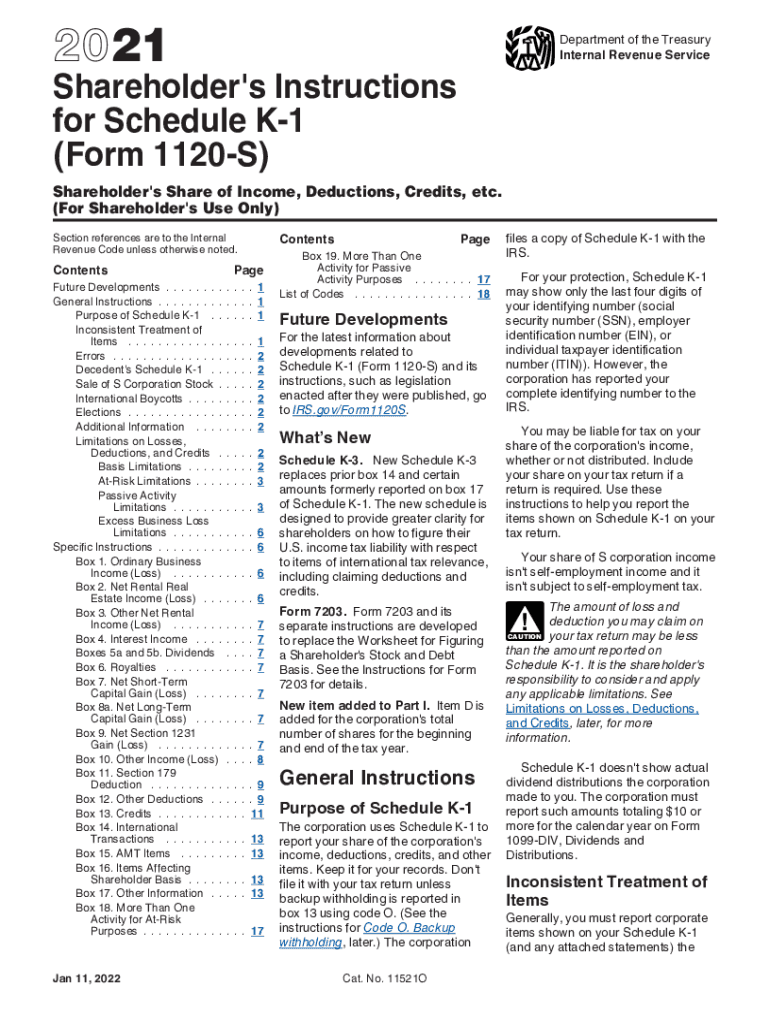

Download Instructions for IRS Form 1120S Schedule K1 Shareholder's

Instructions For Form 1120H 2008 printable pdf download

1120s instructions 2023 PDF Fill online, Printable, Fillable Blank

Instructions For Form 1120W 2012 printable pdf download

IRS Instruction 1120S Schedule K1 20212022 Fill and Sign

Formulaire 1120S de l'IRS Instructions pour le remplir correctement

Related Post: