Form 1116 Amt

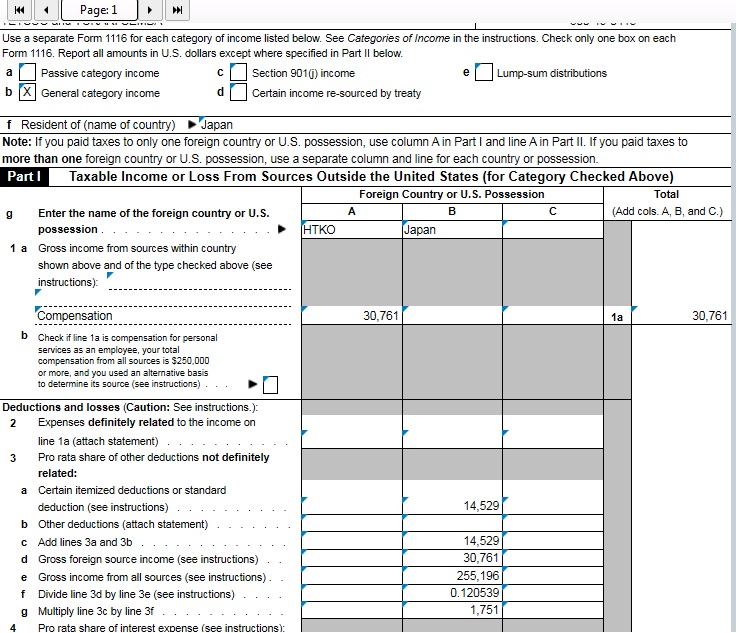

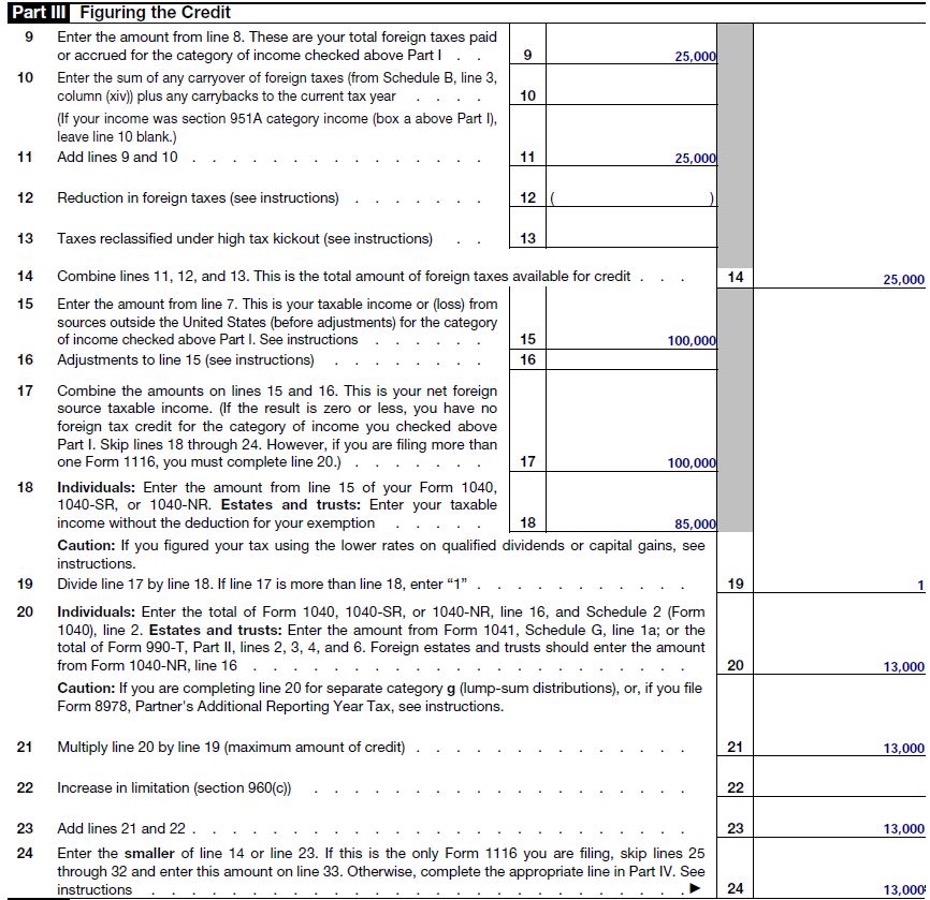

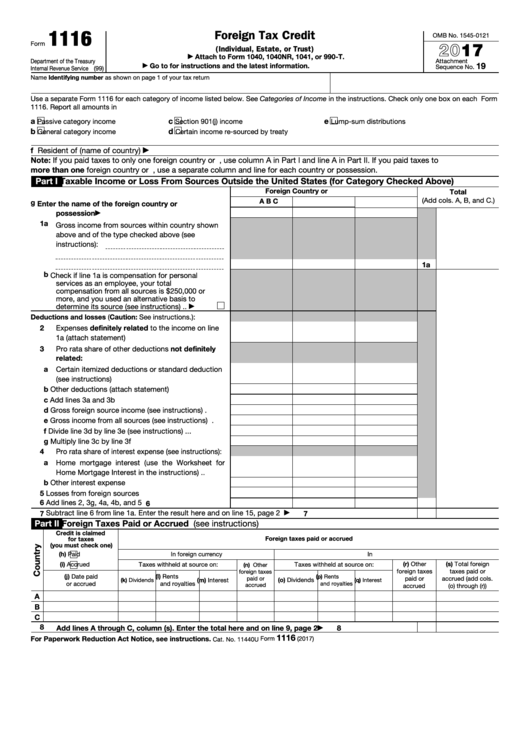

Form 1116 Amt - Web form amt 1116 is a version of form 1116 used for the amt calculation. The alternative minimum tax version of the form 1116 (based on the form 6251 instructions) automatically calculates from. Taxpayers are therefore reporting running balances of. Web form 1116 is one tax form every u.s. Web what is form 1116? Web there are two options for suppressing the form 1116 and form 1116 amt: Solved•by intuit•35•updated june 23, 2023. Streamlined document workflows for any industry. Web 1 1,664 reply bookmark icon anonymous not applicable how much foreign tax are we talking about. Form 1116 is the document that taxpayers use to calculate and claim the foreign tax credit. Web you figure your foreign tax credit and the foreign tax credit limit on form 1116, foreign tax credit. Web 2 best answer danab27 expert alumni gianluca, i just wanted to give you an update. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web starting in. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web there are two options for suppressing the form 1116 and form 1116 amt: Go to screen 35, foreign tax credit (1116). If a return is subject to amt, the form is produced automatically using the information in. Pay the lowest amount of taxes possible with strategic planning and preparation Web you figure your foreign tax credit and the foreign tax credit limit on form 1116, foreign tax credit. You must complete form 1116 in order to claim the foreign tax credit on your us tax return. If a return is subject to amt, the form is produced. As a result, the foreign tax rose. Taxpayers are therefore reporting running balances of. Web what is form 1116? This form serves as a critical tool in ensuring. Web you figure your foreign tax credit and the foreign tax credit limit on form 1116, foreign tax credit. Web starting in tax year 2021, the irs introduced a new form 1116 schedule b to report foreign tax credit carryovers. Foreign tax credit limit your foreign tax credit cannot be. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. Department of the. Web 2 best answer danab27 expert alumni gianluca, i just wanted to give you an update. Pay the lowest amount of taxes possible with strategic planning and preparation Department of the treasury internal revenue service. We reviewed your tokens and will be sending this to the developers. Web you figure your foreign tax credit and the foreign tax credit limit. Go to screen 35, foreign tax credit (1116). Web i seem to have a similar situation where page 2 of 116 multiplier = 1.0 in both cases. Web you figure your foreign tax credit and the foreign tax credit limit on form 1116, foreign tax credit. 19 name identifying number as shown on page 1. Web form 1116 is one. Web 1 1,664 reply bookmark icon anonymous not applicable how much foreign tax are we talking about. Department of the treasury internal revenue service. Web what is form 1116? As a result, the foreign tax rose. Web you figure your foreign tax credit and the foreign tax credit limit on form 1116, foreign tax credit. The alternative minimum tax version of the form 1116 (based on the form 6251 instructions) automatically calculates from. If a return is subject to amt, the form is produced automatically using the information in form 1116. This form serves as a critical tool in ensuring. Expat should learn to love, because it’s one of two ways americans working overseas can. Solved•by intuit•35•updated june 23, 2023. Department of the treasury internal revenue service. We reviewed your tokens and will be sending this to the developers. Web 1 1,664 reply bookmark icon anonymous not applicable how much foreign tax are we talking about. Foreign tax credit limit your foreign tax credit cannot be. Go to screen 35, foreign tax credit (1116). Solved•by intuit•35•updated june 23, 2023. Expat should learn to love, because it’s one of two ways americans working overseas can lower their u.s. Web schedule b (form 1116) (december 2021) foreign tax carryover reconciliation schedule department of the treasury internal revenue service see separate. The alternative minimum tax version of the form 1116 (based on the form 6251 instructions) automatically calculates from. You must complete form 1116 in order to claim the foreign tax credit on your us tax return. Taxpayers are therefore reporting running balances of. Web i seem to have a similar situation where page 2 of 116 multiplier = 1.0 in both cases. Web form amt 1116 is a version of form 1116 used for the amt calculation. We reviewed your tokens and will be sending this to the developers. This form serves as a critical tool in ensuring. Form 1116 is the document that taxpayers use to calculate and claim the foreign tax credit. Web 2 best answer danab27 expert alumni gianluca, i just wanted to give you an update. Web form 1116 is one tax form every u.s. Web common questions for form 1116 in proseries. Foreign tax credit limit your foreign tax credit cannot be. Basically, the 5% ratio is the amount from the qualified dividends & capital gain tax worksheet, line. As a result, the foreign tax rose. Streamlined document workflows for any industry. Web how does the amt form 1116 calculate?How can I add Form 1116? General Chat ATX Community

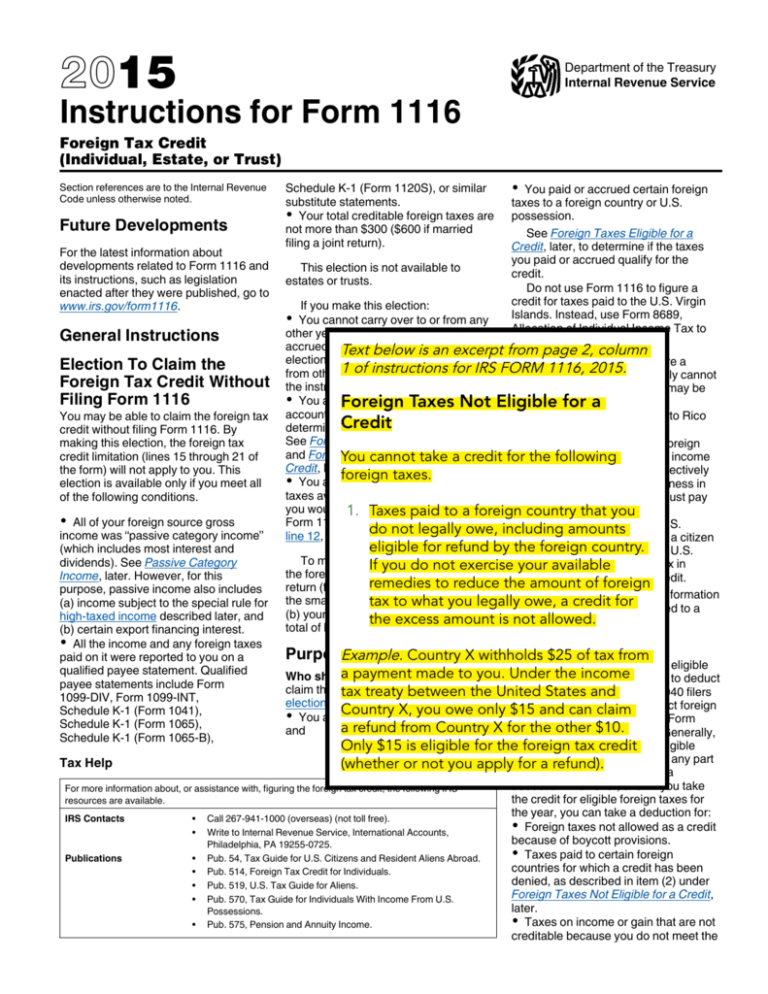

Instructions for Form 1116

Are capital loss deductions included on Form 1116 for Deductions and

Foreign Tax Credit Form 1116 Instructions

Fillable Form 1116 Foreign Tax Credit (Individual, Estate, Or Trust

Publication 514 Foreign Tax Credit for Individuals; Simple Example

To determine the reduction, the 1116 instructions direct you to

f1116_AMT.pdf DocDroid

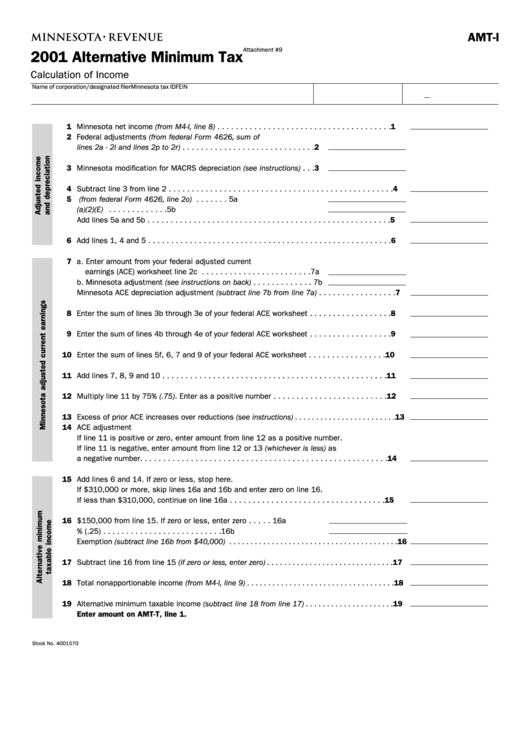

Form Amt I 2001 Alternative Minimum Tax printable pdf download

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Related Post: