Form 1065 Schedule M 3 Instructions

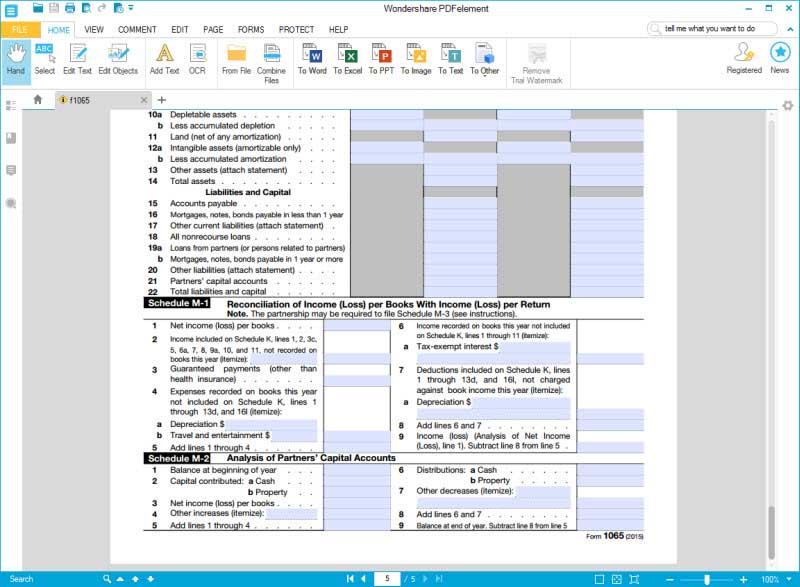

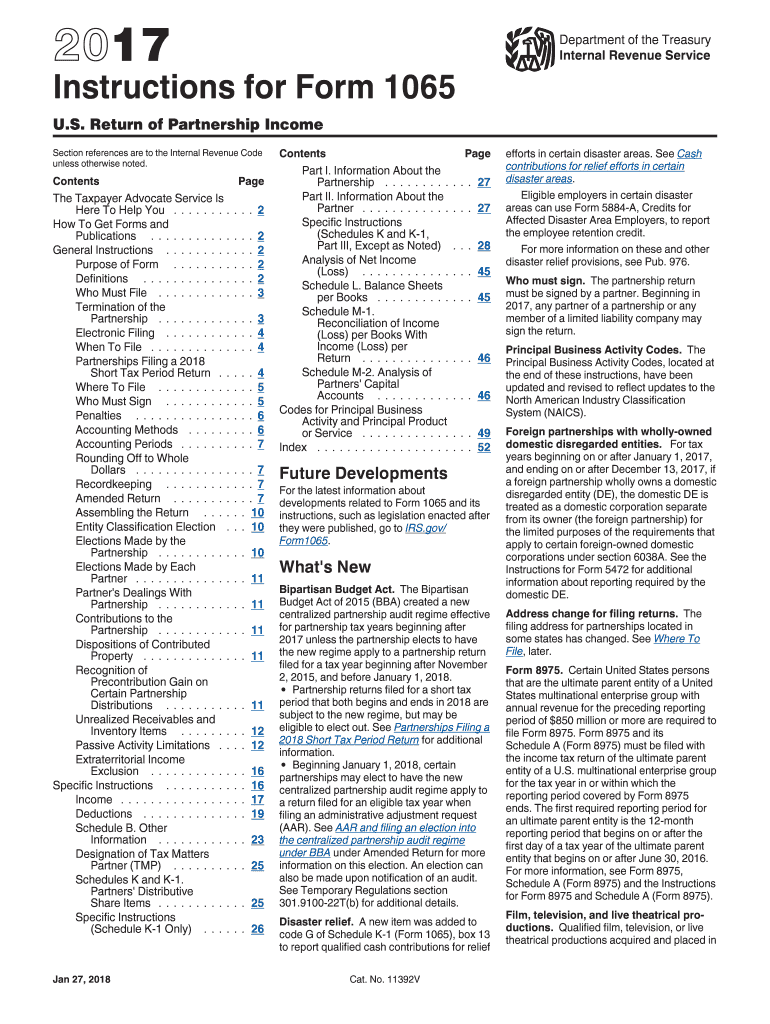

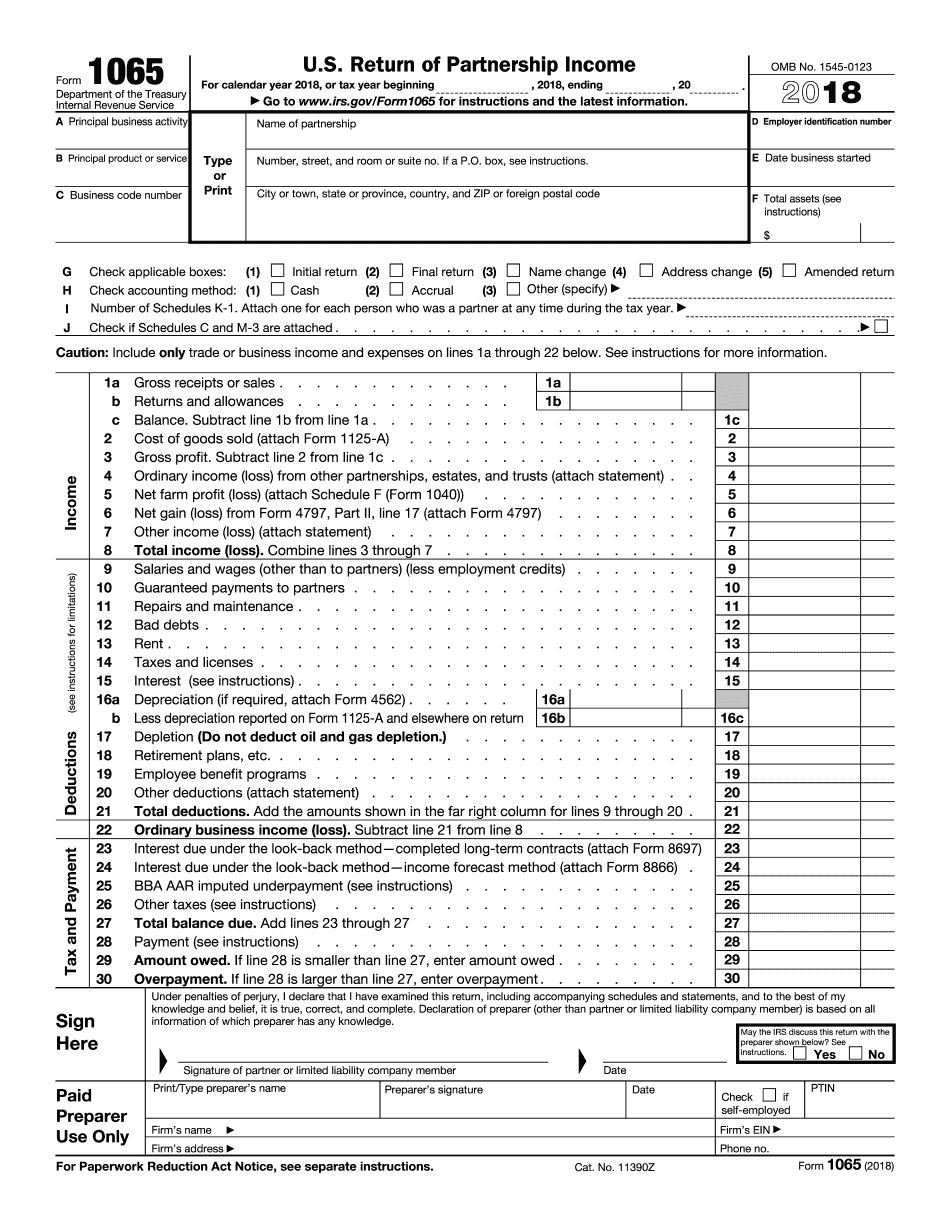

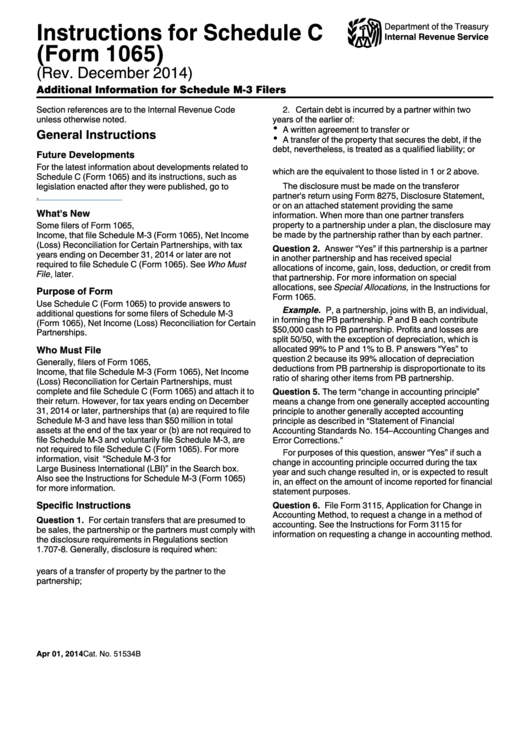

Form 1065 Schedule M 3 Instructions - Web some filers of form 1065, u.s. December 2021) net income (loss) reconciliation for certain partnerships department of the treasury internal revenue service attach to. A partnership must complete parts ii and iii if ending total assets are $50 million or more. Complete, edit or print tax forms instantly. Web go to www.irs.gov/form1065 for instructions and the latest information. Web schedule b, question 6; December 2021) department of the treasury internal revenue service net income (loss) reconciliation for certain partnerships attach to. What is the form used for? Web updated 1 year ago. Web some filers of form 1065, u.s. If the partnership's principal business, office, or agency is. Web updated 1 year ago. Web small business irs form 1065 instructions: Web on november 5, 2022, p reports to k, as it is required to do, that p is a reportable entity partner as of october 16, 2022, deemed to own (under these. Taxact® business 1065 (2022 online edition) is. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web schedule b, question 6; Web some filers of form 1065, u.s. Web some filers of form 1065, u.s. For additional details about the. Ad access irs tax forms. Web on november 5, 2022, p reports to k, as it is required to do, that p is a reportable entity partner as of october 16, 2022, deemed to own (under these. If the partnership's principal business, office, or agency is. Who must file any entity that files form 1065 must file. Complete, edit or. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Taxact® business 1065 (2022 online edition) is the easiest way to file a 1065! Web on november 5, 2022, p reports to k, as it is required to do, that p is a reportable entity partner as of october 16, 2022, deemed. Complete, edit or print tax forms instantly. What is the form used for? December 2021) department of the treasury internal revenue service net income (loss) reconciliation for certain partnerships attach to. December 2021) net income (loss) reconciliation for certain partnerships department of the treasury internal revenue service attach to. Web updated 1 year ago. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Taxact® business 1065 (2022 online edition) is the easiest way to file a 1065! If the partnership's principal business, office, or agency is. Web some filers of form 1065, u.s. Web some filers of form 1065, u.s. Web some filers of form 1065, u.s. A partnership must complete parts ii and iii if ending total assets are $50 million or more. Web go to www.irs.gov/form1065 for instructions and the latest information. Taxact® business 1065 (2022 online edition) is the easiest way to file a 1065! December 2021) department of the treasury internal revenue service net income (loss). Web small business irs form 1065 instructions: Who must file any entity that files form 1065 must file. December 2021) department of the treasury internal revenue service net income (loss) reconciliation for certain partnerships attach to. Web on november 5, 2022, p reports to k, as it is required to do, that p is a reportable entity partner as of. Get ready for tax season deadlines by completing any required tax forms today. Web some filers of form 1065, u.s. If the partnership's principal business, office, or agency is. Web some filers of form 1065, u.s. December 2021) department of the treasury internal revenue service net income (loss) reconciliation for certain partnerships attach to. What is the form used for? For additional details about the. Get ready for tax season deadlines by completing any required tax forms today. Web small business irs form 1065 instructions: Who must file any entity that files form 1065 must file. Web go to www.irs.gov/form1065 for instructions and the latest information. Who must file any entity that files form 1065 must file. Complete, edit or print tax forms instantly. December 2021) department of the treasury internal revenue service net income (loss) reconciliation for certain partnerships attach to. If the partnership's principal business, office, or agency is. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web small business irs form 1065 instructions: Web schedule b, question 6; Web some filers of form 1065, u.s. What is the form used for? Web some filers of form 1065, u.s. For additional details about the. Get ready for tax season deadlines by completing any required tax forms today. Taxact® business 1065 (2022 online edition) is the easiest way to file a 1065! December 2021) net income (loss) reconciliation for certain partnerships department of the treasury internal revenue service attach to. A partnership must complete parts ii and iii if ending total assets are $50 million or more. Web on november 5, 2022, p reports to k, as it is required to do, that p is a reportable entity partner as of october 16, 2022, deemed to own (under these. Web updated 1 year ago. Ad access irs tax forms.Form 1065 (Schedule M3) Net (Loss) Reconciliation for Certain

IRS Form 1065 How to fill it With the Best Form Filler

Form 1065 Instructions Fill Out and Sign Printable PDF Template signNow

How to fill out an LLC 1065 IRS Tax form

Form 1065 2018 2019 Blank Sample to Fill out Online in PDF

Instructions For Schedule C (Form 1065) Additional Information For

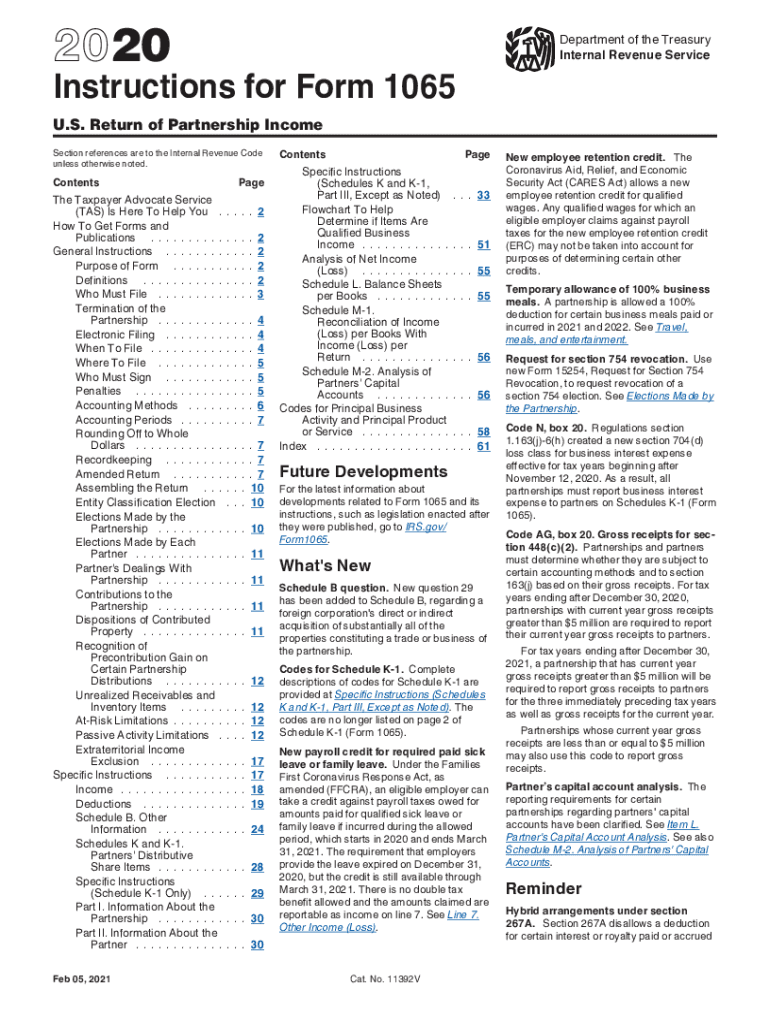

2020 Form IRS Instructions 1065 Fill Online, Printable, Fillable, Blank

Fill Free fillable Form 1065 schedule M3 2019 PDF form

1065 tax instructions gridlasopa

Schedule M 3 Instructions 1065 Blank Sample to Fill out Online in PDF

Related Post: