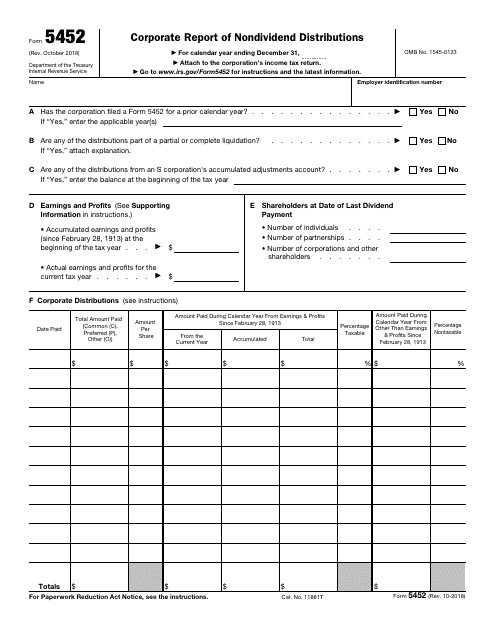

Irs Form 5452

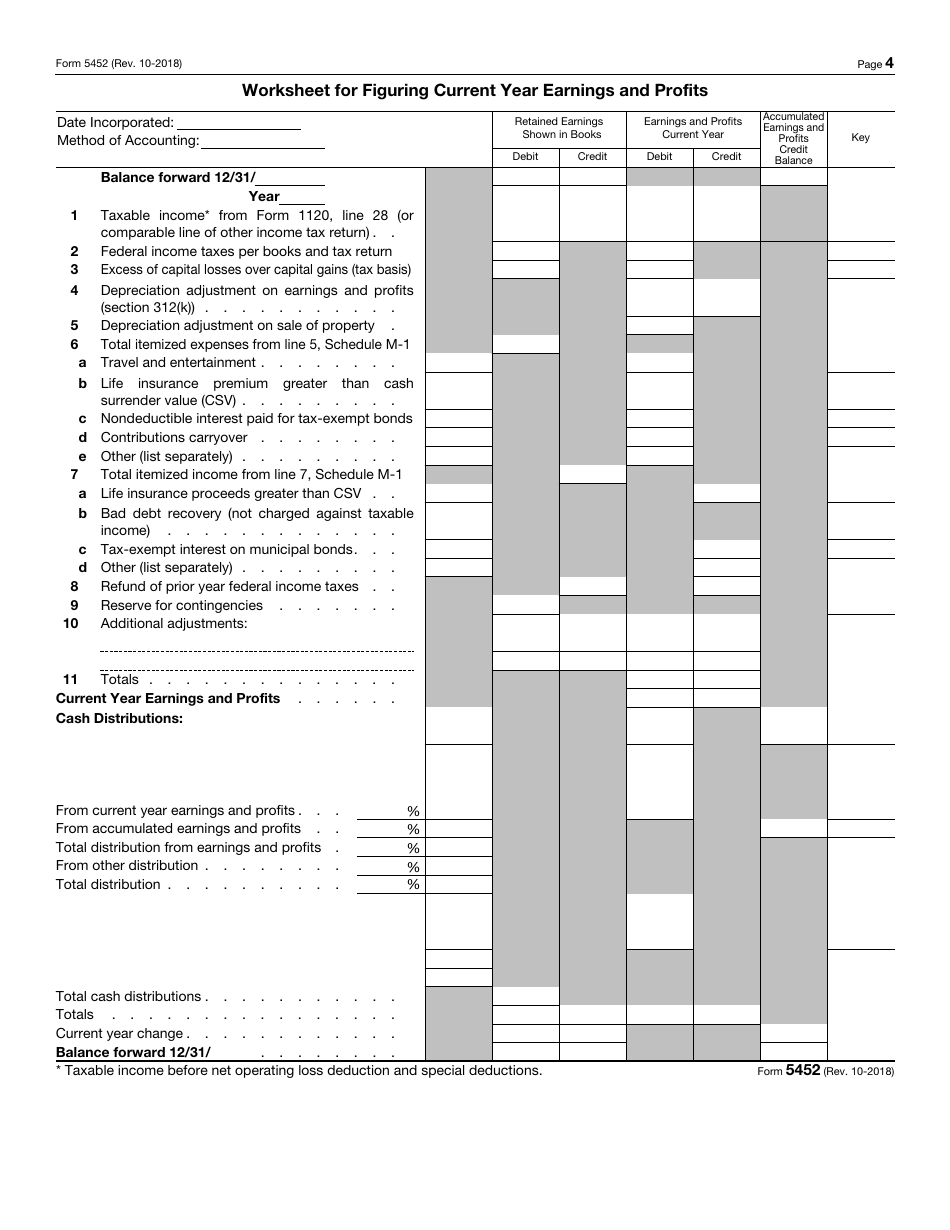

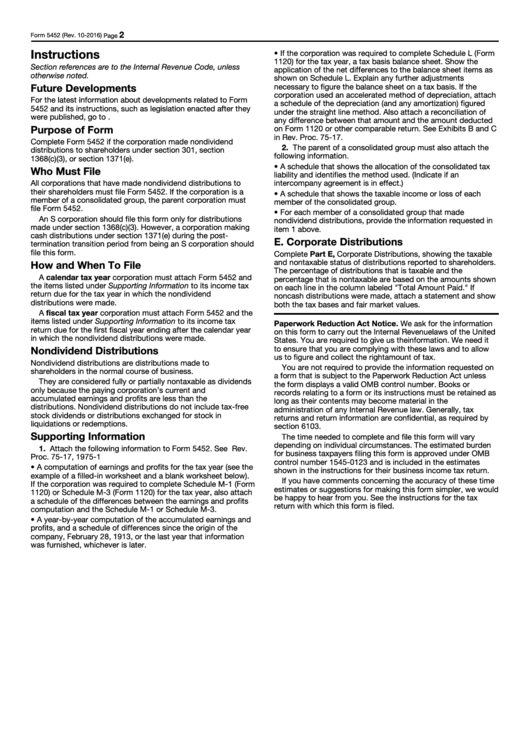

Irs Form 5452 - Web of the premium tax credit were made, you must file a 2018 tax return and form 8962, premium tax credit, even if you are otherwise not required to file. Form 5452, corporate report of nondividend distributions, is used to report nondividend. Web the corporation are required to file form 5452, corporate report of nondividend distributions, with their tax returns when filed with the internal revenue service (irs). For example, the required tax year for an s corporation is the calendar year, ending on december 31. Corporate report of nondividend distributions. For calendar year ending december. Web • the close of the first required tax year ending within such a year. Ad we help get taxpayers relief from owed irs back taxes. Web form 9452 (2011) page. Estimate how much you could potentially save in just a matter of minutes. An s corporation should file this form when distributions are made under. Web form 9452 (2011) page. A calendar tax year corporation must file form 5452 with its income tax return for the tax year in which the. Web of the premium tax credit were made, you must file a 2018 tax return and form 8962, premium tax credit, even. October 2018) department of the treasury internal revenue service. Ad we help get taxpayers relief from owed irs back taxes. For calendar year ending december. Corporate report of nondividend distributions. Web form 5462 is used by corporations to report nondividend distributions to their shareholders under section 301, section 1368(c)(3), or section 1371(e). Web (the e&p study is documented on irs form 5452, corporate report of nondividend distributions, which rsi would include as a part of its tax year 2017 u.s. Web if the corporation is a member of a consolidated group, the parent corporation must file form 5452. If you are an owner in a c corporation, you know all too well. Ad save time and money with professional tax planning & preparation services. Web of the premium tax credit were made, you must file a 2018 tax return and form 8962, premium tax credit, even if you are otherwise not required to file. Ad we help get taxpayers relief from owed irs back taxes. October 2018) department of the treasury internal. Corporate report of nondividend distributions. October 2018) department of the treasury internal revenue service. Web acknowledgement of termination of s status by filing form 5452, corporate report of nondividend distributions , on the same day as any distribution of any. Web we last updated the corporate report of nondividend distributions in february 2023, so this is the latest version of. For calendar year ending december. An s corporation should file this form when distributions are made under. Web complete form 5452 if the corporation made nondividend distributions to shareholders under section 301, section 1368(c)(3), or section 1371(e). Web complete form 5452 if the corporation made nondividend distributions to shareholders under section 301, section 1368(c)(3), or section 1371(e). Web • the. Web the corporation are required to file form 5452, corporate report of nondividend distributions, with their tax returns when filed with the internal revenue service (irs). Web of the premium tax credit were made, you must file a 2018 tax return and form 8962, premium tax credit, even if you are otherwise not required to file. Web • the close. Maximize your tax return by working with experts in the field Web if the corporation is a member of a consolidated group, the parent corporation must file form 5452. For example, the required tax year for an s corporation is the calendar year, ending on december 31. Web the corporation are required to file form 5452, corporate report of nondividend. Web complete form 5452 if nondividend distributions are made to shareholders under section 301, section 1368(c)(3), or section 1371(e). Estimate how much you could potentially save in just a matter of minutes. Web we last updated the corporate report of nondividend distributions in february 2023, so this is the latest version of form 5452, fully updated for tax year 2022.. For calendar year ending december. Social security benefits purpose of form. Web we last updated the corporate report of nondividend distributions in february 2023, so this is the latest version of form 5452, fully updated for tax year 2022. For calendar year ending december. October 2018) department of the treasury internal revenue service. October 2018) department of the treasury internal revenue service. Web we last updated the corporate report of nondividend distributions in february 2023, so this is the latest version of form 5452, fully updated for tax year 2022. Web the form breaks total distributions down into taxable and nontaxable categories. For calendar year ending december. Web acknowledgement of termination of s status by filing form 5452, corporate report of nondividend distributions , on the same day as any distribution of any. Web complete form 5452 if the corporation made nondividend distributions to shareholders under section 301, section 1368(c)(3), or section 1371(e). Web if the corporation is a member of a consolidated group, the parent corporation must file form 5452. Web (the e&p study is documented on irs form 5452, corporate report of nondividend distributions, which rsi would include as a part of its tax year 2017 u.s. Corporate report of nondividend distributions. If you are an owner in a c corporation, you know all too well the double taxation issues. October 2016) department of the treasury internal revenue service. For calendar year ending december. Social security benefits purpose of form. Form 5452, corporate report of nondividend distributions, is used to report nondividend. Maximize your tax return by working with experts in the field Web fill online, printable, fillable, blank corporate report of nondividend distributions form 5452 form. Actual earnings and profits for the current tax year. Ad save time and money with professional tax planning & preparation services. An s corporation should file this form when distributions are made under. For example, the required tax year for an s corporation is the calendar year, ending on december 31.IRS Form 8868 Fill Out, Sign Online and Download Fillable PDF

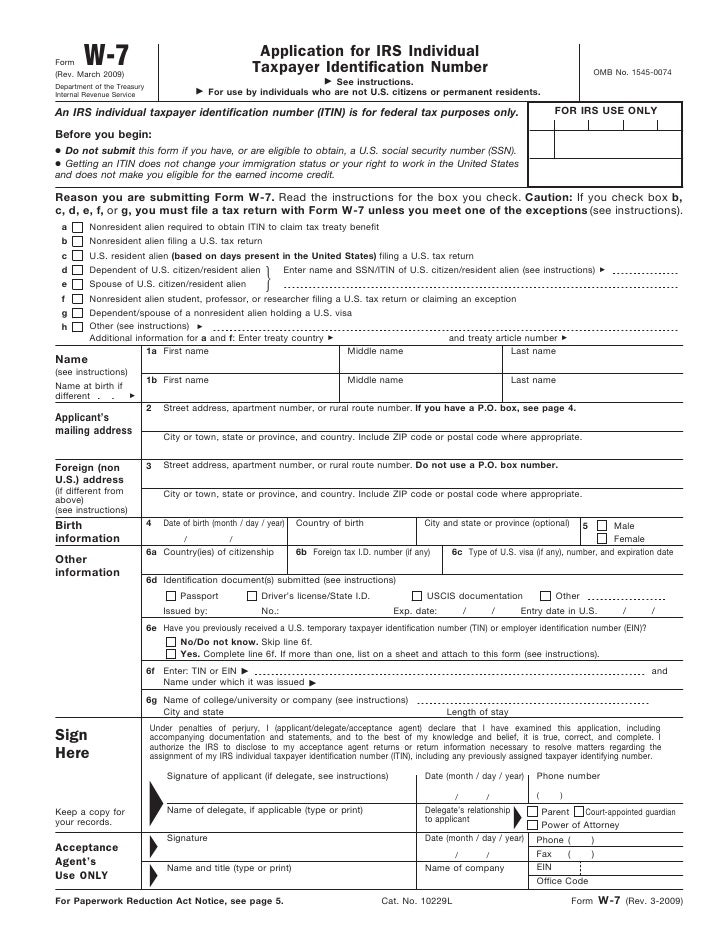

Form W7_Application for IRS Individual Taxpayer Identification Number

Form 5452 Corporate Report of Nondividend Distributions (2006) Free

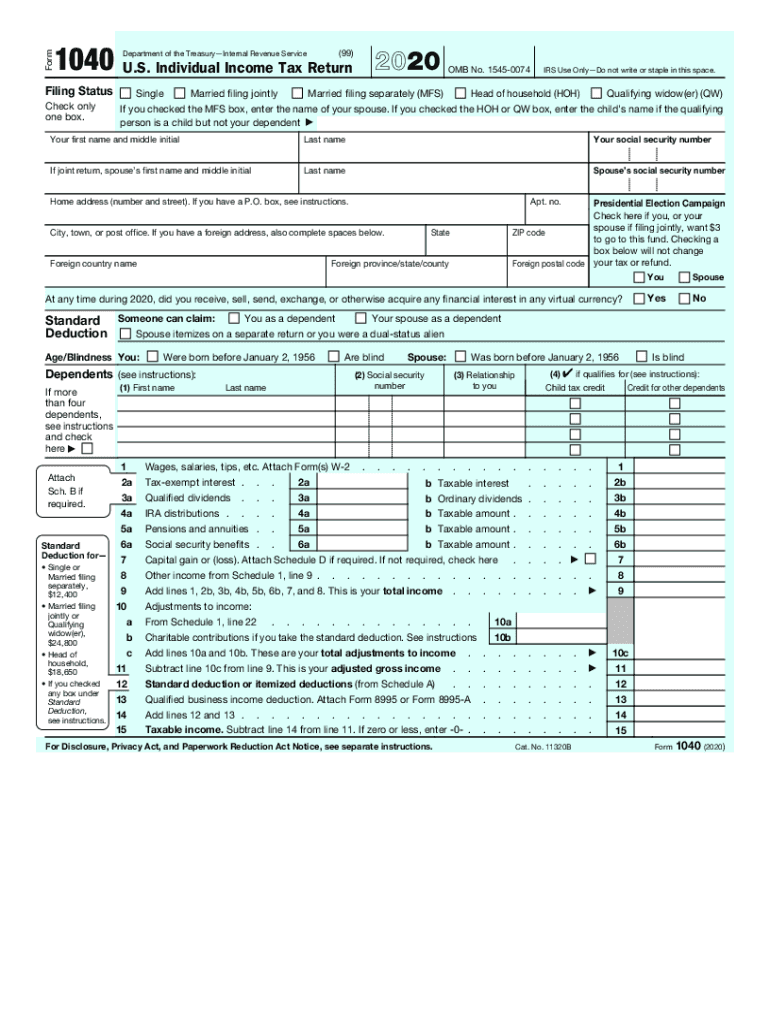

IRS 1040 20202022 Fill out Tax Template Online US Legal Forms

IRS Form 5452 Fill Out, Sign Online and Download Fillable PDF

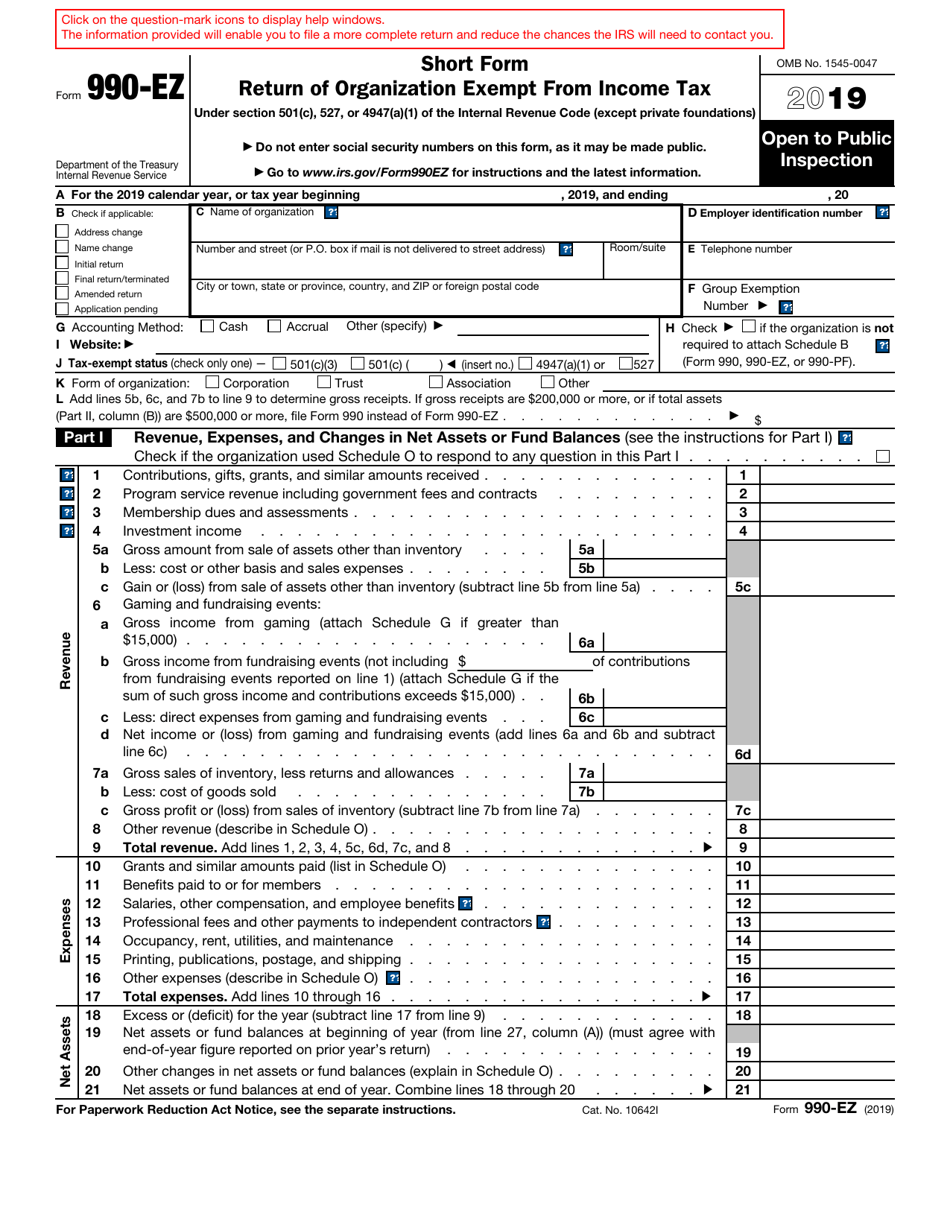

Internal Revenue Fill Online, Printable, Fillable, Blank pdfFiller

Irs Form W4V Printable where do i mail my w 4v form for social

IRS Form 5452 Download Fillable PDF or Fill Online Corporate Report of

Form 5452 ≡ Fill Out Printable PDF Forms Online

Instructions For Form 5452 Corporate Report Of Nondividend

Related Post: