Tax Form 8915

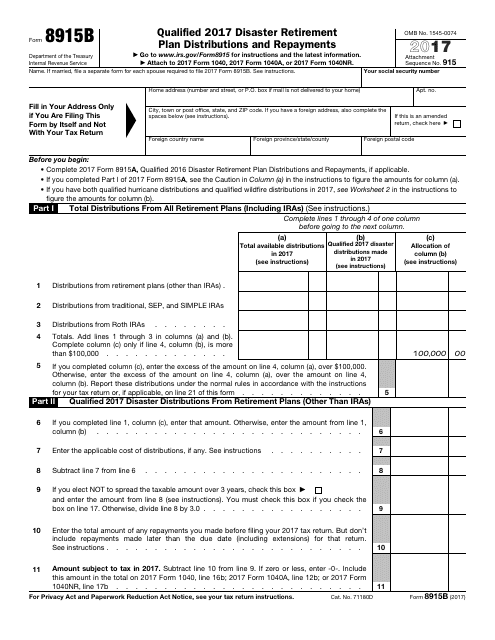

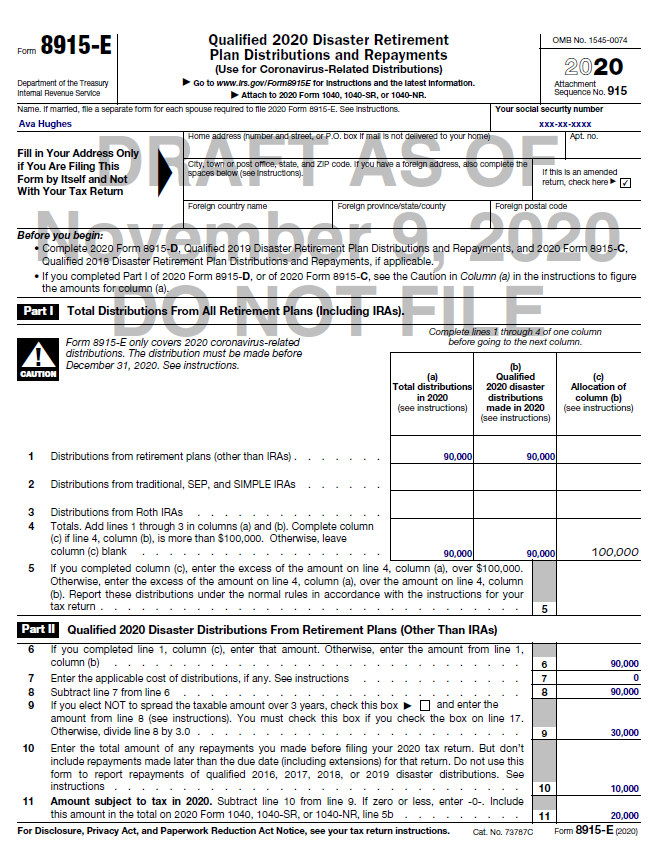

Tax Form 8915 - Qualified 2020 disaster retirement plan distributions and repayments. Web open or continue your return in turbotax. Web a qualified distribution (or any portion thereof) not repaid before june 26, 2021, may be taxable in the year of the distribution, which may be 2020 (or even 2019;. In the left menu, select tax tools and then tools. Web submit your completed form and attachments by: Used to file a return with the county treasurer for property subject to the. In tax year 2020 this form is used to elect to spread the distributions over. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. Get ready for tax season deadlines by completing any required tax forms today. Individual estimated tax payment booklet. Web open or continue your return in turbotax. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. Complete, edit or print tax forms instantly. In tax year 2020 this form is used to elect to spread the distributions over. Web submit your completed form and attachments by: Returns prepared in 2021 ultratax/1040 will proforma these. I can't even get to the part where i have the last 3rd of my 2020 disaster distribution (covid). Get ready for tax season deadlines by completing any required tax forms today. In tax year 2020 this form is used to elect to spread the distributions over. Complete, edit or print tax. Returns prepared in 2021 ultratax/1040 will proforma these. Complete, edit or print tax forms instantly. Qualified 2020 disaster retirement plan distributions and repayments. Web submit your completed form and attachments by: Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. In the left menu, select tax tools and then tools. Qualified 2020 disaster retirement plan distributions and repayments. Web submit your completed form and attachments by: Web a qualified distribution (or any portion thereof) not repaid before june 26, 2021, may be taxable in the year of. Qualified 2020 disaster retirement plan distributions and repayments. Department of the treasury internal revenue service. In tax year 2020 this form is used to elect to spread the distributions over. Web open or continue your return in turbotax. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Individual estimated tax payment booklet. Web a qualified distribution (or any portion thereof) not repaid before june 26, 2021, may be taxable in the year of the distribution, which may be 2020 (or even 2019;. Get ready for tax season deadlines by completing any required tax forms today. Qualified 2020 disaster retirement plan. Used to file a return with the county treasurer for property subject to the. Web the 2017 tax return. Get ready for tax season deadlines by completing any required tax forms today. Web 62 rows on november 19, 2022, you make a repayment of $65,000. Individual estimated tax payment booklet. In tax year 2020 this form is used to elect to spread the distributions over. Complete, edit or print tax forms instantly. Returns prepared in 2021 ultratax/1040 will proforma these. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. In the left menu, select tax tools and then tools. Get ready for tax season deadlines by completing any required tax forms today. Web open or continue your return in turbotax. Complete, edit or print tax forms instantly. Web submit your completed form and attachments by: Individual estimated tax payment booklet. Individual estimated tax payment booklet. Get ready for tax season deadlines by completing any required tax forms today. Web open or continue your return in turbotax. Qualified 2020 disaster retirement plan distributions and repayments. Complete, edit or print tax forms instantly. Returns prepared in 2021 ultratax/1040 will proforma these. Get ready for tax season deadlines by completing any required tax forms today. Qualified 2020 disaster retirement plan distributions and repayments. Web the 2017 tax return. In the left menu, select tax tools and then tools. Department of the treasury internal revenue service. Web submit your completed form and attachments by: I can't even get to the part where i have the last 3rd of my 2020 disaster distribution (covid). For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. Individual estimated tax payment booklet. Web open or continue your return in turbotax. In tax year 2020 this form is used to elect to spread the distributions over. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web 62 rows on november 19, 2022, you make a repayment of $65,000. Used to file a return with the county treasurer for property subject to the. Web a qualified distribution (or any portion thereof) not repaid before june 26, 2021, may be taxable in the year of the distribution, which may be 2020 (or even 2019;.IRS Form 8915B Download Fillable PDF or Fill Online Qualified 2017

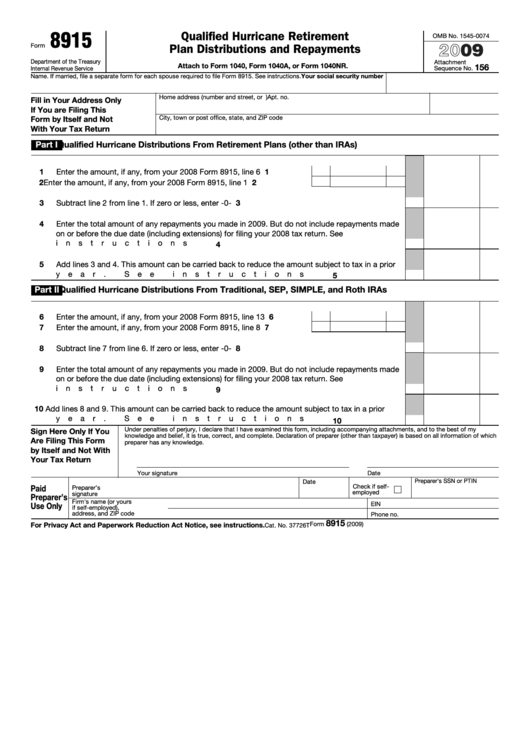

Form 8915 Qualified Hurricane Retirement Plan Distributions and

2022 Form IRS 8915C Fill Online, Printable, Fillable, Blank pdfFiller

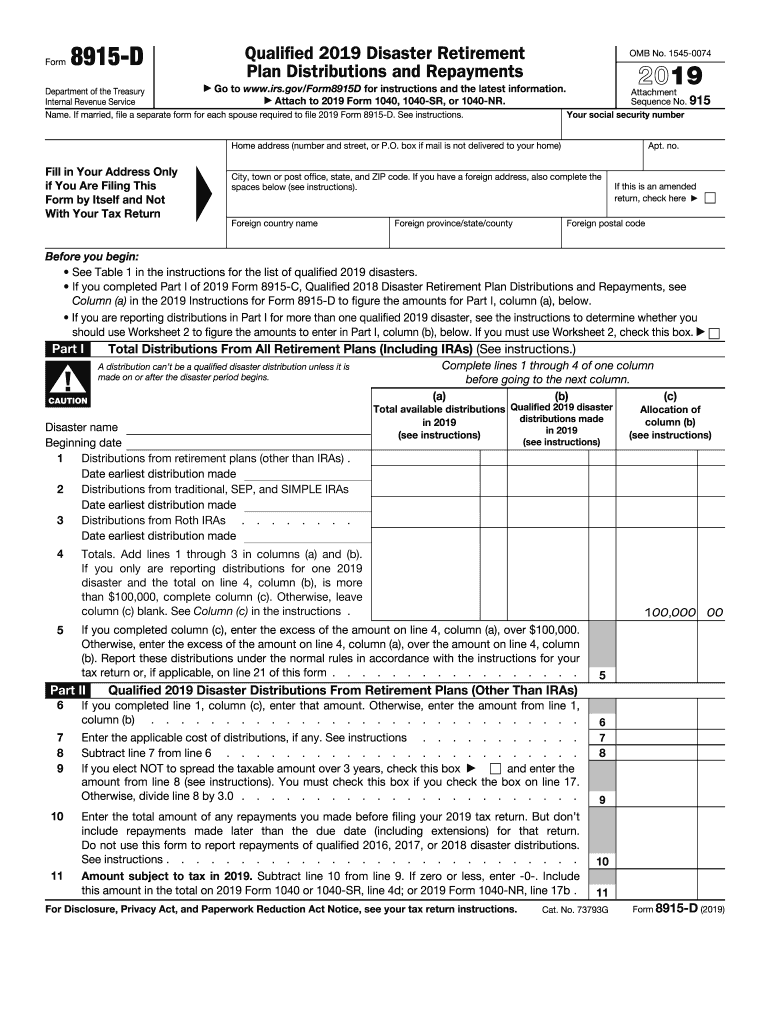

8915 D Form Fill Out and Sign Printable PDF Template signNow

8915e tax form instructions Somer Langley

form 8915 e instructions turbotax Renita Wimberly

Fillable Form 8915 Qualified Hurricane Retirement Plan Distributions

8915 F 2020 Coronavirus Distributions for 2021 Tax Returns YouTube

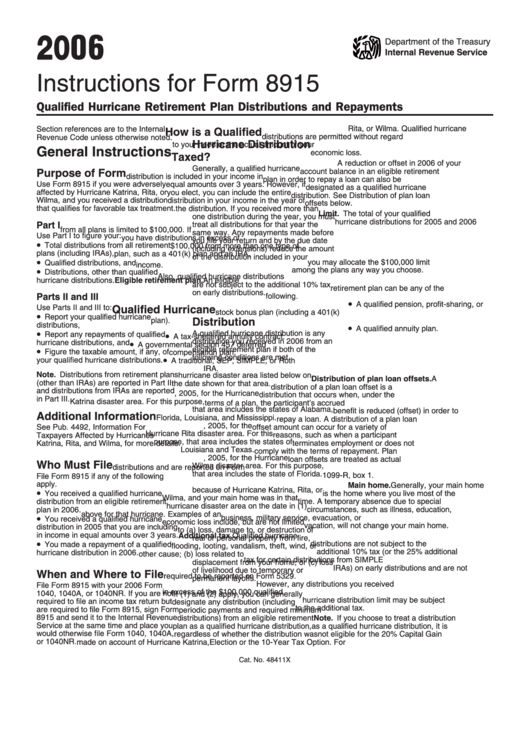

Instructions For Form 8915 2006 printable pdf download

National Association of Tax Professionals Blog

Related Post: