Form 1041 Schedule D

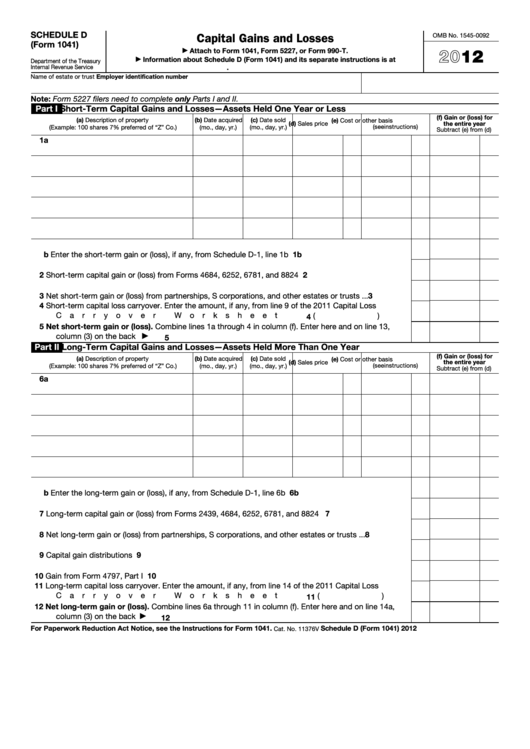

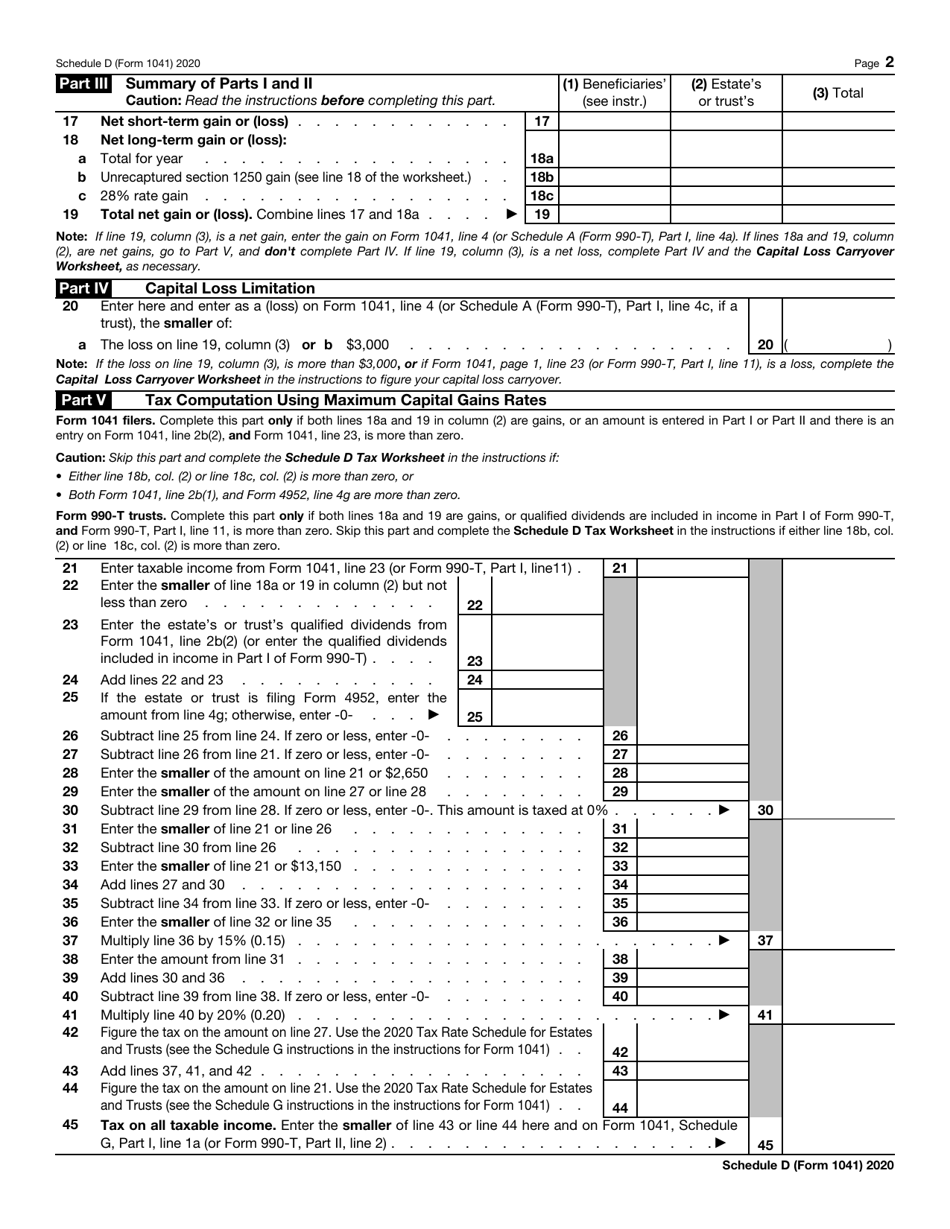

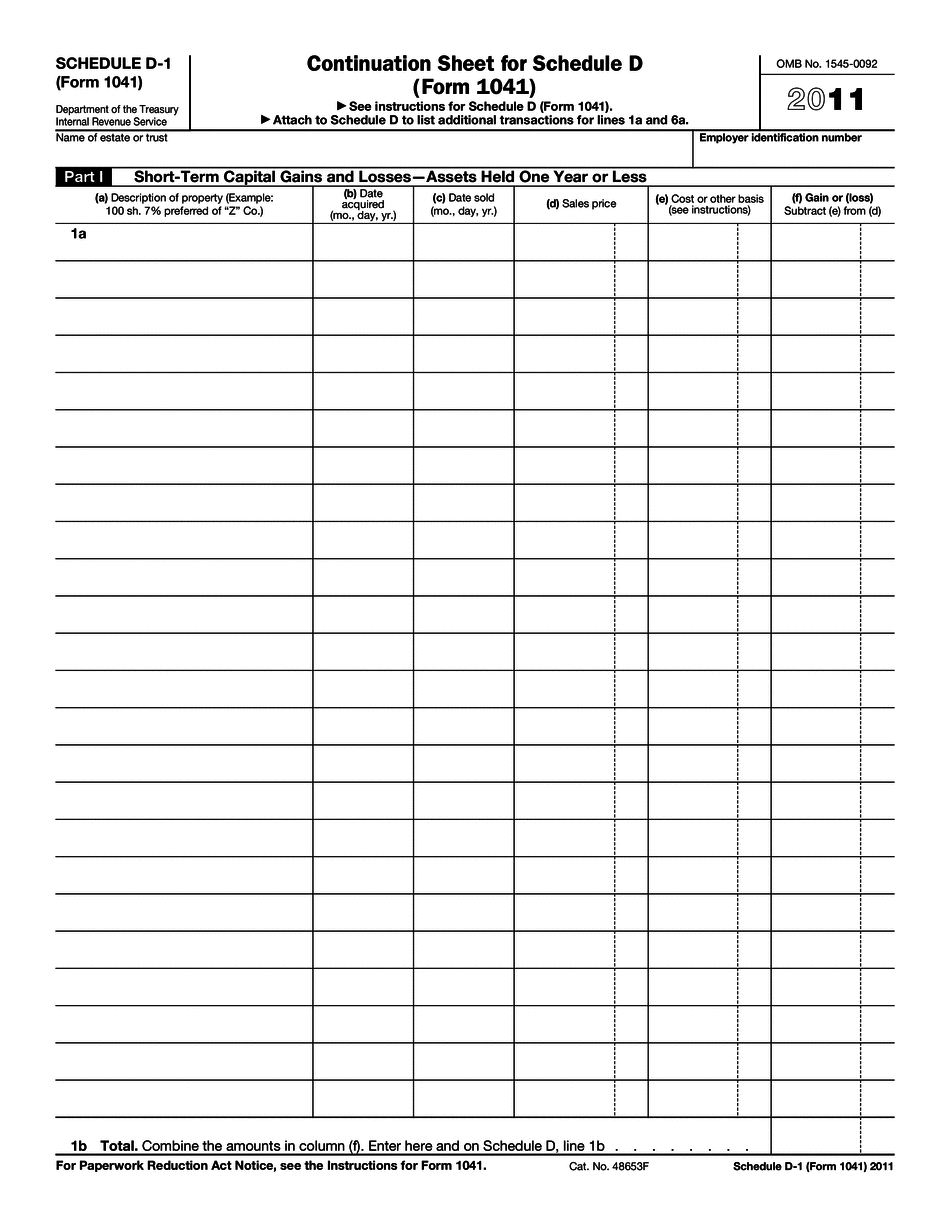

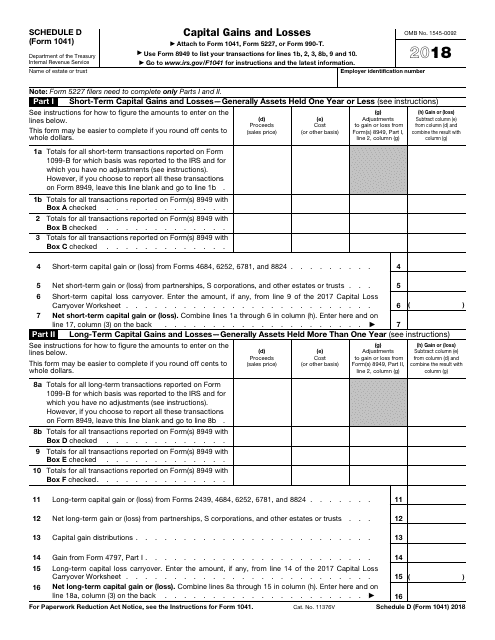

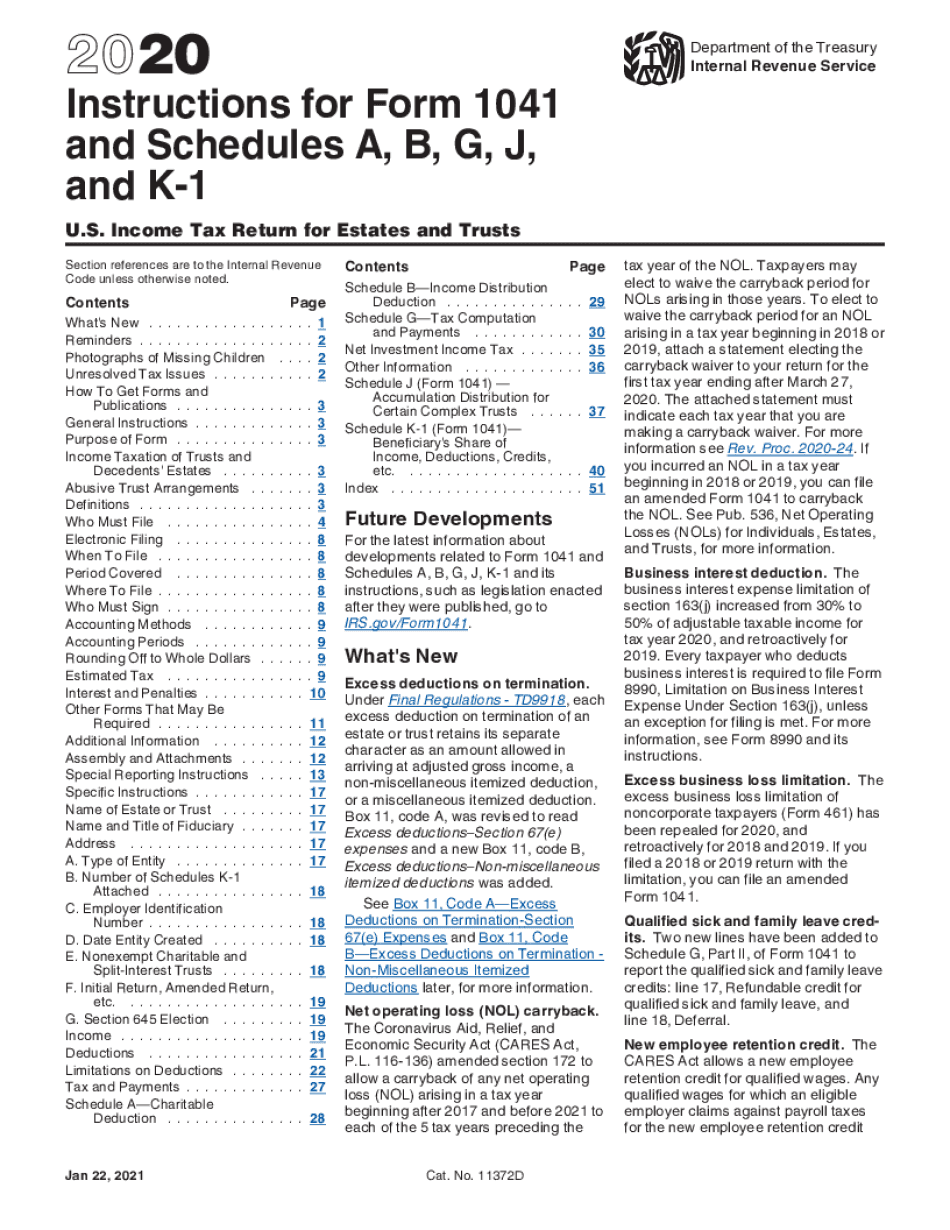

Form 1041 Schedule D - Web use form 1041 schedule d to report gains or losses from capital assets associated with an estate or trust. Decedent’s estate simple trust complex trust qualified disability trust esbt (s portion only) grantor type trust bankruptcy estate—ch. Net operating loss carryover —. Form 1041 schedule d is a supplement to form 1041. Web these instructions explain how to complete schedule d (form 1041). Ad access irs tax forms. Web schedule d (form 1041) department of the treasury internal revenue service. Web a check all that apply: Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Income tax return for estates and trusts. Web use this worksheet to figure the estate’s or trust’s tax if line 14a, column (2), or line 15, column (2), of schedule d or form 1041, line 22 is zero or less; June 2011) department of the treasury—internal. Department of the treasury—internal revenue service. Complete form 8949 before you complete line 1b,. Web the schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. Line 5 of the wksht. (form 1040) department of the treasury internal revenue service. Complete, edit or print tax forms instantly. The sale or exchange of a capital asset not reported. Use schedule d to report. Web use this worksheet to figure the estate’s or trust’s tax if line 14a, column (2), or line 15, column (2), of schedule d or form 1041, line 22 is zero or less; Web limitations on deductions schedule a—charitable deduction schedule b—income distribution deduction schedule g—tax computation and payments schedule j. Decedent’s estate simple trust. Web updated april 30, 2023 reviewed by lea d. Ad access irs tax forms. Web use form 1041 schedule d to report gains or losses from capital assets associated with an estate or trust. Web use this worksheet to figure the estate’s or trust’s tax if line 14a, column (2), or line 15, column (2), of schedule d or form. Complete, edit or print tax forms instantly. Web use this worksheet to figure the estate’s or trust’s tax if line 14a, column (2), or line 15, column (2), of schedule d or form 1041, line 22 is zero or less; Form 1041 schedule d is a supplement to form 1041. For instructions and the latest. Web complete schedule d (form. Web a check all that apply: Web schedule d (form 941): Get ready for tax season deadlines by completing any required tax forms today. Web updated april 30, 2023 reviewed by lea d. Income tax return for estates and trusts? Use schedule d to report the following. Form 1041 schedule d is a supplement to form 1041. For instructions and the latest. Report of discrepancies caused by acquisitions, statutory mergers, or consolidations (rev. Get ready for tax season deadlines by completing any required tax forms today. Uradu fact checked by amanda jackson what is form 1041: Get ready for tax season deadlines by completing any required tax forms today. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. You can download or print. Web updated april 30, 2023 reviewed by lea d. For instructions and the latest. Web use schedule d (form 1040) to report the following: Ad access irs tax forms. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Ad access irs tax forms. Web use schedule d (form 1041) to report gains and losses from the sale or exchange of capital assets by an estate or trust. Form 1041 schedule d is a supplement to form 1041. Use schedule d to report. Web limitations on deductions schedule a—charitable deduction schedule b—income distribution deduction schedule g—tax computation and payments schedule j. Ad access irs. Understanding schedule d (form 941) • a statutory. You can download or print. Web complete schedule d (form 1041). The sale or exchange of a capital asset not reported on another form or schedule. Web we last updated the capital gains and losses in december 2022, so this is the latest version of 1041 (schedule d), fully updated for tax year 2022. Web if you used schedule d (form 1041), the schedule d tax worksheet in the instructions for schedule d (form 1041), or the qualified dividends tax worksheet in the instructions. Ad access irs tax forms. Uradu fact checked by amanda jackson what is form 1041: Web updated april 30, 2023 reviewed by lea d. Form 1041 schedule d is a supplement to form 1041. Web a check all that apply: Income tax return for estates and trusts. Web use form 1041 schedule d to report gains or losses from capital assets associated with an estate or trust. Get ready for tax season deadlines by completing any required tax forms today. Decedent’s estate simple trust complex trust qualified disability trust esbt (s portion only) grantor type trust bankruptcy estate—ch. Web limitations on deductions schedule a—charitable deduction schedule b—income distribution deduction schedule g—tax computation and payments schedule j. Web the schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. Web these instructions explain how to complete schedule d (form 1041). Income tax return for estates and trusts? Department of the treasury—internal revenue service.Fillable Schedule D (Form 1041) Capital Gains And Losses 2012

Free Fillable Irs Form 1041 Printable Forms Free Online

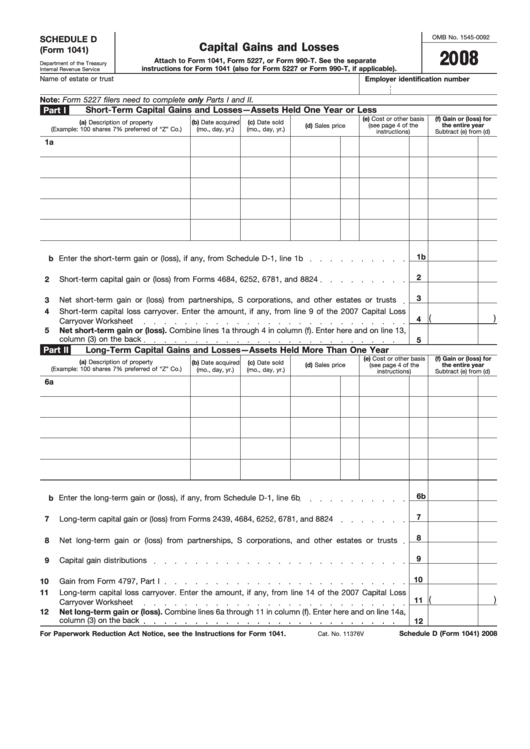

Fillable Form 1041 Schedule D Capital Gains And Losses 2008

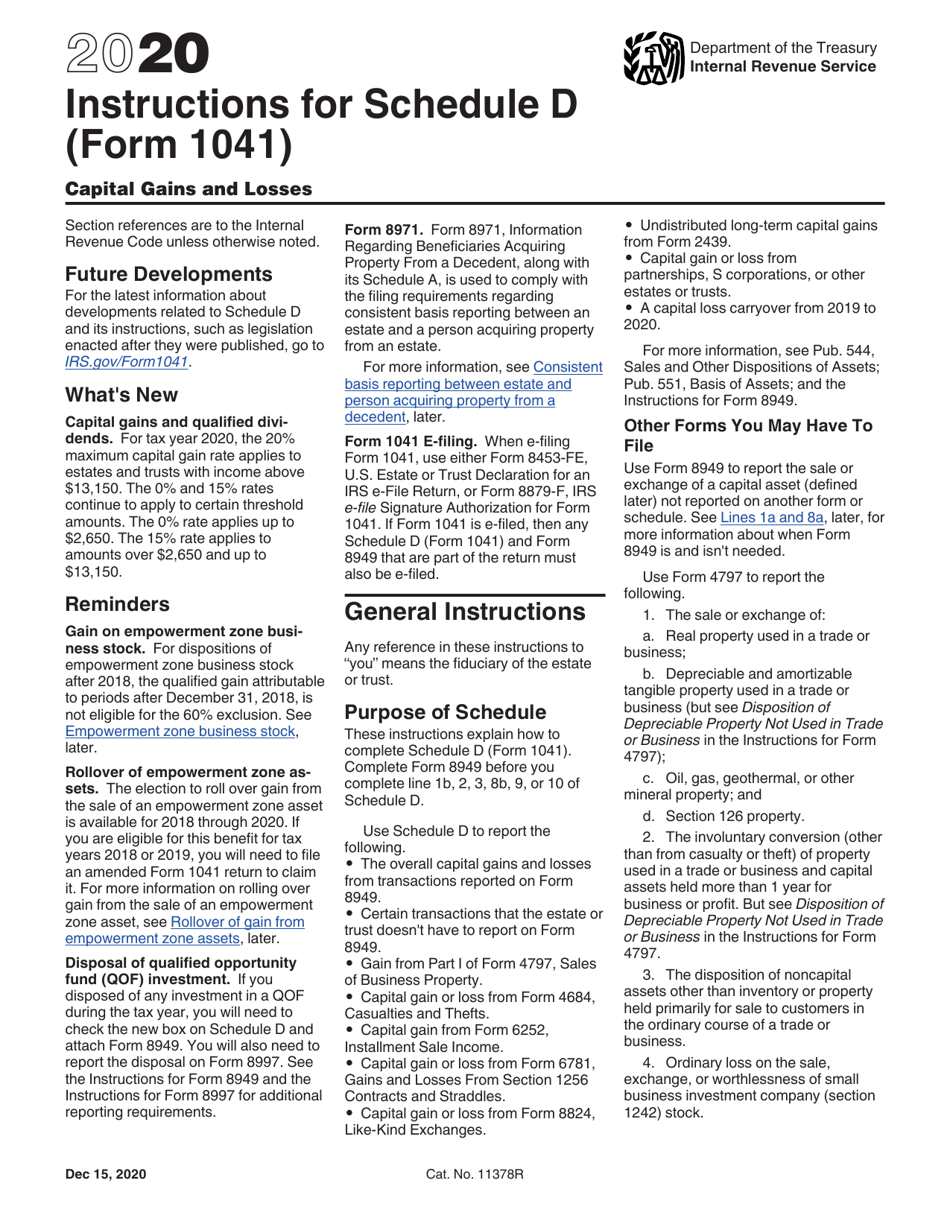

Download Instructions for IRS Form 1041 Schedule D Capital Gains and

Form 1041Schedule D Capital Gains and Losses

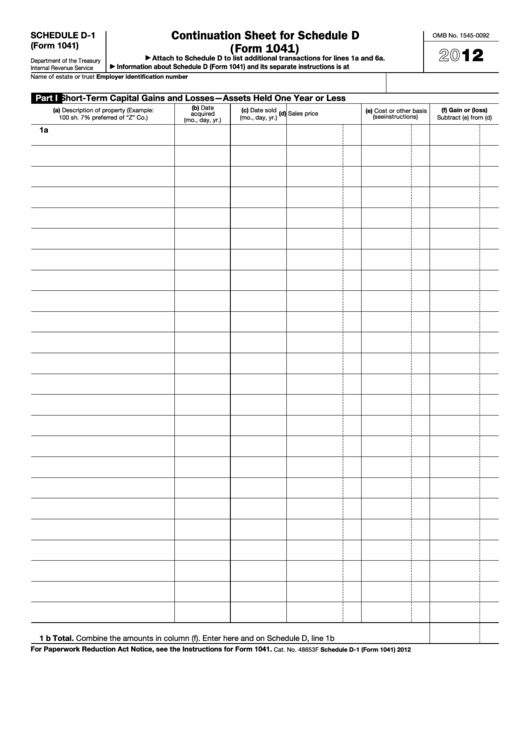

Fillable Schedule D1 (Form 1041) Continuation Sheet For Schedule D

IRS Form 1041 Schedule D Download Fillable PDF or Fill Online Capital

Schedule D 2011 Form Fill Out and Sign Printable PDF Template signNow

IRS Form 1041 Schedule D Download Fillable PDF or Fill Online Capital

form 1041 schedule d Fill Online, Printable, Fillable Blank form

Related Post: