Form 1041 Instructions K-1

Form 1041 Instructions K-1 - Web form 1041 for distributions to beneficiaries of trusts and estates form 8655 for reporting with respect to foreign partnerships. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web the taxpayer is an estate or trust and the source credit can be allocated to beneficiaries. If the amended return results in a change to income, or a change in distribution of any income or other information provided to. Department of the treasury internal revenue service see back of form and. For more details, see the instructions for form 1041, u.s. A trust needs to file a tax return if it has a gross income of $600 or more during the trust tax year or there is a nonresident alien. (for shareholder's use only) (for shareholder's use. Department of the treasury internal revenue service see back of form and. Web below are solutions to frequently asked questions about entering form 1041 distributions to beneficiaries in the fiduciary module of proseries professional. If the amended return results in a change to income, or a change in distribution of any income or other information provided to. Web the taxpayer is an estate or trust and the source credit can be allocated to beneficiaries. Web below are solutions to frequently asked questions about entering form 1041 distributions to beneficiaries in the fiduciary module of. Department of the treasury internal revenue service see back of form and. Web the taxpayer is an estate or trust and the source credit can be allocated to beneficiaries. (for shareholder's use only) (for shareholder's use. Keep it for your records. For more details, see the instructions for form 1041, u.s. A trust needs to file a tax return if it has a gross income of $600 or more during the trust tax year or there is a nonresident alien. Web form 1041 for distributions to beneficiaries of trusts and estates form 8655 for reporting with respect to foreign partnerships. If the amended return results in a change to income, or. For more details, see the instructions for form 1041, u.s. Web below are solutions to frequently asked questions about entering form 1041 distributions to beneficiaries in the fiduciary module of proseries professional. Web form 1041 for distributions to beneficiaries of trusts and estates form 8655 for reporting with respect to foreign partnerships. If the amended return results in a change. Web below are solutions to frequently asked questions about entering form 1041 distributions to beneficiaries in the fiduciary module of proseries professional. (for shareholder's use only) (for shareholder's use. Department of the treasury internal revenue service see back of form and. A trust needs to file a tax return if it has a gross income of $600 or more during. Web below are solutions to frequently asked questions about entering form 1041 distributions to beneficiaries in the fiduciary module of proseries professional. Web form 1041 for distributions to beneficiaries of trusts and estates form 8655 for reporting with respect to foreign partnerships. Keep it for your records. Department of the treasury internal revenue service see back of form and. A. Web the taxpayer is an estate or trust and the source credit can be allocated to beneficiaries. Web form 1041 for distributions to beneficiaries of trusts and estates form 8655 for reporting with respect to foreign partnerships. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web below are solutions to frequently asked questions about. For more details, see the instructions for form 1041, u.s. Keep it for your records. Web below are solutions to frequently asked questions about entering form 1041 distributions to beneficiaries in the fiduciary module of proseries professional. If the amended return results in a change to income, or a change in distribution of any income or other information provided to.. Web below are solutions to frequently asked questions about entering form 1041 distributions to beneficiaries in the fiduciary module of proseries professional. For more details, see the instructions for form 1041, u.s. Department of the treasury internal revenue service see back of form and. Department of the treasury internal revenue service see back of form and. Keep it for your. Web the taxpayer is an estate or trust and the source credit can be allocated to beneficiaries. For more details, see the instructions for form 1041, u.s. Department of the treasury internal revenue service see back of form and. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web below are solutions to frequently asked. Department of the treasury internal revenue service see back of form and. For more details, see the instructions for form 1041, u.s. A trust needs to file a tax return if it has a gross income of $600 or more during the trust tax year or there is a nonresident alien. Keep it for your records. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web below are solutions to frequently asked questions about entering form 1041 distributions to beneficiaries in the fiduciary module of proseries professional. Web form 1041 for distributions to beneficiaries of trusts and estates form 8655 for reporting with respect to foreign partnerships. Department of the treasury internal revenue service see back of form and. Web the taxpayer is an estate or trust and the source credit can be allocated to beneficiaries. (for shareholder's use only) (for shareholder's use. If the amended return results in a change to income, or a change in distribution of any income or other information provided to.2019 Form IRS 1041 Schedule K1Fill Online, Printable, Fillable

Printable K 1 Tax Form Printable World Holiday

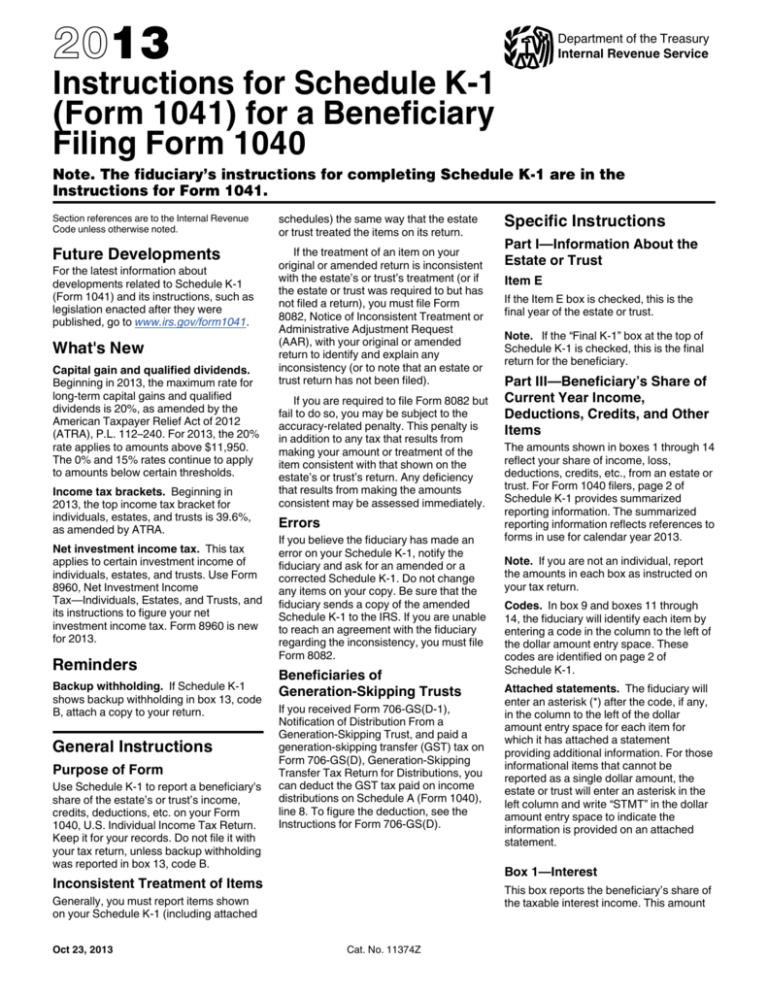

Instructions for Schedule K1 (Form 1041) for a Beneficiary Filing

Download Instructions for IRS Form 1041 Schedule K1 Beneficiary's

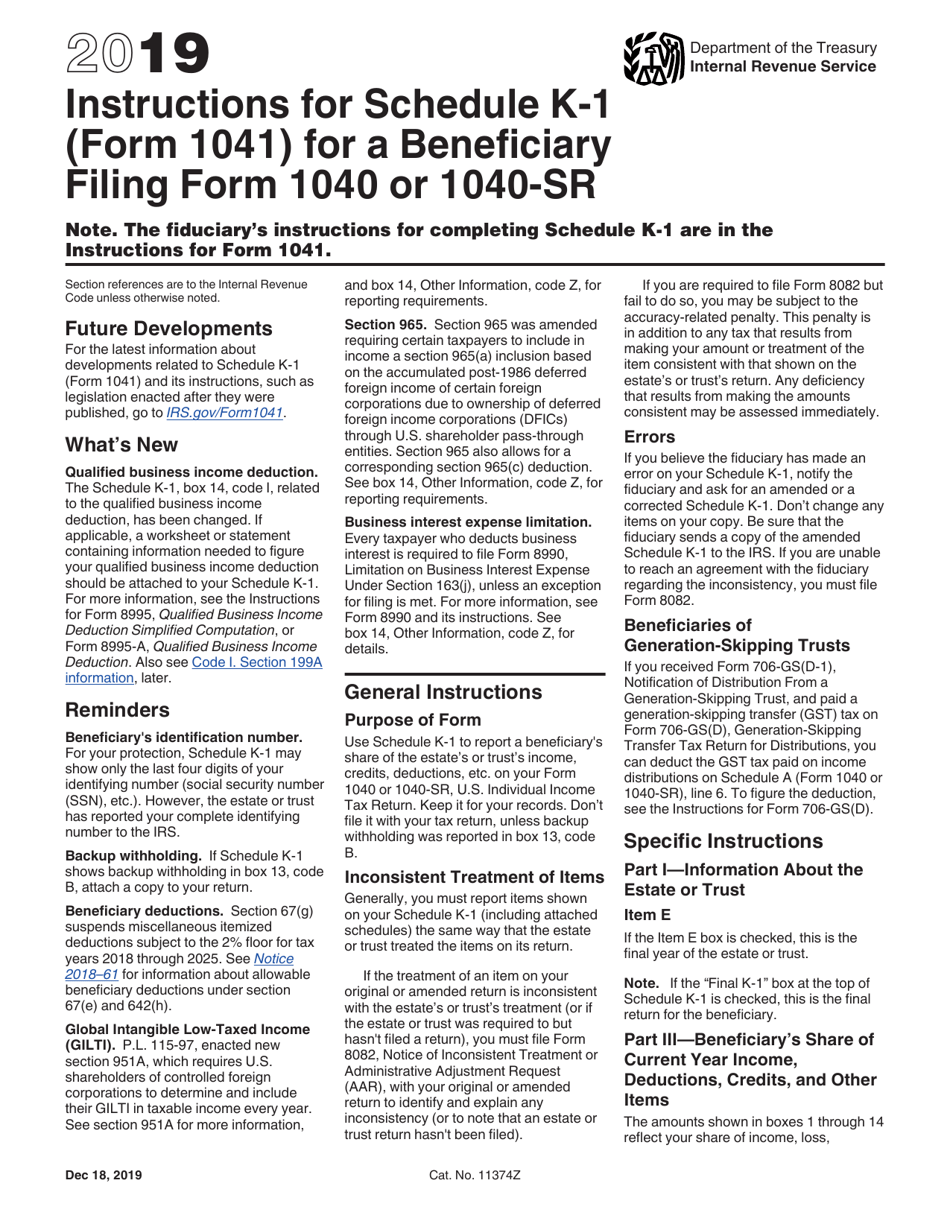

Instructions for Schedule K1 (Form 1041) for a Beneficiary Fill

2011 Form 1041 K 1 Instructions Trust Law Tax Deduction

Instructions For Schedule K1 (Form 1041) 2016 printable pdf download

form 1041 k1 instructions Fill Online, Printable, Fillable Blank

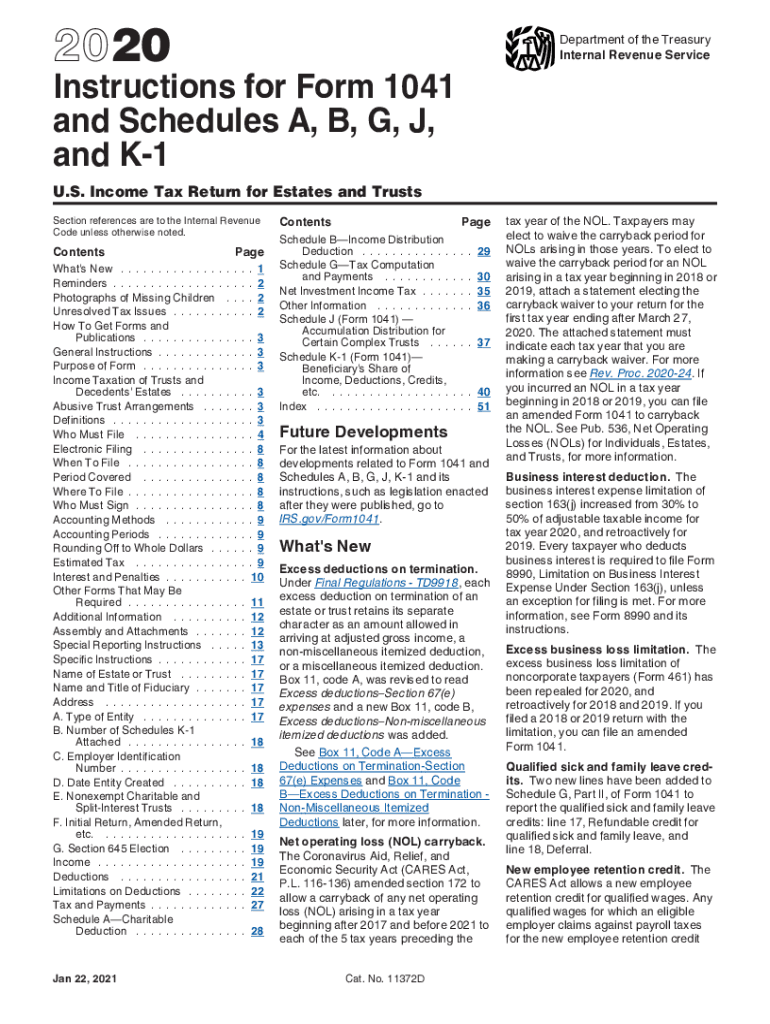

Instructions for Form 1041 and Schedules A, B, G, J, and K 1

Schedule K 1 Instructions How To Fill Out A K 1 And File 2021 Tax

Related Post: