Form 1041 Fillable

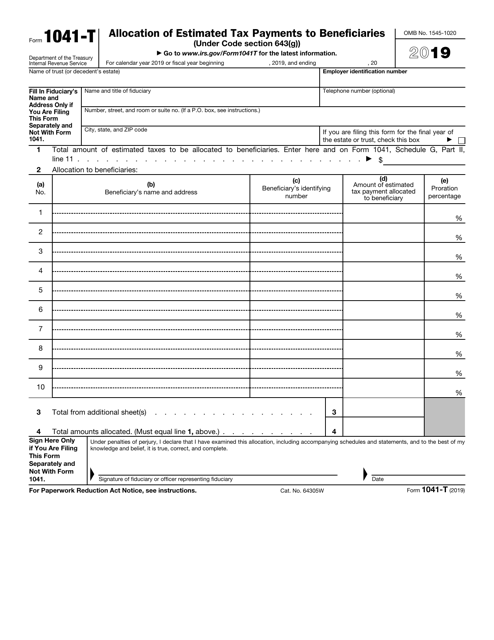

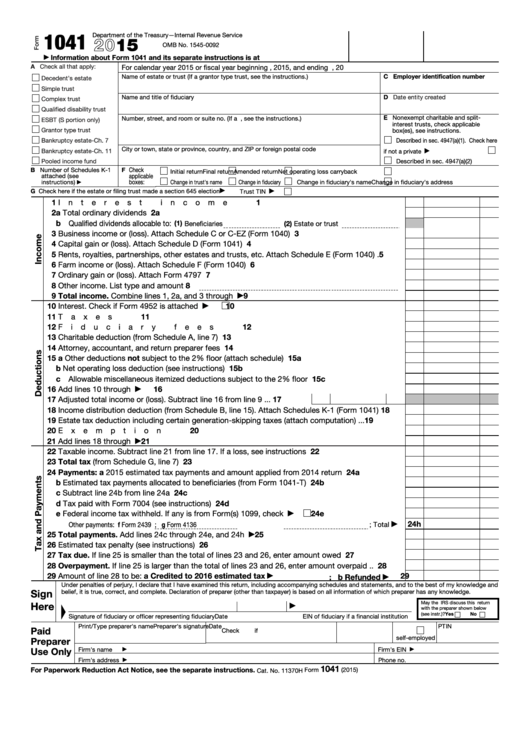

Form 1041 Fillable - Web department of the treasury—internal revenue service. Web general procedures for completing form 1041 during the election period. Due on or before the 15th day of the 4th month following the close of the tax year. The newest guidelines on our website Income tax return for estates and trusts. Department of the treasury internal revenue service. Ad access irs tax forms. See back of form and. 2 what is the due date for the it 1041 fiduciary income tax return? Print irs form 1041 or use a handy editor to complete & file the pdf online. Department of the treasury internal revenue service. The newest guidelines on our website Web fillable form 1041: For instructions and the latest information. If this return is not for calendar year 2021,. Income tax return for estates and trusts. The following rules apply to filing form 1041 while the election is in effect. Check out samples to report income, deductions & losses correctly. Don’t complete for a simple trust or a pooled income fund. Web fillable form 1041: Don’t complete for a simple trust or a pooled income fund. Income tax return for (irs) fill online, printable, fillable, blank form 1041: Complete, edit or print tax forms instantly. Print irs form 1041 or use a handy editor to complete & file the pdf online. The following rules apply to filing form 1041 while the election is in effect. Income tax return for (irs) fill online, printable, fillable, blank form 1041: Print irs form 1041 or use a handy editor to complete & file the pdf online. Web interest from federal form 1041. Use form 8949 to list your transactions for lines. Due on or before the 15th day of the 4th month following the close of the tax. 2 schedule a charitable deduction. Due on or before the 15th day of the 4th month following the close of the tax year. Use form 8949 to list your transactions for lines. Beneficiary’s share of income, deductions, credits, etc. Web fiduciary income and replacement tax return. Use form 8949 to list your transactions for lines. Ad access irs tax forms. Check out the newest instructions and examples. Beneficiary’s share of income, deductions, credits, etc. Irs form 1041 is an income tax return, the same as an individual or business would file, but for a decedent's estate or living trust after their death. Income tax return for (irs) fill online, printable, fillable, blank form 1041: 1 what is the statute of limitations for the pte and fiduciary income taxes? Department of the treasury—internal revenue service. Web interest from federal form 1041. Check out the newest instructions and examples. The newest guidelines on our website Irs form 1041 is an income tax return, the same as an individual or business would file, but for a decedent's estate or living trust after their death. Web correction to the instructions for form 941 (rev. Clean interface to facilitate use process. Web fiduciary income and replacement tax return. Income tax return for (irs) fill online, printable, fillable, blank form 1041: Don’t complete for a simple trust or a pooled income fund. The following rules apply to filing form 1041 while the election is in effect. Get ready for tax season deadlines by completing any required tax forms today. Department of the treasury—internal revenue service. Web download the 1041 form or obtain a fillable pdf to fill out & file online. Don’t complete for a simple trust or a pooled income fund. Income tax return for (irs) form. Beneficiary’s share of income, deductions, credits, etc. 1041 (2022) form 1041 (2022) page. Print irs form 1041 or use a handy editor to complete & file the pdf online. Check out samples to report income, deductions & losses correctly. Web general procedures for completing form 1041 during the election period. Beneficiary’s share of income, deductions, credits, etc. Income tax return for (irs) fill online, printable, fillable, blank form 1041: Due on or before the 15th day of the 4th month following the close of the tax year. Taxes subtract the state, local and dc franchise tax entered on federal form 1041 deduction for distributions to beneficiaries federal form. See back of form and. Smart form filling function to. Don’t complete for a simple trust or a pooled income fund. Department of the treasury—internal revenue service. Complete, edit or print tax forms instantly. The following rules apply to filing form 1041 while the election is in effect. Web fillable form 1041: Use form 8949 to list your transactions for lines. Ad access irs tax forms. Web interest from federal form 1041. Clean interface to facilitate use process. Complete, edit or print tax forms instantly. 1 what is the statute of limitations for the pte and fiduciary income taxes?IRS Form 1041T Download Fillable PDF or Fill Online Allocation of

Fillable Form 1041 U.s. Tax Return For Estates And Trusts

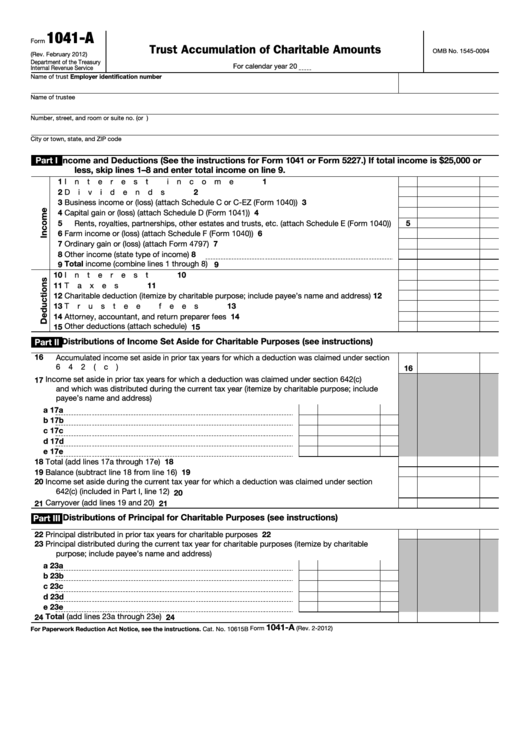

Fillable Form 1041A U.s. Information Return Trust Accumulation Of

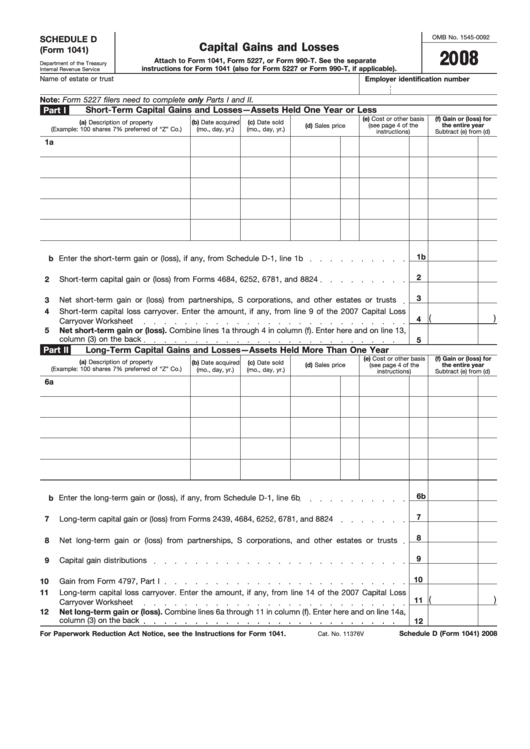

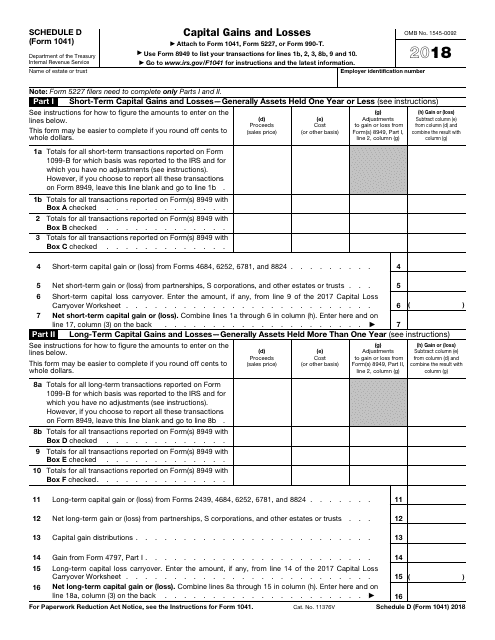

Fillable Form 1041 Schedule D Capital Gains And Losses 2008

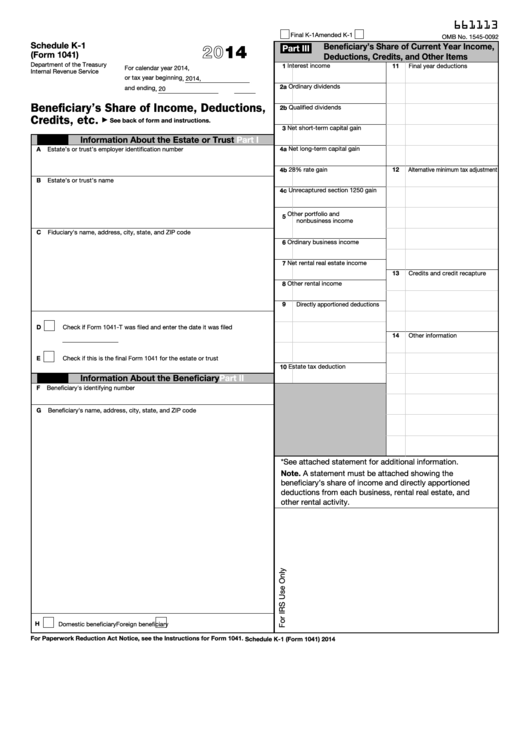

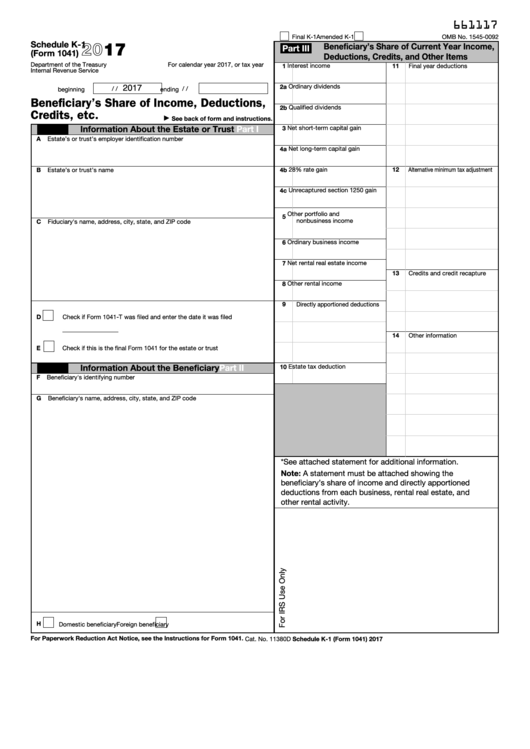

Fillable Form 1041 (Schedule K1) Beneficiary'S Share Of

IRS Form 1041 Schedule D Download Fillable PDF or Fill Online Capital

Fillable Schedule K1 (Form 1041) Beneficiary'S Share Of

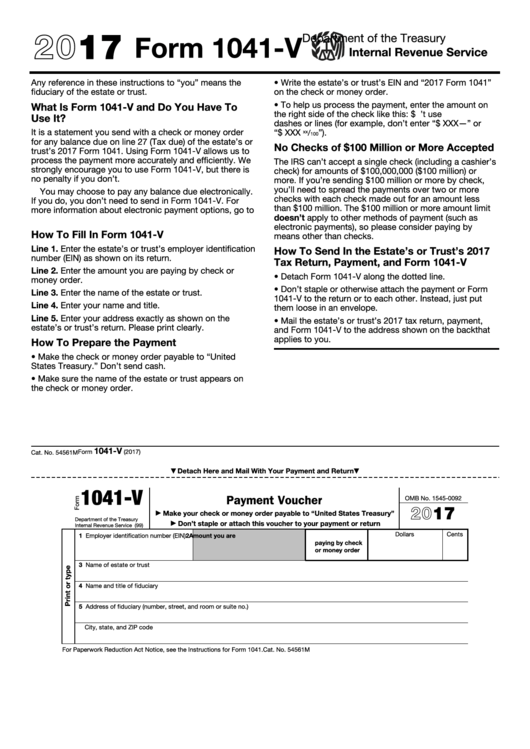

Fillable Form 1041V Payment Voucher 2017 printable pdf download

2020 Form IRS 1041T Fill Online, Printable, Fillable, Blank pdfFiller

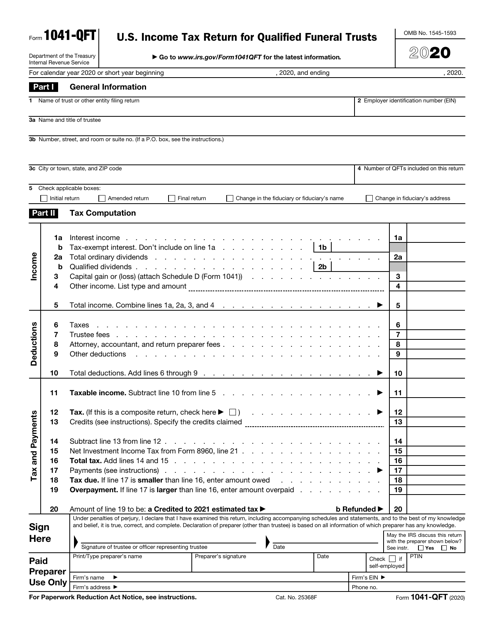

IRS Form 1041QFT Download Fillable PDF or Fill Online U.S. Tax

Related Post: