Form 1041-A Instructions

Form 1041-A Instructions - Ad get ready for tax season deadlines by completing any required tax forms today. Web blank 1041 tax form: Web below is information from the irs regarding the filing requirements for form 1041 u.s. Web limit worksheet in the instructions. 10 11 credit for child and dependent care expenses. Check out the newest instructions and examples. For instructions and the latest information. Instructions to fill it out. Income tax return for estates and trusts. Form 1041 is an income tax return for estates and trusts. Use this form to report the charitable information required by. You should use this request if you are a: Ad get ready for tax season deadlines by completing any required tax forms today. Instructions for this form are on our. Solved•by intuit•2•updated may 03, 2023. Keep it for your records. It is similar to an. Web just like with personal income taxes, deductions reduce the taxable income of the estate or trust, indirectly reducing the tax bill. Income tax return for estates and trusts along with an explanation of the purpose of. Web blank 1041 tax form: Enter the smaller of line 9 or line 10 here and on form 1040, line 48; Income tax return for estates and trusts. On form 1041, you can claim. Ad get ready for tax season deadlines by completing any required tax forms today. Researcher requesting a copy of a. On form 1041, you can claim. It is similar to an. Print irs form 1041 or use a handy editor to complete & file the pdf online. 2 of 8 use only black ink and uppercase letters. Form 1041 is an income tax return for estates and trusts. Enter the smaller of line 9 or line 10 here and on form 1040, line 48; 10 11 credit for child and dependent care expenses. Check out the newest instructions and examples. Solved•by intuit•2•updated may 03, 2023. What is estate and trust income? What is estate and trust income? 2 of 8 use only black ink and uppercase letters. Web instructions for form 8971 and schedule a and column (e)—cost or other basis in the instructions for form 8949. Solved•by intuit•2•updated may 03, 2023. On form 1041, you can claim. Web limit worksheet in the instructions. Obtain the irs form 1041 printable for 2022, which can be. To fill out the blank irs form 1041 correctly, follow these steps: Researcher requesting a copy of a. Web just like with personal income taxes, deductions reduce the taxable income of the estate or trust, indirectly reducing the tax bill. 10 11 credit for child and dependent care expenses. On form 1041, you can claim. Ad pdffiller.com has been visited by 1m+ users in the past month Web how to fill out form 1041 for the 2021 tax year. Enter the smaller of line 9 or line 10 here and on form 1040, line 48; Use this form to report the charitable information required by. What is estate and trust income? Complete, edit or print tax forms instantly. Ad pdffiller.com has been visited by 1m+ users in the past month Researcher requesting a copy of a. Web tax practice resources. 2 of 8 use only black ink and uppercase letters. Keep it for your records. Form 1041 is an income tax return for estates and trusts. On form 1041, you can claim. What is estate and trust income? When to file form 1041. Ad pdffiller.com has been visited by 1m+ users in the past month Instructions to fill it out. Solved•by intuit•2•updated may 03, 2023. Use this form to report the charitable information required by. Researcher requesting a copy of a. Income tax return for estates and trusts along with an explanation of the purpose of. 2 of 8 use only black ink and uppercase letters. It is similar to an. Web instructions for form 8971 and schedule a and column (e)—cost or other basis in the instructions for form 8949. You should use this request if you are a: Web limit worksheet in the instructions. Form 1041 is an income tax return for estates and trusts. Web blank 1041 tax form: 10 11 credit for child and dependent care expenses. Check out the newest instructions and examples. Complete, edit or print tax forms instantly. Web just like with personal income taxes, deductions reduce the taxable income of the estate or trust, indirectly reducing the tax bill. On form 1041, you can claim.Instructions for Form 1041, U.S. Tax Return for Estates and Tr…

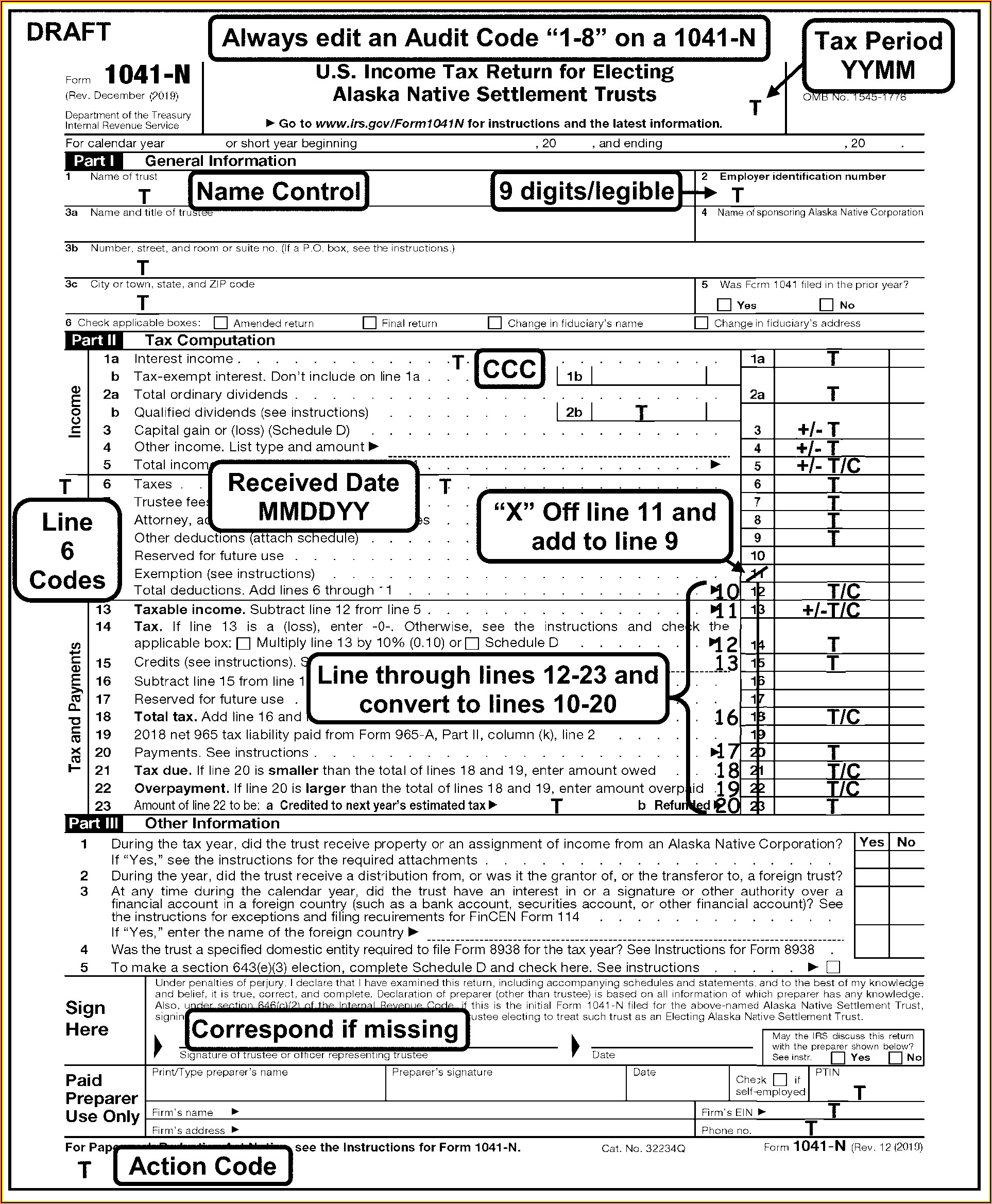

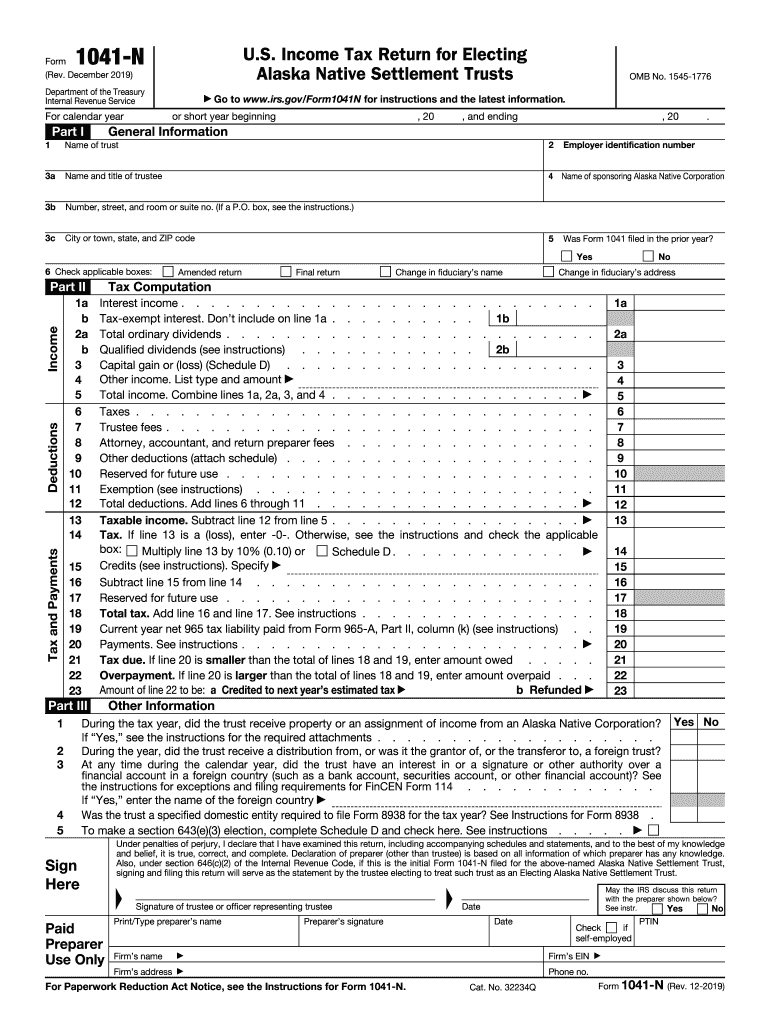

Online IRS Form 1041 2019 Fillable and Editable PDF Template

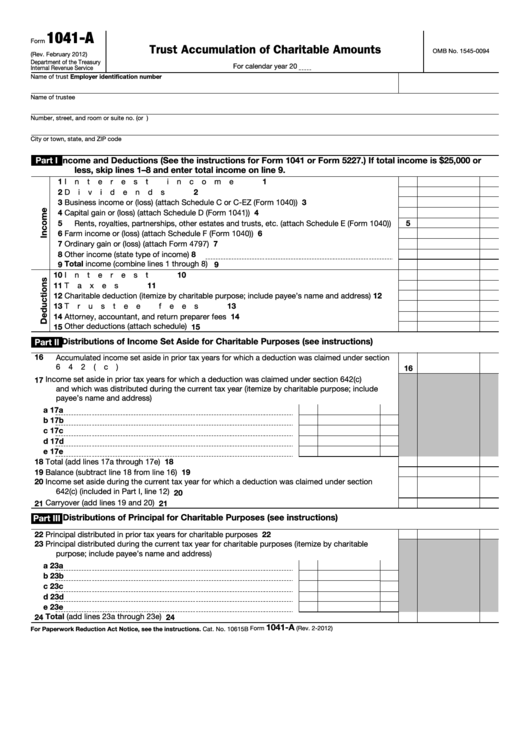

Form 1041A U.S. Information Return Trust Accumulation of Charitable

Fillable Form 1041A U.s. Information Return Trust Accumulation Of

What Expenses Are Deductible On Form 1041 Why Is

Instructions for Form 1041, U.S. Tax Return for Estates and Tr…

Form 1041A U.S. Information Return Trust Accumulation of Charitable

Irs Forms 1041 Instructions Form Resume Examples Kw9kwxQ9JN

IRS Form 1041A Fill Out, Sign Online and Download Fillable PDF

Form 1041 Fill Out and Sign Printable PDF Template signNow

Related Post: