1099 Onlyfans Form

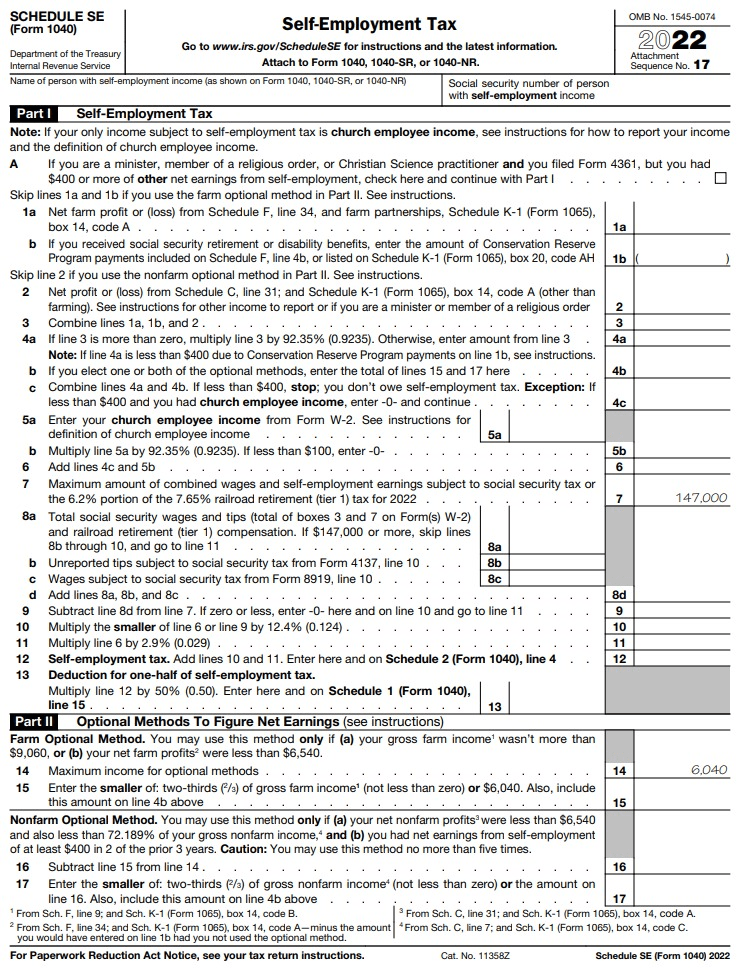

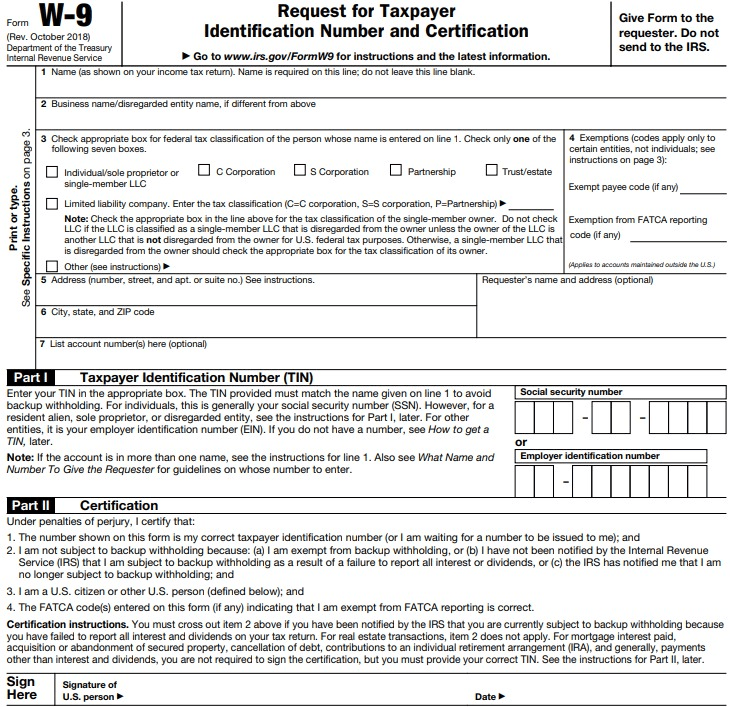

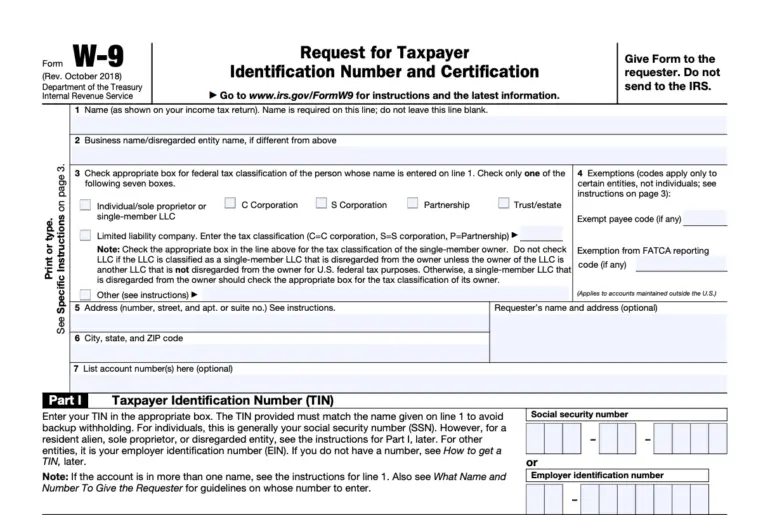

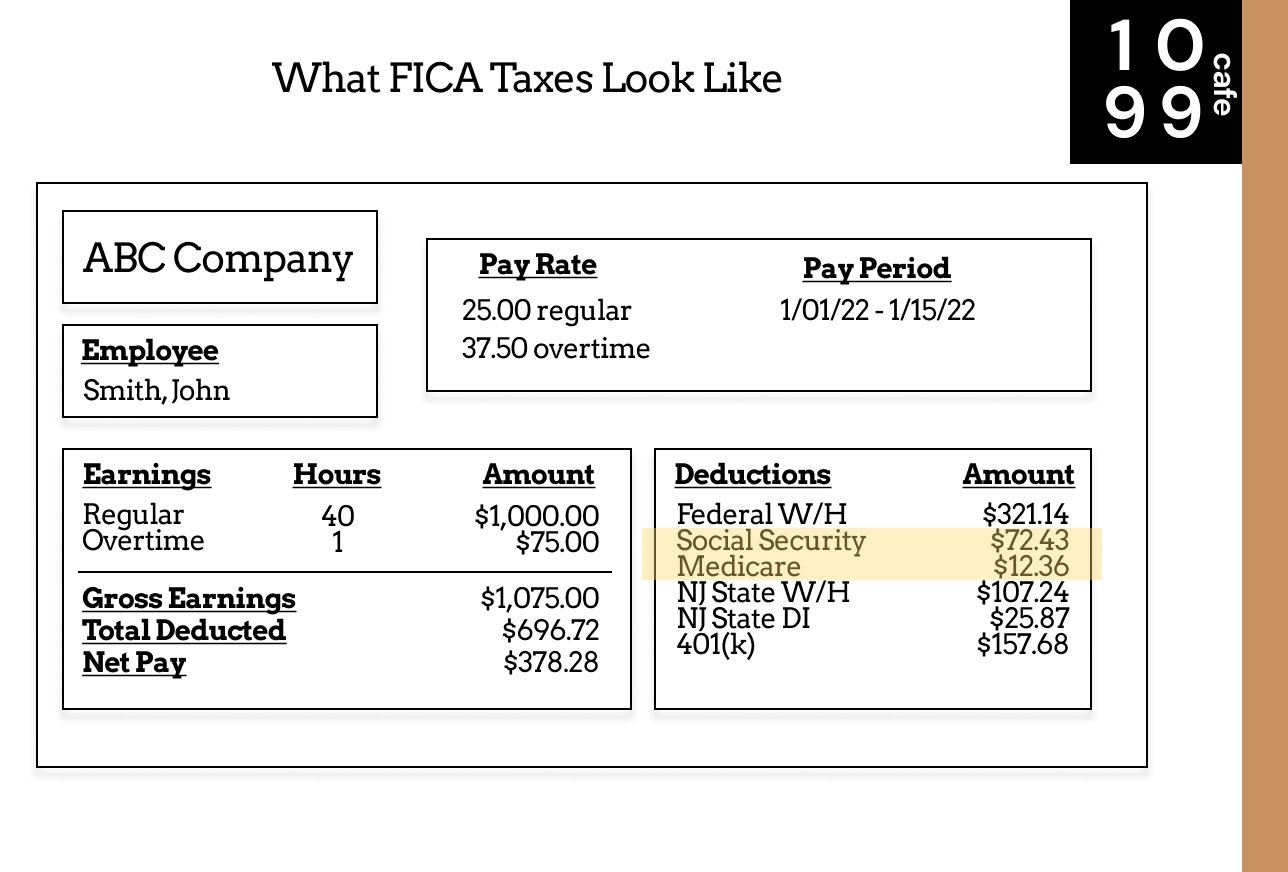

1099 Onlyfans Form - Prepare for irs filing deadlines. Web does onlyfans send you a 1099? Web you’ll get a 1099 (self employment tax form) if you make more than $600 per year. In the united states, anyone who makes a yearly income of $600 is subject to paying taxes by filing a 1099 form. You will be required to pay back around 25ish% since 1099/self employment isn’t taxed. Web you’ll be able to download your 1099 form by january 31. Ad approve payroll when you're ready, access employee services & manage it all in one place. Web as an onlyfans content creator, you will likely receive a 1099 form from the platform if you have earned over $600 in a calendar year. Tax forms for onlyfans creators. This form will report your. Ad approve payroll when you're ready, access employee services & manage it all in one place. Web the vast majority of you, who did not form a separate company, will simply put your social security number in that space provided. Web professionals from the kpmg information reporting & withholding tax practice will discuss: Well the answer is no. Order 1099. Sign and date the form in part 2 and. Well the answer is no. If you earned more than $600, you’ll. Understanding onlyfans income tax and how it works. Web you will need to fill out the onlyfans w9 form before you can withdraw earnings. Sign and date the form in part 2 and. Ad approve payroll when you're ready, access employee services & manage it all in one place. Web a 1099 tax form is used to report income from sources other than regular wages, salaries, or tips. If you made less than $600, you. Web every influencer must pay taxes in line with. Web you’ll get a 1099 (self employment tax form) if you make more than $600 per year. Onlyfans does not withdraw taxes from your pay. Web as an onlyfans independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings. Prepare for irs filing deadlines. Web you’ll be able to download your 1099. Web by us law, onlyfans reports any payments made to you on the irs form 1099 and sends this form to the irs. Save all receipts, both offline and online. If you make over $600 from a brand, you should receive a 1099 if you live in the united states. Sign and date the form in part 2 and. Web. Web 1099 forms & schedules. Web you’ll be able to download your 1099 form by january 31. Prepare for irs filing deadlines. If you make over $600 from a brand, you should receive a 1099 if you live in the united states. Web if you are a hobbyist on onlyfans, you are required to pay your owed taxes, and if. Well the answer is no. This form will report your. Save all receipts, both offline and online. Prepare for irs filing deadlines. Web if you are a hobbyist on onlyfans, you are required to pay your owed taxes, and if your income is $600 or more, the brand you’re working for on the platform should. Web if you are a hobbyist on onlyfans, you are required to pay your owed taxes, and if your income is $600 or more, the brand you’re working for on the platform should. Payroll seamlessly integrates with quickbooks® online. Well the answer is no. You can simply download your 1099 form by following this simple. Save all receipts, both offline. If you earned more than $600, you’ll. Web you may get a 1099 in the mail, and it looks like they will come from a company called fenix international ltd (i can update this when someone confirms). Onlyfans does not withdraw taxes from your pay. Web by us law, onlyfans reports any payments made to you on the irs form. If you make over $600 from a brand, you should receive a 1099 if you live in the united states. This form will report your. Well the answer is no. Web you will need to fill out the onlyfans w9 form before you can withdraw earnings. Save all receipts, both offline and online. Ad approve payroll when you're ready, access employee services & manage it all in one place. Web a 1099 tax form is used to report income from sources other than regular wages, salaries, or tips. If you make over $600 from a brand, you should receive a 1099 if you live in the united states. This form will report your. Tax forms for onlyfans creators. Web you’ll be able to download your 1099 form by january 31. If you earned more than $600, the. Web you will need to fill out the onlyfans w9 form before you can withdraw earnings. Web as an onlyfans independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings. Web you may get a 1099 in the mail, and it looks like they will come from a company called fenix international ltd (i can update this when someone confirms). Prepare for irs filing deadlines. Onlyfans will issue you these around tax time. Web you’ll get a 1099 (self employment tax form) if you make more than $600 per year. Onlyfans will also send out a paper copy of your 1099 to the address they have on file for you. What taxes do onlyfans creators have to pay? You will be required to pay back around 25ish% since 1099/self employment isn’t taxed. In the united states, anyone who makes a yearly income of $600 is subject to paying taxes by filing a 1099 form. Web 1099 forms & schedules. Web every influencer must pay taxes in line with lineh under their country’s rules. Web hi guys, i recently made an onlyfans (9/1/2020) i made $445.50 so far and i am very confused with their taxes and how to file it (first time filing) this is my main.Memo OnlyFans & Myystar Creators Business Set Up and Tax Filing Tips

OnlyFans Taxes in 2022 A Comprehensive Guide — 1099 Cafe

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Onlyfans downloading your 1099 form for taxes. YouTube

How to file OnlyFans taxes (W9 and 1099 forms explained)

How to file OnlyFans taxes (W9 and 1099 forms explained)

How to file OnlyFans taxes (W9 and 1099 forms explained)

Onlyfans downloading your 1099 form for taxes. YouTube

Why hasn’t the 1099 form popped up for me on onlyfans yet? I’ve made

How to Fill Out Form W9 for OnlyFans Vlogfluence

Related Post:

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://images.squarespace-cdn.com/content/v1/56f9ad715f43a6d77cb2536a/1553021637842-T52O55S3Z3ILYDIS44PS/ke17ZwdGBToddI8pDm48kCpGfv303rFPf_R2MmpjQDgUqsxRUqqbr1mOJYKfIPR7LoDQ9mXPOjoJoqy81S2I8N_N4V1vUb5AoIIIbLZhVYxCRW4BPu10St3TBAUQYVKcmomqGy8QKumd8_Xi9pibUHb-95JWteCRKkaNKL5Nmf61lF01BYr72PFdZDEdDuE_/what+is+a+1099-k)