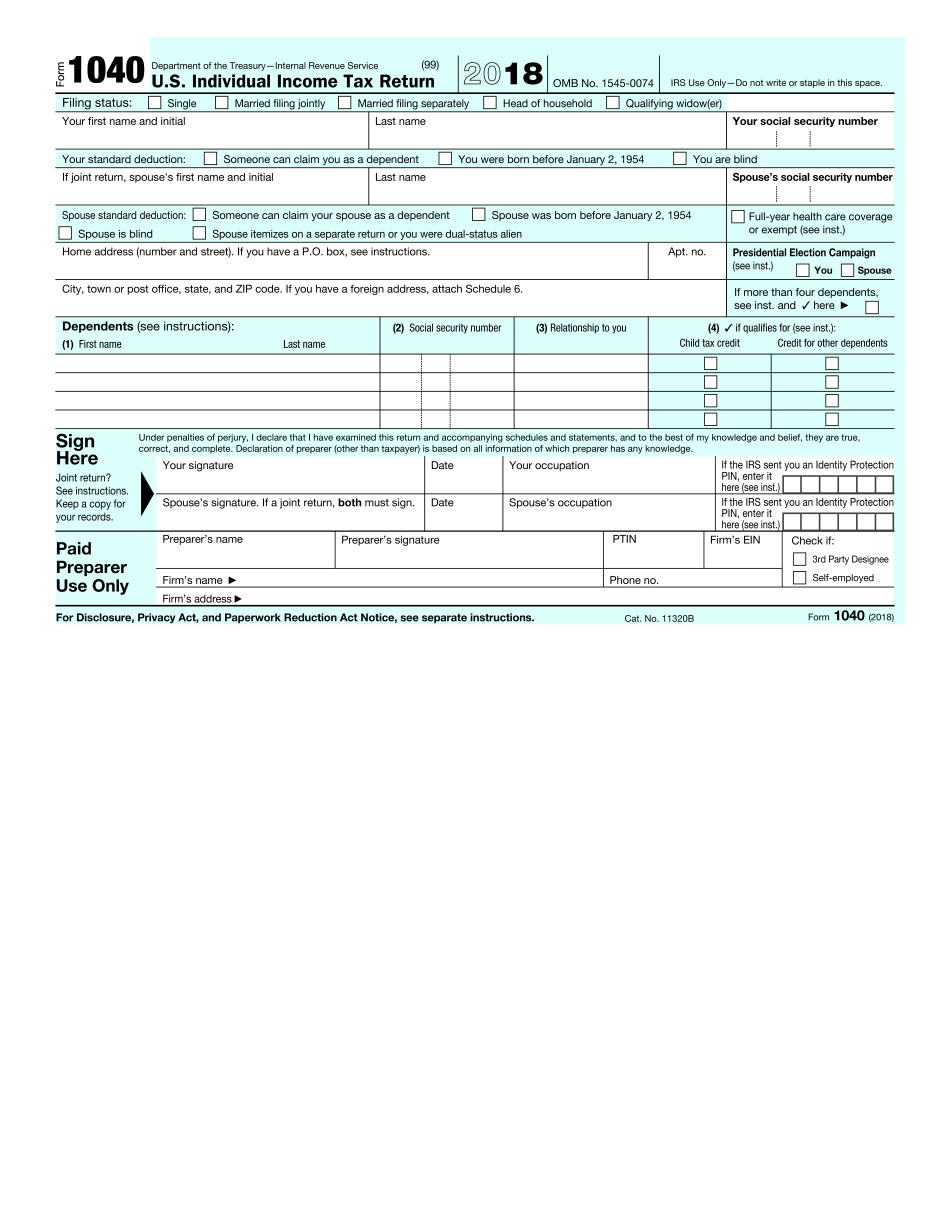

Form 1040 F

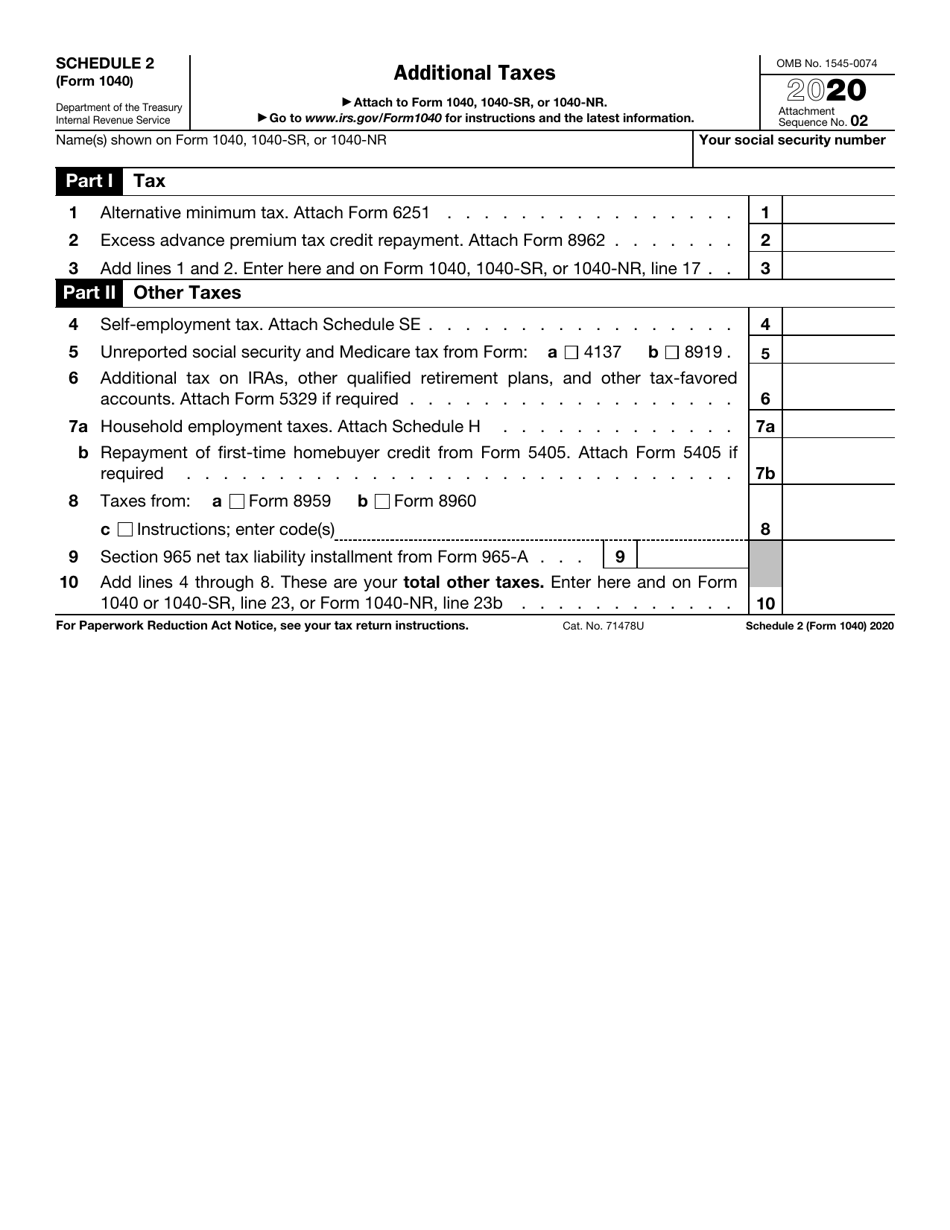

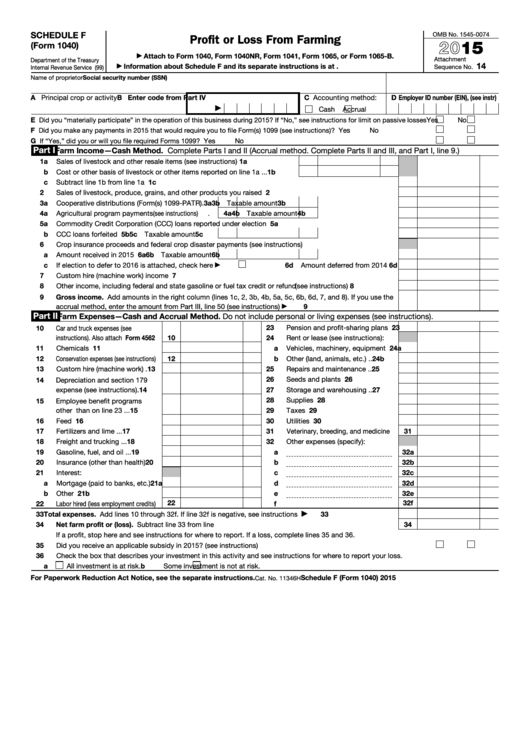

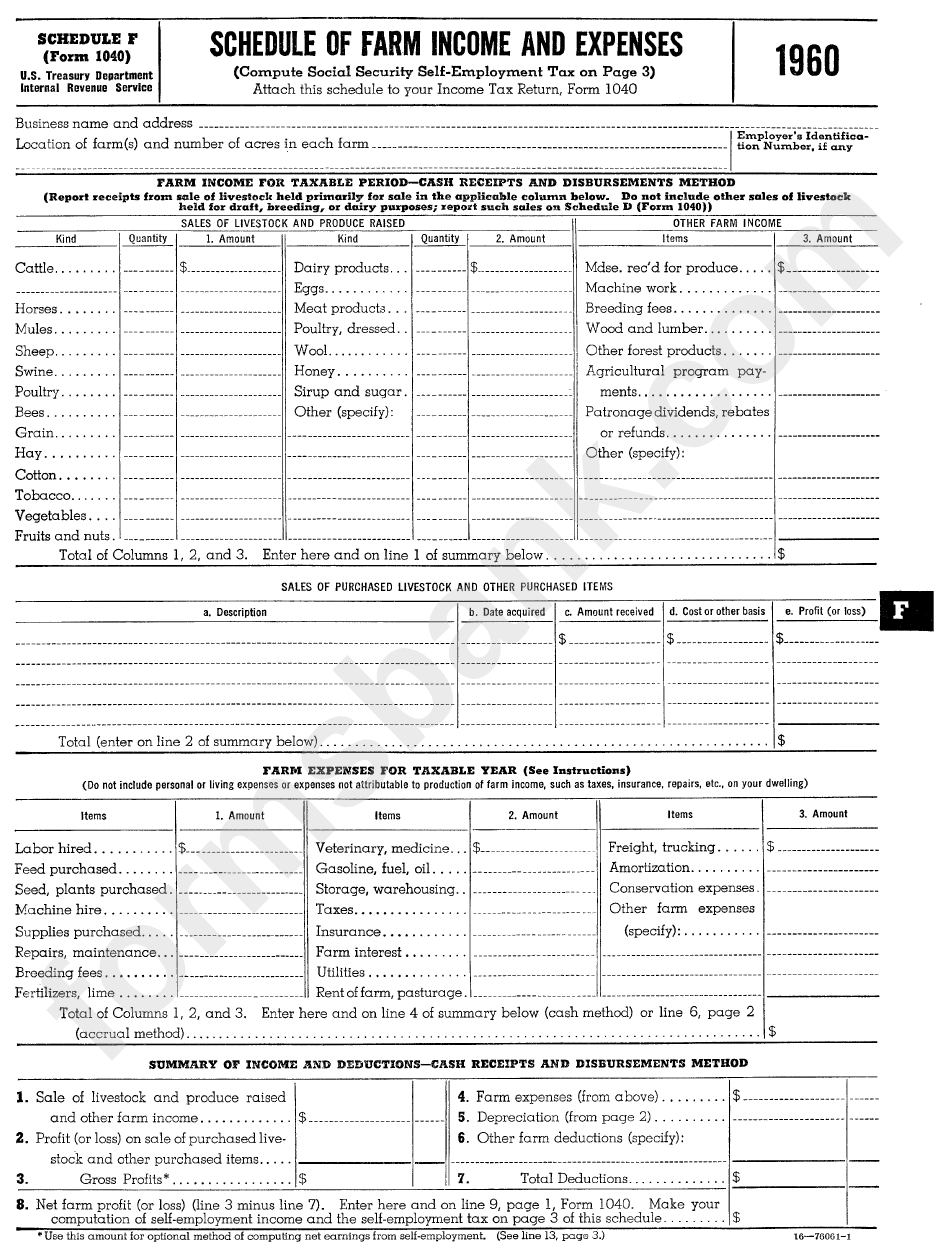

Form 1040 F - Web form 1040, formally known as the “u.s. Your farming activity may subject you to state and. Web lines 1 through 15 of their form 1040 are shown in figure 7. Ad discover helpful information and resources on taxes from aarp. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Taxpayers use this form to calculate net gain. Web use schedule f (form 1040) to report farm income and expenses. Individual tax return form 1040 instructions; Information about form 1040, u.s. During 2023, did you receive, sell, exchange, gift, or otherwise dispose. It is designed to be a helpful. Individual income tax return, including recent updates, related forms and instructions. Web use schedule f (form 1040) to report farm income and expenses. Web do not file schedule f (form 1040) to report the following. Line 7 is the sale of the three heifers from. Individual income tax return,” is the standard federal income tax form people use to report income to the irs, claim tax. Web get federal tax return forms and file by mail. Individual income tax return, including recent updates, related forms and instructions. Web form 940, line 9 or line 10 (f) credit reduction amount allocated to the listed client ein. Web individuals, partnerships, and trusts and estates generally report farm income and expenses on form 1040, schedule f. Individual tax return form 1040 instructions; Web form 940, line 9 or line 10 (f) credit reduction amount allocated to the listed client ein from form 940, line 11 (g) total futa tax after adjustments allocated to the listed client ein. Taxpayers. During 2023, did you receive, sell, exchange, gift, or otherwise dispose. Information about form 1040, u.s. Request for taxpayer identification number (tin) and. Web do not file schedule f (form 1040) to report the following. Ad complete your schedule c 1040 form free. (a) receive (as a reward, award, or payment for property or services); Estimate your taxes and refunds easily with this free tax calculator from aarp. Web page last reviewed or updated: Only certain taxpayers are eligible. During 2023, did you receive, sell, exchange, gift, or otherwise dispose. Information about form 1040, u.s. Form 1040 is a form that you fill out and send to the irs reporting your income, deductions,. Web this article provides a general overview of schedule f (form 1040), the backbone of federal farm income and expense reporting for sole proprietors. Individual income tax return, including recent updates, related forms and instructions. It is. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Your farming activity may subject you to state and. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web this article provides a general overview of schedule f (form 1040),. Ad complete your schedule c 1040 form free. Only certain taxpayers are eligible. Line 7 is the sale of the three heifers from. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. (a) receive (as a reward, award, or payment for property or services); Information about form 1040, u.s. Web form 1040 is the standard internal revenue service (irs) form that individual taxpayers use to file their annual income tax returns. Web use schedule f (form 1040) to report farm income and expenses. Web individuals, partnerships, and trusts and estates generally report farm income and expenses on form 1040, schedule f. Web no, form. Ad complete your schedule c 1040 form free. Request for taxpayer identification number (tin) and. Taxpayers use this form to calculate net gain. Estimate your taxes and refunds easily with this free tax calculator from aarp. Individual income tax return,” is the standard federal income tax form people use to report income to the irs, claim tax. Web page last reviewed or updated: Web form 940, line 9 or line 10 (f) credit reduction amount allocated to the listed client ein from form 940, line 11 (g) total futa tax after adjustments allocated to the listed client ein. Web use schedule f (form 1040) to report farm income and expenses. Taxpayers use this form to calculate net gain. Go to www.irs.gov/schedulef for instructions and the latest. Only certain taxpayers are eligible. (a) receive (as a reward, award, or payment for property or services); Estimate your taxes and refunds easily with this free tax calculator from aarp. Or (b) sell, exchange, gift, or otherwise dispose of a. Line 7 is the sale of the three heifers from. Web get federal tax return forms and file by mail. Web this article provides a general overview of schedule f (form 1040), the backbone of federal farm income and expense reporting for sole proprietors. If you have a profit or a loss, it gets. Web get federal tax return forms and file by mail. Request for taxpayer identification number (tin) and. Your farming activity may subject you to state and. Web do not file schedule f (form 1040) to report the following. Web spouse digital assets at any time during 2022, did you: It is designed to be a helpful. Individual income tax return,” is the standard federal income tax form people use to report income to the irs, claim tax.IRS 1040 Form Fillable & Printable in PDF

Irs Fillable Form 1040 Form 1040 Schedule F Fillable Profit Or Loss

Irs Fillable Form 1040 IRS Form 1040NREZ Download Fillable PDF or

Fillable Schedule F (Form 1040) Profit Or Loss From Farming 2015

Form 1040 Schedule F Edit, Fill, Sign Online Handypdf

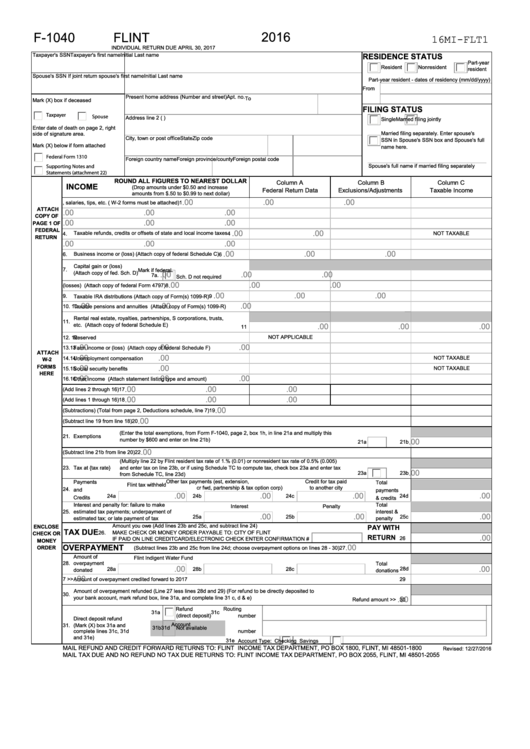

Fillable Form F1040 Flint 2016 printable pdf download

Form 1040 (Schedule F) Profit or Loss From Farming (2014) Free Download

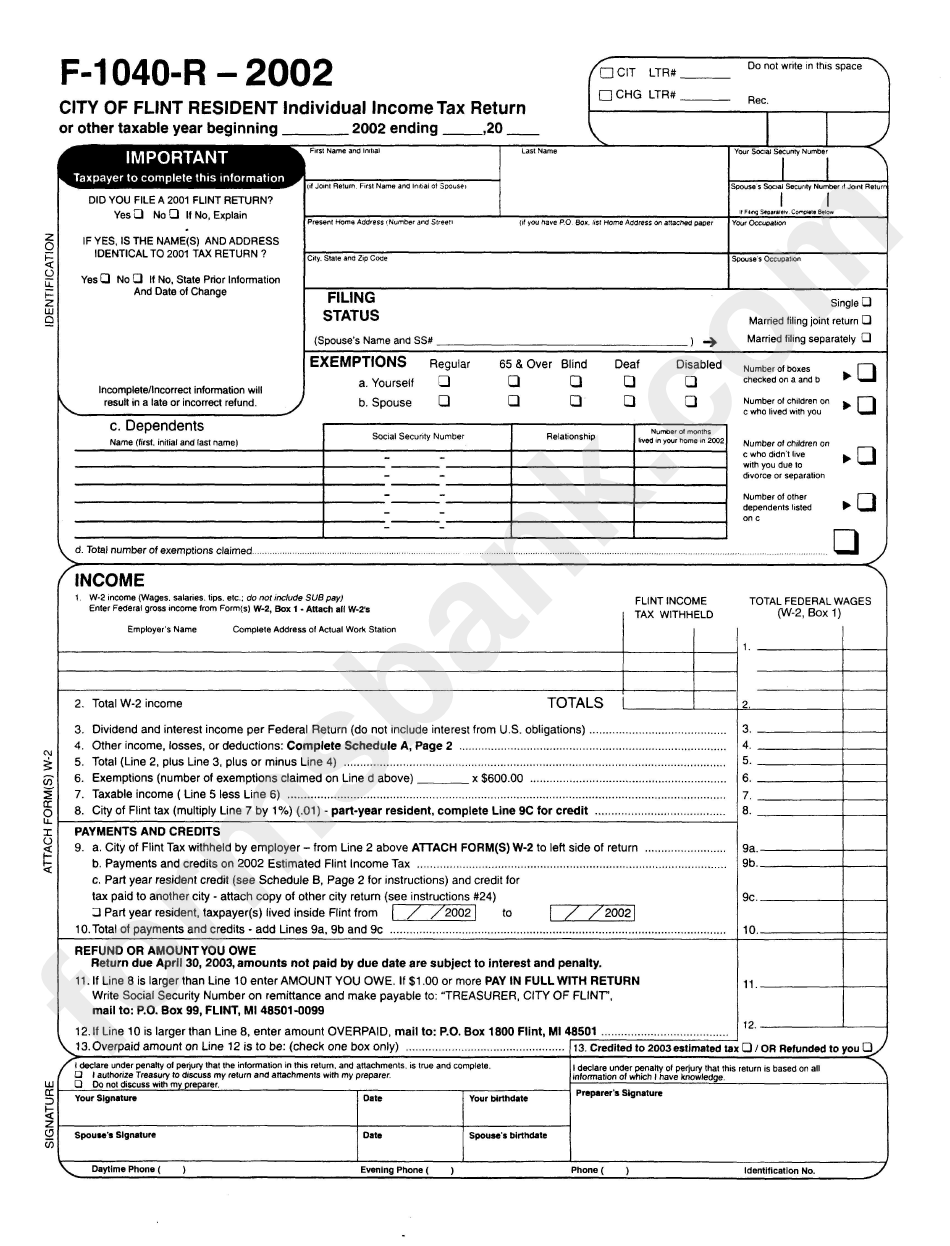

Form F1040R City Of Flint Resident Individual Tax Return

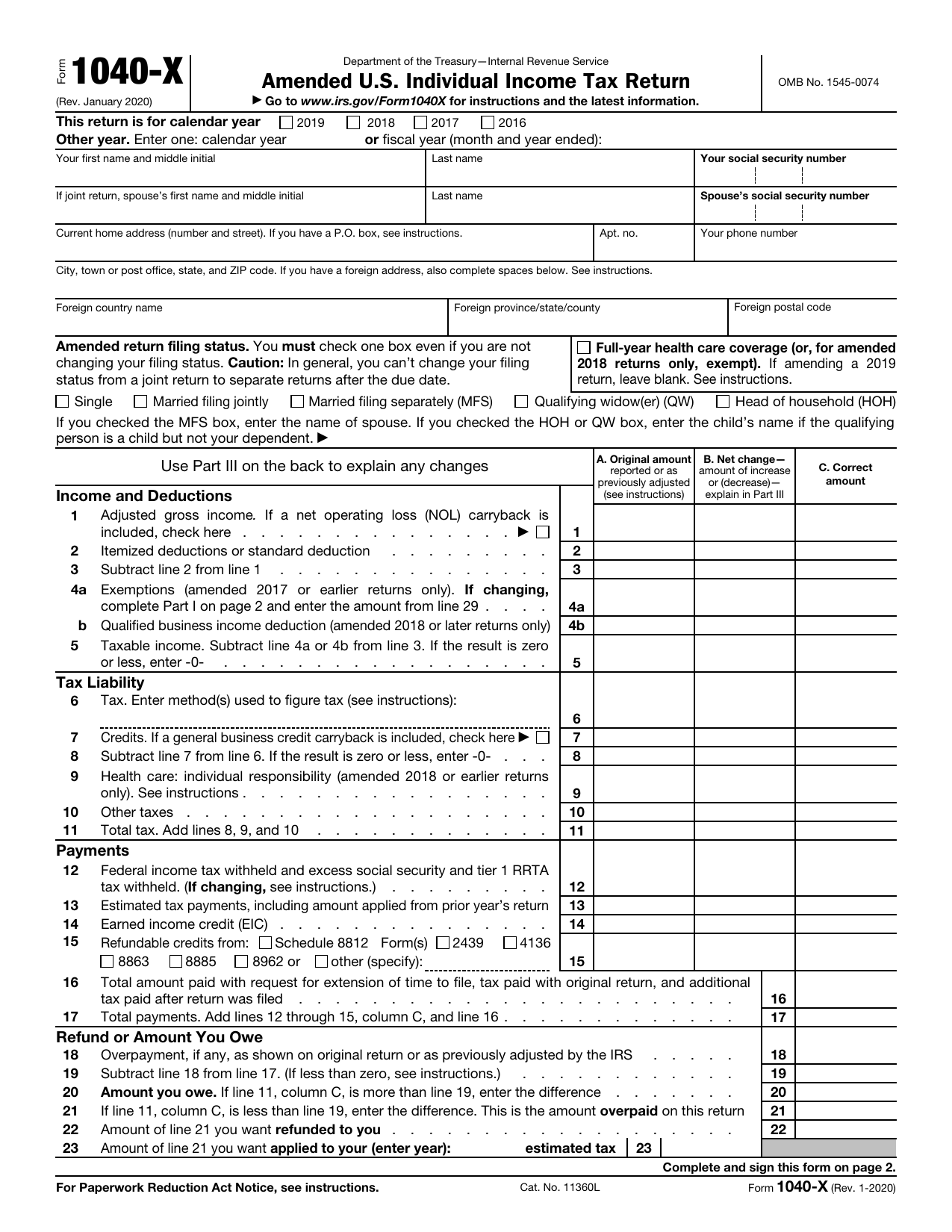

f1040x

Schedule F (Form 1040) Schedule Of Farm And Expenses 1960

Related Post: