Fidelity Qualified Charitable Distribution Form

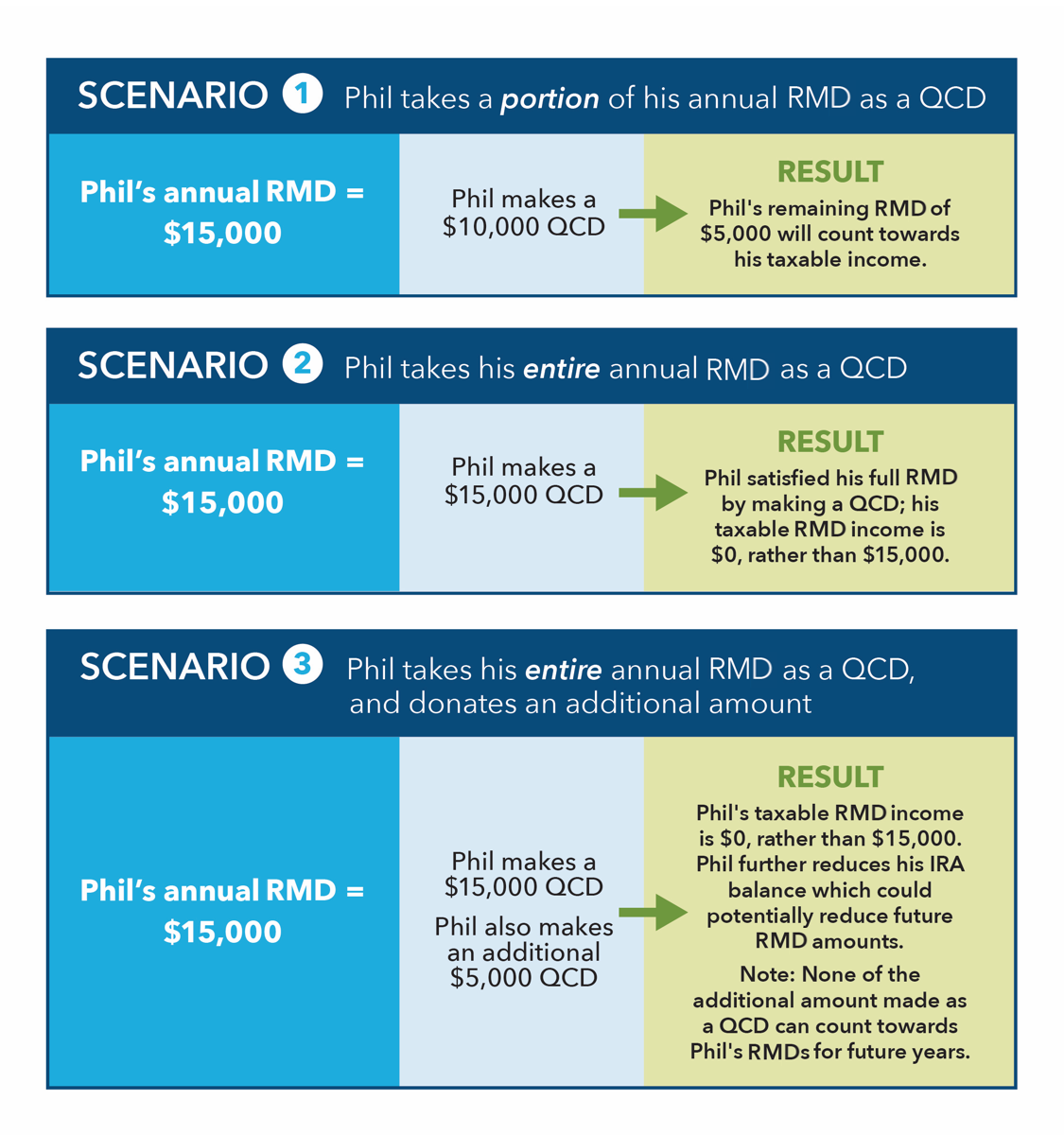

Fidelity Qualified Charitable Distribution Form - Web regardless of your age, you will need to file a form 1040 and show the amount of the ira withdrawal. Morgan securities llc (jpms) roth or. Web how to make a qualified charitable distribution from your ira. Not fdic insured • no bank guarantee • may lose value Web a qualified charitable distribution (qcd) is a distribution of funds from your ira (other than a sep or simple ira) directly to a qualified charitable organization, such as the. ɕ per irs code, you. Then, with the passage of the secure 2.0 act, the starting age for required minimum distributions was. Can i use money from my ira to donate to charity? By donating these funds, you bypass the 50% excise tax penalty for. To make a qcd, you instruct your ira trustee to. Web fa ira one time and periodic distribution request form kit | fidelity institutional. Web if you want to make a qualified charitable distribution (qcd) from your ira, you can use fidelity's easy online tool to select your account and charity of choice. Web you’ll need a distribution form from the brokerage specified for a qcd. 26 ways the new. Since you took the withdrawal before you reached age 59 1/2, unless you. Get started by selecting your ira custodian and filling. Web fa ira one time and periodic distribution request form kit | fidelity institutional. 26 ways the new tax law will affect your wallet regardless of how you do the qcd, a. Web qualified charitable distributions allow you. Morgan securities llc (jpms) roth or. Since you took the withdrawal before you reached age 59 1/2, unless you. Then, with the passage of the secure 2.0 act, the starting age for required minimum distributions was. ɕ per irs code, you. Get started by selecting your ira custodian and filling. 26 ways the new tax law will affect your wallet regardless of how you do the qcd, a. Since you took the withdrawal before you reached age 59 1/2, unless you. Find out if a qualified charitable distribution is right for you. Web qualified charitable distributions allow you to distribute ira funds directly to eligible charities. Get started by selecting. By donating these funds, you bypass the 50% excise tax penalty for. ɕ per irs code, you. Web you are not required to take rmds during your lifetime with a roth ira, but with a roth 401 (k), you are required. Can i use money from my ira to donate to charity? Web qualified charitable distributions allow you to distribute. Web how to make a qualified charitable distribution from your ira. Web it was first bumped back to 72 as part of the secure act. By donating these funds, you bypass the 50% excise tax penalty for. A qualified charitable distribution is a nontaxable charitable contribution made directly from an ira (except for an ongoing sep or simple ira) to. Web a qualified charitable distribution (qcd) is a distribution of funds from your ira (other than a sep or simple ira) directly to a qualified charitable organization, such as the. Web regardless of your age, you will need to file a form 1040 and show the amount of the ira withdrawal. Web you’ll need a distribution form from the brokerage. 26 ways the new tax law will affect your wallet regardless of how you do the qcd, a. Web if you want to make a qualified charitable distribution (qcd) from your ira, you can use fidelity's easy online tool to select your account and charity of choice. Web regardless of your age, you will need to file a form 1040. Web fa ira one time and periodic distribution request form kit | fidelity institutional. Get started by selecting your ira custodian and filling. Web a qualified charitable distribution (qcd) is a distribution of funds from your ira (other than a sep or simple ira) directly to a qualified charitable organization, such as the. Web request information on qcds. Not fdic. To make a qcd, you instruct your ira trustee to. Web it was first bumped back to 72 as part of the secure act. How do i make a qcd from my ira? Not fdic insured • no bank guarantee • may lose value A qualified charitable distribution is a nontaxable charitable contribution made directly from an ira (except for. In general, a distribution to a public charity described in section 509 (a) (1), (2), or (3) to accomplish a religious, charitable,. This form is used to request a one time distribution or a periodic distribution from an ira. To make a qcd, you instruct your ira trustee to. Find out if a qualified charitable distribution is right for you. Web a qualified charitable distribution (qcd) is a distribution of funds from your ira (other than a sep or simple ira) directly to a qualified charitable organization, such as the. Web qualified charitable distributions allow you to distribute ira funds directly to eligible charities. Web request information on qcds. A qualified charitable distribution (qcd) is a direct transfer of funds from your ira custodian directly to a. Not fdic insured • no bank guarantee • may lose value Web if you want to make a qualified charitable distribution (qcd) from your ira, you can use fidelity's easy online tool to select your account and charity of choice. Web you are not required to take rmds during your lifetime with a roth ira, but with a roth 401 (k), you are required. By donating these funds, you bypass the 50% excise tax penalty for. Web it was first bumped back to 72 as part of the secure act. Morgan securities llc (jpms) roth or. How do i make a qcd from my ira? Web you’ll need a distribution form from the brokerage specified for a qcd. Web regardless of your age, you will need to file a form 1040 and show the amount of the ira withdrawal. 26 ways the new tax law will affect your wallet regardless of how you do the qcd, a. Get started by selecting your ira custodian and filling. Web any qualifying amount set aside.Qualified Charitable Distributions (QCDs) Meaning & Qualifications

Fidelity Application Form 20202022 Fill and Sign Printable Template

Fidelity Investments Alternate Payee Distribution Form Fill and Sign

Make Qualified Charitable Distributions Pathfinder Wealth Consulting

Fidelity 401k Distribution Form Universal Network Free Nude Porn Photos

Qualified Charitable Distributions Fidelity

How to Properly Report Qualified Charitable Distributions on Your Form

Fidelity Beneficiary Claim Form Fill and Sign Printable Template

Fillable Online ira qualified charitable distribution (qcd) form Fax

Fidelity Charitable Organizational Giving Account Application 20182021

Related Post: