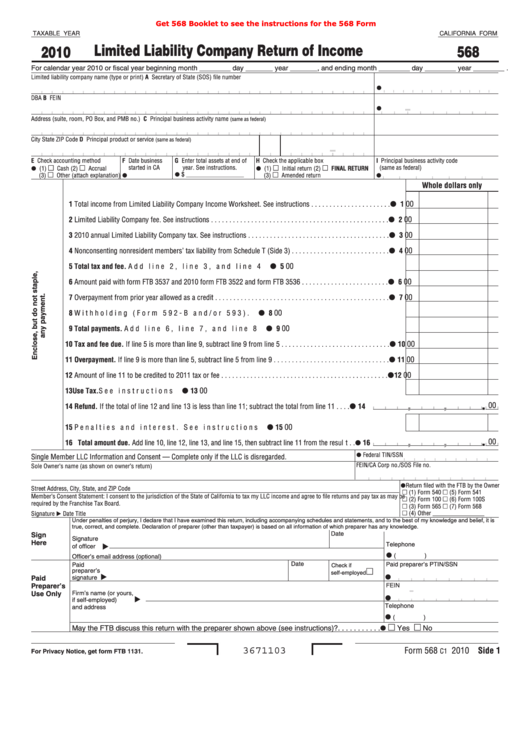

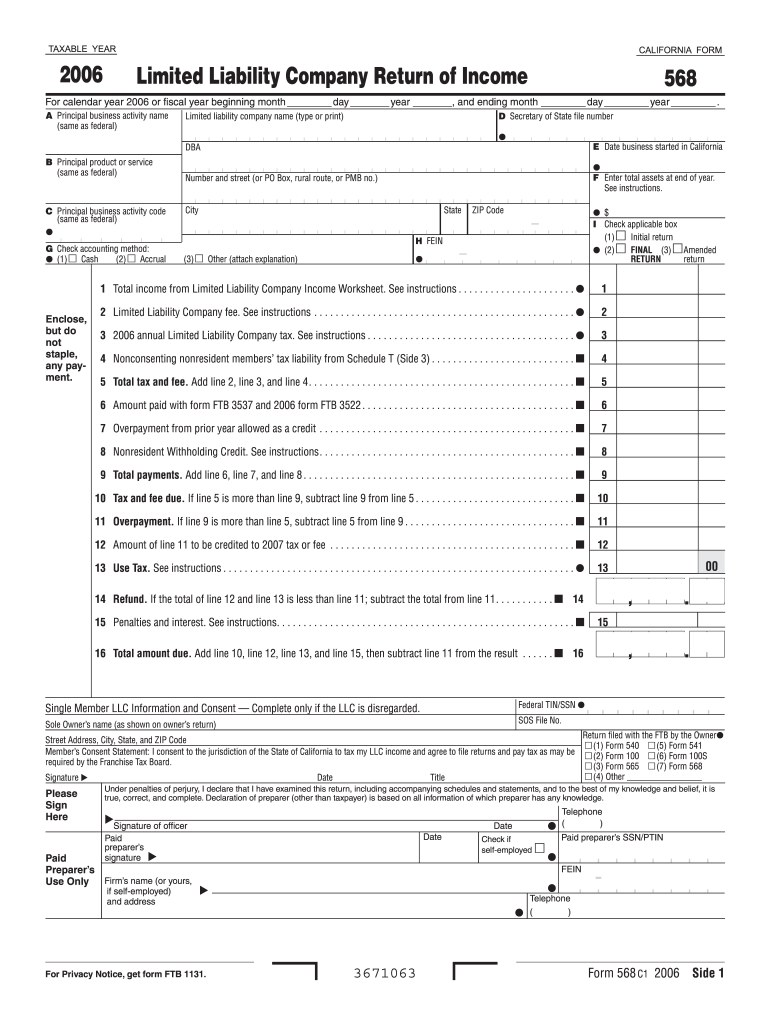

Tax Form 568

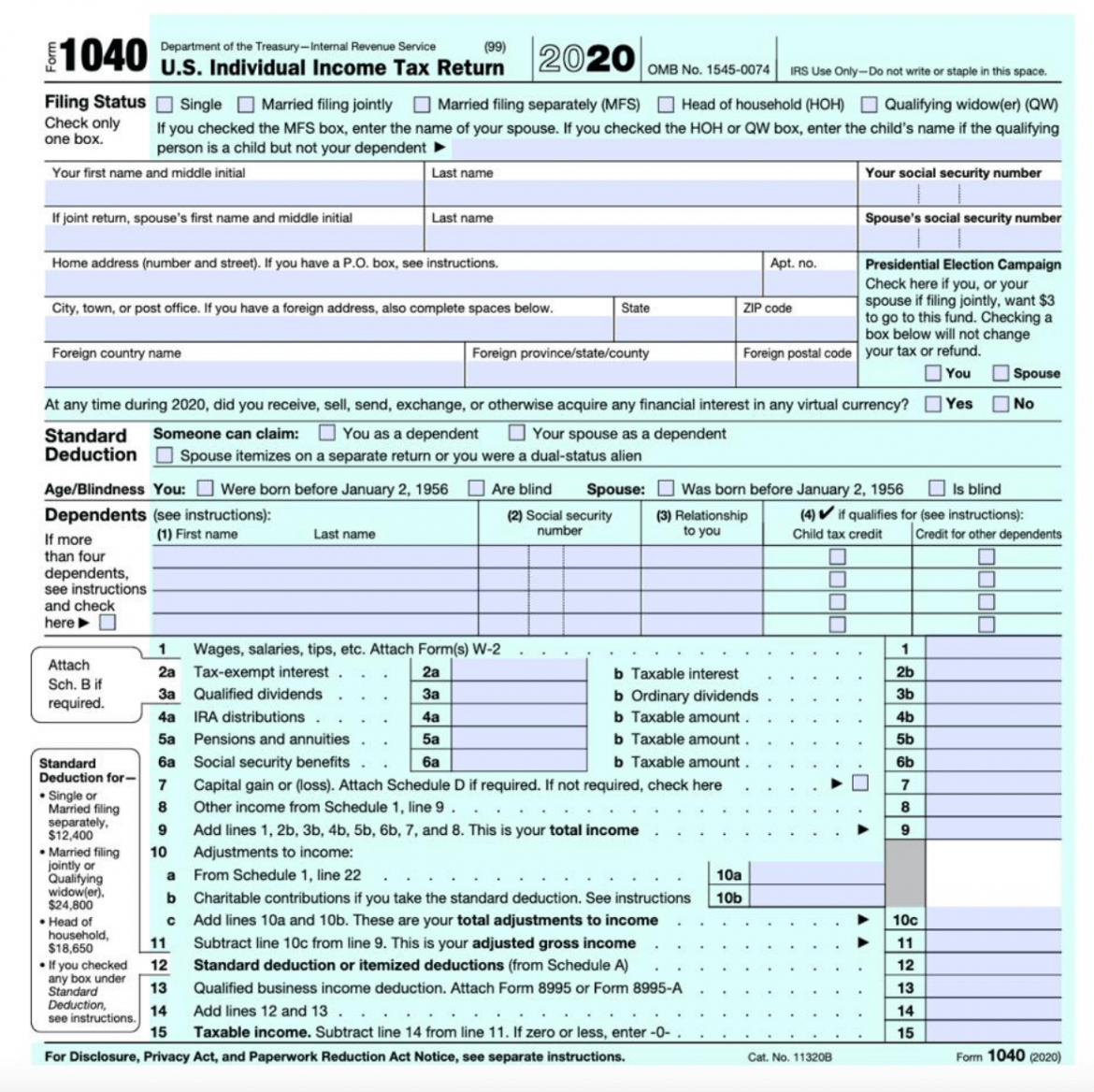

Tax Form 568 - Ad outgrow.us has been visited by 10k+ users in the past month It appears you don't have a pdf plugin for this browser. California defines a single member llc as a disregarded entity because the single owner's. Web 2020 instructions for form 568 limited liability company tax booklet revised: Web form 568 due date. The llc is doing business in. (m m / d d / y y y y) (m m / d d / y y y y) rp. If your llc files on an extension, refer to payment for automatic extension for llcs. California — limited liability company return of income. Individual estimated tax payment booklet. Web form 568, limited liability return of income: Every tax problem has a solution. It appears you don't have a pdf plugin for this browser. This article will show you how to access california form 568 for a ca llc return in proseries professional. Web california limited liability company return of income. Instantly find & download legal forms drafted by attorneys for your state. Every tax problem has a solution. While you can submit your state income tax return and federal income tax return by april. Ad outgrow.us has been visited by 10k+ users in the past month Web solved•by intuit•15•updated november 17, 2022. Web form 568, limited liability return of income: Web form 568 due date. Web enter the llc’s “total california income” as computed on line 17 of schedule iw. 100 100s 100w 100x 109 565 568: Ad tax levy attorney & cpa helping resolve back tax issues no matter how complex. 2021 limited liability company return of income. Web form 568 due date. If your llc files on an extension, refer to payment for automatic extension for llcs. They are subject to the annual tax, llc fee and credit limitations. Web how do i know if i should file california form 568, llc return of income for this year? I (1) during this taxable year, did another person or legal entity acquire control or. While you can submit your state income tax return and federal income tax return by april. Web file limited liability company return of income (form 568) by the original return due date. Web form without payment with payment other correspondence; Get a free consultation today. Web 2020 instructions for form 568 limited liability company tax booklet revised: For calendar year 2020 or fiscal year beginning and ending. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including combined reports • form 100w, california corporation franchise or income tax. While you can submit your state income tax return and federal income tax return by april. Web form without payment with payment other correspondence; Web failing to file required tax forms like form 568 for an llc can result in penalties and fines from the tax authorities. Form 568 must be filed by every llc that is not taxable as. This article will show you how to access california form 568 for a ca llc return in proseries professional. Web solved•by intuit•15•updated november 17, 2022. Web failing to file required tax forms like form 568 for an llc can result in penalties and fines from the tax authorities. I (1) during this taxable year, did another person or legal entity. Web how do i know if i should file california form 568, llc return of income for this year? Limited liability company name (type or print). The llc is doing business in. 2020 instructions for form 568, limited liability company return of income. Ad outgrow.us has been visited by 10k+ users in the past month Web form 568 due date. Web up to $40 cash back form 568, california limited liability company tax booklet, requires information about the llc, such as the name, address, and the names and addresses of all. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Web form 568, limited. For calendar year 2020 or fiscal year beginning and ending. Web how do i know if i should file california form 568, llc return of income for this year? Ad outgrow.us has been visited by 10k+ users in the past month It appears you don't have a pdf plugin for this browser. Web 2020 instructions for form 568 limited liability company tax booklet revised: Web form without payment with payment other correspondence; Web form 568, limited liability return of income: 2020 instructions for form 568, limited liability company return of income. Llcs classified as a disregarded entity or. Web form 568 due date. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. The amount entered on form 568, line 1, may not be a negative number. The llc is doing business in. If your llc files on an extension, refer to payment for automatic extension for llcs. The llc needs to file a 1065 partnership return and. Web enter the llc’s “total california income” as computed on line 17 of schedule iw. California defines a single member llc as a disregarded entity because the single owner's. Ad tax levy attorney & cpa helping resolve back tax issues no matter how complex. Ad tax levy attorney & cpa helping resolve back tax issues no matter how complex. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes.Irs Form W4V Printable Federal Form W 4v Voluntary Withholding

Form 568 Instructions 2023 State And Local Taxes Zrivo

CA FTB 568 20202022 Fill out Tax Template Online

Getting a Loan While Self Employed Here's What You Need

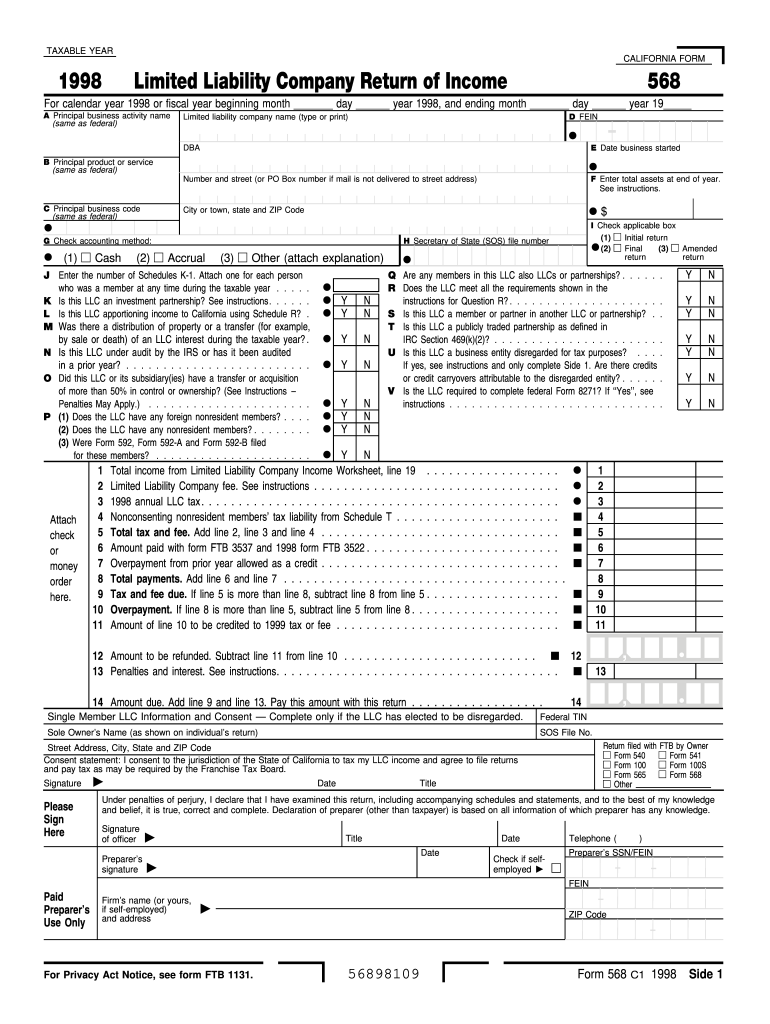

1998 form 568 Fill out & sign online DocHub

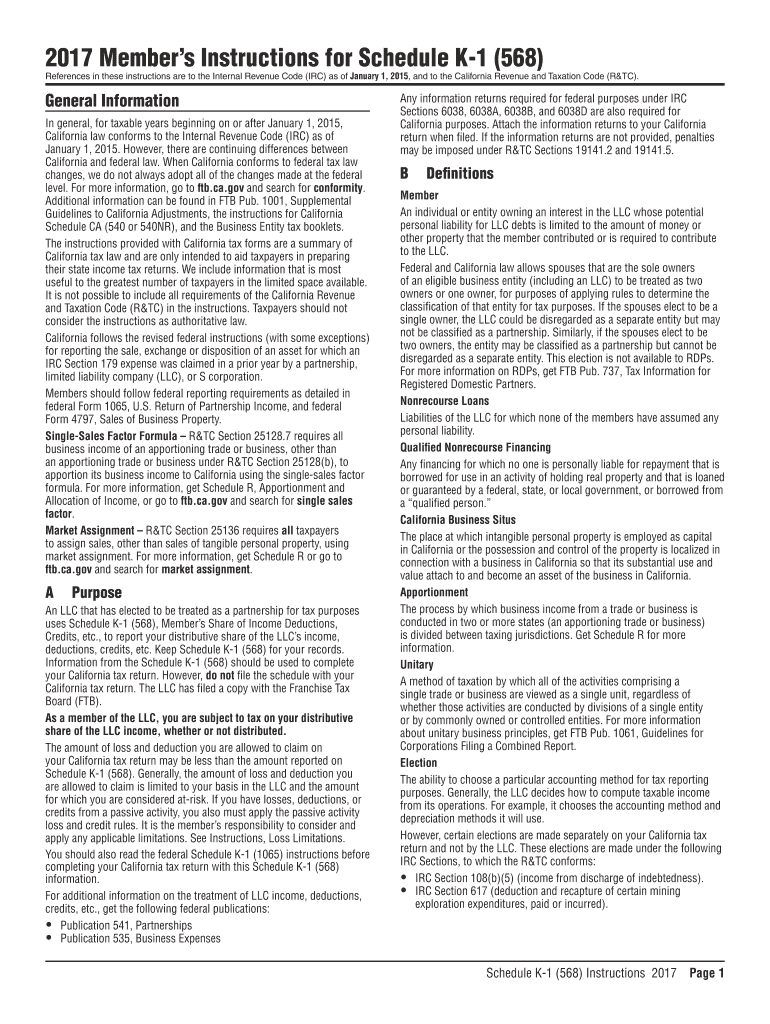

CA FTB Schedule K1 (568) Instructions 2017 Fill out Tax Template

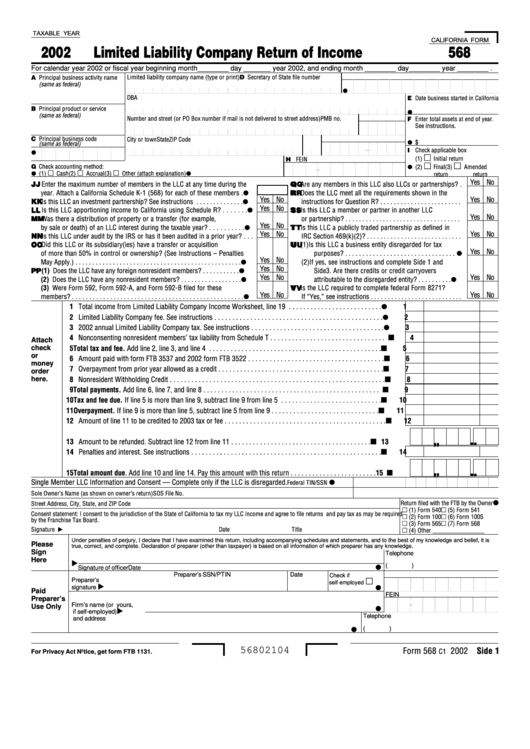

Booklet for california tax form 568 2002 Fill out & sign online DocHub

California Form 568 Limited Liability Company Return Of 2002

Fillable California Form 568 Limited Liability Company Return Of

Form 568 Limited Liability Company Return of Fill Out and Sign

Related Post: