Example Of Completed Form 8880

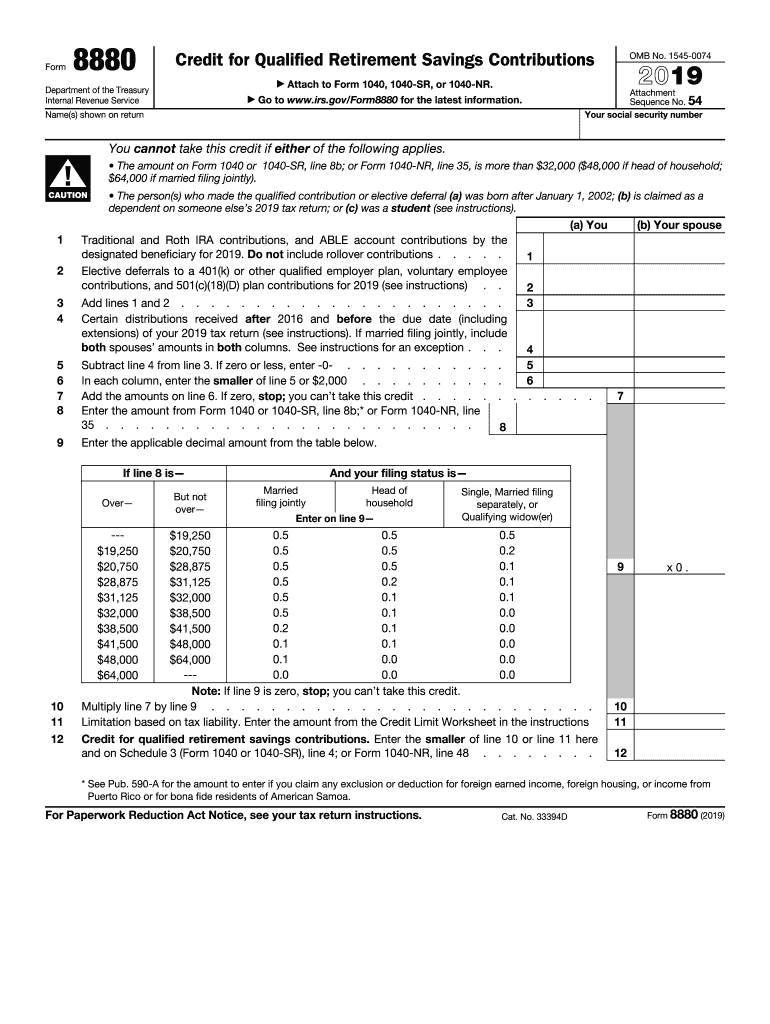

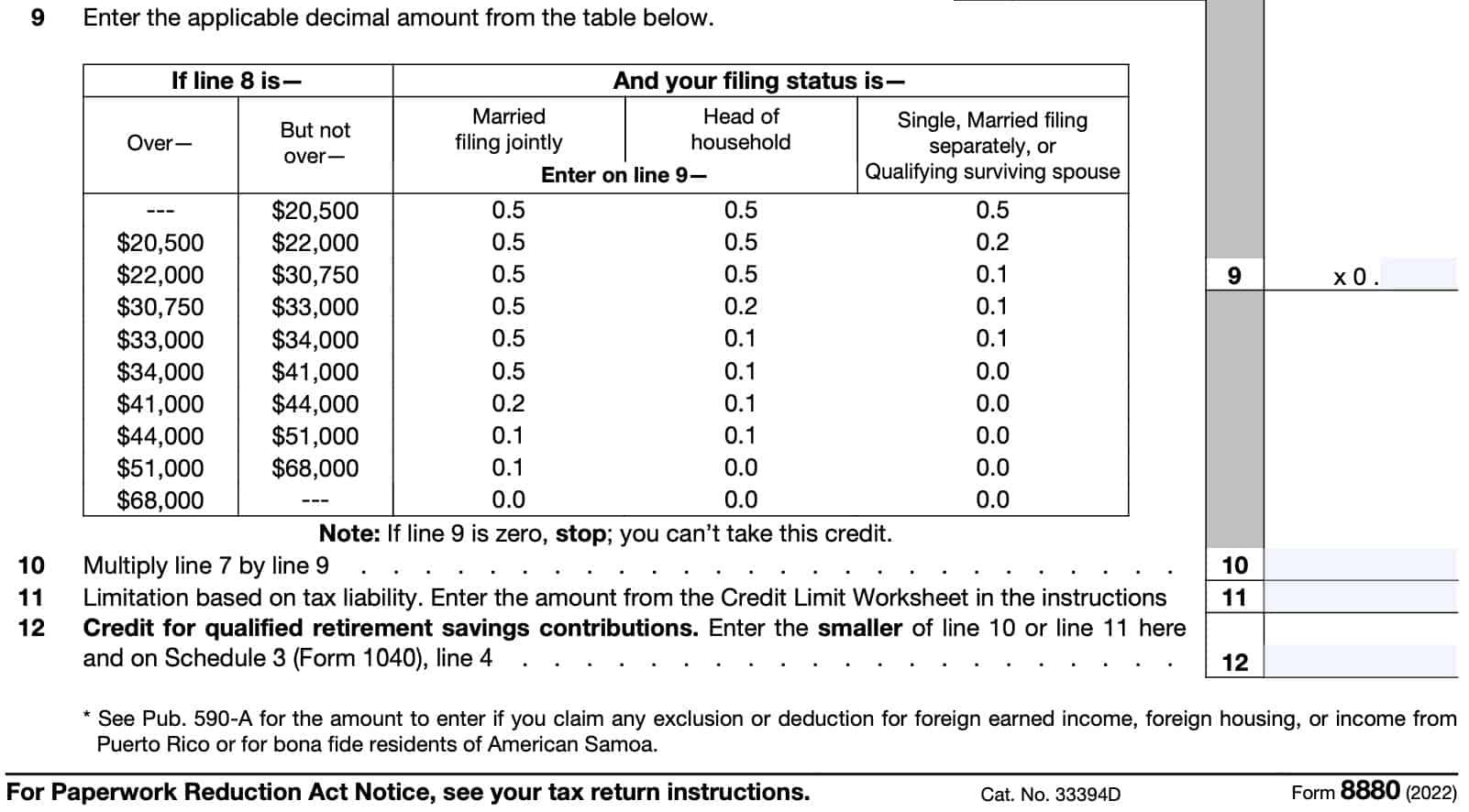

Example Of Completed Form 8880 - Web 0:00 / 2:19. Tip this credit can be claimed in. Two key pieces of information you need before preparing form 8880 is. You received a distribution of $5,000 from a qualified retirement plan in 2014. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Before you complete the following worksheet,. $63,000 if married filing jointly). Your spouse received a distribution of $2,000 from a roth ira in 2012. Web we last updated the credit for qualified retirement savings contributions in december 2022, so this is the latest version of form 8880, fully updated for tax year 2022. Web use form 8880 to figure the amount, if any, of your retirement savings. You will then need to complete the form with the necessary information. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Your spouse received a distribution of $2,000 from a roth ira in 2012. Two key pieces of information you need before preparing form 8880 is. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). You received a distribution of $5,000 from a qualified retirement plan in 2020. The maximum amount of the. Before you complete the following worksheet,. Before you complete the following worksheet,. You received a distribution of $5,000 from a qualified. Web to claim the credit, you must complete irs form 8880 and include it with your tax return. You received a distribution of $5,000 from a qualified retirement plan in 2020. Web form 8880 tax incentives for retirement account — example of completed form 8880. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Taxpayers may be eligible for. The process of form 8880 creation starts by printing out a copy of the form. Web the amount on form 1040, line 7 or form 1040nr, line 36 is more than $31,500 ($47,250 if head of household; Web 0:00. Taxpayers may be eligible for. Web to claim the credit, you must complete irs form 8880 and include it with your tax return. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). You received a distribution of $5,000 from a qualified retirement plan in 2020. You will then. Web in the left section list, select retirement savings contributions credit (8880). Web form 8880 tax incentives for retirement account — example of completed form 8880. Web use form 8880 to figure the amount, if any, of your retirement savings. Before you complete the following worksheet,. Form 8880 is a simple one. Learn how to fill the form 8880 credit for qualified retirement savings contributions. You received a distribution of $5,000 from a qualified retirement plan in 2014. Web form 8880 tax incentives for retirement account — example of completed form 8880. Your spouse received a distribution of $2,000 from a roth ira in 2012. You will then need to complete the. $63,000 if married filing jointly). Get ready for tax season deadlines by completing any required tax forms today. Taxpayers may be eligible for. Web you can determine how much money you qualify for by filling out irs form 8880 credit for qualified retirement savings contributions. • the person(s) who made the. Taxpayers may be eligible for. Your spouse received a distribution of $2,000 from a roth ira in 2012. Web 0:00 / 2:19. $63,000 if married filing jointly). Web in the left section list, select retirement savings contributions credit (8880). You will then need to complete the form with the necessary information. You received a distribution of $5,000 from a qualified retirement plan in 2020. Web to claim the credit, you must complete irs form 8880 and include it with your tax return. Tip this credit can be claimed in. Web you can determine how much money you qualify for. Web you can determine how much money you qualify for by filling out irs form 8880 credit for qualified retirement savings contributions. Complete, edit or print tax forms instantly. Web form 8880 tax incentives for retirement account — example of completed form 8880. Web use form 8880 to figure the amount, if any, of your retirement savings. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Ad access irs tax forms. Web 0:00 / 2:19. Learn how to fill the form 8880 credit for qualified retirement savings contributions. • the person(s) who made the. You received a distribution of $5,000 from a qualified retirement plan in 2014. Your spouse received a distribution of $2,000 from a roth ira in 2012. Web form 8880 department of the treasury internal revenue service. Web in the left section list, select retirement savings contributions credit (8880). Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Two key pieces of information you need before preparing form 8880 is. The maximum amount of the. Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in the current year. Web to claim the credit, you must complete irs form 8880 and include it with your tax return. Get ready for tax season deadlines by completing any required tax forms today.Sample Forms For Authorized Drivers Resources And Forms For Auto

How To File For Unemployment Missouri TOWOH

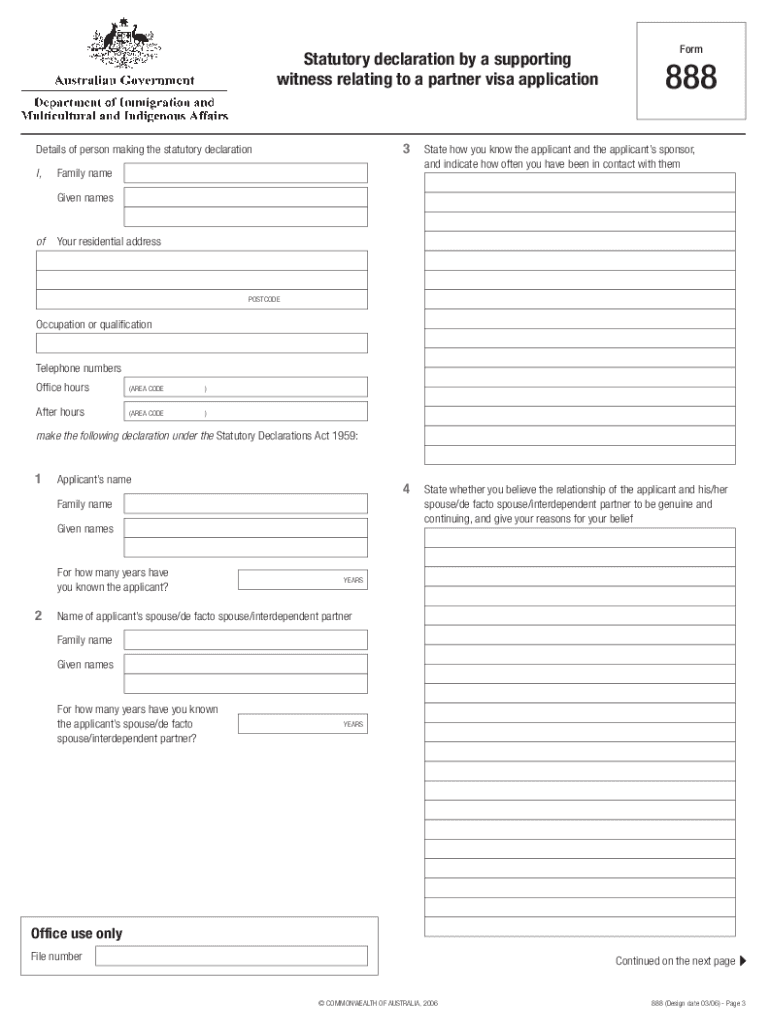

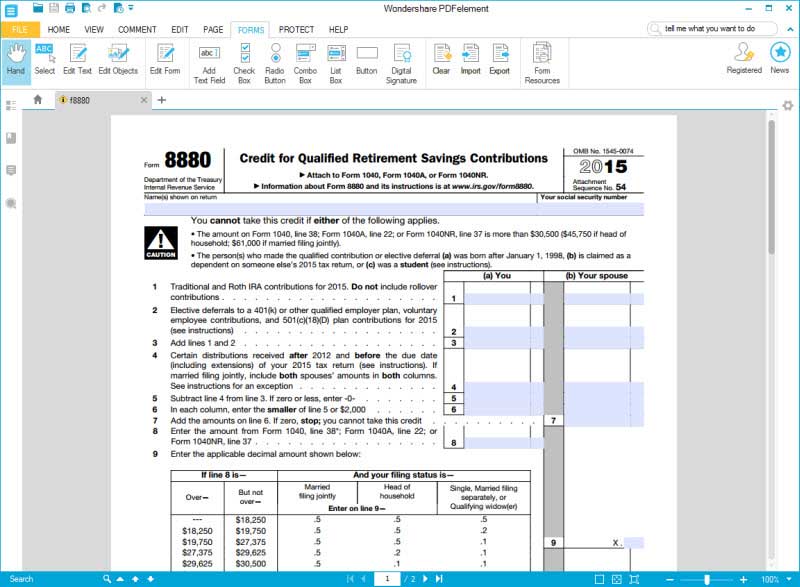

888 Form Examples Fill Online, Printable, Fillable, Blank pdfFiller

Form 8880 Fill Out and Sign Printable PDF Template signNow

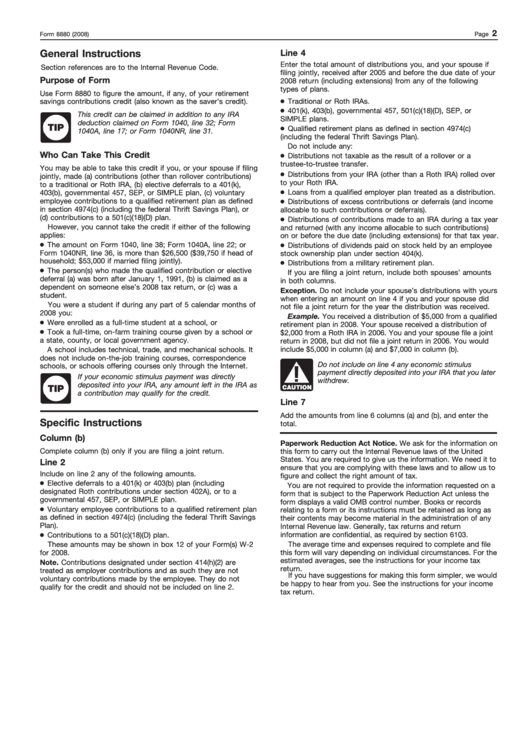

Instructions For Form 8880 2008 printable pdf download

Form 8880 Credit for Qualified Retirement Savings Contributions (2015

Instructions for How to Fill in IRS Form 8880

Credit Limit Worksheet 8880 —

IRS Form 8880 Instructions Retirement Savings Tax Credit

Form 8880 Edit, Fill, Sign Online Handypdf

Related Post: